Transferring Brokerage Accounts Between Interactive Brokers and Ally Invest

Do you have an Interactive Brokers account? Are you interested in moving it to Ally Invest? Keep reading—we’ll show you everything you need to do to make the switch using the Automated Customer Account Transfer Service (ACATS). We’ll also describe in detail how to move an Ally Invest account to Interactive Brokers.

Transfer From Interactive Brokers to Ally Invest

To electronically move a securities account from Interactive Brokers to Ally Invest, just follow this simple guide:

Step #1: So you want to move your Interactive Brokers account to Ally Invest. Well, you need to open an Ally Invest account. There are some rules you need to be aware of, however.

First, both accounts must be of the same type (such as Individual Retirement Accounts). Second, they have to have the same name on them. Third, if you plan to move any option contracts, your Ally Invest account will need option privileges. Fourth, option contracts that expire in less than two weeks should not be transferred. And fifth, if you’re transporting margin balances or option spreads, you’ll need to apply for margin trading.

Your Ally Invest account can be set up in either self-directed or robo mode. If you select a managed account, you can only move cash into it, which will affect the next step.

Step #2: In this second phase, you want to prep your Interactive Brokers account for the forthcoming transfer. If you’re moving into a robo account at Ally, this will mean liquidating everything to produce the amount of cash you want to transfer.

If you’re going to push securities over, you need to be aware that Ally Invest will not accept the transfer of some over-the-counter equities. Before attempting to transport any through the ACATS network, contact Ally Invest and see if they will accept your OTC positions.

Several asset classes available at Interactive Brokers are off limits inside an Ally Invest account. These include forex, futures, cryptocurrencies, spot gold, foreign stocks, and hedge funds. None of these can be moved into an Ally Invest account. They could be kept in a separate Interactive Brokers account or liquidated. You could also do a partial transfer and leave them in your IB account.

Before doing a full transfer, you must close out open orders and allow all trades to settle.

