Transfer from E*Trade to Robinhood (and Vice Versa) in 2024

Transfer from Robinhood to E*Trade

Do you have a Robinhood account but need E*Trade’s customer service? With the following guide, you’ll

be able to move your assets with minimal hassle. We’ll also show you how to go

from E*Trade to Robinhood. Here are the steps:

First, Open a New Brokerage Account at E*Trade

If you want to move your Robinhood account over to E*Trade, then obviously you’ll need to

open an E*Trade account. Besides this self-evident point, you also need an E*Trade account to start the transfer because the paperwork is handled by the incoming firm, not the outgoing one.

With electronic transfers, the names on the two accounts must match exactly, and the two accounts must

also be of the same type. A transfer request could be rejected if there are any discrepancies. Because

Robinhood currently offers only individual and Traditional/ROTH IRA accounts, the new E*Trade account

should be one of these.

E*Trade Promotion

At E*TRADE, get $0 trades + 65₵ per options contract.

Open Etrade Account

Second, Submit a Transfer Request

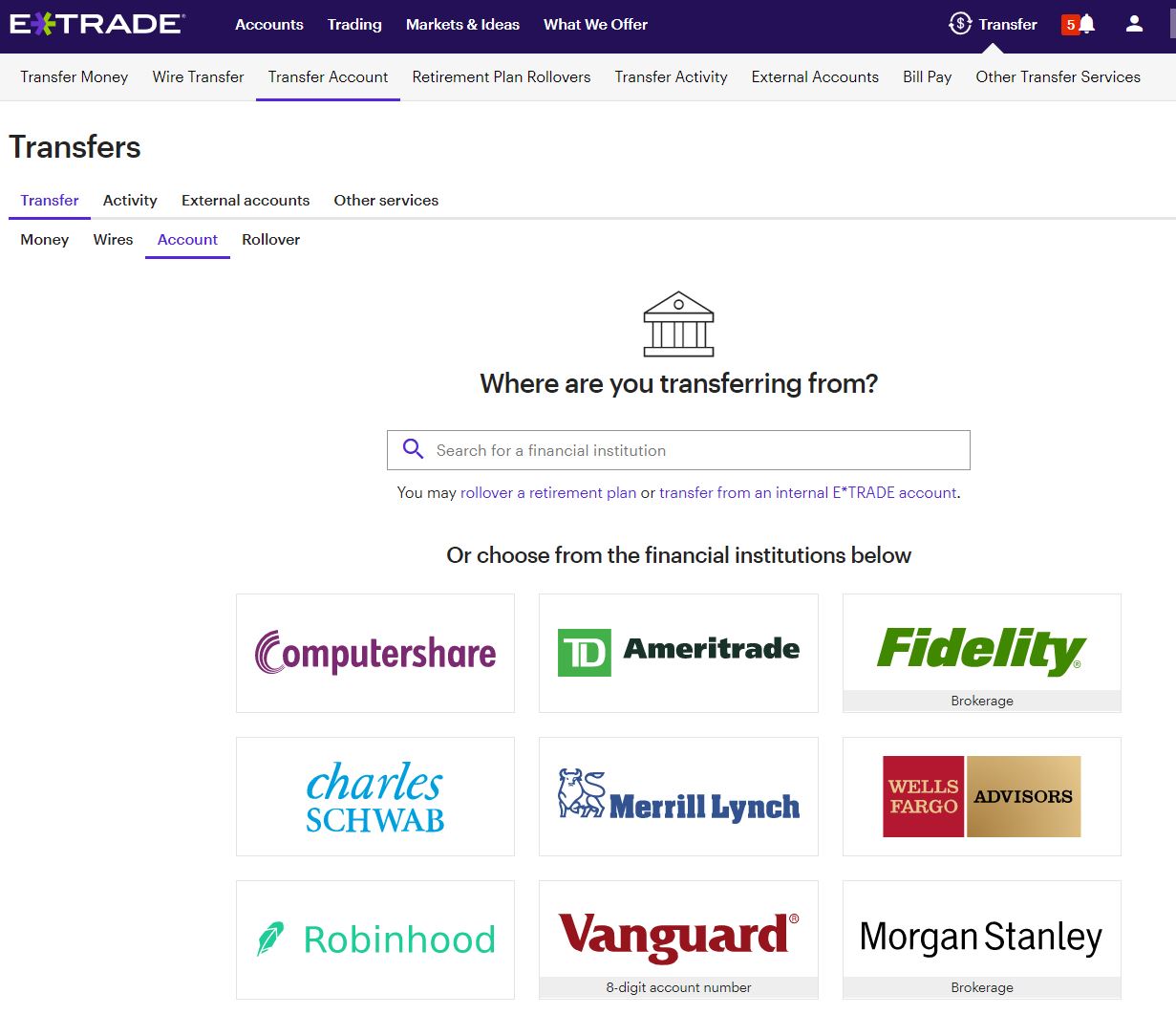

With your new E*Trade account open, it’s time to start the transfer. To do this, hover over the Transfer link at the top of E*Trade’s site (after you have logged in). You’ll see a drop-down menu with several options: click on the one that says Transfer Account.

The website will generate a new page with a list of brokers and their logos. Robinhood’s is displayed in this list. After clicking on the Robinhood logo, you’ll get a new page where you’ll need to select the account type you’re transferring. Apparently, no one has told E*Trade that Robinhood only offers individual taxable accounts because there’s a long list of available accounts. Be sure to select individual from this list.

Next, you will need to choose the E*Trade account where the assets from Robinhood should be deposited if you have multiple E*Trade accounts. You will need to supply your Robinhood account number and other details in the next few pages.

