Robinhood vs. DAS Trader Introduction

Robinhood and DAS Trader are just about polar opposites in the world of trading platforms. Surprisingly enough, this makes for a rather interesting comparison. Let’s take a closer.

Investment Products

When examining the various financial products offered by these two platforms, it’s important to understand the fundamental difference between them: Robinhood is a full brokerage where you can hold both cash and margin accounts, whereas DAS Trader is an advanced trading tool that can be used with numerous different brokerages to enhance your trading capabilities. This primary difference means that the “products” offered by both platforms are very different.

Robinhood is a brokerage platform that is very much focused on simplifying your ability to enter and

interact with the financial markets. You can trade

stocks, options, ETFs, and crypto. You can also set up an individual retirement account (IRA). If you are interested in a wider variety of investment asset classes, such as mutual funds, bonds, futures, or forex, you will need to look elsewhere.

DAS is a brokerage independent platform. Your access to various financial asset classes will depend on

which brokerage you use alongside DAS. The list of brokerages that currently support DAS includes

Interactive Brokers,

Charles Schwab, Cobra Trading, Speed Trader, and more. A full list of supported brokerages can be found during the enrollment process on the DAS Trader website.

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

DAS Trader: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Pricing

The price to use these platforms, like many other aspects, differs by a huge degree. One of Robinhood’s

greatest contributions to the entire brokerage world was being one of the leaders to introduce

true $0 commission trades. You will not pay any fees for stocks, option contracts, ETFs or crypto trades on Robinhood.

It is also free to join and it has no minimum balance amount required for your account. This makes it extremely accessible for people, regardless of their financial status or background.

DAS Trader is not a free platform to use. It is a subscription services with prices typically ranging between $100 to $200 per month. There are also a variety of ‘add-ons’ available which can bring additional features and functionality. These add-ons range in price from $5 to $55 each. Pricing will also vary depending on which brokerage you plan to use with DAS.

The difference in pricing between DAS and Robinhood once again demonstrates the magnitude of difference between these two platforms and what audiences they are geared towards.

