Discover Bank IRA Review

As economic conditions change, more commercial banks enter the retirement account service sphere to diversify their income streams. This benefits customers because the increased competition between banks means more significant incentives for account holders as those banks compete for your business.

Discover Bank is making waves in the retirement account community because of its focus on relatively high-yield fixed-income retirement accounts like savings IRAs and IRA certificates of deposit (CDs).

Why Fixed-Income IRAs?

Since Discover Bank is a commercial bank and not eligible to offer equity or other securities trading (like stocks), only fixed-income options are available. Some may shy away from this, as stocks outperform most commercial fixed-income products in the long run, but consider these factors:

1. There is no limit to the total number of IRA accounts you can hold – there is only an annual maximum deposit allowed, $6,000, but that maximum can be spread across as many accounts as you’d like.

2. Stocks are in the gutter right now, and the outlook of continued economic turbulence makes a guaranteed return from Discover Bank savings IRAs and CDs much more viable than fixed rates were in the past, especially for those closer to retirement.

3. You can always transfer the IRA to a brokerage that allows stock trading. So, if you were inclined to do so, you could generate a guaranteed rate with Discover before transferring when the stock market shows signs of rebounding.

Understanding the benefits of fixed-income IRAs is essential, especially in today’s environment, but Discover Bank offers some particularly attractive benefits.

High Yield Options

Savings accounts and CDs are often maligned for their low rates, low yield, and low returns, but Discover is changing that perception. They’re offering desirable savings IRAs and CDs rates, especially considering competitor averages.

