Rolling a 401(k) Over to a Fidelity IRA

If you have a 401(k) plan from an old employer but don't know what to do with it, you have a few options. One route to take is to move the plan to Fidelity, where it will be changed to an IRA. You can do this without incurring any taxes or penalties. Here's a step-by-step guide on how to make the transition.

Moving a 401(k) Plan to Fidelity

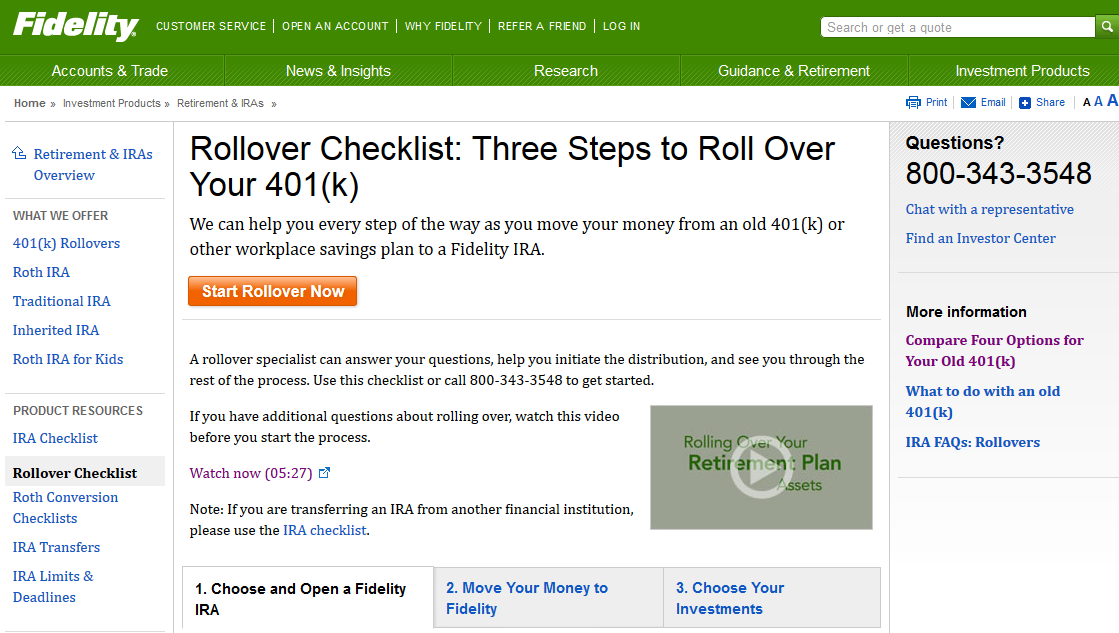

The first thing you might want to do before starting the conversion process is to

watch a 5-minute video

on Fidelity's website that describes the rollover procedure. The tutorial covers a lot of helpful information, such as whether an old employer plan

should be converted into a Traditional or Roth account, working with the administrator of the old plan, and making investments after the IRA is open.

The link to the video is on an informative page that is devoted to 401(k) rollovers. If you can't find it on Fidelity's website (it has a lot of

information), then just do an Internet search for "Fidelity 401(k) rollover", and the page should display in the results.