Platforms

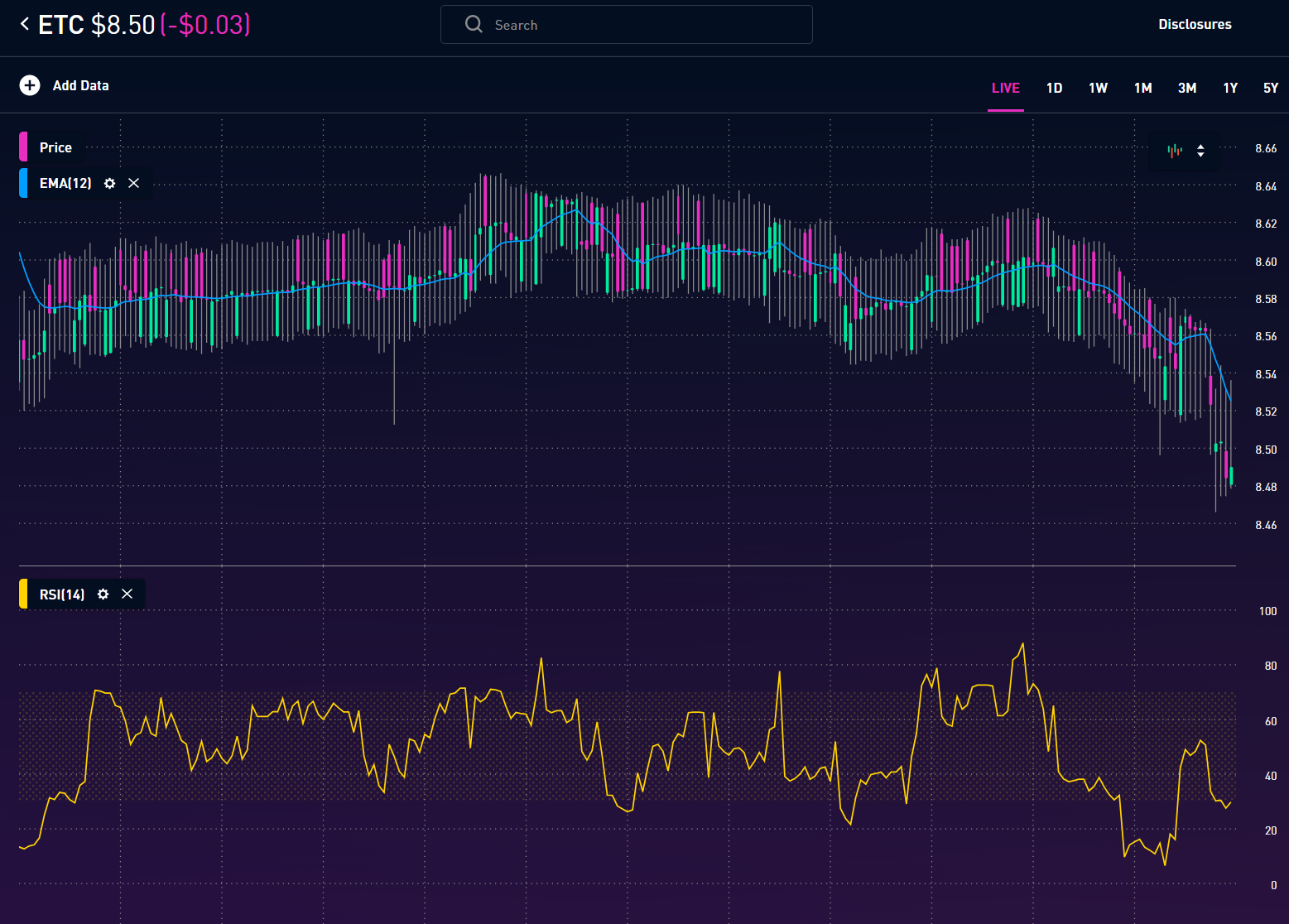

Robinhood can be used on iOS and Android, as well as through a web browser. It offers very basic charting

and technical analysis capabilities, as well as news updates relating to different stocks, sectors, and

the market in general.

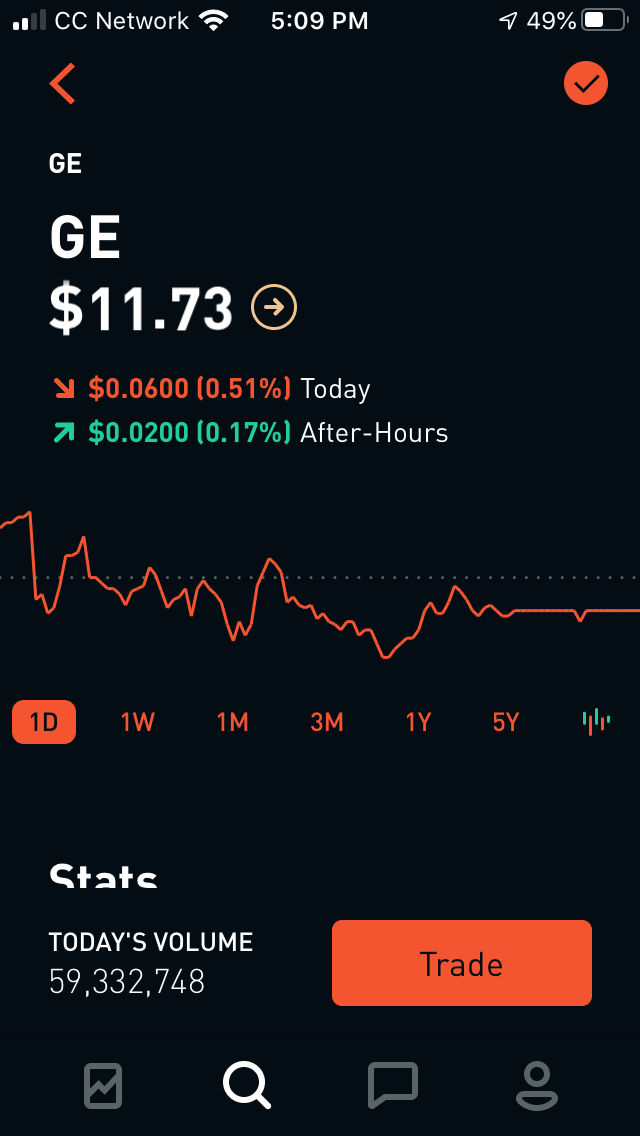

One of the main positives with Robinhood that is nearly universally agreed upon is that its user

interface is extremely well designed and very easy to navigate. The mobile app has an excellent look

and feel to it. We’ll look at this in a bit more detail below.

