How to Withdraw Money from SoFi

If you have a SoFi Invest account and want to withdraw money from it, there is one primary method to do so. SoFi uses ACH to handle money transfers, and the broker has a convenient tool to make the process as simple as possible.

Continue reading to learn about SoFi’s withdrawal process and how to make a withdrawal from your brokerage account.

Withdrawal Money from Your SoFi Account

To withdraw money from your Active Invest account or Auto Invest account, SoFi offers ACH transfers to make the process as simple as possible.

SoFi Active Invest accounts have two balance categories, while the Auto Invest account has one.

SoFi Active Invest Withdrawals

Active Invest defines your balance as 'withdrawable cash' and 'buying power.' The withdrawable cash comprises all the funds in your account that are not tied up in investments and are not going through a settlement period. The 'buying power' balance can be larger and includes funds that have not cleared yet.

SoFi Auto Invest Withdrawals

For Auto Invest accounts, balances are always fully invested. For that reason, there is no 'withdrawable cash' category. When you want to take money out of the Auto Invest account, you must submit a request, and SoFi will sell the required number of securities to meet your withdrawal request. After liquidating your Auto Invest assets, SoFi automatically sends the withdrawn amount to your connected account.

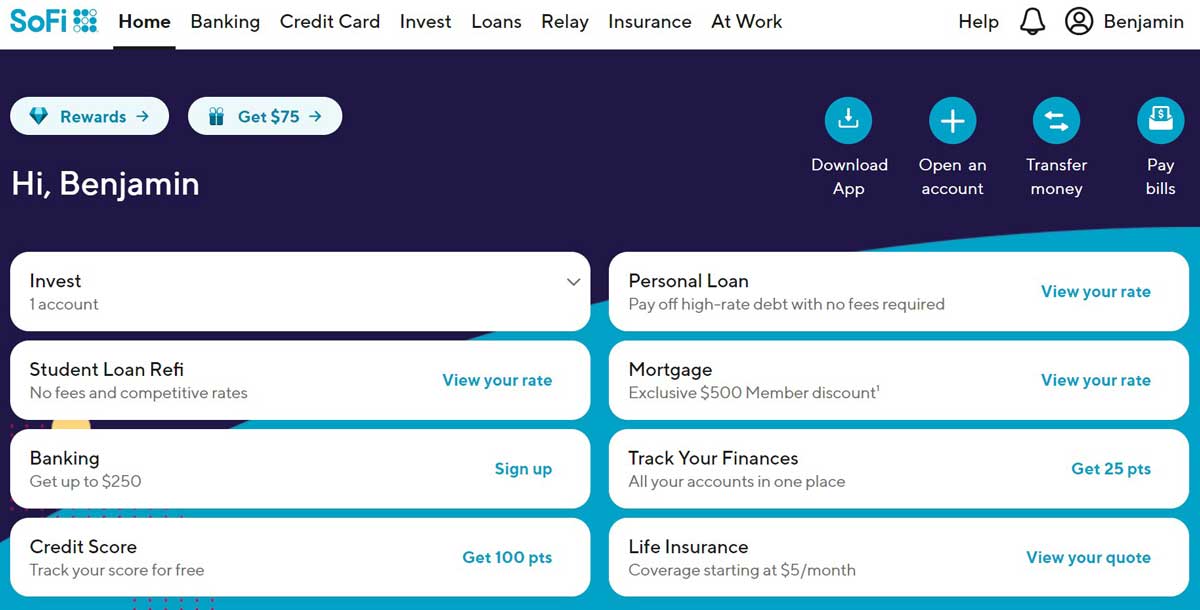

Setting up a Withdrawal Request at SoFi

Setting up a withdrawal request from a SoFi Active Invest account is quite simple if you have already connected a bank account to your SoFi account.

