Overview of Moomoo, Citi Self Invest, and Wealthfront

Citi Self Invest is owned by one of the largest banks in the world. Does that mean it delivers a better

investing experience than moomoo and Wealthfront? Let’s have a look.

Fees

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Moomoo

|

$0

|

na

|

$0 per contract

|

$0

|

$0

|

|

Wealthfront

|

$0

|

na

|

na

|

0.25%

|

0.25%

|

|

Citibank

|

$0

|

$0

|

na

|

$0

|

$0

|

Services

Available Investments

In the realm of brokerage accounts, Citi Self Invest offers trading in stocks, exchange-traded funds, and mutual funds. Moomoo doesn’t have mutual funds but it does offer stocks and ETFs (plus option contracts, closed-end funds, and Chinese stocks). And Wealthfront has a stock-trading account that has a short list of stocks.

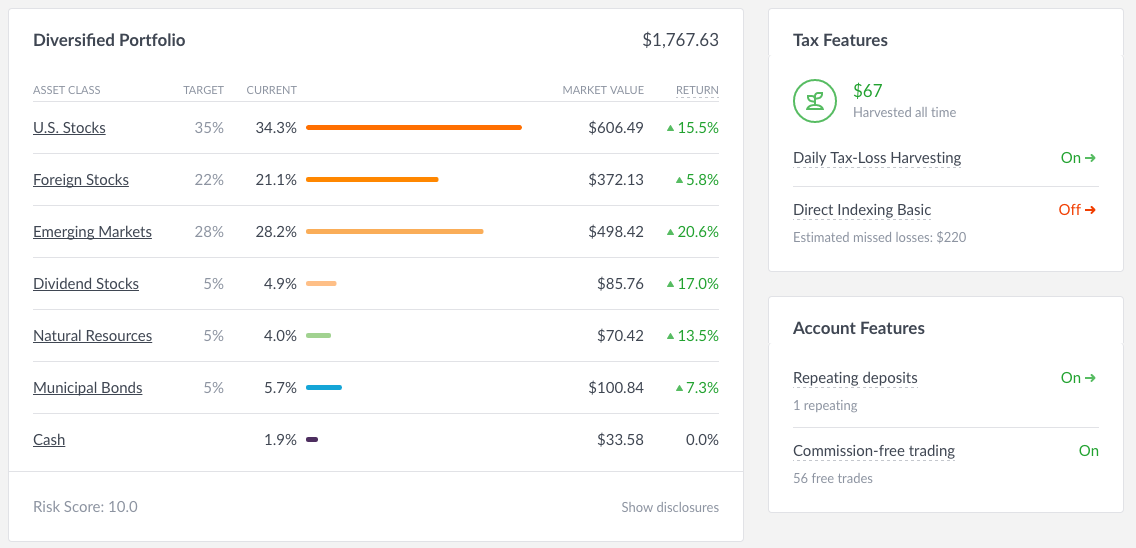

Then there are the managed accounts. Wealthfront specializes in robo investing with low-cost ETFs. Citi offers Citi Wealth Builder, which is an automated program. It also has a Wealth Management service that adds actual human advisors to the mix. For something in between, there is Wealth Builder Plus, an automated program with human financial planners.

Moomoo does not offer any type of investment-advisory program. It also fails to deliver any tax vehicle other than the individual taxable account. The same is true for Citi Self Invest and Citi Wealth Builder. Wealthfront has individual, joint, 529, and trust accounts (although the stock-investing account is individual-only).

Winner: Citi

Websites

Wealthfront’s website is designed to be simple, and it is. Accounts of both types—robo and stock investing—can be managed. It’s easy to set up purchases of securities with either account type. The latter, the stock-investing system, does not have any advanced trading tools because Wealthfront is the party responsible for executing the trades.