Fractional shares of stocks and ETFs won’t transfer through the electronic network. Robinhood will convert these into a cash amount and move the money along with the equity positions. Options will move, but cryptocurrencies will not. Like fractional shares of securities, digital currencies will be liquidated.

Once the transfer initiates, it should take about a week to two weeks to complete. You will see your assets from Robinhood appear in your new E*Trade account. Technically, it’s just the investments that move, not the actual account. If you do a partial transfer, your Robinhood account will remain open. A full account transfer will close it.

If you choose a full account transfer, you shouldn’t do any trading in your old account while your assets are being moved over. Also, you should close any open orders in the old account and be sure that all trades have settled before requesting a transfer.

You can easily monitor the progress of the transfer inside your E*Trade account by going back to the Transfer link at the top of the site and clicking on Transfer Activity. Transfer requests display here for 90 days.

Transfer from E*Trade to Robinhood

The process is similar if you have an E*Trade account and want to transfer it to Robinhood.

You’ll first need to open a Robinhood account since the transfer request is made from Robinhood.

If you don’t already have one, you can open a Robinhood account here: Free stock up to $200 and 1% IRA match when you open an account.

And pick up a nice welcome bonus to boost your new account. Here are the details for transferring an E*Trade account to Robinhood.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Transfer Process

From your Robinhood account, you can request a full or partial account transfer from E*Trade. After choosing a transfer method, Robinhood contacts E*Trade on your behalf to initiate the transfer.

