Trust Accounts at Interactive Brokers

Interactive Brokers offers many account types for both individuals and institutions. Among these is the trust account. It’s really easy to open one of these on the IBKR website, and it comes with fantastic pricing.

Overview of Trust Accounts at Interactive Brokers

Interactive Brokers offers several trust types. Among these are:

- Irrevocable Living Trust

- Revocable Living Trust

- Regulated Retirement Trust (Qualified Retirement Plan)

- Regulated Retirement Trust (Non-Qualified Retirement Plan)

- Testamentary Trust

- Other

Interactive Brokers accepts both legally-established trusts and common-law trusts.

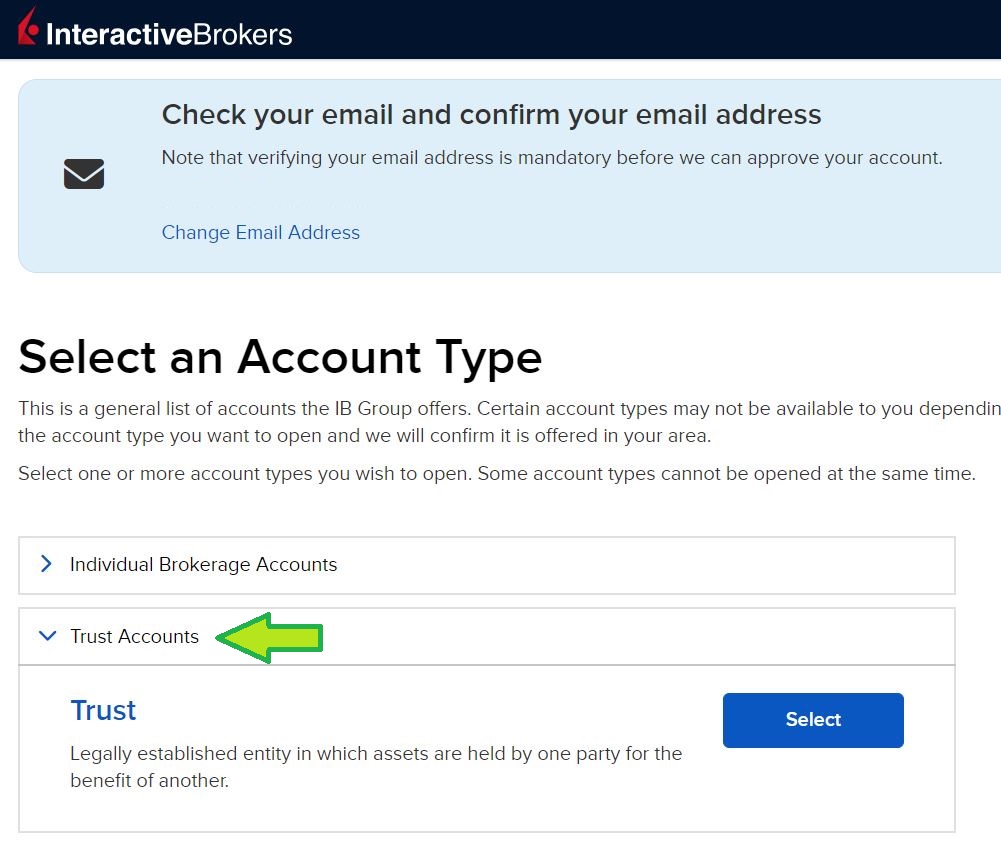

Opening a Trust at IBKR

It’s possible to

open a trust account using the IBKR website. As logical as it sounds, the best place to begin is with the red Open an Account button that appears prominently at the top of the site. After clicking on this button, you’ll be presented with a page to create a login. Both new and existing IBKR clients should open a trust account in this manner. A trust must have its own login credentials; it cannot use the login credentials of an existing account.

On the initial sign-up page, the country of residency must be indicated. Besides the United States, there are lots of other countries of tax residency that Interactive Brokers will accept. Examples we found include:

- Turkmenistan

- Western Sahara

- Zambia

- Canada

An email address must also be specified, and this email will need to be verified before Interactive Brokers will actually open the account.

Further down the list, a commission schedule must be chosen for the trust account. The two options are IKBR Lite and IBKR Pro.

Fill in the other requested details, including contact information, tax ID number, and principal place of business. A tax ID number is required, although it doesn’t have to be a Social Security Number or any number from the U.S. government.

Interactive Brokers Promotion

Open IB Account

Trust Accounts at Interactive Advisors

Trust accounts can be opened at Interactive Advisors, the robo arm of the company, only by institutions. Individuals are not eligible.

Fees for Trusts at IBKR

Interactive Brokers imposes no special pricing schedule on trust accounts. Thus, a trust can be opened with zero deposit. There is no low-balance fee or other recurring charges, like annual or maintenance fees.

Trading will come with very low fees on many products. A U.S.-based trust pays no commissions at all on online trades of U.S.-listed stocks and ETFs. Other products will have trading costs of some kind, although IBKR does a good job of keeping these quite low. Trades of futures, for example, can cost as little as 10¢ per trade.

Investments for Trusts

Trust accounts at Interactive Brokers can trade a wide assortment of asset classes. These products include the same investments other accounts have access to, such as:

Futures

Stocks, including OTC and foreign stocks

Mutual funds

Fixed income

ETFs

Options

Forex

And more

Trust Education

Once the trust is open and account access is granted, there will be an Education tab at the top of the site after logging in. This tab presents many learning materials geared towards active trading. Although they don’t generally target an estate-planning audience, there are a few trust terms in the glossary that are worth taking a look at.

IBKR Trust Account Judgment

Yes, trusts are available at Interactive Brokers. It’s really easy to open one, thanks to the company’s user-friendly online application. Even common-law trusts can be opened. But there’s not much in terms of trust education, so only experienced investors who know what they’re doing should take the plunge.

Interactive Brokers Promotion

Open IB Account

|