Citibank Margin Rates

|

Debit Balance

|

Margin Interest Rates

|

|

above $5,000,000

|

6.25%

|

|

$1,000,000 - $4,999,999.99

|

8.25%

|

|

$500,000 - $999,999.99

|

9.25%

|

|

$100,000 - $499,999.99

|

9.75%

|

|

$75,000 - $99,999.99

|

10.5%

|

|

$50,000 - $74,999.99

|

11.25%

|

|

$25,000 - $49,999.99

|

11.75%

|

|

$10,000 - $24,999.99

|

12.25%

|

|

$0 - $9,999.99

|

12.75%

|

Current Citibank base rate is 9.00%.

The Lowest Margin Rates

| Broker |

$0 - $4,999 |

$5,000 - $9,999 |

$10,000 - $24,999 |

$25,000 - $49,999 |

$50,000 - $99,999 |

$100,000 - $249,999 |

$250,000 - $499,999 |

$500,000 - $999,999 |

above $1,000,000 |

|

Robinhood

|

6.75%

|

6.75%

|

6.75%

|

6.75%

|

6.75%

|

6.75%

|

6.75%

|

6.75%

|

6.75%

|

|

M1 Finance

|

7.25%

|

7.25%

|

7.25%

|

7.25%

|

7.25%

|

7.25%

|

7.25%

|

7.25%

|

7.25%

|

|

ZacksTrade

|

8.58%

|

8.58%

|

8.58%

|

8.58%

|

8.58%

|

8.08%

|

8.08%

|

8.08%

|

7.83%

|

Citi Brokerage vs. M1 Finance Introduction

Although Citigroup is more famous for its global banking services, it does offer brokerage

accounts in the United States. Can the much smaller investment firm M1 Finance deliver more

than the behemoth Citi? Let’s find out.

Pricing

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

M1 Finance

|

$0

|

na

|

na

|

$0

|

$0

|

|

Citibank

|

$0

|

$0

|

na

|

$0

|

$0

|

Promotions

M1 Finance:

$250 cash bonus for making a $10K deposit at M1 Finance.

Citi:

Open a Citi investment account.

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

M1 Finance

|

|

|

|

|

|

|

|

Citibank

|

|

|

|

|

|

|

Category #1: Investing Styles

Citi provides self-directed trading in the following:

- Options

- Equities, including OTC stocks

- Fixed-income securities

- Mutual Funds

- ETFs

- Closed-end funds

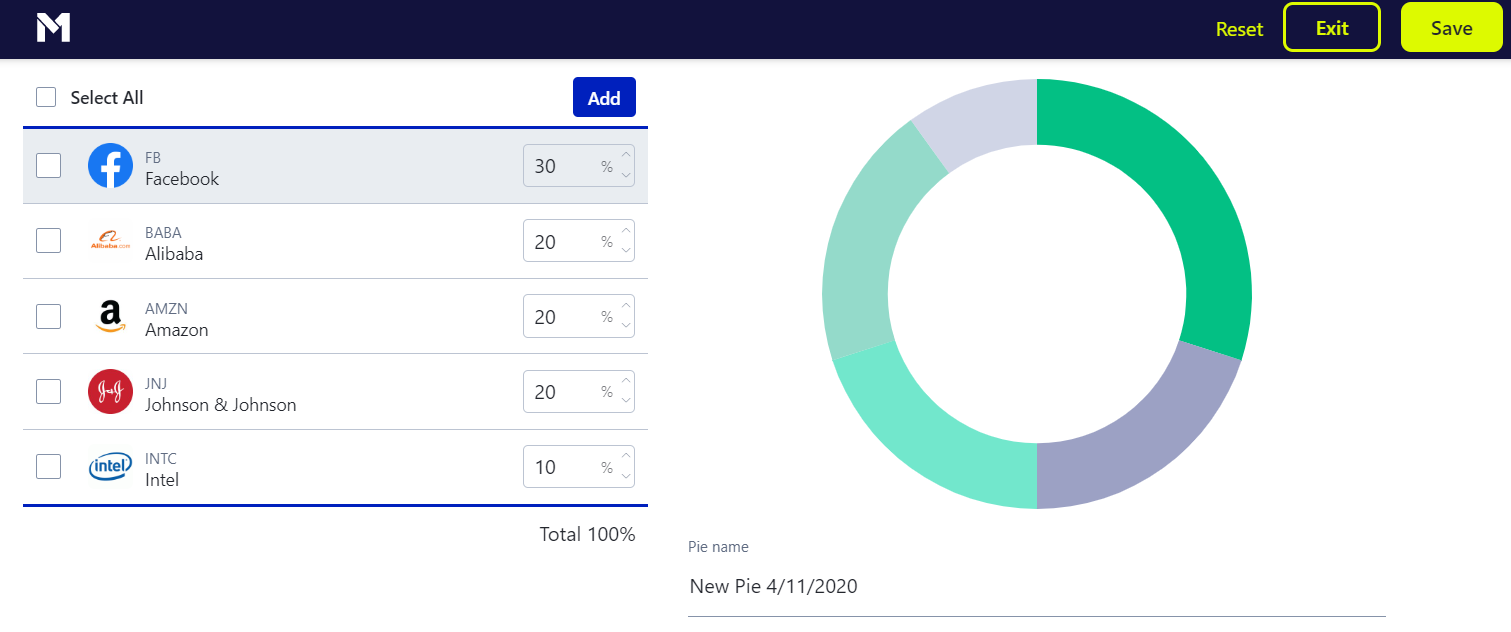

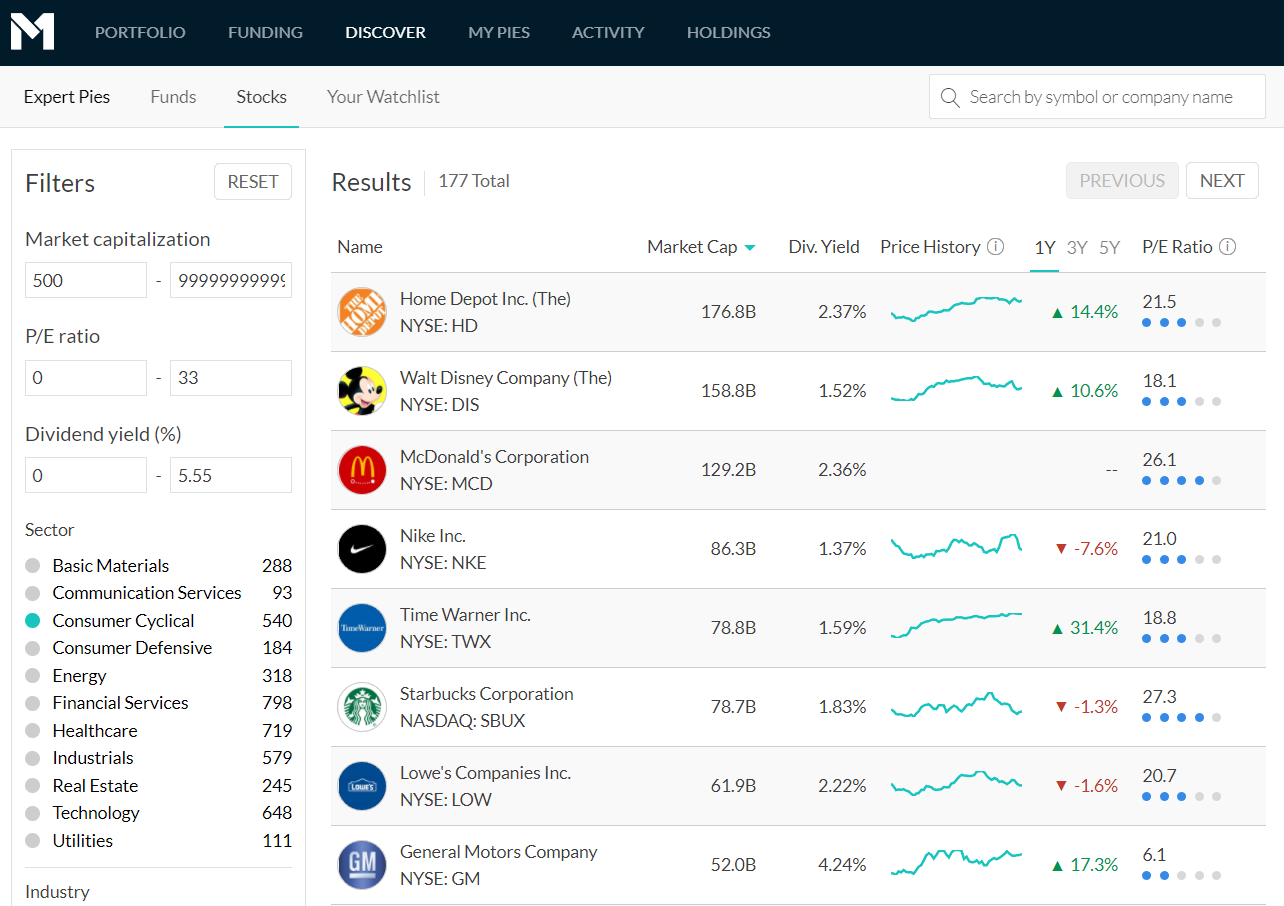

M1 Finance drops bonds, options, and over-the-counter stocks from this list. Like its rival, it only offers self-directed accounts, although it does offer pre-built Pies, which are baskets of securities with various themes, like Icahn Capital and domestic value.

Winner: Citi

Category #2: Margin

Margin accounts are available with both firms. M1 Finance is unique in the brokerage industry by charging just a flat rate at all balance tiers (this company tries to simplify everything). The rate is currently a low 7.25%. Customers who aren’t satisfied with this rate can get a discount of 150 basis points by paying an annual fee.

Citi is the traditional brokerage firm in this contest. As such, it’s not surprising that it charges margin interest on a tiered schedule. The broker starts at 12.75% and gradually reduces its rate for higher and higher balances. The schedule reaches 3.5% at a margin debit of $1 million.