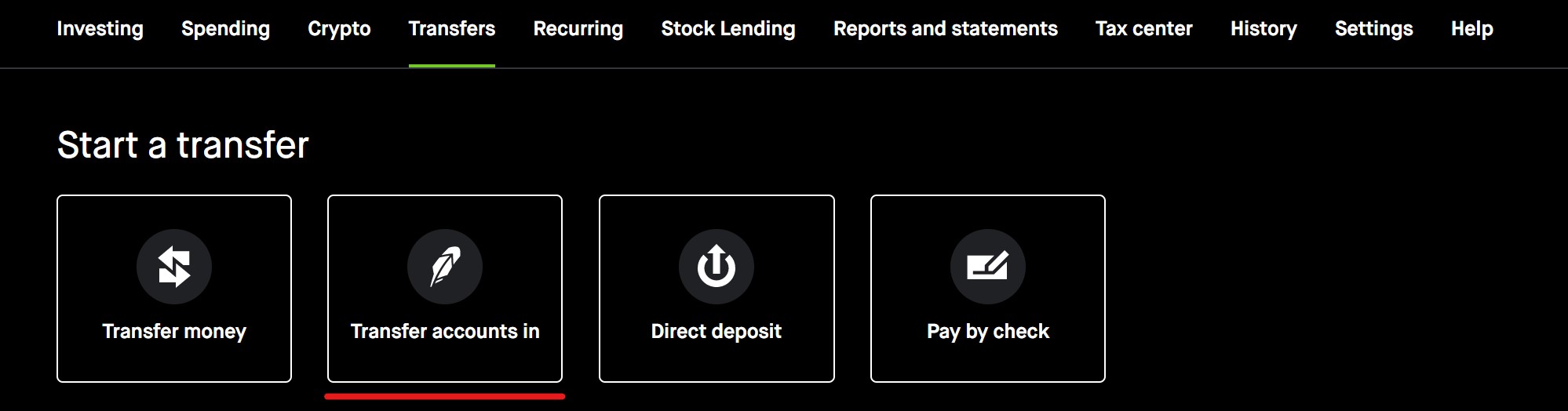

To start, go to the ‘Settings’ page and select ‘Transfers.’ Several transfer options are listed. For ACATS, choose ‘Transfer accounts in.’

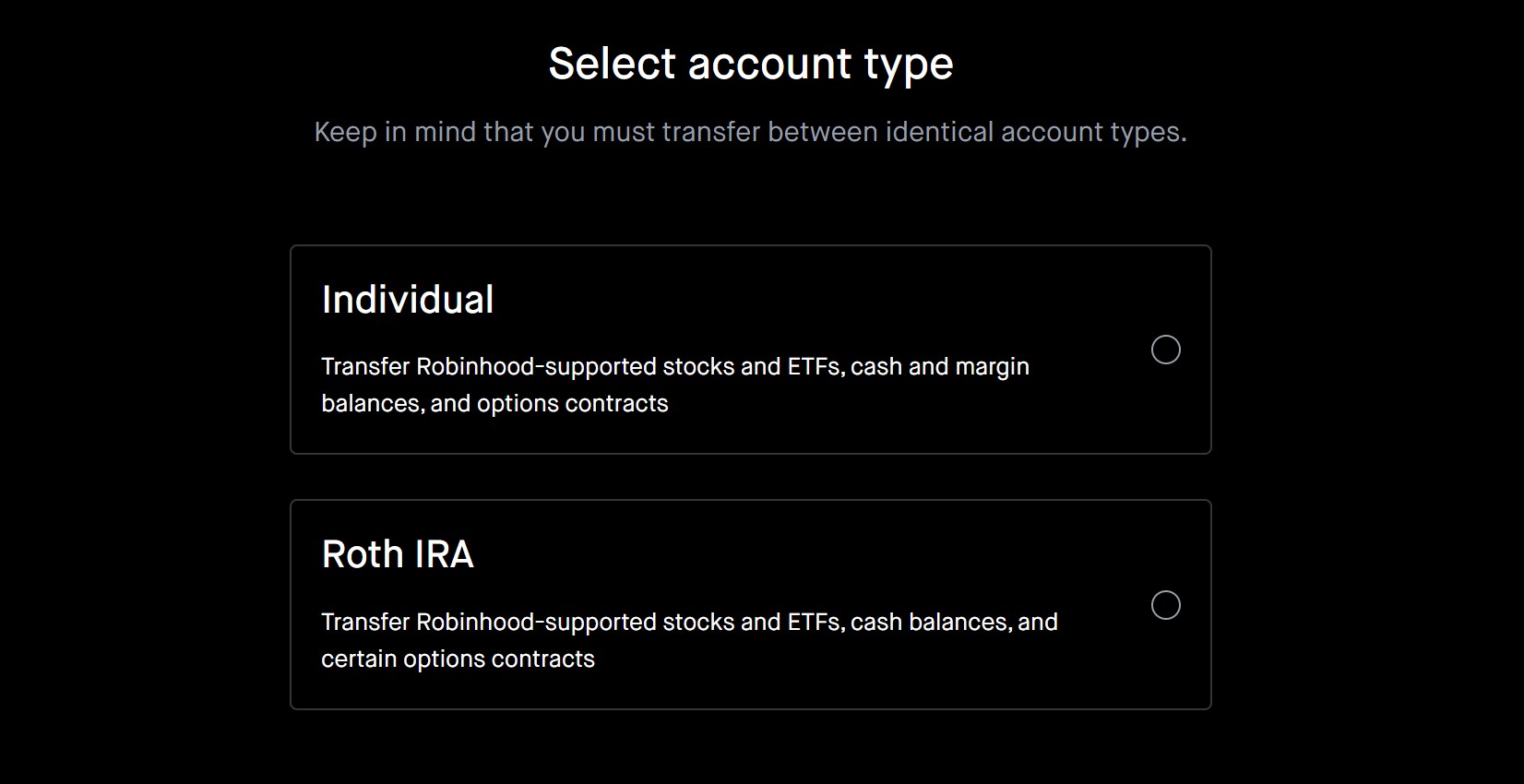

The next step is to select the type of account you want to transfer. You’ll notice that options are limited (more on that below).