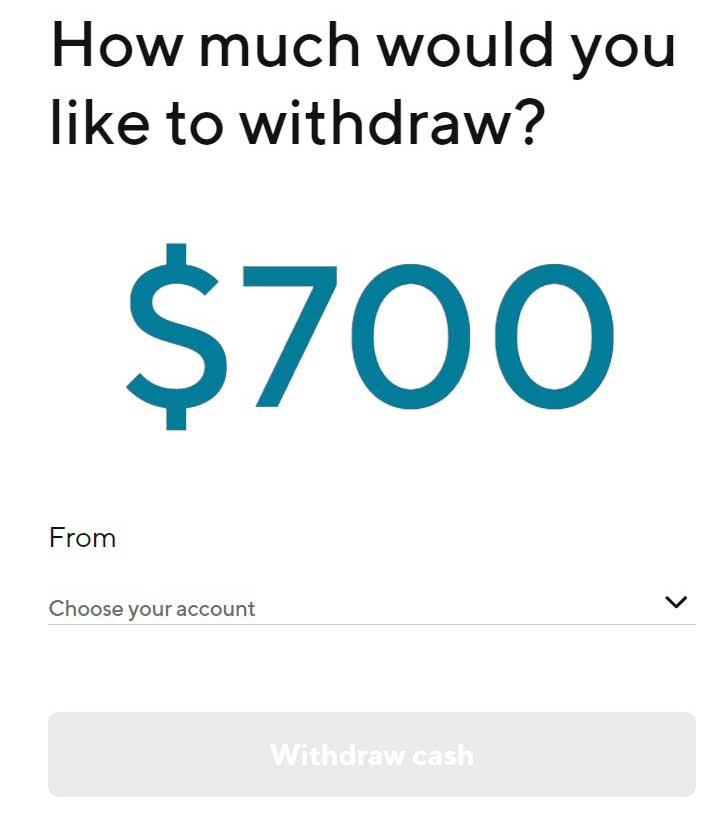

First, navigate to the withdrawal page on the website, or you can find the same tool on the mobile app by going to the 'Trade' button. You'll see a 'Withdrawal' option that provides you with the necessary steps.

After defining a receiving bank account and transfer amount, you can set the withdrawal process in motion by reviewing the details of your request and confirming that everything looks good.

Setting up a withdrawal request from an Auto Invest account should be done with the mobile app, and you can find the withdrawal tool in the same place (within the 'Trade' options).

Preparing Your SoFi Account for Withdrawal

As mentioned, there is a difference between the balance you can withdraw and the balance you can trade with. To remove your funds from SoFi, they should be free of any holds or restrictions.

There are two main reasons for not being able to remove your cash. Either your deposits have not cleared, or your trades have not settled.

Best Brokers

Deposit Hold Times

Both SoFi Auto Invest and Active Invest have hold times for new deposits. Auto Invest accounts have a five-day hold before these deposits can be withdrawn. Active Invest accounts hold new deposits for approximately six days as directed by regulatory bodies to counteract money laundering.

Withdrawal requests can be processed after the deposit hold times have been completed.

Deposit Settlement

In addition to deposit holds, paying attention to the settlement times for new deposits is important. Only fully settled funds can be withdrawn. Deposits made with wire transfers are settled as soon as they hit your brokerage account, but ACH deposits take at least three days to settle.

Trade Settlement

Another consideration is trade settlement. Each time you sell a security at SoFi, there is a three-day settlement period (T+3) until the funds from that transaction are ready for withdrawal.

Transfer Timeline

ACH transfers can take up to five days, but they often process faster than that. For example, many withdrawals are completed on the third day.

It's important to remember, however, that if you withdraw funds from an Auto Invest account, you must add three or four days to the processing time. The added time comes from the next-day liquidation process and the required settlement period for those sales.

SoFi Withdrawal Fee and Limits

Since all of SoFi's withdrawals are handled through the ACH system, there are no fees to withdraw your money. However, if your ACH is returned due to a problem with the receiving bank, there is a $15 fee for that.

Regarding ACH transfer limits, SoFi allows traders to withdraw up to $100,000 per day - this limit is one of the largest in the industry.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|