Transfer from Citi to Robinhood in 2024

How to Transfer a Robinhood Account to Citi

To begin the transfer process, it's important to note that you should initiate your transfer request from a Robinhood account.

If you don't have a Robinhood account yet, you can open one here: Free stock up to $200 and 1% IRA match when you open an account.

Here's a step-by-step guide on how to transfer your Citi brokerage account to Robinhood:

Requesting an ACATS Transfer

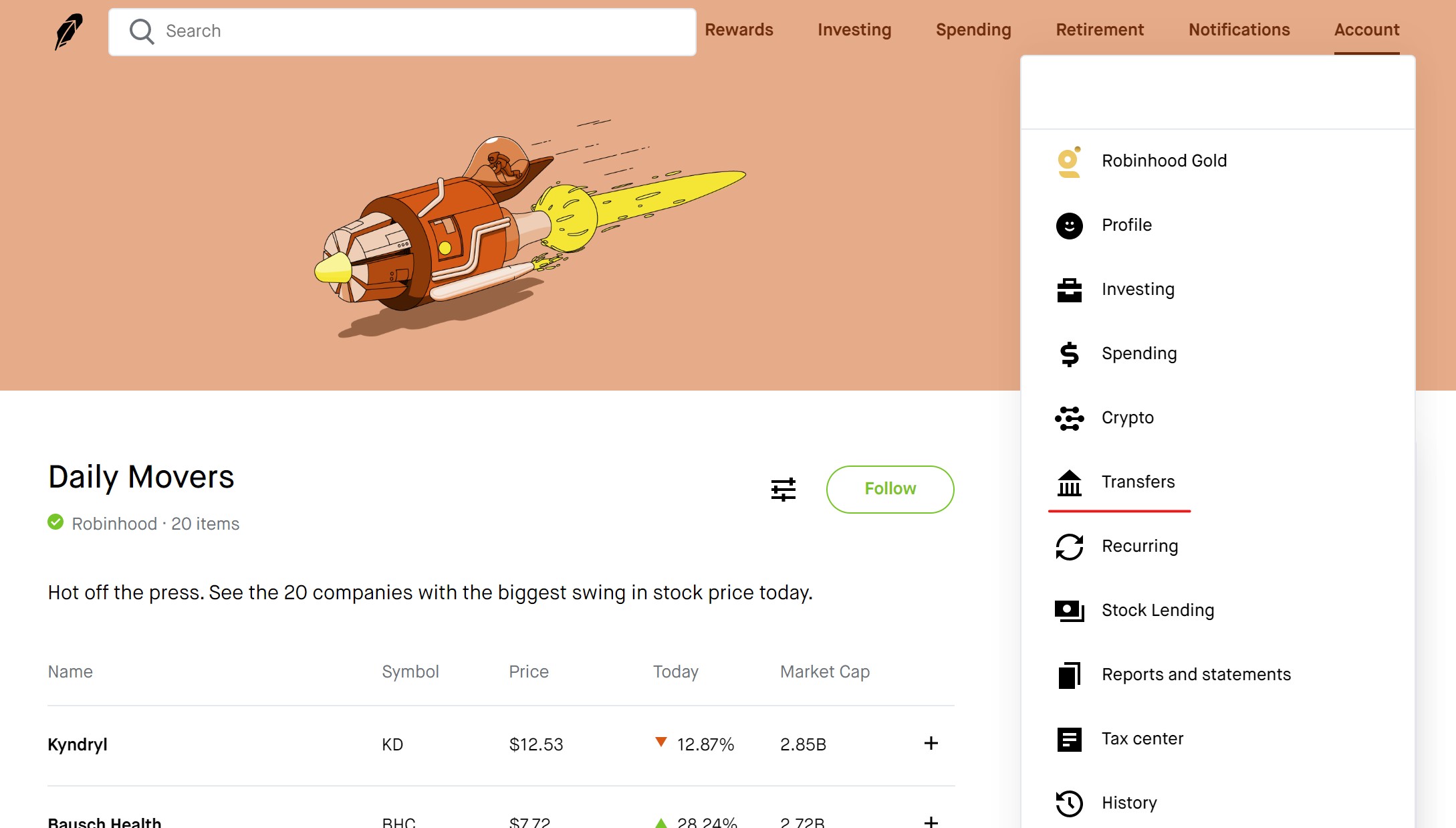

Access your Robinhood account (available on the app or browser-based platforms) and navigate to the 'Transfers' menu under 'Settings.'

From there, select 'Transfer accounts in' to initiate the ACATS transfer.