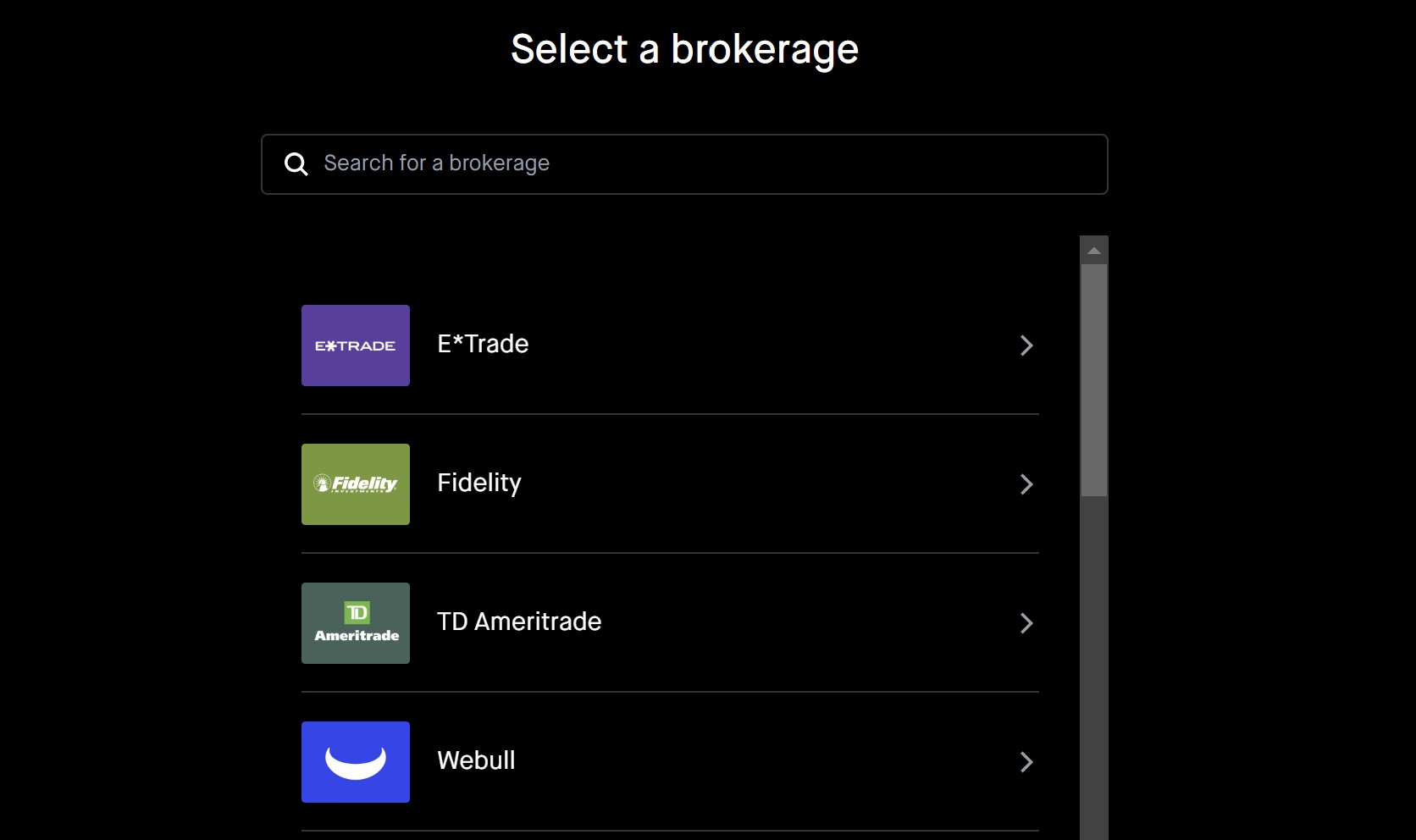

The next step is to select E*Trade from the list of available brokers.

