|

Vanguard vs Citi vs Webull (2024)

|

Citibank vs. Webull and Vanguard

Although Citi is a large, global company, smaller American firms may provide better brokerage

services. Take a look at this comparison, for example:

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Vanguard

|

$0

|

$20

|

$1.00 per contract

|

$20*

|

varies

|

|

Citibank

|

$0

|

$0

|

na

|

$0

|

$0

|

|

WeBull

|

$0

|

na

|

$0

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Vanguard

|

|

|

|

|

|

|

|

Citibank

|

|

|

|

|

|

|

|

WeBull

|

|

|

|

|

|

|

Promotions

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Vanguard: no promotion right now.

Citi: no promotion right now.

Tradable Assets

Investors at Webull can buy and sell these products:

- Cryptocurrencies

- ETFs

- Closed-end funds

- Equities

- Options

Vanguard and Citi customers lose cryptos but gain mutual funds and bonds. Citi does not offer trading in cannabis stocks, but the other two firms do.

Winner: Vanguard

Margin Resources

With a margin account at any broker in this survey, you’ll be able to trade using borrowed money. Here’s what it will cost you:

Citi: 12.75%

Vanguard: 13.75%

Webull: 9.74%

On Webull’s trading platforms, you’ll find margin details on every stock and ETF. These particulars include details like overnight leverage and the cost to borrow the security. Vanguard’s and Citi’s platforms don’t offer these data points.

