Wire and ACH Limits, Fees, and Transfer Times at Citi Self Invest

A brokerage account with Citi Self Invest and a deposit account with Citibank both have a variety of money transfer options. There are fees and limits in some cases, so be sure to read over our research.

Transfers by Wire

Citibank and Citi Self Invest accounts can both receive and send wires. The advantage of this transfer system is speed. Transactions are typically processed and finished by the next business day. If a wire transfer request is submitted in the morning, it may complete that day. The cutoff time is 6:45 pm, Eastern Standard Time.

There is often a fee for a wire transfer. The exact fee will depend on the outgoing account’s relationship with Citi. The standard fee is $25 for an outgoing domestic wire (when submitted online) and $35 for an outgoing international wire (when submitted online). An outgoing wire requested through any other channel is an additional $10. Citi is one of the few banks to charge a fee for an incoming wire. It’s $15.

Some Citi customers can have all three of these fees waived. Citi Private Bank customers, Citigold clients, and Citi Alliance members pay nothing. Some Citi customers have reduced fees. For example, Citi Priority customers pay nothing for an incoming wire, while an outgoing domestic wire costs $17.50, and an outgoing international wire is $25.

Citi imposes limits on wire transfer amounts. For regular customers, the cap is $50,000 per business day. This amount can be raised, possibly to infinity, for various clients.