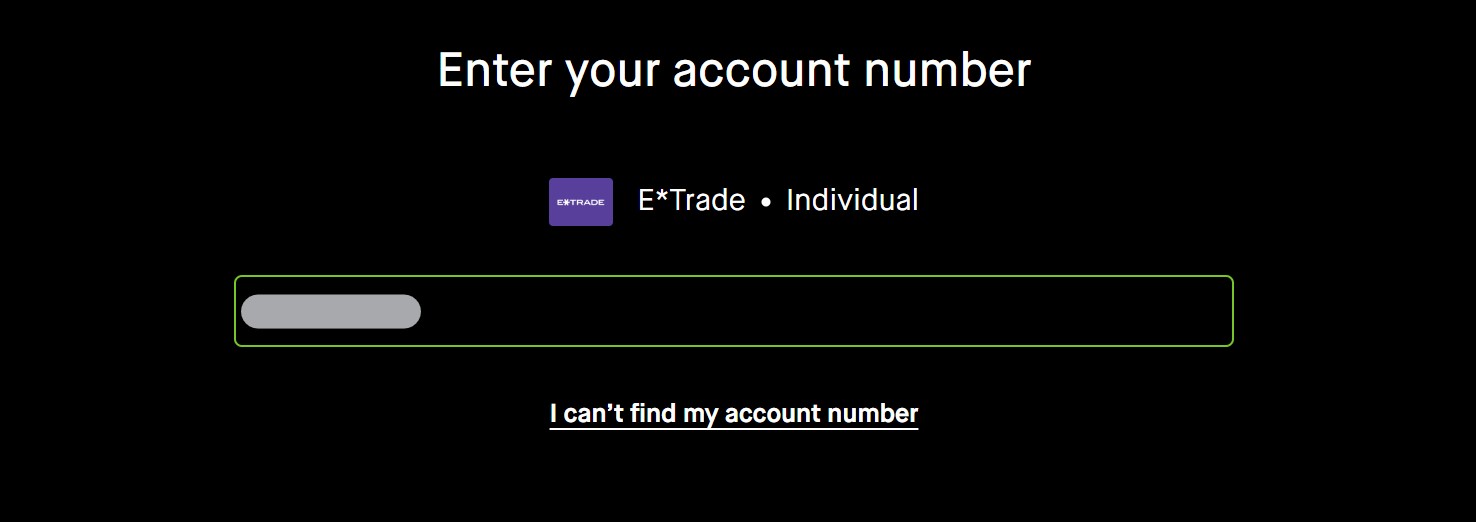

Enter your E*Trade account number.

Confirm your name.

