|

SoFi vs Merrill Lynch (2024)

Merrill Edge versus SoFi. Compare brokerage fees, options/futures accounts, & stock trading platforms. Which broker is better?

|

Overview of SoFi and Merrill Edge

Merrill Edge and SoFi Invest are two places where you can find several important brokerage services.

If you’re wondering which firm is better, keep reading. We have the answers you seek.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Merrill Edge

|

$0

|

$19.99

|

$0.65 per contract

|

$0

|

$0

|

|

Sofi Invest

|

$0

|

na

|

$0

|

$25*

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Merrill Edge

|

|

|

|

|

|

|

|

Sofi Invest

|

|

|

|

|

|

|

Open Account

Merrill Edge: Get $0 trades + 65₵ per options contract at Merrill Edge.

Sofi Invest:

Get no commission stock trades.

Investment Lineup

Merrill Edge customers can trade bonds, equities, option contracts, mutual funds, exchange-traded funds, and closed-end funds. The equity category includes OTC stocks.

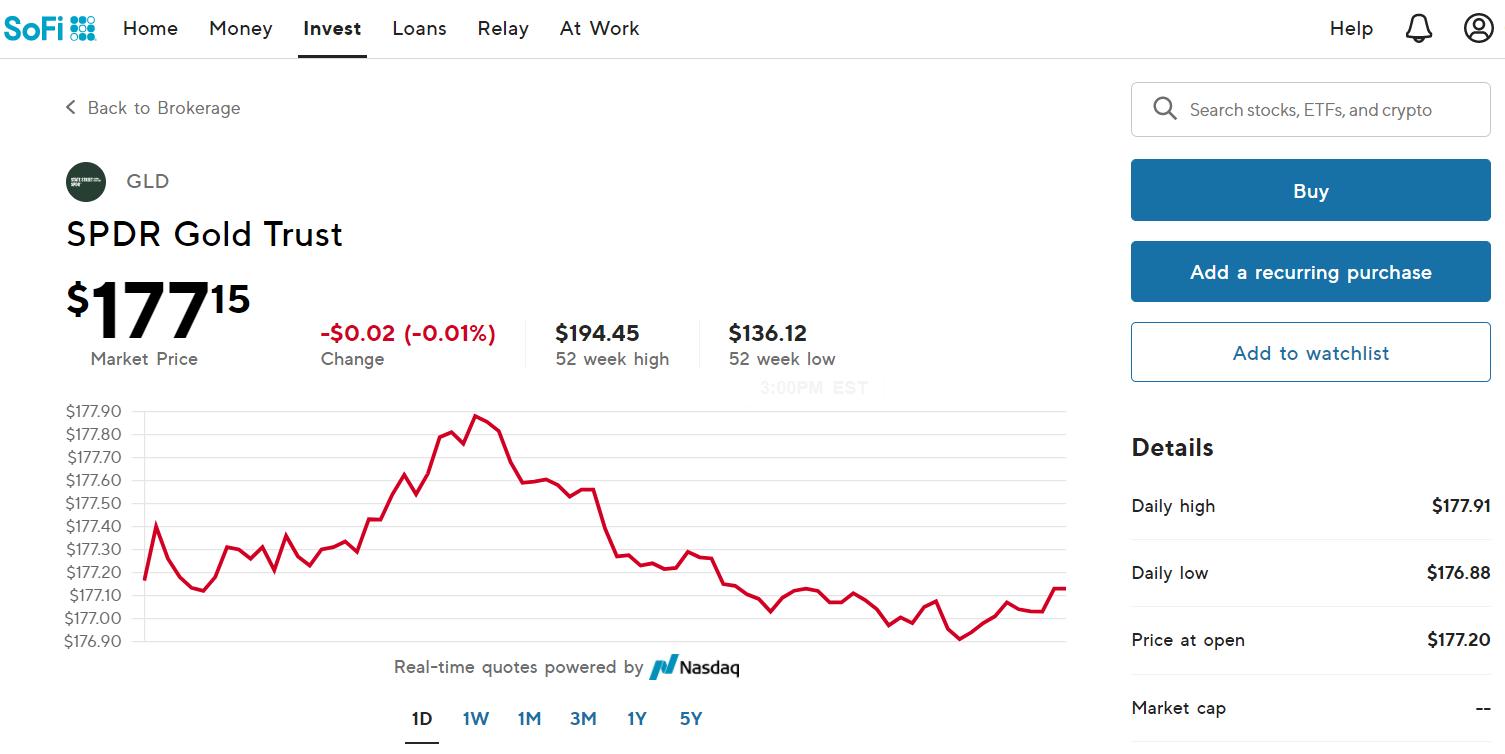

SoFi Invest provides trading in digital currencies, exchange-traded funds, closed-end funds, and stocks. The last category does not include any over-the-counter offerings.

SoFi Invest permits whole-dollar investing in a select group of stocks and ETFs. Merrill Edge does not.

All things considered, Merrill looks like the better option to us here.

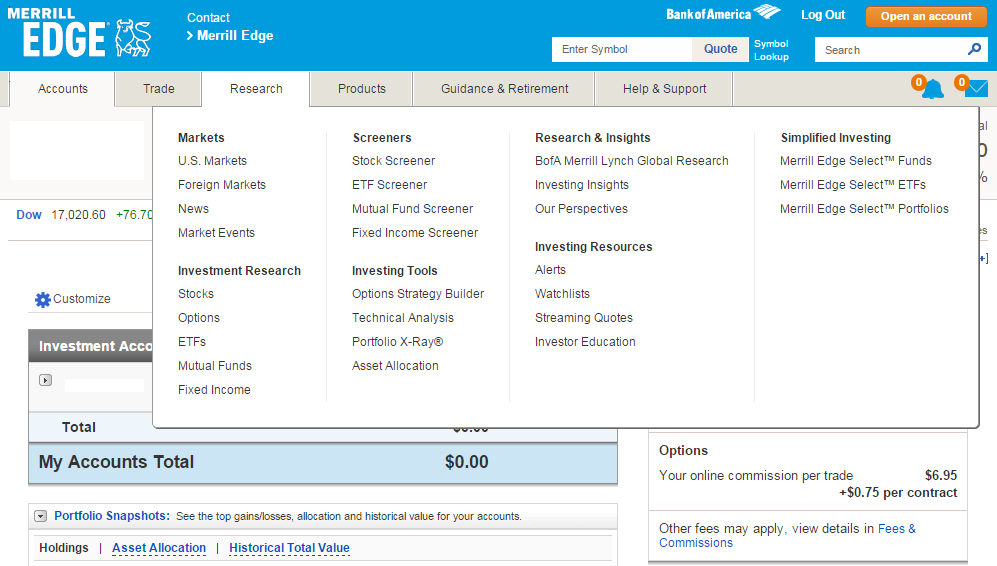

Security Research

The Merrill Edge website hosts market commentary from Merrill Lynch investment advisors. Screeners do a good job of scanning the markets for potential investments. And asset profiles provide plenty of helpful information, including free analyst reports from industry heavyweights like CFRA and Morningstar.