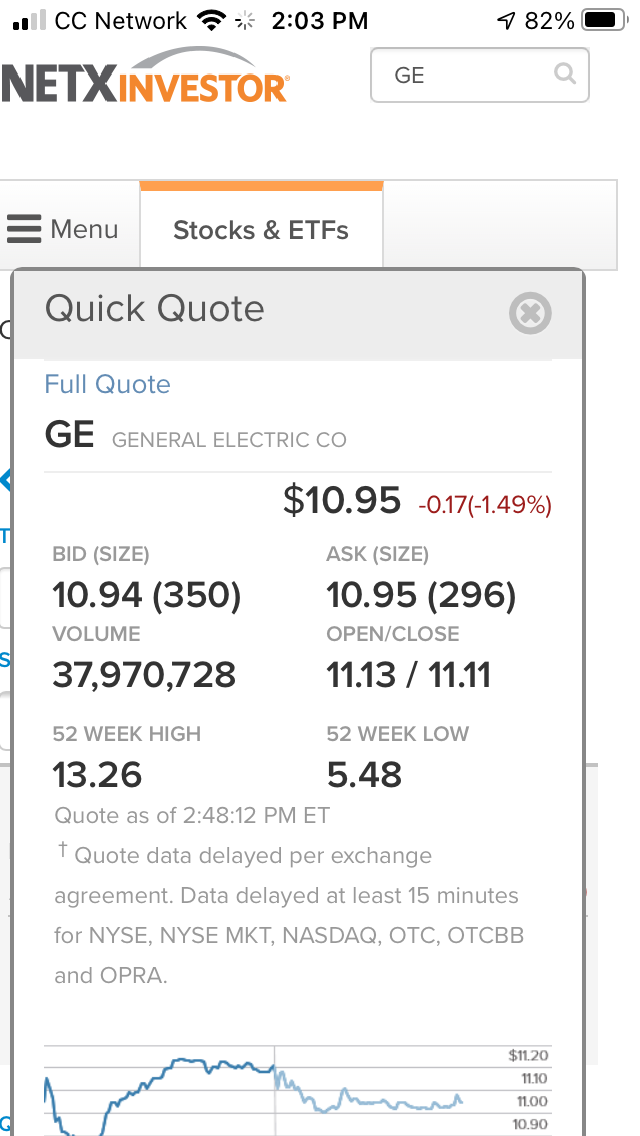

Over at Citi Self Invest, the situation is the opposite. The account owner submits trades, and the website does have a decent order ticket for this. We found market, limit, and stop orders. All or none and fill or kill are qualifiers that can be added to a ticket. Charting, however, is on a very low level with no tools to speak of.