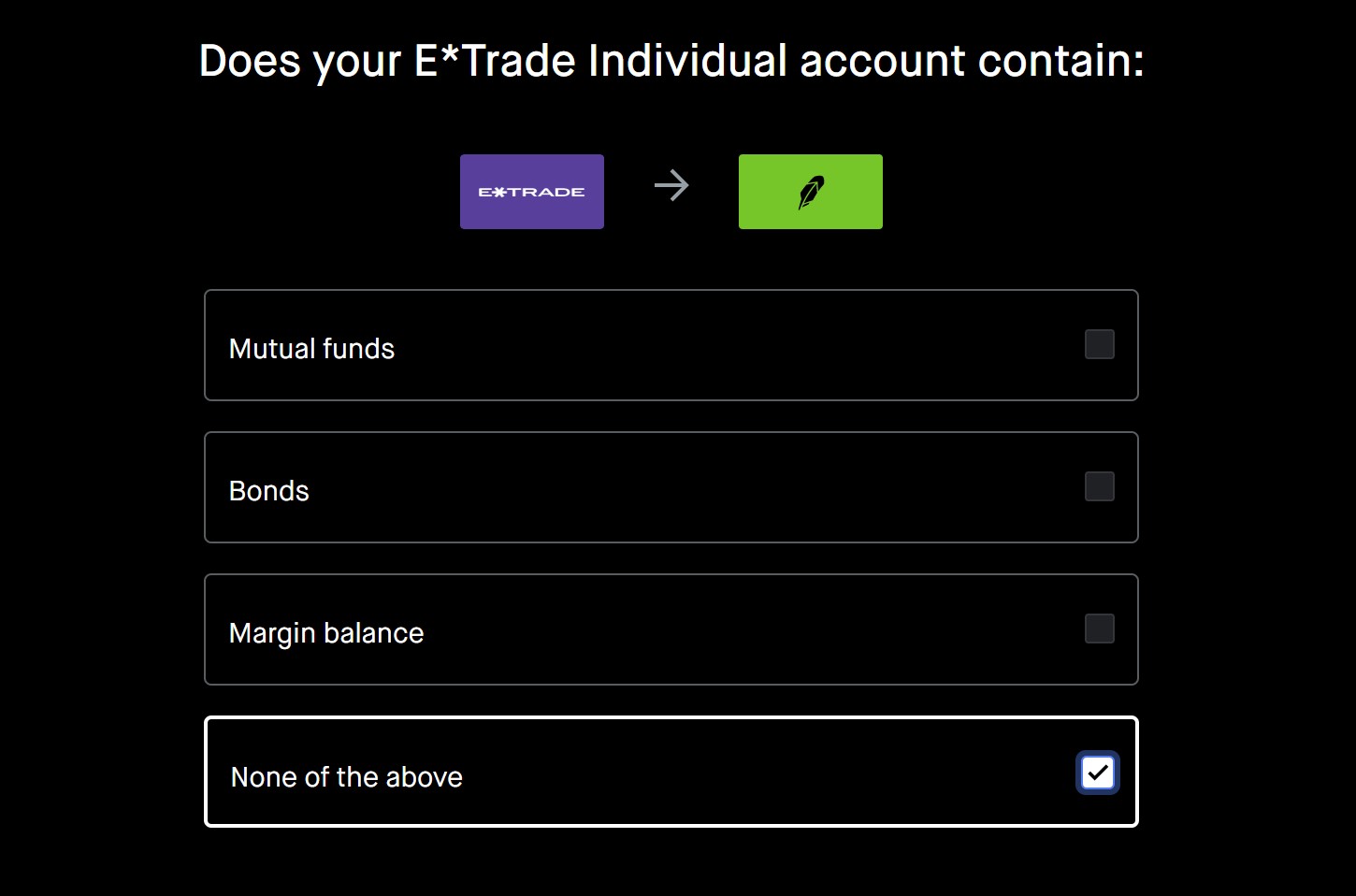

The next step is to check your eligibility. Your choices on this screen determine what happens on the

next one. Choosing ‘mutual funds’ and ‘bonds’ leads to a screen that allows only partial transfers (since they are unsupported assets). Choosing ‘margin balance’ or ‘none of the above’ allows you to choose between a full or partial transfer on the next page.

