Moomoo Margin Interest Rates

Moomoo has margin accounts with a very simple margin interest rates:

|

Debit Balance

|

Margin Interest Rates

|

|

above $1,000,000

|

6.8%

|

|

$500,000 - $999,999.99

|

6.8%

|

|

$250,000 - $499,999.99

|

6.8%

|

|

$100,000 - $249,999.99

|

6.8%

|

|

$50,000 - $99,999.99

|

6.8%

|

|

$25,000 - $49,999.99

|

6.8%

|

|

$10,000 - $24,999.99

|

6.8%

|

|

$0 - $9,999.99

|

6.8%

|

It’s just a flat rate for all debit levels. Can’t get much easier than that.

Moomoo Promotion

Get zero commissions at Moomoo.

Open Moomoo Account

Competitor Margin Rates

| Broker |

$0 - $4,999 |

$5,000 - $9,999 |

$10,000 - $24,999 |

$25,000 - $49,999 |

$50,000 - $99,999 |

$100,000 - $249,999 |

$250,000 - $499,999 |

$500,000 - $999,999 |

above $1,000,000 |

|

Robinhood Gold

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

8%

|

|

ZacksTrade

|

8.58%

|

8.58%

|

8.58%

|

8.58%

|

8.58%

|

8.08%

|

8.08%

|

8.08%

|

7.83%

|

|

M1 Finance

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

8.75%

|

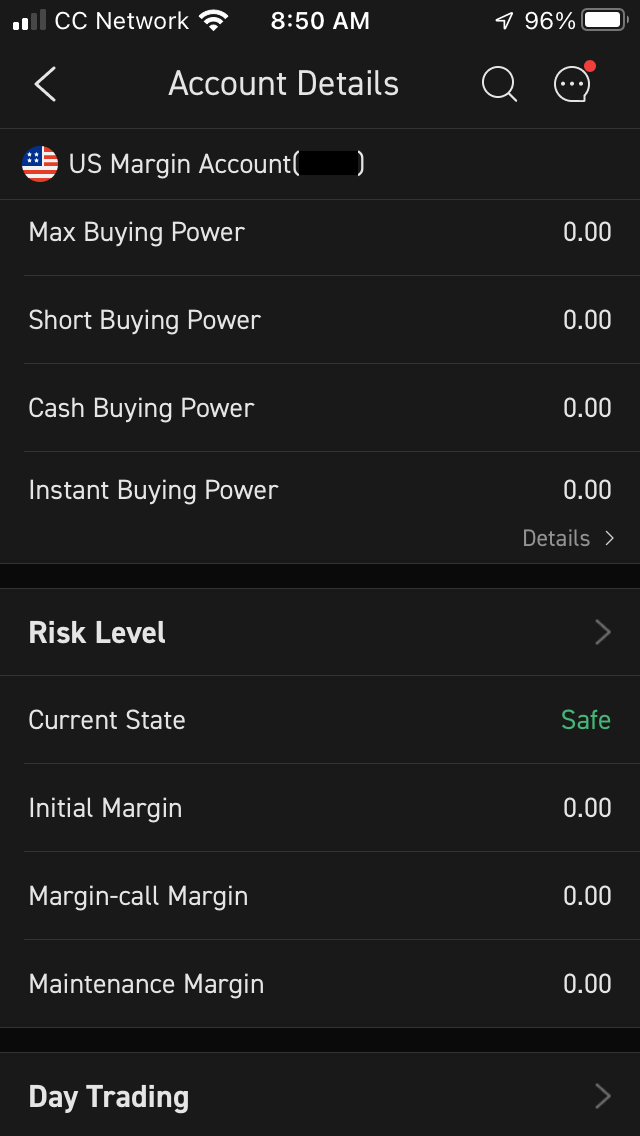

Moomoo Margin and Cash Accounts

Moomoo offers margin accounts only. Cash accounts are not available. This means it’s not possible to convert a margin account into a cash account or vice versa.

The primary advantage of a cash account is that it’s a little simpler in terms of buying power, amount available for withdrawal, etc. Another advantage is that a cash account also can never be accidentally overdrawn and be charged interest.

Locating Margin Balances

Moomoo of course provides balance details on its margin accounts. On the desktop platform, these numbers can be found on the Me tab (located at the top of the left-hand menu). Click on this tab and you’ll see margin details on each account linked to the login credentials. Available lines include:

- Day trades left

- Buying power

- LMV (long market value)

- SMV (short market value)

- Margin loan

The Moomoo mobile app has slightly different margin particulars that don’t appear on the desktop platform. These include PDT status, margin-call margin, risk level, frozen funds, and more.

To find margin info on the mobile app, tap on the Trade icon at the bottom of the screen and then hit the Account Details icon.

Overview of Moomoo Investing App

Moomoo is a new brokerage firm with some advanced trading tools. A subsidiary of Futu, Inc., it

uses the same trading tools as its parent company. Starting in 2015, it has built an impressive

software platform, but many services are still missing. Here are the details of Moomoo pros and cons:

Opening an Account

Moomoo’s website is available in English and Chinese. The broker has a user-friendly online account

application through its parent company’s website at fututrade.com.

Besides Americans, Futu accepts applications from residents of many other countries. Residents of mainland China have their own dedicated application. A Chinese Identity Card is required. Applicants from other countries require a passport.

Although headquartered in Silicon Valley, some of the instructions on Moomoo’s application sound like they were written by non-native English speakers. Futu is insured by SIPC and regulated by FINRA and SEC.

The real downside of Moomoo right now is that it only provides individual margin accounts.

Updated on 4/20/2024.

|