Keep in mind that Robinhood offers two types of account transfers: full and partial. Full transfers move all your assets and close the originating account, while partial transfers only move the assets you choose.

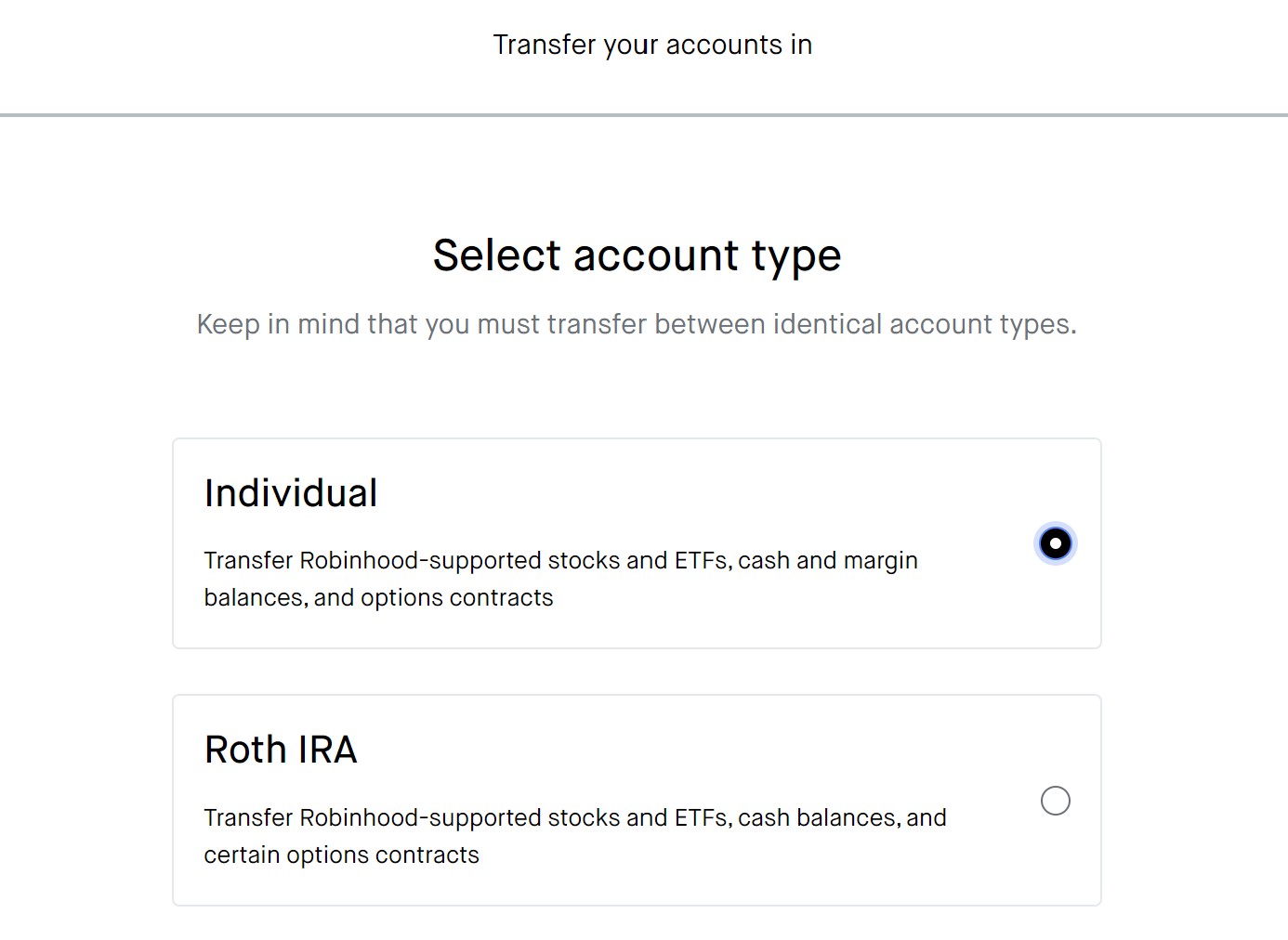

Inform Robinhood about the type of account you're transferring. They support standard brokerage accounts and two types of IRAs (Traditional and ROTH IRA).

