Transfer Vanguard to Robinhood (and Vice Versa) in 2024

How to Transfer Accounts between Vanguard and Robinhood

Moving an investment account from Vanguard to Robinhood or from Robinhood to Vanguard is not only possible, it is simple and fast, thanks to the Automated Customer Account Transfer Service (ACATS). Keep reading—we’re going to show you everything you need to know.

Transfer from Robinhood to Vanguard

To move a Robinhood account into Vanguard, just follow these steps:

First, prepare your Robinhood account for the upcoming transfer. This includes closing out any option contracts that expire in 5 days or less (for a full transfer). If you opt for a partial transfer, you could simply leave them behind.

Cryptocurrencies also don’t transfer. If you attempt to move any of these out of your Robinhood account, they could be sold off. You could do an internal transfer at Robinhood to move the digital currencies from one Robinhood account to another. Then, you could do a full account transfer from the account that doesn’t have the cryptocurrencies. This is also true for option contracts.

Although Robinhood doesn’t offer trading in most over-the-counter stocks, it does have a few. Be aware that Vanguard no longer offers trading in most OTC stocks, so any OTC equities at Robinhood probably won’t transfer.

If you have a negative cash balance in your Robinhood account, that will need to be eliminated.

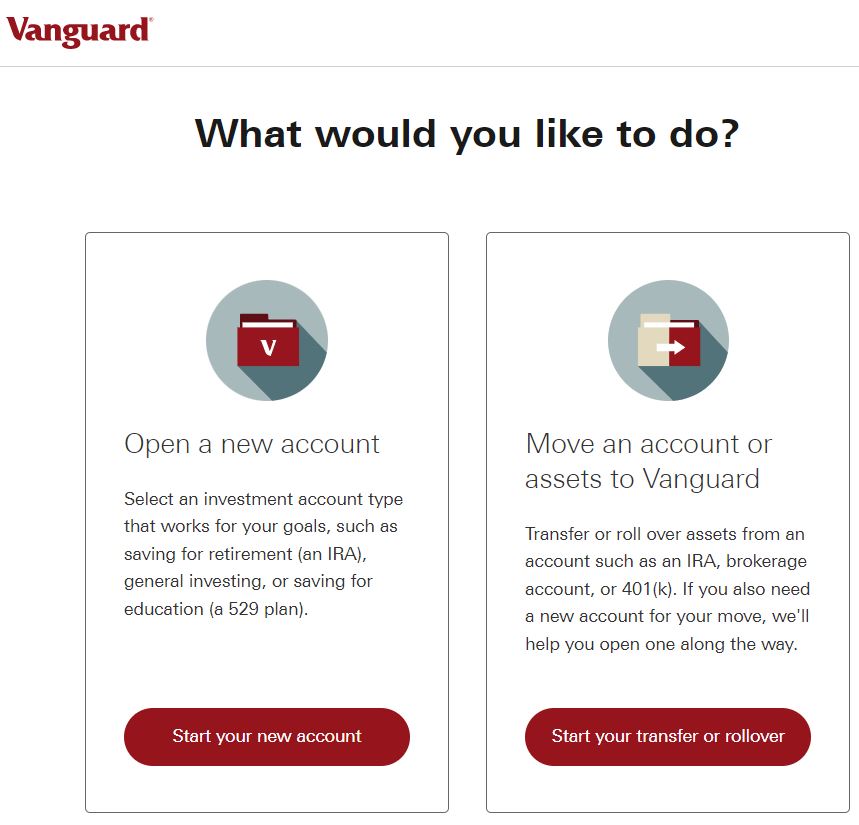

Second, open a Vanguard account if you don’t have one already. In an ACATS transfer, what happens is assets are moved from one account at one brokerage firm into a second account at another firm. The accounts themselves don’t actually move. A full account transfer will close the outgoing account, while a partial transfer will leave it open.

If you have an existing Vanguard account, it might be able to receive a transfer of assets from Robinhood. The names on the two accounts must match exactly, and the two account types must also be the same (this means the Vanguard account must be an individual account). If either one of these conditions isn’t met, it’s fairly painless to open a new Vanguard account. Just look for the link to open a new account in the upper-right corner of the website. You’ll be given the option to open a new account or open a new account and transfer assets from an external account at the same time. Although the second choice sounds ideal here, it is still possible to open an account and do the transfer at a later date.

Third, request the transfer. This can be done during the account application, as already mentioned. If you have an existing individual account at Vanguard and want to use that one, the ACATS form can be located by clicking on the Open an account link that appears at the top of the site. On the next page, you can open a new account or transfer an existing account from Robinhood.

Selecting the second option creates the transfer form. You’ll want to select individual as the account type you’re moving over. You’ll be given a few possible outside brokerage firms to select. Robinhood is one of the choices, so click on Robinhood.