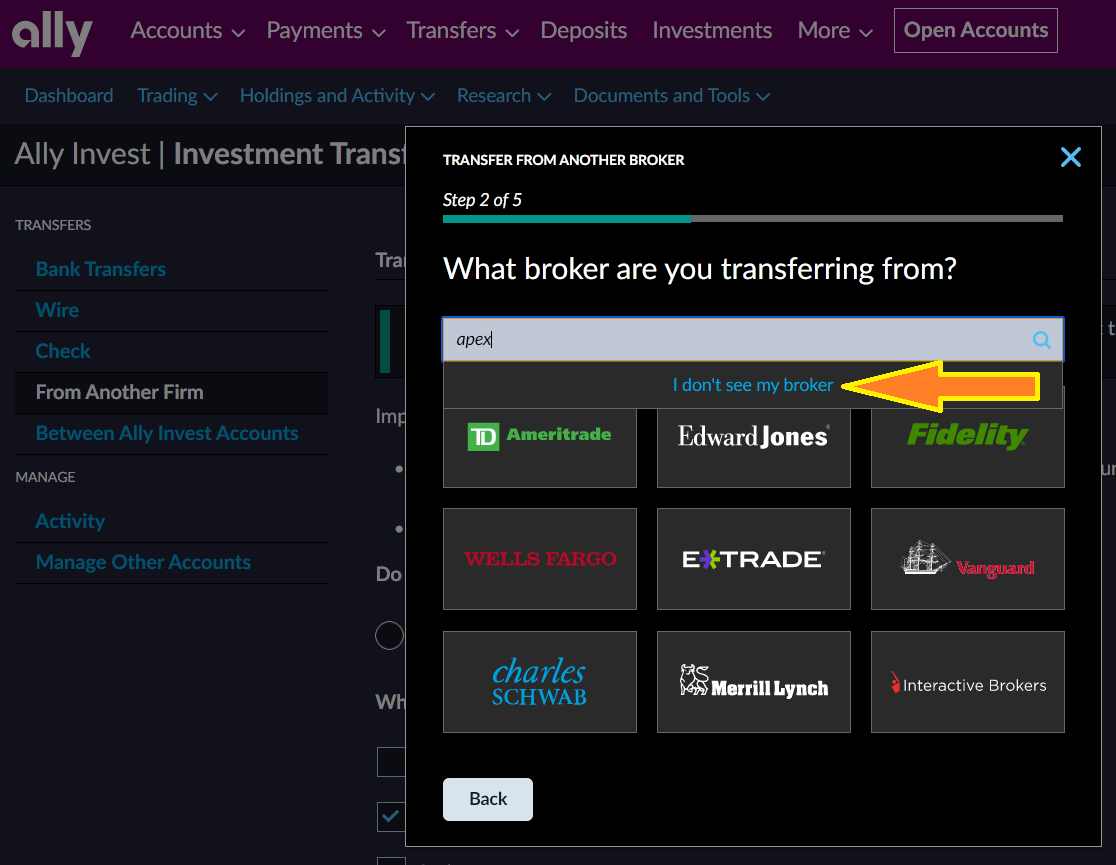

Step #3: All right, you have both accounts ready, which means there’s just one thing left to do: request the ACATS transfer. You can do this easily on Ally Invest’s website. Just select My Accounts in the upper-left corner, then hover over Transfer funds, and finally click on Account transfer in the small window that appears.

Now you’ll see Ally’s user-friendly ACATS form. If you look over the brokerage firm logos on the transfer form, you’ll see IB’s logo. Click on it to select Interactive Brokers as the outgoing firm. You’ll need to type in your IB account number and a few other details.

You can select either full or partial transfer on the ACATS form. If you choose full transfer, your old account will be closed when the transfer completes. If you select partial, it will remain open.

If you’re going to move cash only, it may be easier to opt for an ACH bank transfer. This is easy to do. Just connect the same checking or savings account to both brokerage accounts and use it as a middleman to get money from Interactive Brokers to Ally Invest.

Ally Alternatives

Transfer From Ally Invest to Interactive Brokers

Moving an account in the other direction has a similar story, although there are some important

differences.

Step #1: you need to open an IB account. The first difference is that Interactive Brokers offers a much larger list of accounts, so it is especially important here to open the right account type. Remember that it must match the account that you have at Ally Invest. Many account types at Interactive Brokers, such as proprietary trading group and small business, are not available at Ally Invest.

If you have options that you plan to move over, be sure to add options trading to your IB account. And if you have any margin balances or option spreads, you’ll need to make it a margin account as well.

Step #2: With your Interactive Brokers account open and ready to go, it’s time to prep your Ally Invest account. The same tasks mentioned in the previous section apply here. Take care of open orders and unsettled trades. Option contracts with less than two weeks of life in them should be closed out or moved to a discrete account.

Forex can never be moved in an ACATS transfer, so if you have any currency positions at Ally Invest, make sure they are in a discrete account (or you could just close them out or do a partial transfer and leave them out of the transfer).

If you have mutual funds you want to transfer, you may want to contact Interactive Brokers to verify that they will accept the specific funds you have.

If you have micro-cap stocks in your Ally Invest account, you need to check with Interactive Brokers if they will accept these assets. Some of them IB will not accept.

It’s certainly possible to transfer a robo account from Ally Invest to Interactive Brokers. Remember that the ETFs in the account will be your responsibility once they arrive because Interactive Brokers does not offer robo management.