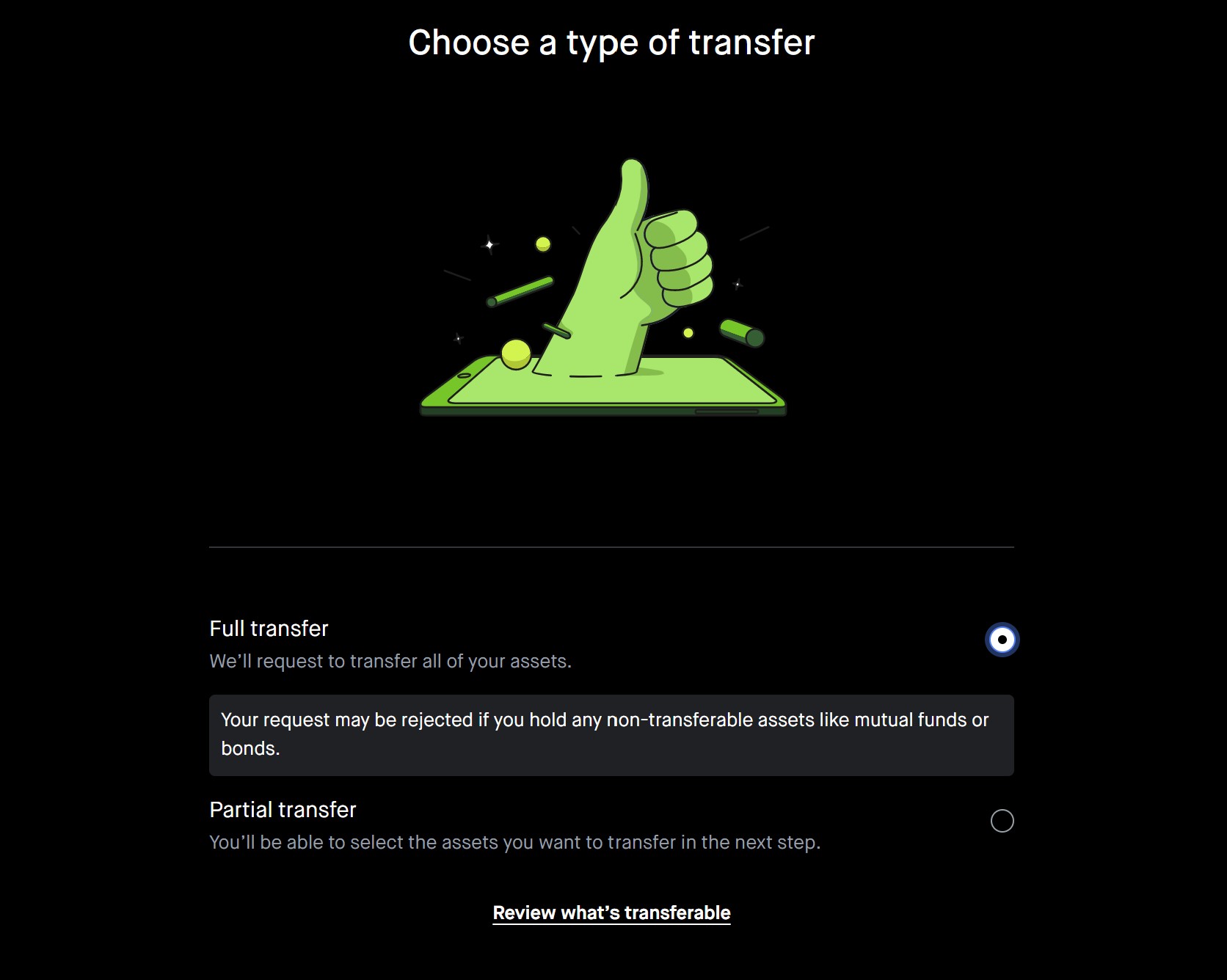

Choose the type of transfer you want to initiate (full or partial).

The final steps are to review the terms and details of your transfer request. If all your information looks good, you can ‘submit your transfer request’ and await confirmation.

Available Account Types

Robinhood’s list of account types is relatively short compared to many other brokers. That means you can only transfer E*Trade accounts that match Robinhood’s available account types.

You can transfer individual cash or margin brokerage accounts, traditional IRAs, and Roth IRAs.

You cannot yet transfer specialized accounts, like custodial, joint, business, or trust accounts.

Transferrable Assets

When it comes to the types of securities you can transfer, the story is similar to that of the account types. E*Trade has a wide variety of securities, and Robinhood does not support many of them. Before transferring your E*Trade account into Robinhood, you must liquidate all unsupported assets.

You can transfer stocks, ETFs, options contracts (not expiring within seven days), cash, and margin balances (if margin is enabled in your Robinhood account).

Non-transferable assets include fractional shares, crypto, options contracts expiring within seven days, unsupported options strategies (ensure that you have the proper options permissions enabled in Robinhood for any options strategies you plan to transfer), mutual funds, bonds, futures, annuities, and other unidentified assets (like OTC Pink sheets and foreign stocks).

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

ACATS Fees

Robinhood does not charge any fees for inbound account transfers, and

fees from the originating broker

are reimbursed up to $75.

That’s good news because outbound ACATS from E*Trade cost $75 for full account transfers and $25 for

partial transfers. It should be noted, however, that the value of your transfer must be at least

$7,500 to qualify for reimbursement.

Transfer Timeline

Transferring your E*Trade account to Robinhood takes about a week (3-7 days), but the process can take longer if there are any issues or complications with the transfer request.

One way to avoid transfer delays is to ensure that the E*Trade account is set up correctly for the transfer. That means waiting for transactions to fully settle within the account, liquidating securities that Robinhood does not support, and settling any debts that you have with E*Trade.

Benefits of transferring from E*Trade to Robinhood

There are several benefits to transferring your account from E*Trade to Robinhood, including:

* Lower fees and commission rates

* User-friendly trading platform and mobile apps

* IRAs with 1% match on deposits

* Direct access to cryptocurrency markets

* Dedicated crypto wallet for Ethereum-based tokens

Overall, Robinhood offers a more cost-effective and user-friendly trading experience than E*Trade.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

|