Transfer from Betterment to Robinhood (and Vice Versa) in 2024

How to Transfer a Robinhood Account to Betterment

Do you have a Robinhood account but want to try robo management at Betterment? No problem, thanks to the services of both companies, you can electronically move your assets at Robinhood into a Betterment account in short order. We’ll also show you how to move a Betterment account to Robinhood.

Transfer From Robinhood to Betterment

The first thing you need to understand about moving a brokerage account from Robinhood to Betterment is that you’ll be changing from self-directed trading to automated investing. Although Betterment only offers robo investing, it will nevertheless accept transfers of self-directed accounts. Keep in mind, however, that any asset that Betterment’s robot does not like will be sold, and the cash will be used to buy low-cost ETFs.

If you’re still reading and want to give this automated-investing program a shot, here’s how to make the move:

First, understand the requirements of going through with an ACATS transfer. Robinhood will

charge your account $100. If you

move your Robinhood to Webull,

Webull will reimburse the $100 transfer fee.

Open Webull Account

Open Webull Account

Moreover, Betterment has a $6,000 account minimum to accept an incoming transfer. If your Robinhood account is valued under this amount, Betterment will reject the transfer.

Second, you need to prepare your Robinhood account for an ACATS transfer. This means you need to close out any open orders and finish trading. This is especially true if you plan on doing a full transfer. Betterment also accepts partial transfers.

Third, you need to open a Betterment account. This step is pretty obvious, but you need

to make sure that the account names are the same and both accounts are the same type.

Since Robinhood only offers individual and Traditional/ROTH IRA accounts, this means you need to open

an individual or Traditional/ROTH IRA account at Betterment.

Fourth, you must connect your old account to your new account. If you plan on doing an electronic ACATS transfer, this step is required by Betterment. To make the connection, log into the Betterment website (the mobile app won’t work for this) and scroll down to the section that says Connected accounts.

In this section, you’ll see a button that says Connect new. Click on this link and you’ll be able to hook up your Robinhood account using your Robinhood login credentials or a long list of other details such as account type, broker, and account number.

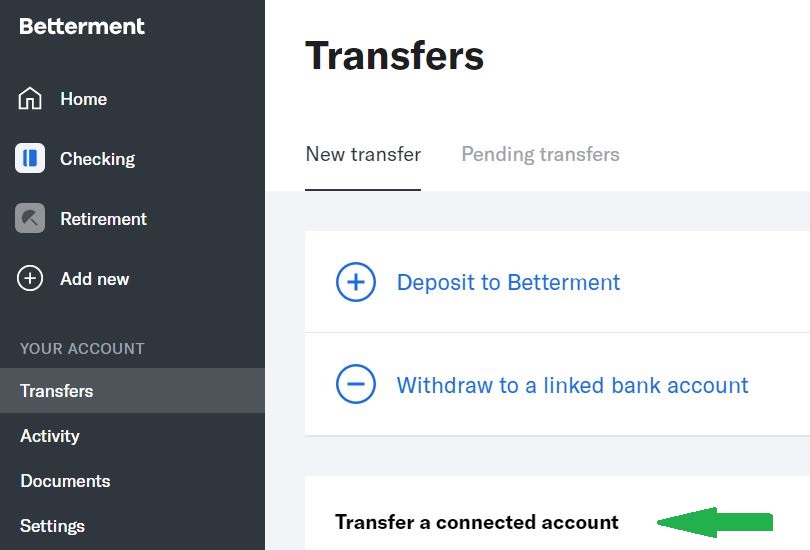

Once you have your Robinhood account linked to your new Betterment robo account, it’s time to make an ACATS request. To do this, click on Transfers in the vertical left-hand menu on Betterment’s site. You should see your Robinhood account under Transfer a connected account if it was successfully linked. A paperless transfer should take just 5-6 business days according to Betterment, which is shorter than most brokers promise.

If you can’t link your Robinhood account for any reason, you could always do an old-fashioned transfer. This will take longer, however. To get started, send an email to transfers@betterment.com.

Transfer from Betterment to Robinhood

Transferring in the other direction follows a similar, although not exact, path.

First, be aware that Betterment charges nothing for an outgoing ACATS transfer, and Robinhood charges nothing to accept one. Also be aware that Robinhood only offers self-directed trading, so the ETFs that are moved into Robinhood will no longer be managed by the investment firm.

Second, it’s time to prepare everything on the Betterment side. Cryptocurrencies cannot be moved out of Betterment, so these will need to be kept in a discrete account not involved with the transfer.

Third, a brokerage account at Robinhood needs to be opened. The same rules above should be followed regarding account name and tax structure.

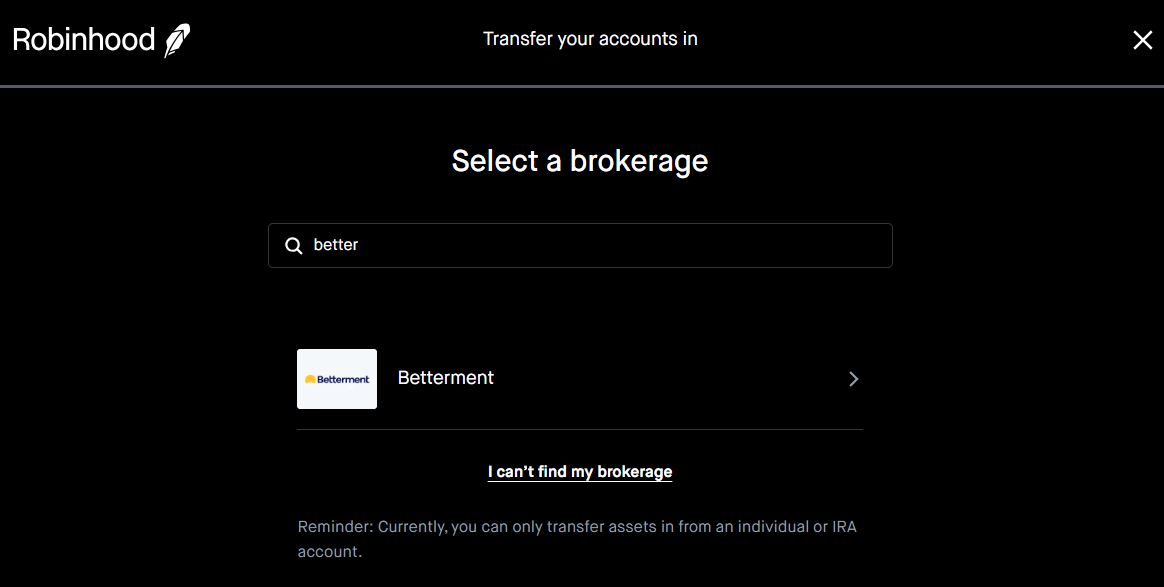

Fourth, it’s time to submit an ACATS transfer request. This time, there is no need to connect the outgoing account to the incoming. Instead, just open Robinhood’s mobile app and tap on the little guy in the bottom menu. Next, there will be three horizontal bars in the upper-left corner. Tap on this icon and select the Transfers link. On the next page, select the link to transfer accounts into Robinhood.

This will pull up the ACATS form. Search for Betterment and tap on the Betterment logo. Supply the requested details, such as account number, and submit the transfer. The same transfer form is on the website (look under the Account tab for the Transfers link).

The total time for an ACATS migration is about a week and half. Fractional shares of ETFs that are converted to cash may arrive a few business days later.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

|