Winner: Webull

Trading Software

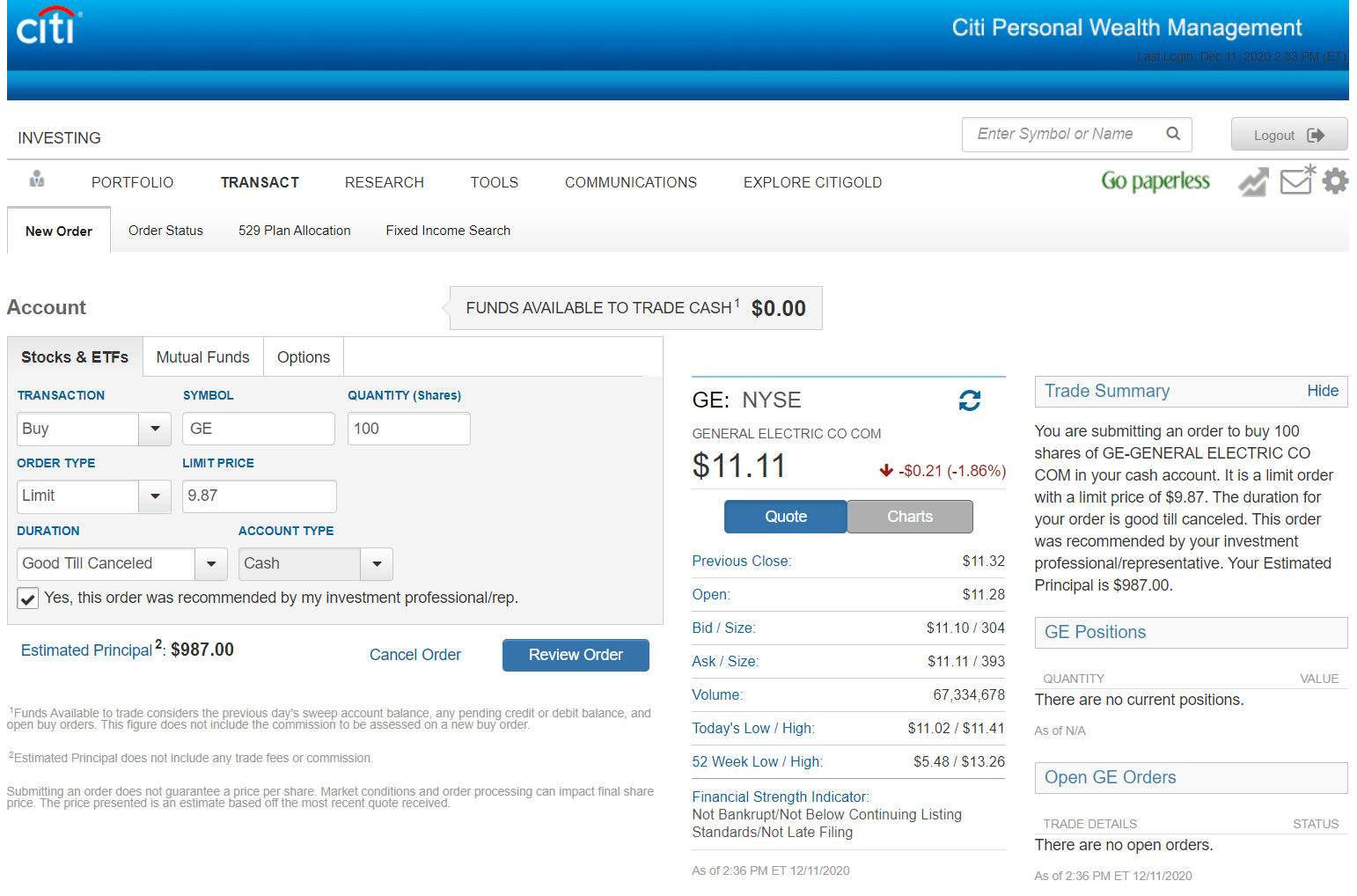

To actually submit orders for securities, Vanguard and Citi have simple websites that, while simple, can get the job done. Citi’s site offers multiple charting tools, including about 15 technical indicators, comparisons, and 4 graph styles. But there’s no full-screen mode, which is a disappointment. Citi’s order ticket has limit and stop orders. More advanced order types are absent.

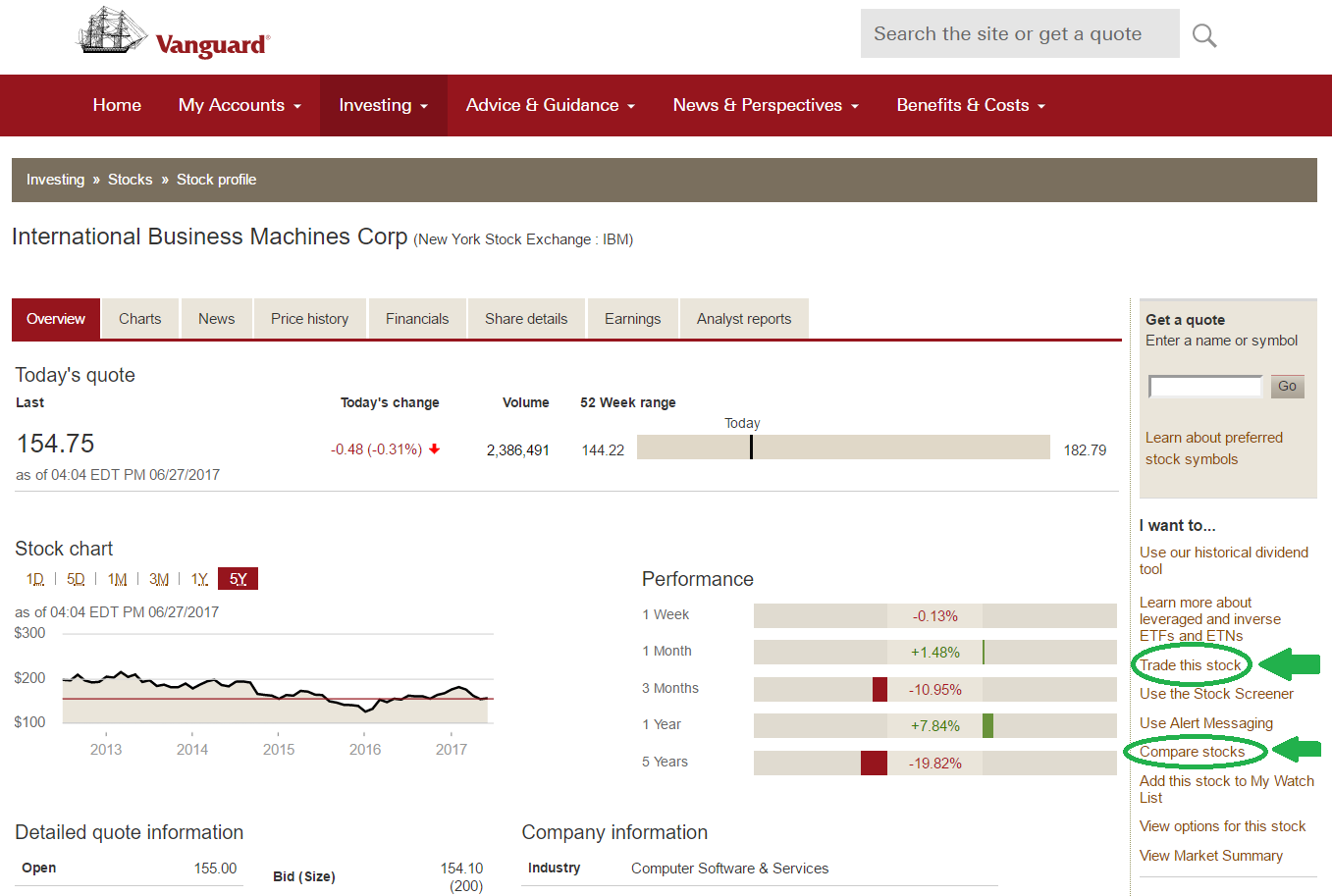

Moving on to Vanguard, we find the same order types, although there are no fill-or-kill or all-or-none choices. These do appear on Citi’s ticket. For charting, Vanguard has a pretty similar widget with remarkably similar results.