Despite the positives in terms of user friendliness, this does come at a cost. If you’re a more advanced

trader or investor, you will likely find Robinhood’s available tools to be lacking. You will not be able

to do more detailed analysis on a position’s risk profile, back-testing, stock scanning, and more here.

The order fill times also leave a lot to be desired. It’s not uncommon to miss your desired entry point due to the time it can take to fill an order. This issue can be significantly exacerbated in volatile market conditions. For those who plan on day trading, or for anyone who requires more complex analysis capabilities, Robinhood is certainly not the best option on the market. This is where platforms like DAS Trader come into play.

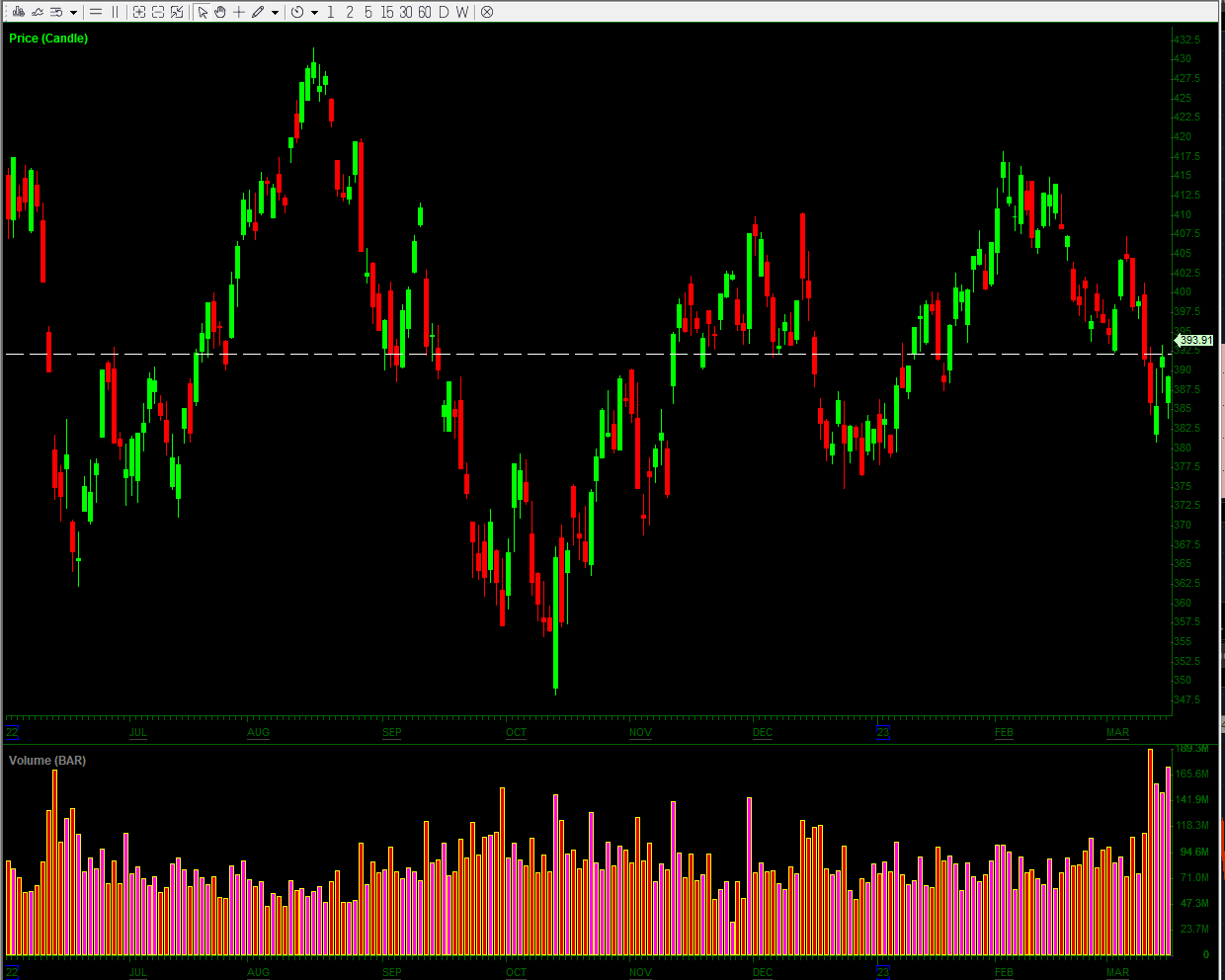

DAS Trader is a toolset designed for advanced, active traders who require the fastest order fill times

and near instant access to real time data. This is a direct access platform, meaning that it has a

direct connection to numerous different exchanges, including NYSE, NASDAQ, AMEX, ARCA, CBOE, BATS, EDGE,

CBSX, and OTC.

DAS is also a market data provider to these exchanges, providing users with the fastest real time data,

including level 2 data which can be critical for day traders trying to anticipate what direction the

market might move next on a moment to moment basis.

The platform itself offers more advanced charting capabilities with a variety of technical indicators

and risk management tools.

DAS also offers significant support for developers, including its own scripting language (DASScript), as

well as support for other programming languages, allowing traders to build their own technical indicators,

test orders, back-testing strategies, and a wide range of other tools.

There is also built in support for chat communities, allowing users to interact with other traders based

on different topics in a group setting, as well as supporting private conversations.

Although the user interface is certainly not as friendly or as modern looking as Robinhood’s, the target

user for DAS is clearly aim at those who have significantly more knowledge and experience in the markets.

This is not a good platform for beginners.

Mobile

Both Robinhood and DAS offer mobile apps for iOS and Android devices. This is where Robinhood really shines.

As mentioned above, the user interface of Robinhood’s mobile app is well designed, easy to navigate, has

a very attractive modern look, and provides an overall excellent user experience.

Although the overall platform is clearly meant to be used primarily on mobile, there is also a web portal

available as well. The web portal is, more or less, the mobile app blown up into a browser interface.

There are no additional tools or features offered in the web platform.