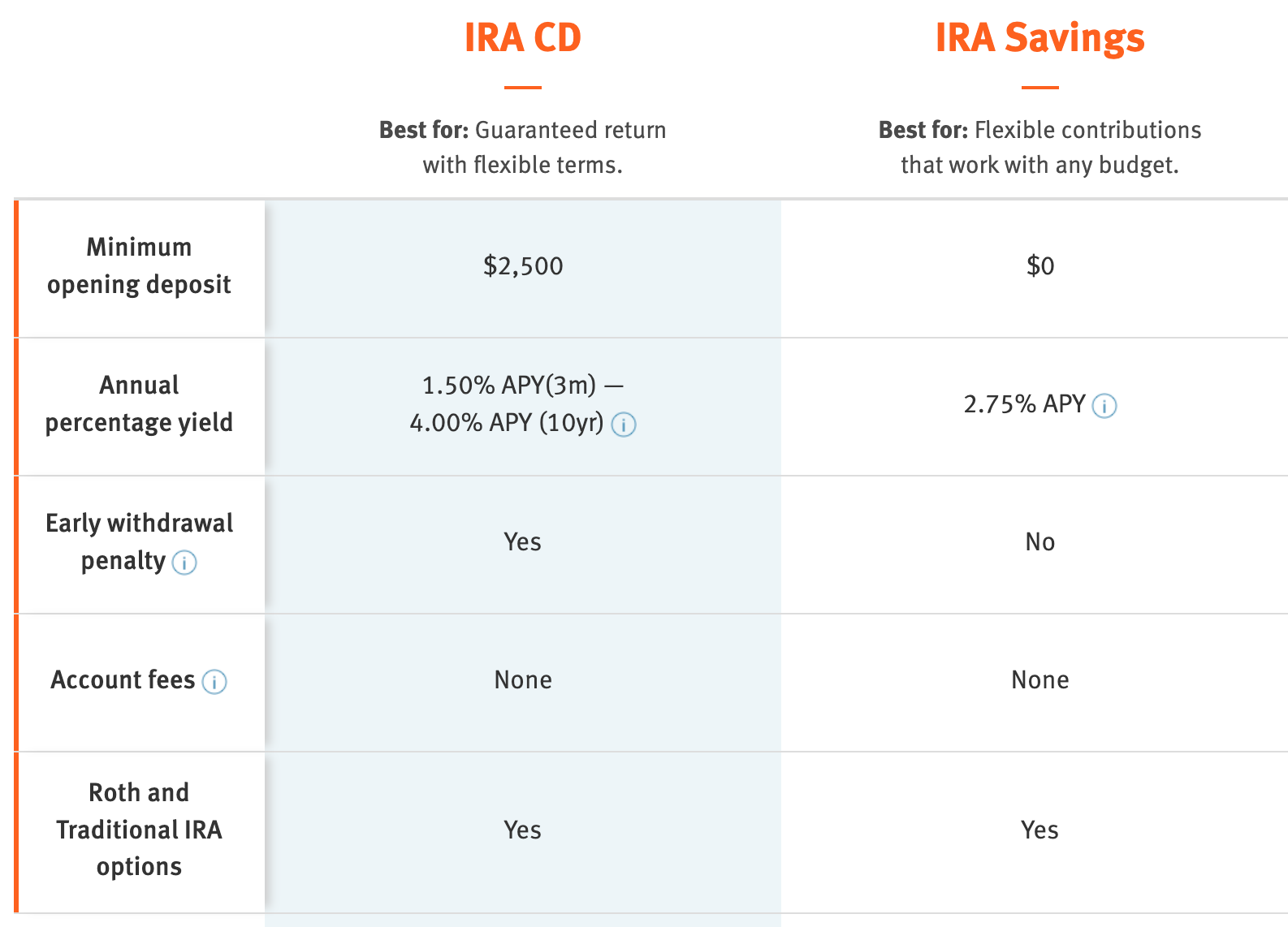

Discover IRA CD

Discover’s IRA CD rate currently yields between 1.50% (three-month CD) and 4% (ten-year CD). If you didn’t know, a CD is “locked’ until maturity. This means that although you are guaranteed the interest accrual for the life of the CD, you are also not allowed to withdraw from or close it until it matures.

Since your capital will be tied up, a CD is not ideal for someone who wants to actively trade or manage their IRA, although a higher rate offsets the decreased flexibility.