Winner: M1 Finance

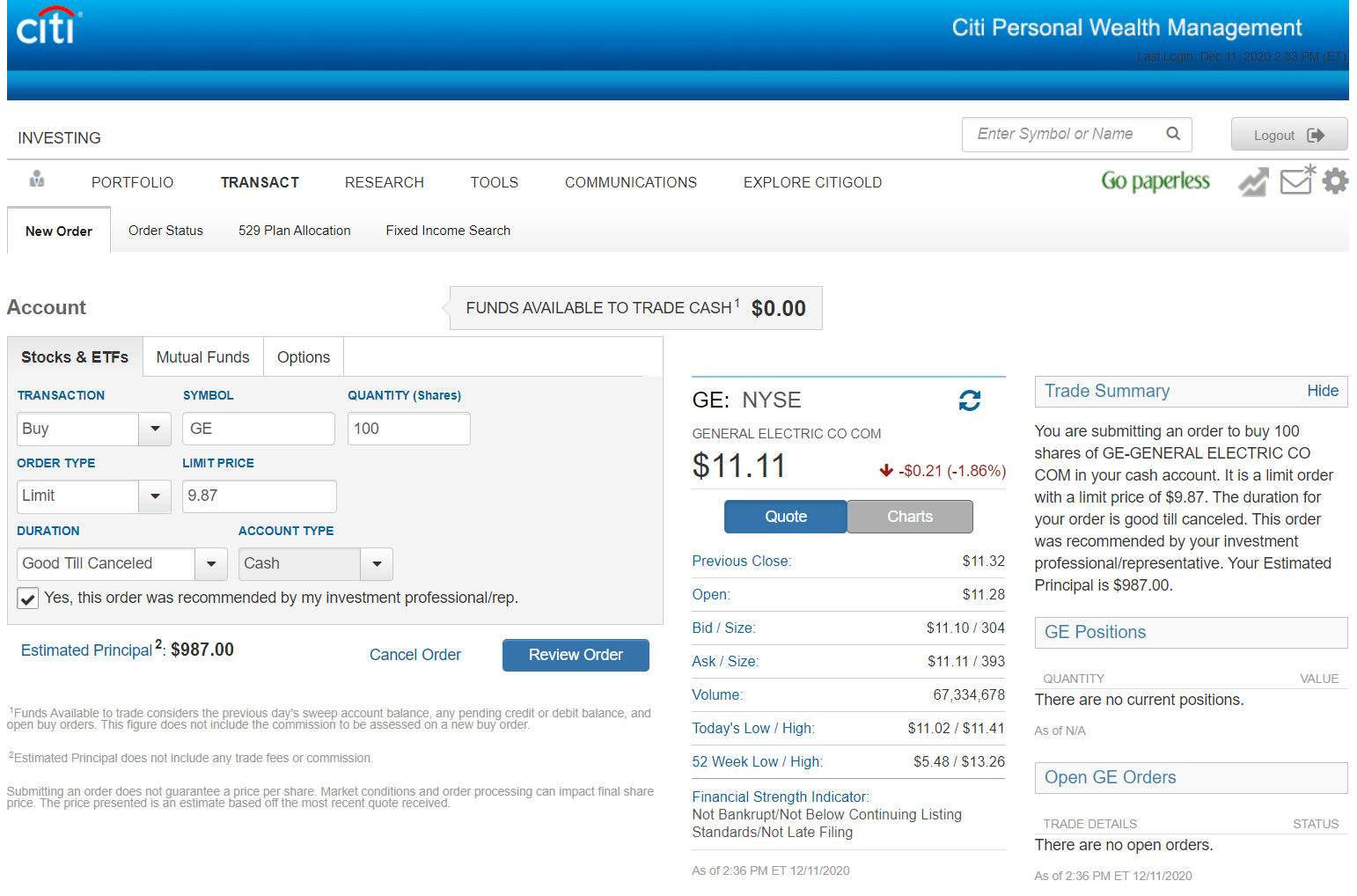

Category #3: Websites

Citi has a rather undeveloped website. Although it is not well designed, it does have a user-friendly top menu that makes navigating the site fairly straightforward.

A search box at the top of the site can be used to quickly retrieve market data on a ticker symbol. Volume, bid-ask numbers, and the price action of the last 2 days can be viewed.

A stock’s profile has a much larger chart with several graphing tools. These include the following:

Comparisons

Technical studies

Multiple display styles

The Transact tab in the top menu offers a selection of order types, including:

Limit / All or none

Limit / Fill or kill

Stop / Limit

Mutual funds have their own trade ticket. Orders can be placed using dollars or shares.

The M1 Finance site has an order request form. It’s not really a trade ticket as the broker is the one who sends orders to the major exchanges.

Charts on the M1 site have no tools of any kind. There is only one display style, and five years of price history is the max.

On the upside, the M1 Finance site is easier to navigate than Citi’s.

Winner: Citi

Category #4: Mobile Apps

The brokerage arm of Citi does not use the standard Citi app, nor does it have its own. Instead, it uses the NetXInvestor™ mobile app. This is a brokerage app that several broker-dealers use. It has a lot of the same features that the Citi brokerage site has, including market news, stock research, and analyst ratings. The order ticket has the same trade types as the website.

The M1 Finance mobile app is much more user-friendly than the NetXInvestor™ platform. Nevertheless, there is no order ticket (keeping with the M1 investment philosophy), although it is possible to build Pies on a mobile device. Unlike the NetXInvestor™ app, it’s possible to access multiple accounts from the M1 Finance app.

Winner: M1 Finance

Category #5: Miscellaneous Services

Extended Hours: Not available at either firm.

DRIP Availability: Citi and M1 Finance offer dividend reinvesting. Citi has no minimum, while M1 Finance requires a $25 reinvestment amount.

IPO Availability: Neither broker-dealer provides IPO trading before an offering hits the secondary market.

Fractional-share Trading: M1 Finance customers can trade baskets of securities in whole dollars, which results in fractional shares. Citi does not yet offer partial-share trading in stocks and ETFs.

Individual Retirement Accounts: Both brokerage firms offer IRAs. Citi has a $95 closeout fee. M1 Finance does not.

Cash Management Tools: Surprisingly, a Citi brokerage account doesn’t come with any banking tools. M1 Finance offers several cash management features, some of them at zero cost.

Automatic Mutual Fund Investing: Citi offers periodic mutual fund investing.

Winner: M1 Finance

Our Recommendations

ETF & Stock Trading: Citi is the only brokerage house in this survey to offer trading during the entire market day, so it gets our endorsement.

Retirement Savers and Long-Term Investors: We don’t like Citi’s $95 IRA closeout fee, but it does have target-date mutual funds. Although M1 Finance has target-date Pies, there aren’t very many of them. Pretty even here.

Small Accounts: Citi has multiple account fees. Small traders should definitely stick with M1 Finance.

Beginners: M1 Finance does a better job of simplifying the investment process compared to its rival.

Promotions

M1 Finance:

$250 cash bonus for making a $10K deposit at M1 Finance.

Citi:

Open a Citi investment account.

Citi vs M1 Finance - Judgment

Citi may have the global name, but that doesn’t help it much in this rundown, which has seen

M1 Finance perform quite well in many areas.

Updated on 7/13/2024.

|