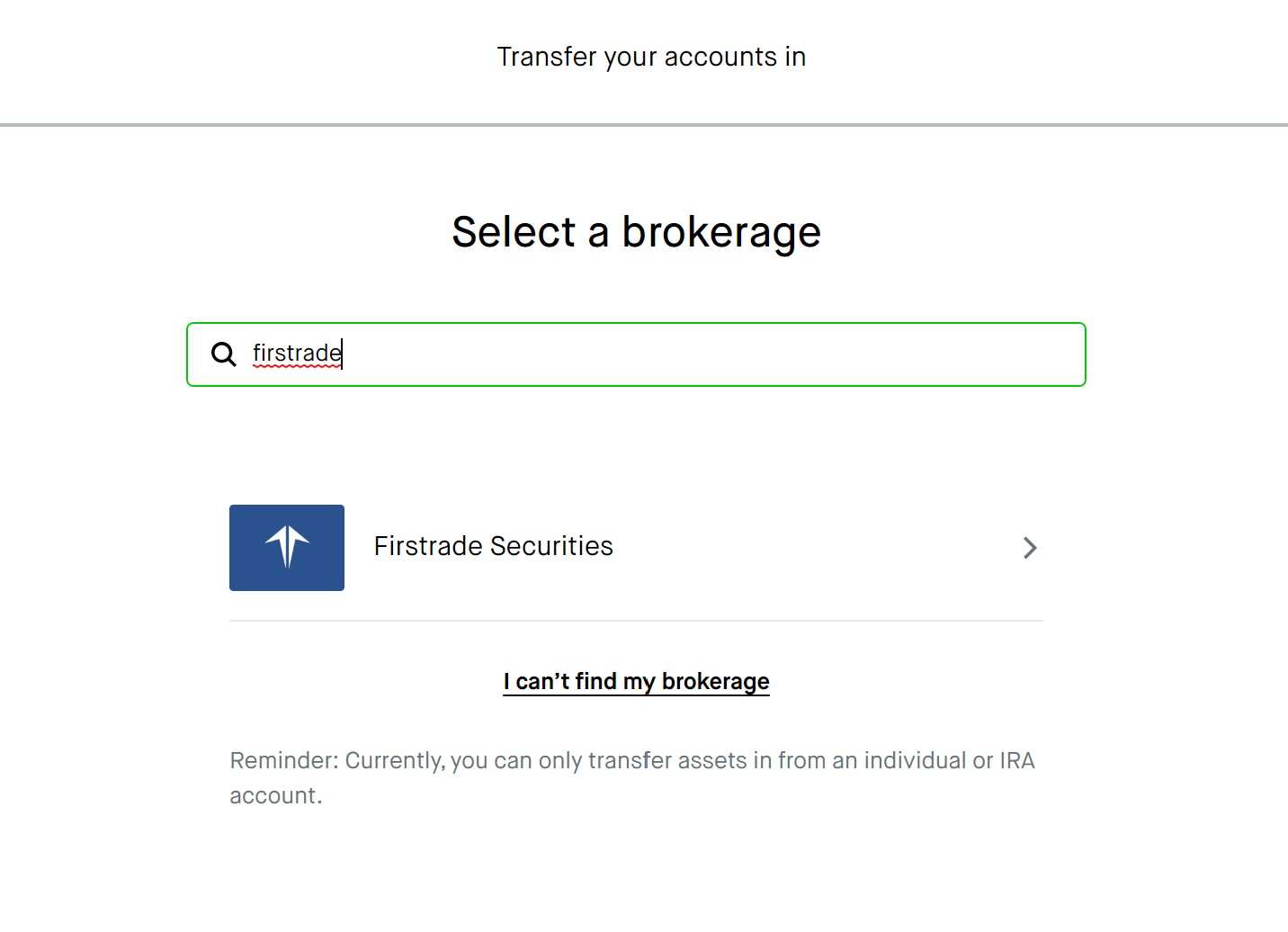

Connect your Citi and Robinhood brokerage accounts by providing your Citi account number and other necessary details. Robinhood requires this information to validate the transfer request with the other broker.