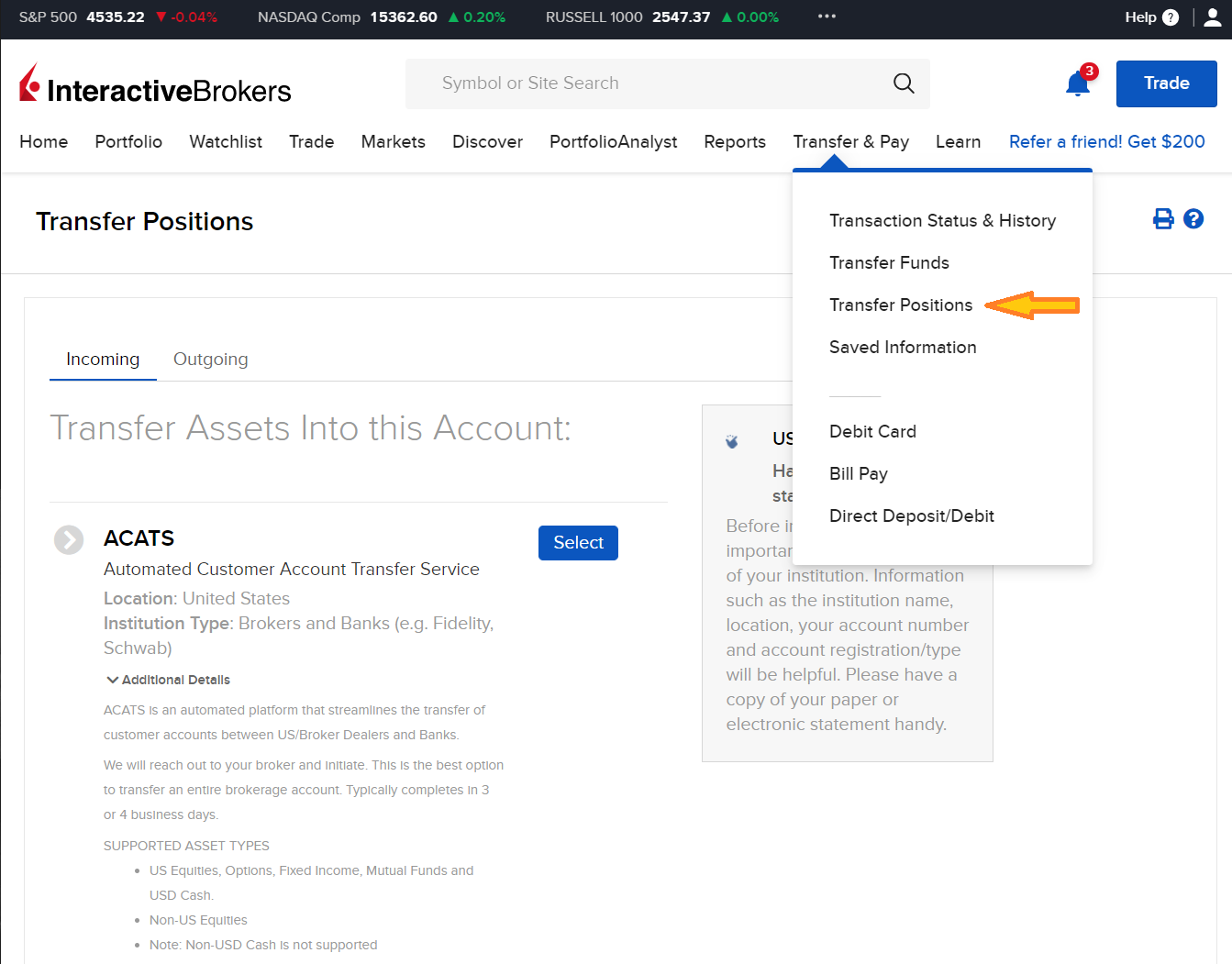

Step #3: Now it’s time to pull the trigger. This time, you’ll do it on the IB website. Go to the top menu and and select Transfer & Pay. In the sub-menu, click on Transfer Positions.

This will pull up the digital transfer form. First, you’ll want to be sure to select incoming transfer (not outgoing in this case) and then select ACATS transfer. Interactive Brokers offers other types, so make sure you select ACATS.

Once your assets arrive inside your Interactive Brokers account, be aware that you may not be able to withdraw cash or transfer assets to another brokerage house for 10 business days after the transfer from Ally is received. Transferred equity positions are not available for withdrawal for up to 30 days.

Open Interactive Brokers Account

Open IB Account

Cost of Moving an Account

Interactive Brokers customers don’t have to pay anything for an outgoing transfer, which simplifies things a great amount. Surprisingly, the broker-dealer does have $1 ACH fee after one free transfer per month. Most banks don’t add anything to this fee.

Ally charges nothing for ACH transfers, but Ally Invest has a $50 ACATS fee. Interactive Brokers does not refund this fee.

How Long Does an ACATS Transfer Take?

An ACATS transfer can take up to 2 weeks and usually does. A transfer of cash through the ACH network could be shorter than this, although it depends on whether you already have the intermediary bank account linked to both brokerage accounts. If you have to do this linking first, an ACATS transfer would probably be quicker.

|