If you are a beginner in the financial markets and are looking for an easy place to start, Robinhood’s mobile app is a great first step.

The DAS trader platform is primarily geared towards desktop usage. That being said, there is a mobile

application for both iOS and Android. It will allow you to send orders, as well as see real time level 2

data.

However, it should be noted that the performance, technical analysis, and risk management features are much more limited on mobile. Having reliably fast performance - one of the main strong suits of this platform - can be considerably more inconsistent on mobile. This is a platform that is best used in a desktop environment.

Extra Features

Additional features on both platforms are fairly limited. As mentioned earlier, Robinhood does offer

support for individual retirement accounts (IRA), which is certainly a nice addition. They also offer

“instant deposits” which allow traders to place certain types of trades immediately after making a

deposit, without having to wait for funds to settle.

Additionally, Robinhood offers a wallet feature that allows users to store and swap various crypto tokens

to use alongside some decentralized ‘web3’ apps and services. This is a newer feature, and it remains to

be seen how useful it will end up being.

As stated above, DAS offers great support for developers to build their own technical tools to aid in their trading activities. This is easily a stand out extra feature for more advanced users, and something that is not offered on many other platforms. DAS can be used with numerous different brokerages, and its features may vary depending on which brokerage you choose to use.

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

DAS Trader: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Which is best for me

When you look at both of these platforms next to each other, it is abundantly clear that they serve very

different audiences. Robinhood’s goal of making the financial markets more accessible and easy to

navigate puts it squarely in the beginners category in the world of brokerages and trading platforms. It

is also a good option for people who are constantly on the move and who value an

extremely well designed mobile app.

DAS Trader is on the opposite end of the spectrum in the world of trading platforms. It is a

comprehensive tool that is aimed at experienced traders who need the best performance possible. It is

especially well suited for serious day traders, thanks to its blistering order fill times and instant

data access.

Although they both have their strengths and weaknesses, the choice to use one or the

other is probably a clear decision for most people, based on their goals and experience level. Despite

their differences, there is a place for both Robinhood and DAS Trader in the vast and ever expanding

world of the financial markets.

|