Interactive Brokers Margin Rates

If you’re looking for a brokerage firm that offers margin accounts with the lowest possible

interest rates, look no further than Interactive Brokers. There is a difference between

IBKR Pro and Lite pricing schedules, but even Lite customers get a great deal.

IBKR Pro Margin Rates

|

Debit Balance

|

Margin Rate

|

|

$0 - $100,000

|

6.83%

|

|

$100,001 - $1,000,000

|

6.33%

|

|

$1,000,001 - $50,000,000

|

6.03%

|

|

$50,500,001+

|

5.83%

|

IBKR Lite Margin Rates

|

Debit Balance

|

Margin Rate

|

|

$0 - $100,000

|

7.83%

|

|

$100,001 - $1,000,000

|

7.83%

|

|

$1,000,001 - $50,000,000

|

7.83%

|

|

$50,000,001+

|

7.83%

|

Open Interactive Brokers Account

Get up to $1,000 of IBKR Stock for FREE!

Open IB Account

Competitor Margin Rates

| Broker |

$0 - $4,999 |

$5,000 - $9,999 |

$10,000 - $24,999 |

$25,000 - $49,999 |

$50,000 - $99,999 |

$100,000 - $249,999 |

$250,000 - $499,999 |

$500,000 - $999,999 |

above $1,000,000 |

|

Robinhood Gold

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

|

ZacksTrade

|

8.58%

|

8.58%

|

8.58%

|

8.58%

|

8.58%

|

8.08%

|

8.08%

|

8.08%

|

7.83%

|

|

M1 Finance

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

Non-USD Accounts Margin Rates at IBKR

An Interactive Brokers account can be denominated in U.S. dollars or in one of several other currencies. Examples include Canadian dollars, Euros, British pounds, and Japanese yen. All of these currencies have different margin rates for the sheer fact that their central banks have set different interest rates. Nevertheless, Interactive Brokers does a good job of keeping rates low.

Margin rates for a JPY-denominated account range from 2.5% to 0.75%. The highest rate we found was for the Turkish lira (currently 21.7%).

Cash Accounts and Margin Accounts

A cash account is simple. You deposit $3,000 in cash and have $3,000 to buy securities. But those securities are assets, and like any asset, they can serve as collateral for a loan. That’s what a margin account is. It is borrowing against an account’s assets to buy more assets.

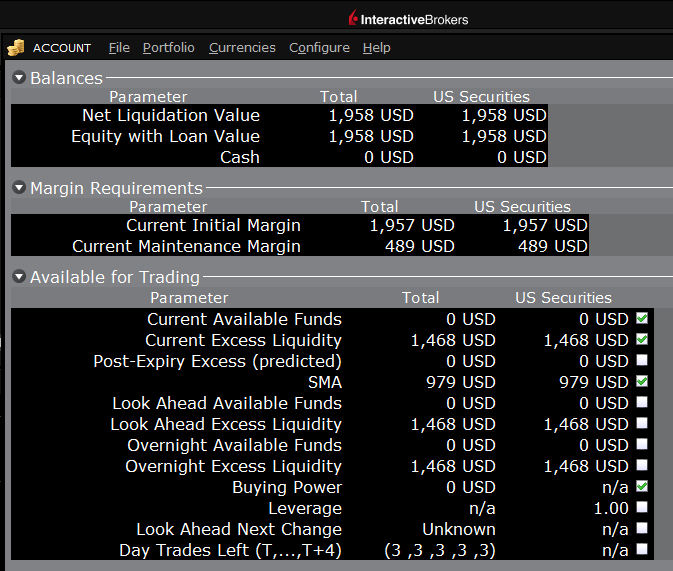

Although margin trading may sound like a more complicated system, and it certainly is, Interactive Brokers makes it as easy as possible by automatically calculating margin numbers for an account and displaying them on the trading platform.

To locate margin details on an account, log into the company’s desktop platform Trader Workstation and click on the Portfolio link found under the New Window tab (located in the upper-left portion of the screen).

This will produce a window (which may already exist in the workspace) with a list of current positions. In the upper-right corner of this window is an account tab with a plus sign. Click on this to get extensive margin information on the account, including:

- Buying power

- Overnight excess liquidity

- Day trades left

- Special memorandum account (SMA)

To add margin trading privileges to a cash account, click on the man icon in the upper-right corner of the website and click on Settings. Under the section for Account Configuration, click on the link for Account Type. Follow the online prompts to upgrade from cash to margin or to downgrade from margin to cash.

Margin Requirements at Interactive Brokers

As always, Interactive Brokers caters to the most demanding and sophisticated of traders out there. This emphasis does result in a more complex margin system, but we’ll do our best to simplify it.

Margin requirements at Interactive Brokers are affected by three variables:

- Country of residence

- Country of exchange

- Product traded

Obviously, there can be many margin examples as these three variables change. For US-based accounts trading stocks on US exchanges, the numbers are as follows:

- Initial Margin Requirement: 25%

- Maintenance Margin Requirement: 25%

- Reg T End of Day Initial Margin: 50%

Short positions have slightly different numbers. The initial and maintenance requirements are both 30% for a stock priced above $16.67. The margin requirements decrease if the stock price is below $16.67.

Leveraged ETFs have more restrictive margin policies at Interactive Brokers. Some securities are not marginable at all. These include over-the-counter instruments.

Long stocks below $5 do not have any special margin requirements at Interactive Brokers.

Mutual funds can never be purchased on margin, although they can be used for collateral after 30 days.

A US-based account at Interactive Brokers must have at least $2,000 in equity before it can begin using margin.

Portfolio Margin

Interactive Brokers offers Portfolio Margin accounts. These can have higher leverage than regular margin accounts, although they have higher minimum requirements.

A Portfolio Margin account must have a Net Liquidation Value (NLV) of at least $110,000. If the account value falls below $100,000, Interactive Brokers will place restrictions on the account.

Some securities cannot be included in the calculation for Portfolio Margin. These include several foreign securities. Canadian accounts are not eligible for Portfolio Margin.

Exposure Fee

Interactive Brokers has an exposure fee for high-risk accounts. The company uses advanced computer programs to scan its accounts for unusually risky positions. Although these accounts may be margin compliant, IB still assesses an exposure fee against these accounts.

The exposure fee is calculated on every calendar day and is assessed against the account at the end of the following trading day.

Positions that increase the likelihood of an account being charged an exposure fee include short positions and highly-concentrated long positions.

Margin-Enabled IRA at Interactive Brokers

Although the IRS prohibits the use of IRA funds as collateral, it is still possible to add margin capability to a retirement account at Interactive Brokers. This will allow the IRA to trade with unsettled funds, which means it can day trade.

Margin Education

Interactive Brokers has an extensive educational program called Traders’ Academy. Among the many online lessons it offers, one is an overview of trading on margin. There are five lessons in total in the program. They are:

- Margin – Getting Started

- Securities Margin Trading in the US

- Commodities Margin Trading in the US

- Margin in Practice Part 1: Trader Workstation (TWS)

- Non-US Margin Trading

The margin course would be especially good for beginners.

Interactive Brokers Cash Interest Rate

0%

|