|

Interactive Brokers vs Citi Self Invest (2024)

|

Citi Self Invest vs. Interactive Brokers Introduction

Interactive Brokers and Citi Self Invest could not be more different. Take a look at this comparison:

Fees

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Charles Schwab

|

$0

|

$49.95 ($0 to sell)

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

IB

|

$0+

|

$14.95

|

$0.25+ per contract

|

$0-$240**

|

$30

|

|

Citibank

|

$0

|

$0

|

na

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Charles Schwab

|

|

|

|

|

|

|

|

IB

|

|

|

|

|

|

|

|

Citibank

|

|

|

|

|

|

|

New Account Promotions

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Citi: none right now.

Accounts and Assets

Traders at Citi Self Invest can buy and sell equities, mutual funds, and ETFs. There are no other investment vehicles available at this time.

Interactive Brokers goes a giant leap further with cryptocurrencies, fixed-income securities, options, futures, precious metals, foreign assets, and forex.

Both broker-dealers also offer managed accounts through affiliated companies.

Winner: Interactive Brokers

Margin

Margin accounts at Interactive Brokers pay anywhere from 6.83% to 7.83% for borrowed money, depending on the commission schedule chosen and the margin balance. Citi Self Invest only offers cash accounts.

Winner: Interactive Brokers

Computer Software

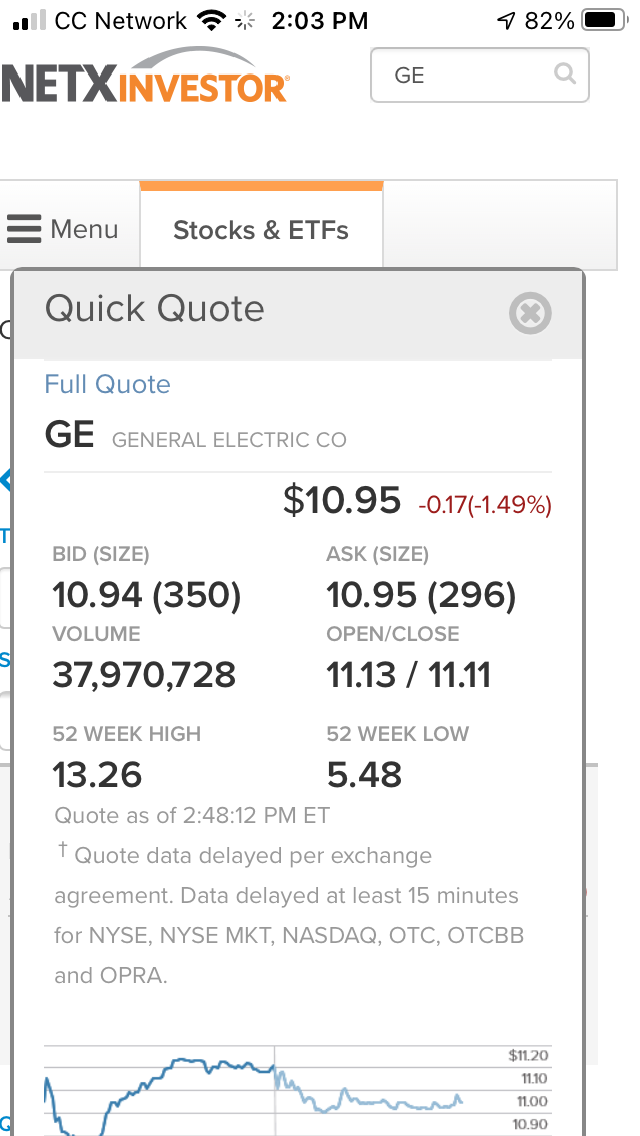

Traders at Citi Self Invest use the same site that other Citi customers use. It is rather simple, and because other accounts with Citi are integrated in it, it can be difficult to navigate. The IBKR site can be difficult to get around as well. What really separates these two is in actual trading.

Charts on the Citi site, for example, are very rudimentary with no tools of any kind. Charts on the IBKR site, by comparison, have lots of gadgets and gizmos. During our probing, we found over 70 technical studies, more than 10 graph styles, and no less than 100 drawing tools. A graph can be saved and reloaded later.

Order entry is on a similar level. The ticket on Citi Self Invest’s website is rather simple with just four order types (market, stop, stop limit, and limit). The IBKR site, by comparison, has 6 order types, including market and limit on close. There are toggle switches to add a bracket order to a trade. There’s also a price management algo feature to bring the order ticket to a more sophisticated level.

Both sites do provide research materials on securities, although the IBKR site has many more resources, including an actual stock screener that won’t be found on the Citi site.

