Mutual Fund Short-Term Redemption Fees

Investors who buy a mutual fund and then sell it too soon may be charged a fee, usually called a

redemption fee, by the broker. Sometimes the mutual fund itself may asses a short-term trade fee, which

is in addition to the redemption fee.

It's a good idea to know what these fees are ahead of time, so be sure to read the mutual fund prospectus before you buy a fund. And here's information on the redemption fees charged by brokers, along with their general mutual fund offerings.

JP Morgan Chase Short Term Redemption Fee

JP Morgan Chase charges $0 on any mutual fund transaction.

There are no mutual fund short-term redemption fees at this broker.

JP Morgan Promotion

Get $0 stock commissions at J.P. Morgan.

Open Chase Account

Firstrade Short Term Redemption Fee

Firstrade charges $0 on

any mutual fund transaction.

A short term redemption fee of $19.95 will be chraged on mutual fund shares held less than 90 days.

Firstrade Promotion

Get up to $250 ACAT rebate and $0 commission trades.

Open Firstrade Account

Fidelity Short Term Redemption Fee

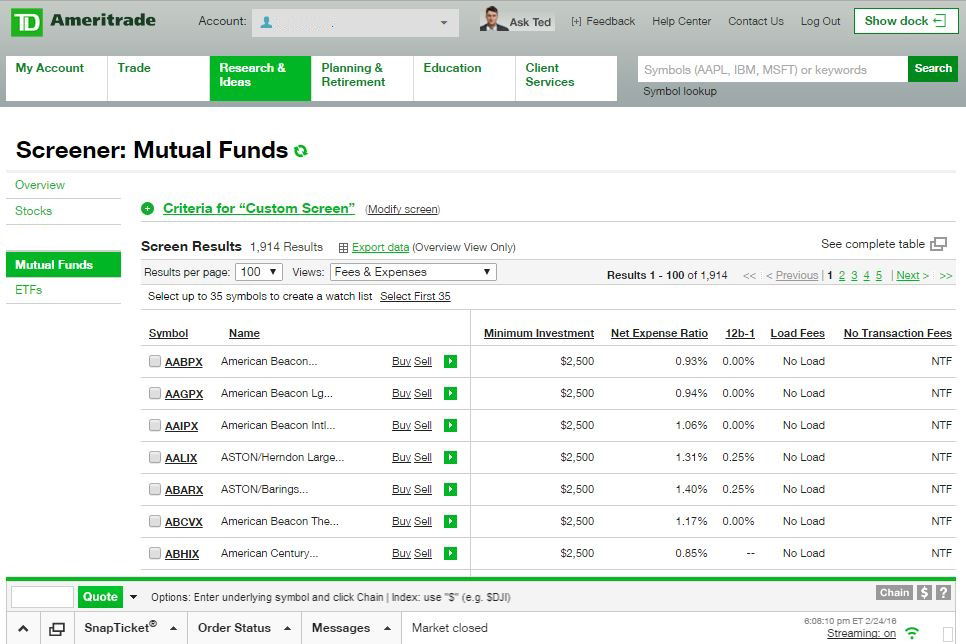

A short-term redemption fee is charged by Fidelity anytime an NTF fund with no load is sold in less than 2 months. The fee is $49.95 when transacted on-line. The fee changes to 0.5625% of principal when using the broker's automated phone system. There is a $187.50 maximum and a $75 minimum in this case. Using a living, breathing agent to complete the sale of the fund over the phone increases the charge to 0.75%, with a $250 maximum and a $100 minimum. The broker's mutual fund screener returns around 11,500 mutual funds, with approximately 1,800 that carry no load and no transaction fee.

Vanguard Short Term Redemption Fee

Vanguard charges $50 for the sale of no-transaction-fee funds when sold less than 2 months after the most recent purchase. The firm offers its clients over 16,000 funds. Of these, more than 2,500 are no-load, no-transaction-fee products. Several criteria can be selected on the Vanguard mutual fund screener, including fund family, load status, return history, and minimum initial investment.

E*Trade Short Term Redemption Fee

E*Trade customers pay $49.99 whenever they sell a mutual fund that carries no load and no transaction fee less than 3 months after purchase. Some fund families are exempt from the broker's policy. These include Rydex, ProFunds and money market funds. Direxion funds are also exempt; although one commodity fund (DXCTX) is not. The firm's mutual fund screener has several variables that can make finding products easier. These include expense ratio, distribution yield, and Morningstar rating. The screener returns a total of 7,628 funds that are open to new investors, including 2,124 that have neither transaction fee nor load.

Schwab Short Term Redemption Fee

A redemption charge of $49.95 is assessed by Charles Schwab for sales of mutual funds that don't have a transaction fee if they are held for less than 3 months. Some funds are exempt from this short-term trade fee, including Schwab funds and certain products that are designed for short-term trading. The broker's mutual fund screener generates roughly 5,300 securities that can be purchased by new investors. Approximately 3,250 can be traded with no transaction fee and no load.

Free Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Merrill Edge Short Term Redemption Fee

Merrill Edge traders pay a short-term trade fee of $39.95 for any NTF fund, regardless of load status, if it is sold less than 3 months after purchase. As with the other brokers, this fee is in addition to any short-term fee charged by the mutual fund. Merrill Edge's screener shows roughly 4,000 mutual funds that can be purchased by new investors, with approximately 2,200 having neither load nor transaction fee. The screener is able to sort according to a large number of criteria, including fund objective, average bond coupon, and standard deviation.

Mutual Fund's Own Early Redemption Fee

In addition to the broker-imposed redemption fee, many mutual funds themselves also impose short-term trading charges. An example of a redemption

fee is 2% charge it is sold in less than 3 months after purchase.

Mutual Fund Early Redemption Fees Recap

Both brokerage firms and mutual funds charge short-term trade fees because frequently buying and selling shares increases mutual fund expenses. Knowing the specific policies of both loads and redemption fees and trading accordingly can help make owning funds less expensive.

|