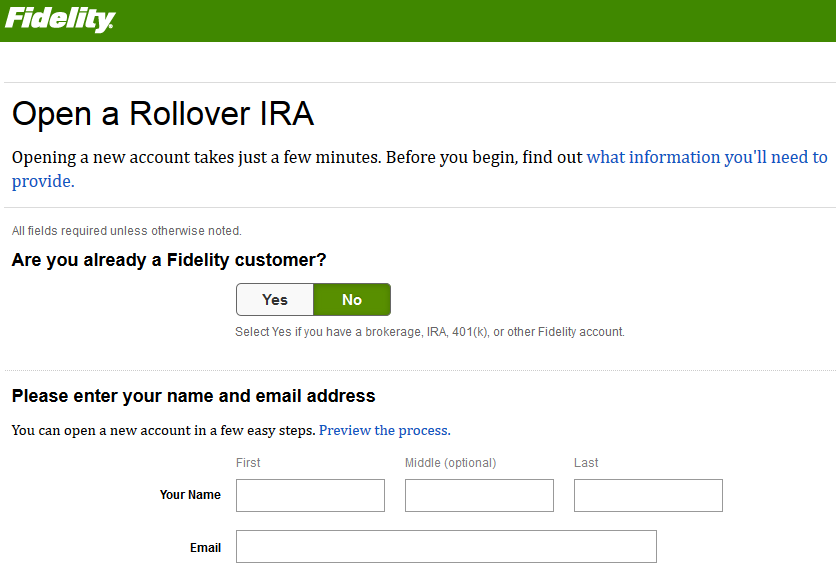

When you're ready to begin moving your former employer's plan, the first step is to apply for a Fidelity IRA. You can do this easily on the broker's website. Click on the "Start Rollover Now" button that appears on the 401(k) rollover page mentioned above. If you're a current Fidelity customer, you'll need to enter your login information. If you're not, enter your name and e-mail address to get started. On the next few pages, be prepared to submit all the information you would normally give when opening a financial account. This includes your address and Social Security Number. Also required is information about your old employer's plan.

Generally, a regular 401(k) plan is converted into a Traditional IRA, which means distributions will be taxed at withdrawal. Contributions to a normal 401(k) plan are tax deductible, as are deposits to a Traditional IRA. A Roth 401(k) plan is moved into a Roth IRA, where distributions are tax free, because the contributions have already been taxed. If you have any questions about the account transfer process, Fidelity has specialists who are ready to help. Just give them a call at 1‑800‑343‑3548. On-line chat is also available. Larger cities in the U.S. have Fidelity offices where investment advisors are stationed. The broker has over 180 locations currently.

IRA Resources on Fidelity's Website

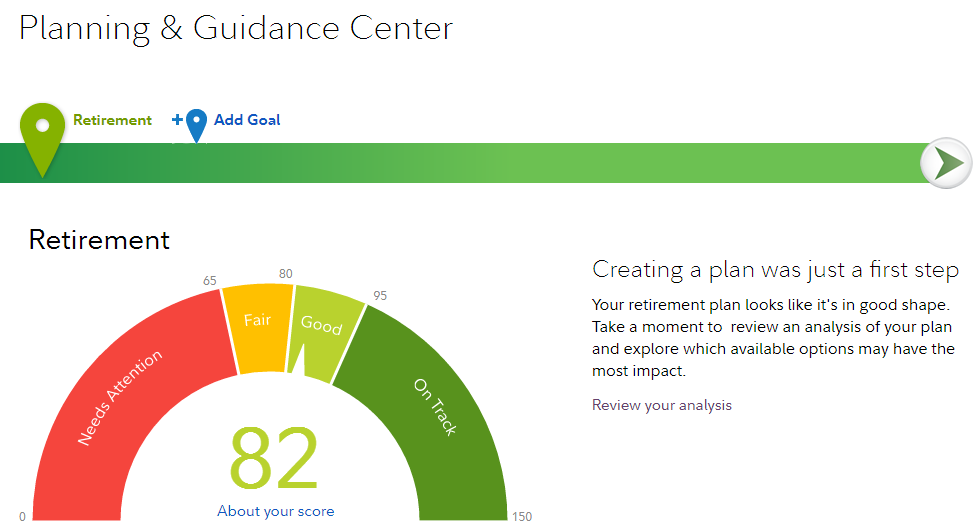

The Fidelity website has excellent resources for do-it-yourself retirement savers. There are videos, articles, and self-guided courses on retirement topics. These include required minimum distributions, the effect of inflation on retirement savings, IRS rollover rules, and more. There are also helpful articles on estate planning and inheritance topics. The broker has several calculators as well, including a minimum required distribution calculator and a strategy evaluator that helps users find income-generating investments. There is also an on-line tool that will lead you step-by-step in creating your own retirement plan. It asks for information such as age at retirement, typical income per year, current Fidelity account balances, and number of expected years during retirement. The software then estimates whether you're saving enough currently, and if not, it calculates the extra amount per month that you need to save.

Investment Advice and Portfolio Management From Fidelity

Investors who aren't especially confident in their own financial management skills can find good help from Fidelity. The broker offers several avenues of assistance. First is investment advice, which may be obtained simply by calling the broker over the phone or visiting one of the company's many brick-and-mortar locations. Alternatively, you can simply turn your account over to Fidelity and let a team of professionals manage it. The cheapest option is called Fidelity Go, which invests in passively-managed funds and costs 0.35% annually with a $5,000 account balance. More expensive choices go as high as 1.7% and include stocks and actively-managed funds.

Top Alternatives

Fidelity 401K To IRA Rollover Summary

If you have an old 401(k) plan that you don't know what to do with, moving it to Fidelity (read Fidelity IRA review)

would be a good decision. Don't hesitate to contact the broker to make the move easier.

Another very popular and better priced broker for 401K rollover into IRA account is

Charles Schwab.

Free Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

|