On the next page, you can either link your Robinhood account with its login credentials, or you can supply an account number. In either case, you’ll be able to specify full or partial transfer. Go through the remaining steps and supply any requested information. Once Vanguard receives the transfer request, it will notify Robinhood. There’s nothing left for you to do at this point.

Fourth, wait. It should take about a week and a half for your assets from Robinhood to arrive in your

Vanguard account.

Robinhood charges $100 to transfer your account out. If you

>move your Robinhood to Webull,

the broker reimburse the $100 transfer fee if your transfer is valued at $2,000 or more.

Free Webull Account

Open Webull Account

Transfer from Vanguard to Robinhood

Going in the other direction follows a very similar path, with a few extra caveats.

First, get your Vanguard account arranged for the imminent transfer. Because Robinhood only offers

individual and Traditional/ROTH IRA accounts, the Vanguard account will have to be one of these.

If it’s not, you could open a new Vanguard individual account and transfer assets into that new account. Be aware that doing so could have tax consequences, so be sure to consult a licensed tax professional before taking this step.

Option contracts in their expiration week should be closed out or left behind in a partial transfer. Robinhood will not accept them. Some option strategies may not be accepted by Robinhood, either.

Bonds and mutual funds cannot be transferred at all because Robinhood doesn’t offer trading in them.

Fractional shares of stocks and exchange-traded funds can’t be moved through the ACATS network. Vanguard will automatically convert them to cash, which can be moved. Otherwise, you can submit sell orders for them, which will do the conversion.

Because Robinhood does not permit short positions, any short positions in your Vanguard account will need to be covered before requesting a transfer.

Second, it’s time to

open that new Robinhood account

if you haven’t done so already. Remember, the name on it must match the name on the Vanguard account.

If you have options or a margin balance coming over from Vanguard, the Robinhood account must have those privileges added. This includes the correct options level for spreads or other strategies requiring an advanced level.

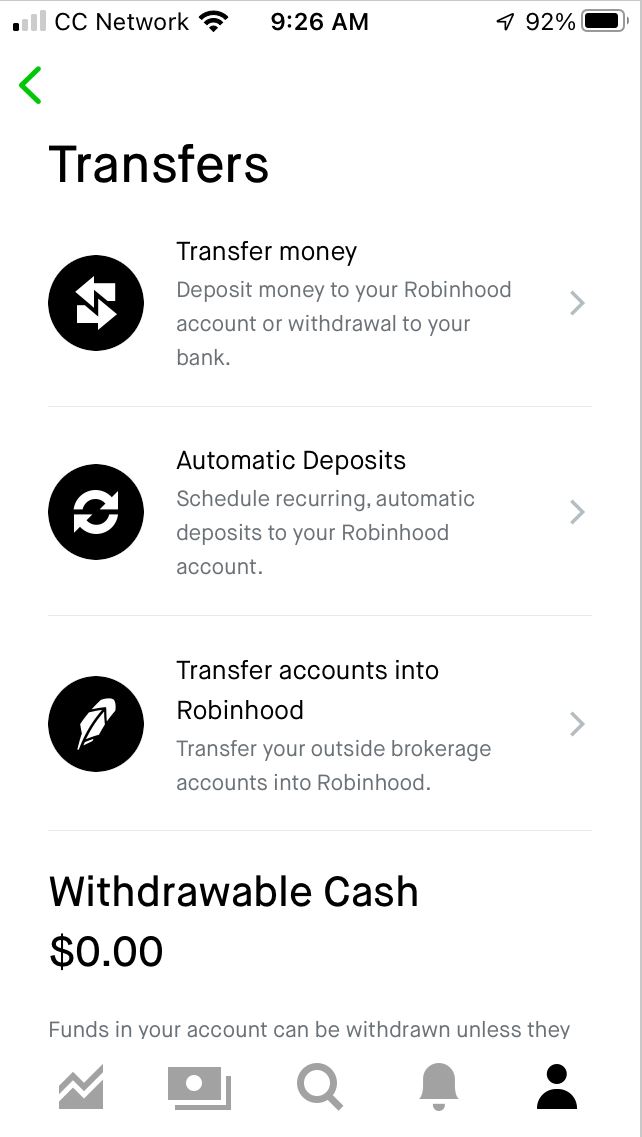

Third, it’s time to fill out the ACATS form. This time, you’ll use Robinhood’s mobile app (the broker’s website doesn’t have the form).

To locate the form on the app, tap on the person icon. It’s in the bottom-right corner of the main menu. Next, tap on the settings icon, which is represented by three horizontal bars. It will be in the upper-left corner.

On the next page, tap on the Transfers link. Then tap on the link to transfer accounts into Robinhood. This will give you the ACATS request form. Scroll down in the list of brokerage firms until you see Vanguard’s logo. Tap on this to pre-fill the outgoing broker and begin the application. You’ll need to enter some account information, such as your Vanguard account number. Move through the requested fields and submit the application.

Fourth, monitor the transfer. Its progress will appear on Robinhood’s website and mobile app. It should take about 5 to 7 business days to complete.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

|