Finally, IBKR has a desktop platform that delivers a professional-level trading experience. Citi Self Invest has no such software.

Winner: Interactive Brokers

Mobile Apps

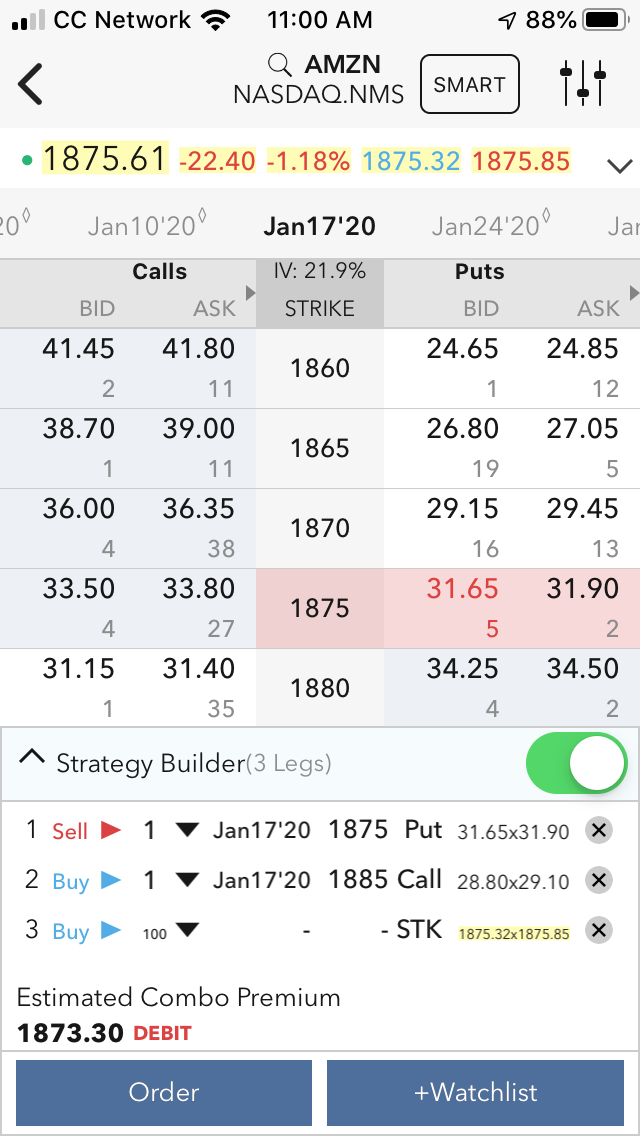

The trading competition continues on mobile apps, and here we find much the same situation: advanced trading at Interactive Brokers and simple trading at Citi Self Invest. Citi’s order ticket is the same one we found on the website, while IBKR has created even more order types than its website has. New trade types include:

- Market or limit if touched

- Relative

- Trail limit

Charting manages to be very good on the IBKR app, although it’s not quite on the same level we found on the website. A chart can be displayed horizontally, and there are some really good tools. Option chains are available for calls and puts and a few spreads. There’s also an options wizard to create custom trades.

Because Citi Self Invest uses Citibank’s app, there are lots of cash-management tools on it.

Winner: Interactive Brokers

Day Trading

Level II Quotes: Interactive Brokers has them.

Direct-access Routing: Only at Interactive Brokers.

Extended Hours: Not at Citi Self Invest.

PDT Status: At Interactive Brokers, a pattern day-trading account can be reset. The broker’s software shows how many day trades an account has.

Shorting: Only Interactive Brokers permits short positions.

Maker-Taker Fees: Again, only with an Interactive Brokers account.

Winner: Interactive Brokers

Supplementary Services

Fully-Paid Stock Lending: IBKR clients can make money by lending out their shares.

Individual Retirement Accounts: Only at Interactive Brokers.

Automatic Mutual Fund Investing: Only at Citi Self Invest.

Initial Public Offerings: Not available at either brokerage house.

Fractional Shares: Available at both firms.

DRIP Service: Citi Self Invest has dividend reinvesting for both stocks and ETFs. Interactive Brokers restricts its service to stocks.

Extended-hours Trading: IBKR clients can trade pretty much 24/7 when considering all asset classes and exchanges.

Winner: Interactive Brokers

Recommendations

Beginning Investors: A robo account with either company.

Mutual Fund Trading: IBKR is the only option.

Small Accounts: Neither firm has any minimums for self-directed accounts.

Retirement Planning & Long-Term Investing: An IRA with Interactive Brokers.

Stock and ETF Trading: Definitely IBKR.

New Account Promotions

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Citi: none right now.

Final Judgment

Citi Self Invest simply can’t stand up to the trading prowess of Interactive Brokers.

|