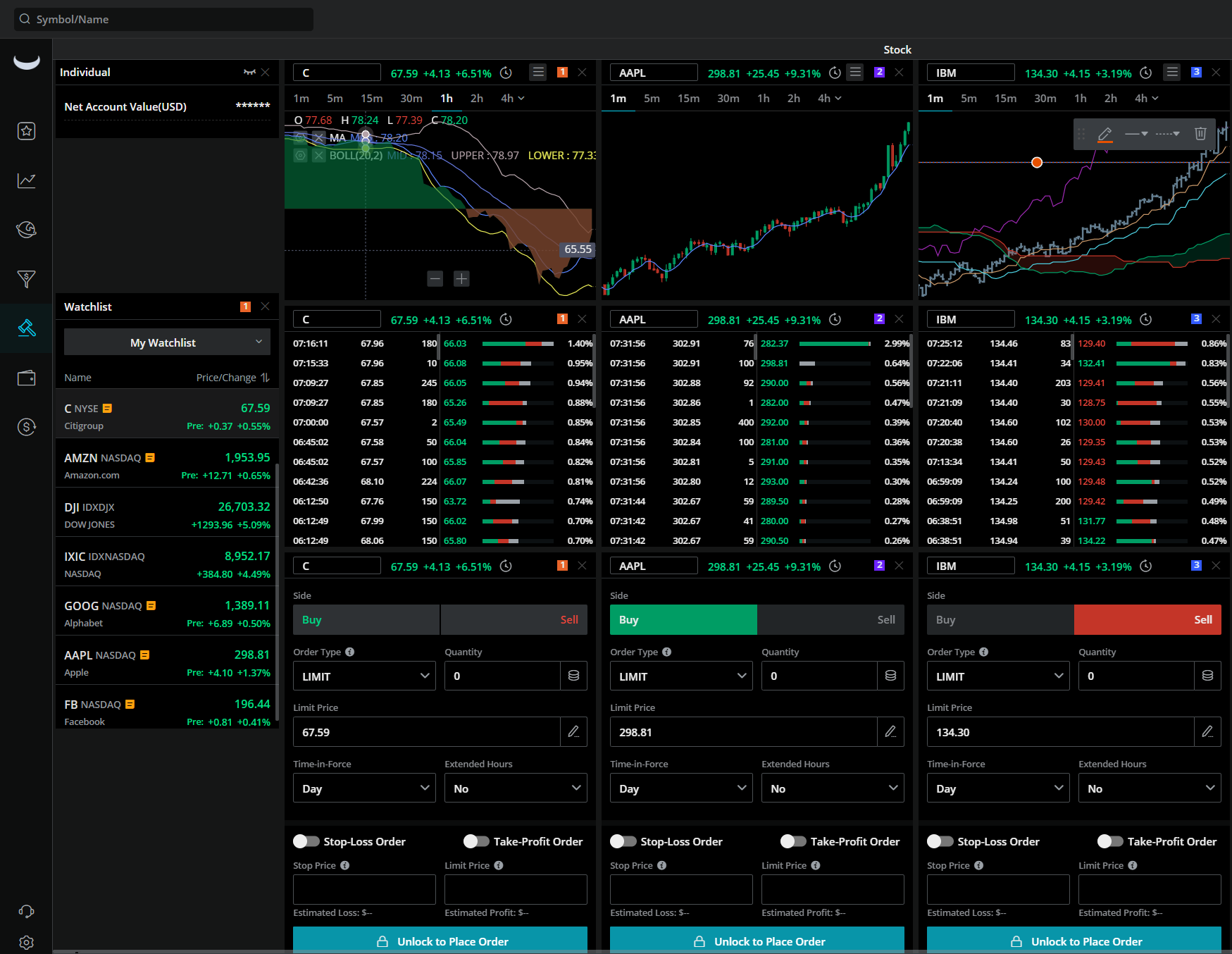

But Webull is a different story. It is the lone broker in this faceoff to have a desktop program. With either the desktop system or browser platform, you’ll find many more technical studies than either Citi or Vanguard has. Plus, Webull’s charts can be displayed the full width of the monitor. And we really like having 8 display options (including baseline and hollow candle).