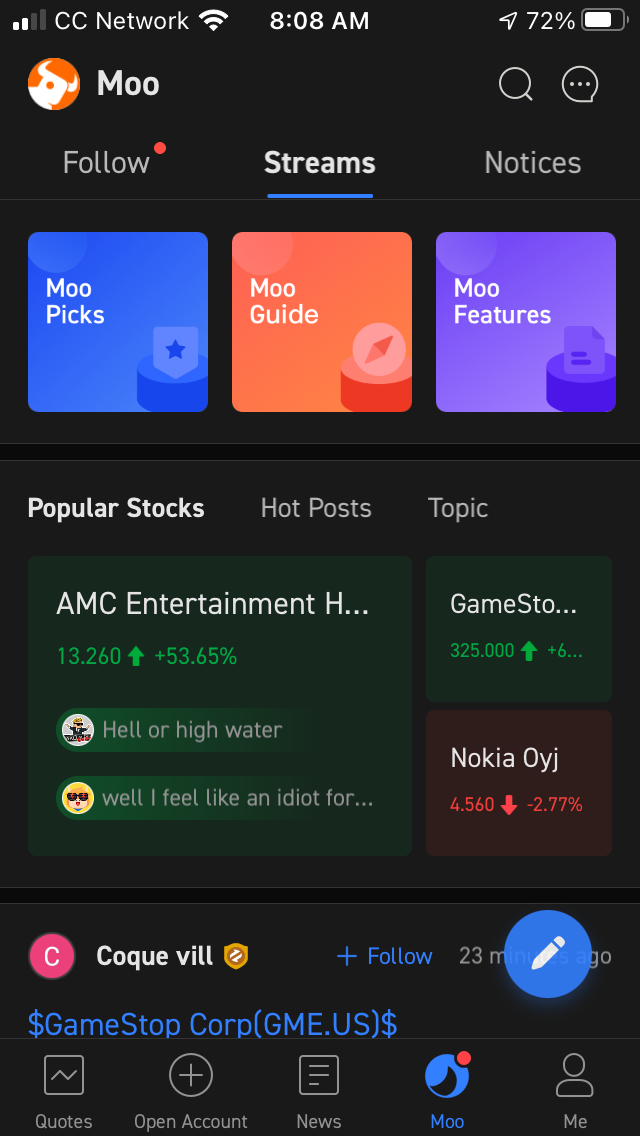

Although moomoo is a high-octane brokerage firm, its website doesn’t have any trading tools. Instead, the site is used for market and security research. Assets have profiles, and here we discovered lots of useful resources. There are option chains, financial statements, price targets, and analysts’ trade recommendations. A paper-trading feature allows for practice trading with no risk.

Winner: Moomoo

Mobile Apps

For Wealthfront and Citi Self Invest, simple trading and account management continue on their mobile apps. Both apps have cash-management tools as both firms offer such resources. The Citi app has the same basic charting and order entry that we saw on the website with a watchlist that syncs with the site. There is trade data on profiles that include such information as previous close and the day’s price range.

Then there is the moomoo app. This time, there is live trading, and it is quite advanced thanks to many sophisticated resources. The order form has 8 trade types, including some advanced ones like trailing stop limit and market if touched. Charting on the app has many gadgets, including overlays, trend projections, drawing tools, and technical studies. A graph can be rotated horizontally for easier viewing.

Winner: Moomoo

Desktop Software

Finally, there is desktop software for the most advanced level of trading. Moomoo’s platform has a similar layout and feel as its mobile app. During our test drive of the program, we found it powerful yet easy to use. Of particular importance are these features:

- 12 order types

- Watchlists that sync with the mobile app

- Simulated trading

- Level II quotes

- Time & sales data

- Quant strategies

- Social networking

- Paperfolio, a hypothetical basket of securities to analyze a simulated investment

Wealthfront and Citi Self Invest do not have any desktop software.

Winner: Moomoo

Margin Trading

Although Citi Self Invest does not offer any type of margin trading, Moomoo does. Currently, interest

rates are 6.8% annualized for Hong Kong and American securities. China A-shares are 8.8%.

Wealthfront has something called a Portfolio Line of Credit. This does require $25k in assets to use.

The cost is 8.9%.

Winner: Moomoo

Bonus Services

Dividend reinvestment program: For self-directed accounts, only Citi Self Invest has dividend reinvesting.

Extended hours: Only available at moomoo.

Fractional shares: Wealthfront and Citi both offer whole-dollar investing. Moomoo does not.

IPO availability: Moomoo clients can buy shares of upcoming stock launches before they hit the secondary market.

Fully-paid securities lending program: Not available at any one of the investment firms in this survey.

Individual Retirement Accounts: Only at Wealthfront.

Periodic mutual fund investing: Citi Self Invest has it.

Winner: Small advantage to Citi Self Invest

Our Recommendations

Beginners: Citi Wealth Builder Plus (although it does require $25k). For accounts under $25k, Wealth Builder or Wealthfront.

Mutual fund trading: Citi Self Invest gets the nod here.

Active stock trading: Definitely moomoo.

Small accounts: For automated accounts, Citi Wealth Builder requires $5k. Wealthfront only requires $500. None of the three brokers here requires any deposit to open a self-directed account.

Retirement savers and long-term investors: With joint accounts, trusts, personal IRAs, SEP IRAs, and 401k rollovers, Wealthfront gets the endorsement.

Final Judgment

For investment management, Citi seems to have the upper hand here. For self-directed trading, moomoo is

the clear winner.

|