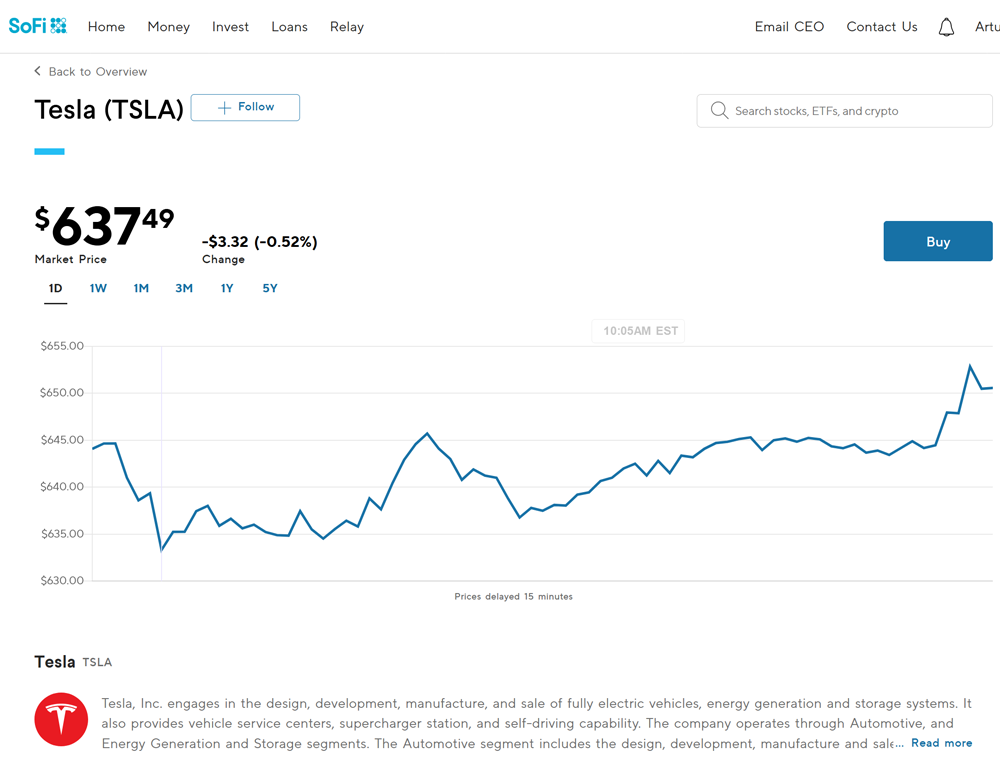

SoFi Invest’s website has far fewer tools on it. There are no screeners of any type, and this obviously hampers the investment research process. Security profiles also don’t have much information on them; and don’t even bother asking about third-party analyst recommendations.

Merrill Edge is a much better choice here.