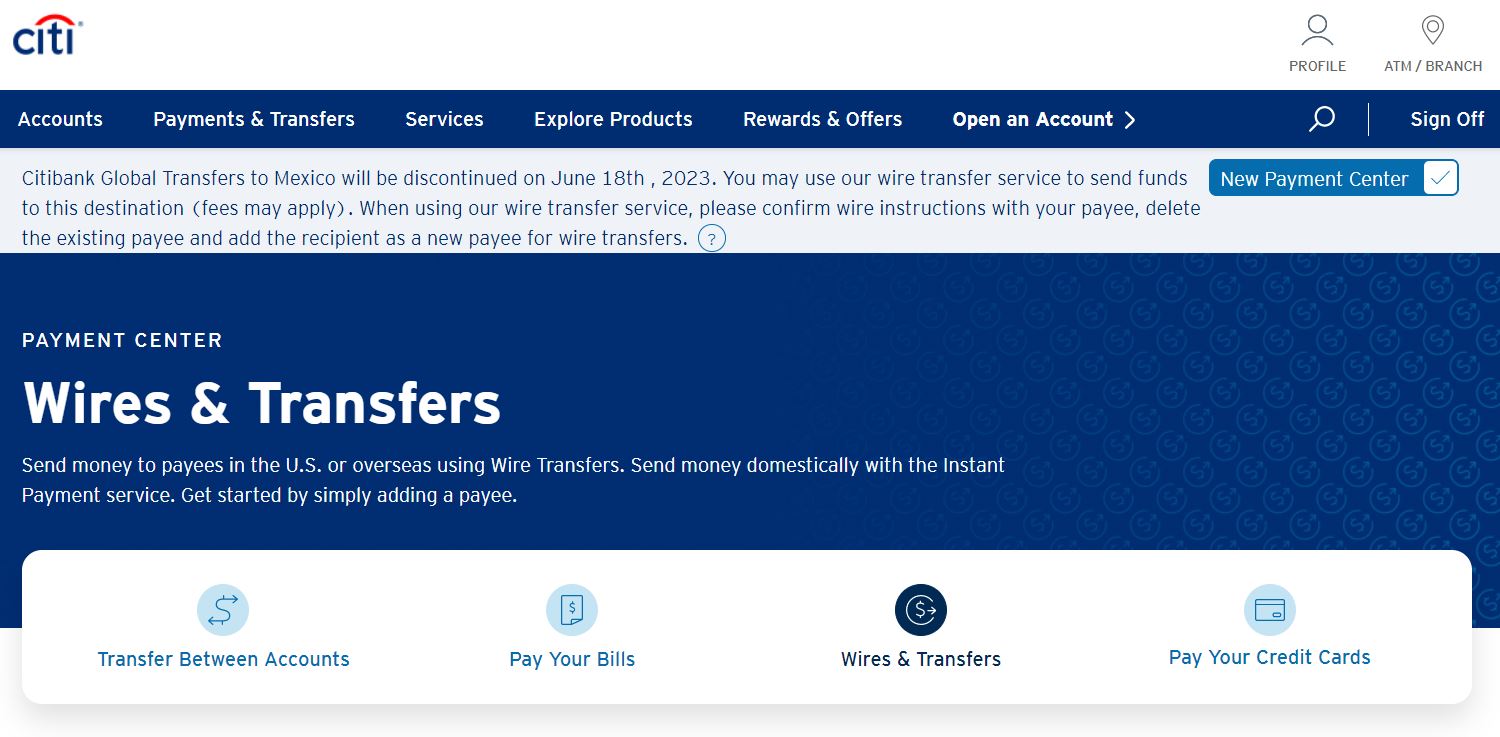

It’s really easy to request a wire transfer on the Citi Self Invest website.

Simply go to a brokerage account’s dashboard and click on the link to transfer funds. On the next page, click on the Wires & Transfers link. On the following page, you’ll need to specify the bank location (U.S. or foreign), the recipient type (person or business), and the receiving account number.

ACH Transfers

The same transfers page we saw in the previous section on wires has a link to transfer between accounts. This option is the ACH transfer tool. The advantage of ACH transfers is the cost. They are free in all situations for all accounts. The disadvantage is a slower speed. An ACH transfer will take 2 to 3 days to complete. Citi Self Invest does permit trading on the same day with cash that is transferred through the ACH tool.

Citi Self Invest has a $500,000 daily transfer limit on ACH movements (inbound and outbound). Recurring transfers can be set up with the ACH widget. Choices include weekly, bi-weekly, and monthly.

Best Brokers

Checkwriting and Debit Cards

Citi Self Invest does not offer checkwriting or debit cards. Many Citibank checking accounts do, though. These typically come with all sorts of fees, some of which can be avoided by maintaining minimum account levels.

ATM cards have daily withdrawal limits, and these will vary by account. One we found had a withdrawal limit of $1,500 per day with a $2.50 ATM fee for using a non-Citi machine (in addition to any fee the ATM operator charges).

Bill Pay

Citibank (but not Citi Self Invest) offers a free bill-pay service that can be used to withdraw funds from a checking account to pay a wide variety of bills.

Zelle Transfers

The same is true for Zelle transfers. They are available but only for checking accounts. There is no fee from Citi for sending or receiving money in this manner. Transfers are instant, which is a huge benefit. However, Citi places low limits on transfer amounts. These range from $500 to $40,000, depending on the account type, the relationship with Citi, and how long the account has been enrolled with the Zelle service.

Instant Payment

Citibank and Citi Self Invest accounts can send money instantly through the ACH network. There is no fee for this service, and as the name suggests, transfers are instant. There are only a few available counter-party banks for this service, though. Examples include:

Bank of America

Capital One

Comerica Bank

Fifth Third Bank

HSBC Bank USA

JPMorgan Chase

PNC Bank

Because this is an ACH service, there are transfer limits. They range from $1,500 to $40,000 per day, depending on the same factors mentioned for Zelle transfers.

The instant-payment widget can be found on the same page for wire transfers.

Global Transfers

Citibank (but not Citi Self Invest) offers one more payment method: global transfers. The service can be used to send money between Citi accounts based in any country. This time, a savings or money market deposit account can be used.

The service is free, although there are maximum transfer amounts. They range from $50,000 to infinity, depending on a variety of factors. Global transfers are completed instantly.

The global-transfer tool is right next to the widgets for instant payments and wire transfers on the Citi website.

Updated on 1/31/2024.

|