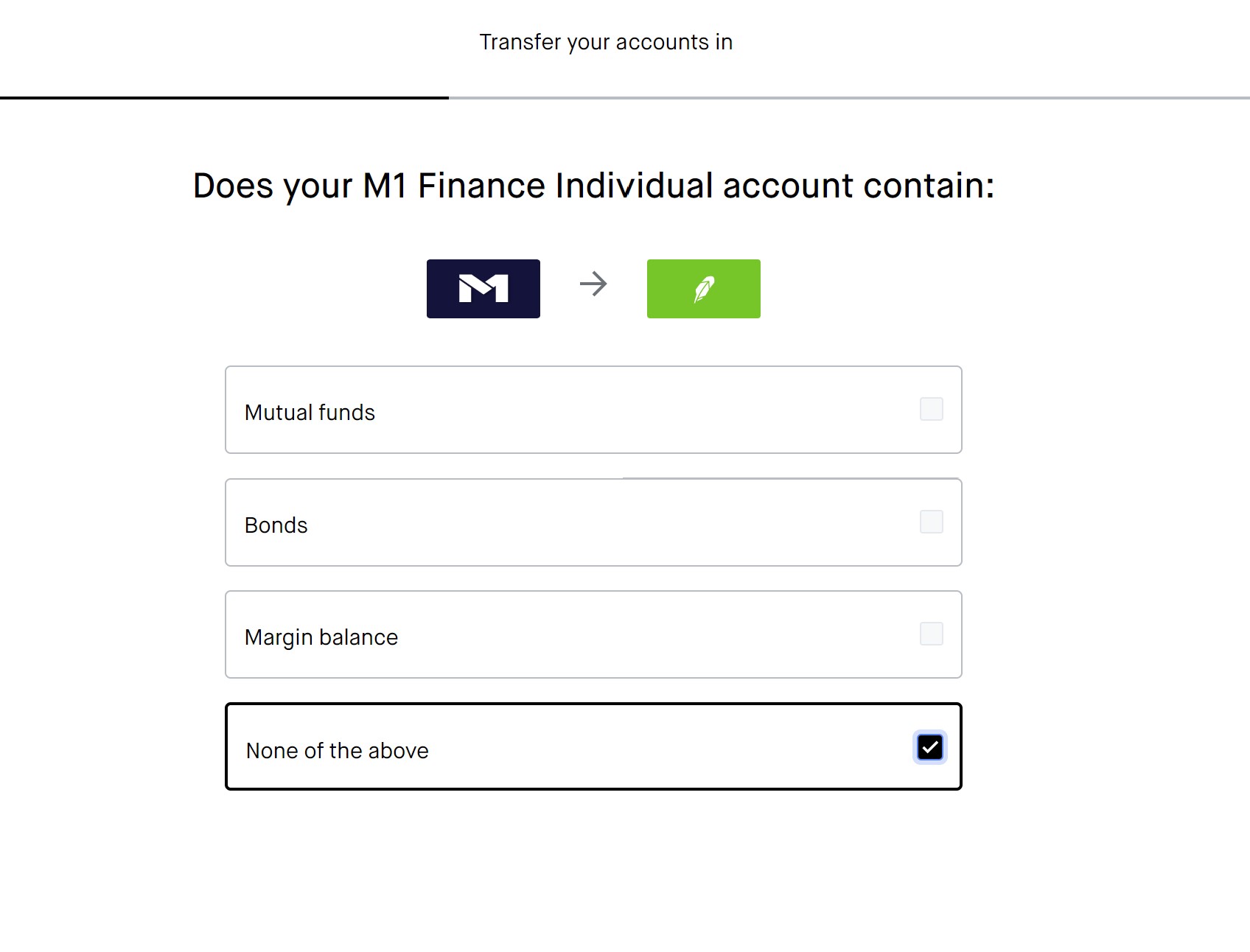

Ensure that the securities in your Citi account are transferable. If you select any securities that Robinhood does not support, such as bonds, CDs, or mutual funds, you'll only be able to do a partial transfer. Otherwise, you can choose between a full or partial transfer.

Select the transfer type (full or partial), review the details of your request, and submit your transfer request.

Account Transfer Timeline

The transfer process usually takes about a week, but it may take longer in case of complications. To expedite the process, make sure your Citi account is set up correctly by allowing transactions to settle fully, liquidating non-supported securities, and resolving any outstanding debts.

Free Robinhood Account

Open Robinhood Account

Transfer Fees

Robinhood does not impose any fees for incoming account transfers. Additionally, they will reimburse the fees charged by Citi, up to $75. Note that the transfer amount must be at least $7,500 to be eligible for reimbursement.

Eligible Account Types

Keep in mind that Robinhood has a limited list of eligible account types compared to other brokers like Citi. Only individual cash or margin brokerage accounts, traditional IRAs, and Roth IRAs can be transferred. Custodial, joint, business, and trust accounts are not supported.

Eligible Securities

Not all securities can be transferred from Citi to Robinhood. Robinhood accepts stocks, ETFs, options contracts (with more than seven days until expiration), cash, and margin balances (if enabled). Unsupported assets include fractional shares, cryptocurrencies, options expiring within 7 days, unsupported options strategies, mutual funds, bonds, futures, annuities, OTC Pink sheets, and foreign stocks. It's essential to sell any unsupported assets prior to initiating the transfer.

Robinhood Promotion

Robinhood offers a free stock valued between $5 and $200 and an ACATS transfer reimbursement:

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

|