For order entry, Webull’s software delivers multiple trade tickets. One is a rapid-entry widget with trade buttons already populated with share amount, ticker symbol, and order type. The broker’s regular order form offers bracket and trailing orders, a considerable advantage over its rivals here.

Winner: Webull

Option Tools

All three brokerage firms in this survey offer trading in option contracts. Unfortunately, we didn’t find any spectacular tools at a single one of them.

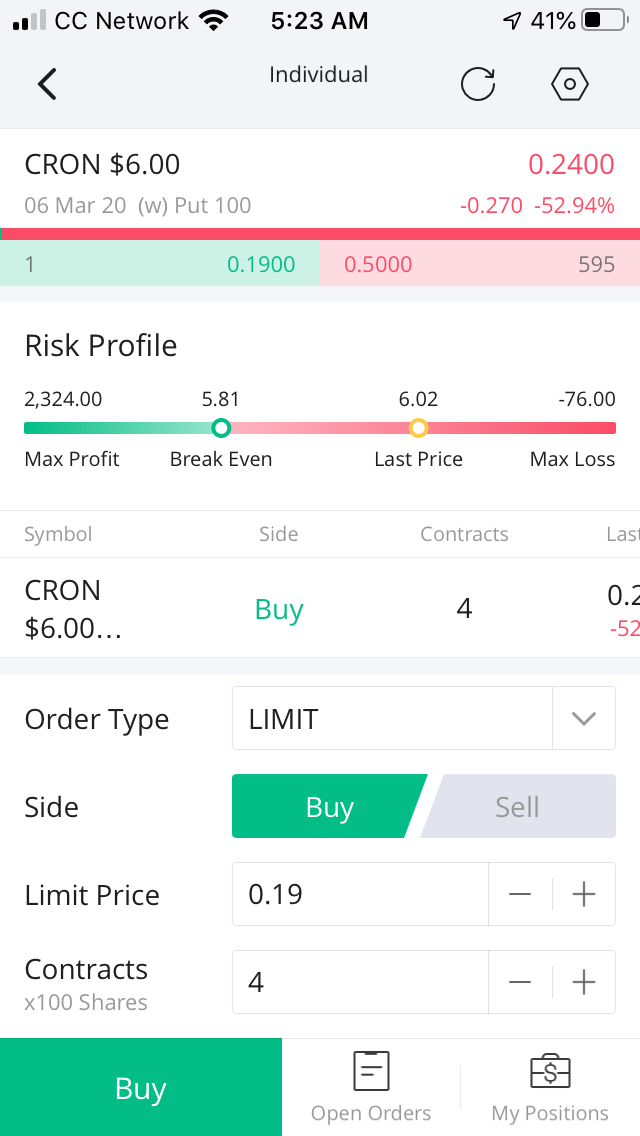

Webull’s browser platform delivers chains for calls and puts. Just click on a bid or ask price and a single contract will populate an order ticket. Maximum profit and loss numbers are shown. But unfortunately, the broker doesn’t offer trading in option spreads, so single orders are the only possibility.

Vanguard’s software can only display one option type (call or put) at a time. Like Webull, Citi does offer multi-leg strategies, but its software shows a pop-up graph of a contract’s price history when you hover over a bid or ask price.

Winner: Tie between Citi and Webull

Other Services

IPO availability: The only brokerage firm to provide direct participation in IPOs before they begin trading is Webull. The other two only allow trading in IPOs in the secondary market after they start trading.

IRAs: All three brokerage houses offer Individual Retirement Accounts. Webull has the fewest types, and Citi has the steepest fees.

Fractional-share trading: It’s not possible to invest a whole-dollar amount in stocks or ETFs at any of the broker-dealers in this study. Webull does offer whole-dollar investing in cryptocurrencies.

Dividend Reinvestment Program: DRIP service isn’t available at Webull, but it is at the other two brokers.

Automatic mutual fund investing: Citi customers can enroll their mutual fund holdings in periodic investments. Vanguard provides this service only for Vanguard funds.

Extended hours: Webull provides both pre-market and after-hours trading. Vanguard only has a late-night session, and Citi has nothing.

Winner: Webull

Our Recommendations

Small accounts: Webull.

Stock/ETF trading: Webull.

Beginners: Vanguard or Webull.

Long-term investors and retirement savers: Vanguard.

Promotions

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Vanguard: no promotion right now.

Citi: no promotion right now.

Results

The largest financial company in this survey is the weakest performer. And the newest broker on

the scene, Webull, is the overachiever.

Open Account

Open Account

Open Account

|