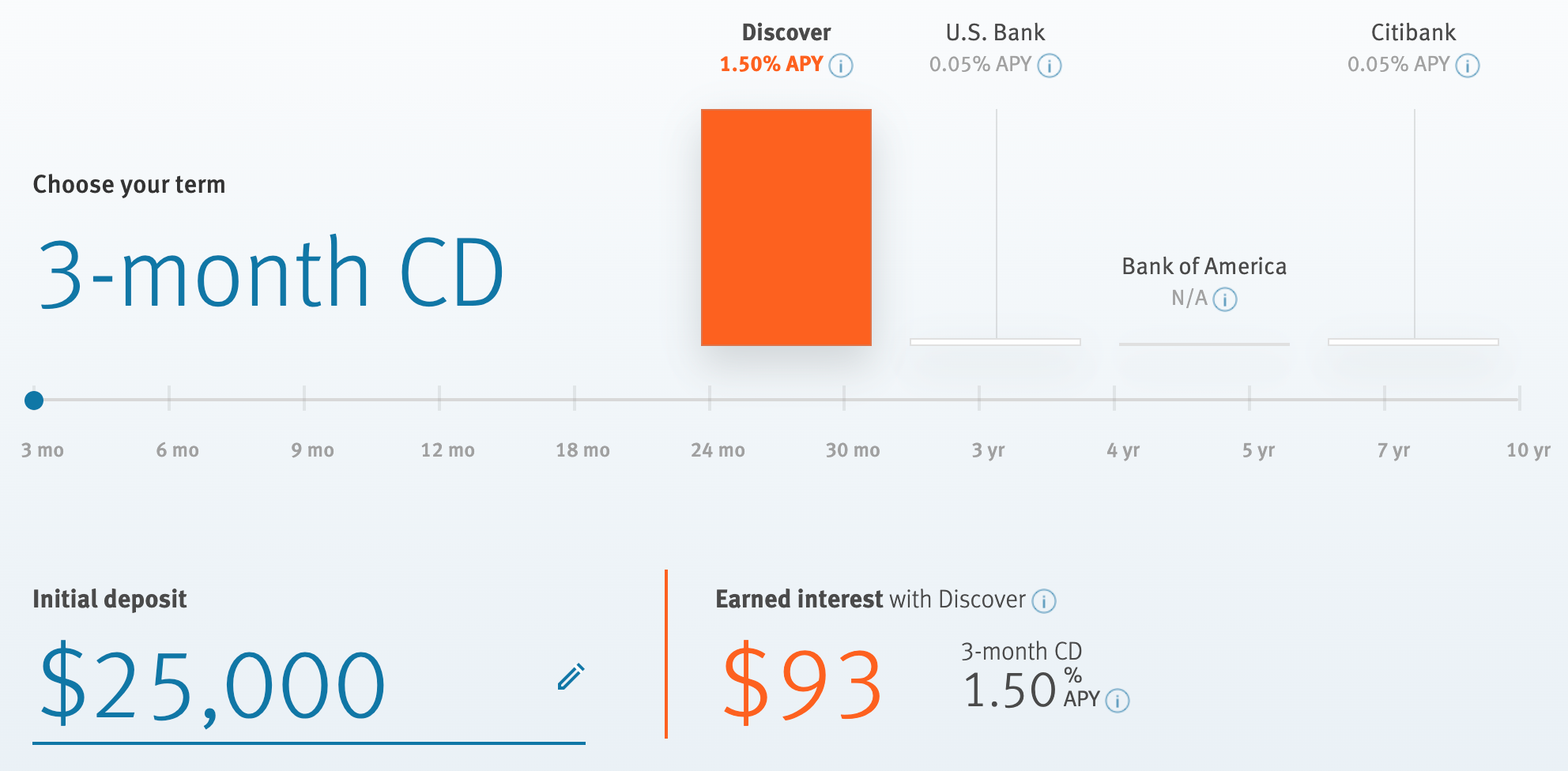

Discover has a handy rate overview tool that shows the current CD rate by maturity, compares it to competitors, and lets you calculate how much interest you’ll earn based on your investment. We won’t cover each of the available CD maturities, but here is a sample of short, medium, and long-term options – check out Discover’s calculator for more options. We’ll assume that the investment in the IRA CD is the maximum allowed annually, $6,000 and that no additional capital is invested in the IRA:

| Maturity | Interest Rate | Closest Competitor Rate | Earned Interest (Total) |

|---|

| 3-month | 1.50% | 0.05% | $22 |

| 12-month | 3.75% | 3.75% | $224 |

| 24-month | 3.80% | 2.00% | $464 |

| 7-year | 4.00% | 0.25% | $1,189 |

| 10-year | 4.00% | 0.25% | $2,879 |

As you can see, compound interest at a guaranteed rate is very beneficial over the life of a CD. If you’re within ten years of withdrawing from the IRA or want the peace of mind that a guaranteed rate provides, IRA CDs with Discover are some of the best in the industry today.

Discover’s IRA CDs are not subject to fees. Customers can fund the account through regular contributions, a rollover from other retirement plans, or transfers from external IRAs with a brokerage or bank.

Whatever the funding method, the minimum opening deposit for an IRA CD with Discover Bank is $2,500.

Discover Savings IRA

Discover Bank also offers savings IRAs for those who want their IRA capital to be more liquid or not locked in like it is with a CD. Savings IRAs combine the best of savings accounts and IRAs, and Discover offers a higher rate than you’ll typically find elsewhere.

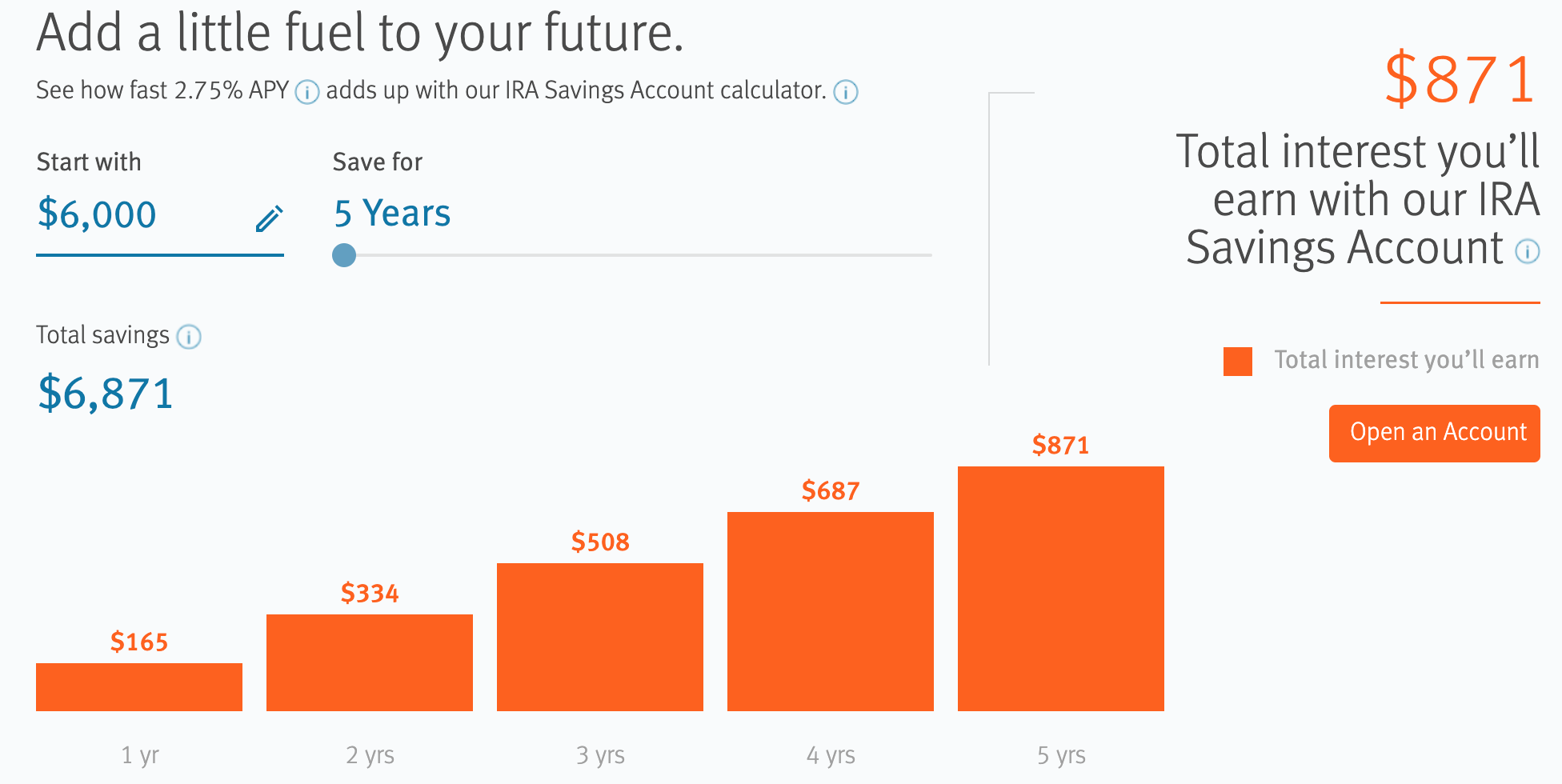

Currently, Discover’s savings IRAs yield 2.75%. This rate, unlike CDs, does fluctuate over time – although it can continue to rise, especially as the Federal Reserve continues rate hikes. Although lower than most CD options, the ability to quickly move cash from a savings IRA into an IRA with a traditional brokerage makes this option suitable for an investor waiting on the sidelines for market volatility to fall.

Discover offers a similar calculator to see how your cash will grow in a savings IRA at the current rate.

Like the IRA CD, there are no fees with the savings IRA. But, unlike the CD option, there is also no minimum opening deposit. The account can be funded through deposit, rollover, or transfer from another institution.

Top Alternatives

Discover IRA Review Conclusion

In general, fixed-income IRAs aren’t ideal for younger investors who have plenty of time until retirement. Even with ongoing volatility, they’re typically better off dollar-cost-averaging into market funds as they have time on their side and can take advantage of relatively low prices before they rise again.

For risk-averse investors, though, or those close to retirement whose primary goal is capital preservation Discover’s savings IRA and IRA CDs are a great option. Offering higher rates than competitors, locking in a guaranteed rate with a CD, or taking advantage of savings liquidity is a great way to preserve your cash while still generating some gains.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|