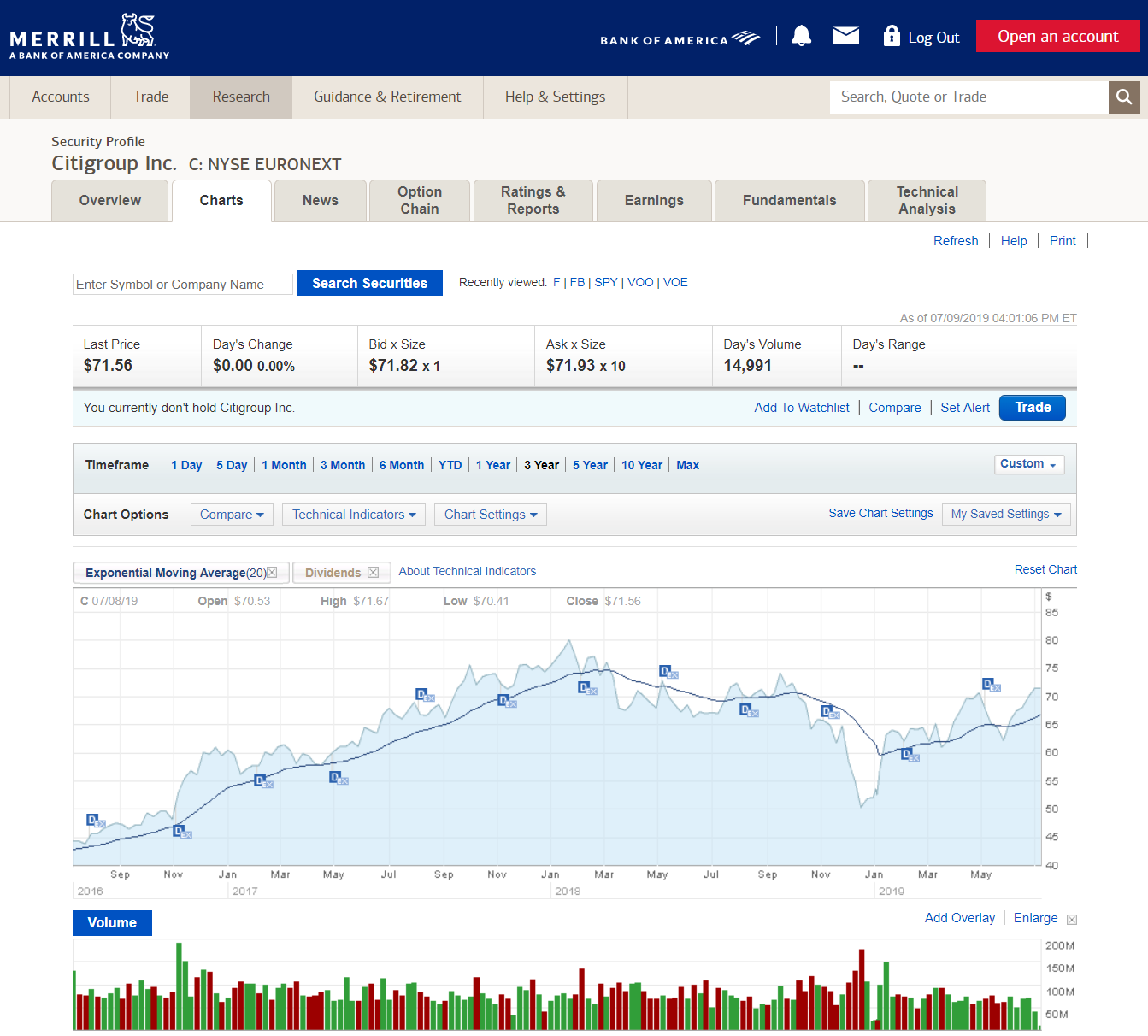

Trading Tools

In the realm of software, Merrill Edge does a decent, although not complete, job. First up is the broker’s website, which has passable charting. There are technical studies, multiple graph styles, and company events. And the broker’s web-based trading ticket offers several order types plus extended-hours capability.

A desktop platform called MarketPro® is available for active traders and large accounts. It includes a lot of advanced features not available on the website. These include technical tools from Recognia, Merrill Lynch Global Research, the ability to rearrange windows, and Level II quotes.

SoFi Invest doesn’t specialize in active trading (nor does Merrill Edge, really), so it doesn’t have much of an emphasis on software. Its website is very simple, and there’s actually no real trade ticket. SoFi Invest clients submit order requests to the broker, who in turn sends orders to the exchanges at specific times. There is also very simple charting on its site, which is a disappointment because there are no other trading platforms.

Merrill Edge easily wins this one.

Portfolio Management

Merrill Edge has a digital advisory service that costs 45 basis points per annum with a $5,000 deposit requirement. Adding a human advisor to the picture increases these numbers to 0.85% and $20,000.

SoFi offers the same robo and human advisory services, but charges nothing and only requires $1 to start.

SoFi Invest is the best option here.

Other Services

Dividend Reinvestment Program: Merrill Edge and SoFi customers can sign up for a free DRIP service.

IRAs: An Individual Retirement Account can be opened at either brokerage firm in this competition. Closing an IRA at Merrill Edge costs $49.95. At SoFi, there is no charge. Merrill has a SIMPLE IRA, which is missing at SoFi.

Automatic mutual fund investing: Merrill Edge offers this.

The victory in the last category goes to Merrill.

Recommendations

Beginners: With better customer service and learning materials, we have to defend Merrill Edge.

Mutual Fund Traders: Merrill Edge of course.

ETF and Stock Trading: With an actual trade ticket and a very good desktop program, Merrill Edge gets our stamp of approval.

Retirement Savers: Merrill again.

Small Accounts: Both brokers have good policies for small accounts.

Open Account

Sofi Invest:

Get no commission stock trades.

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Merrill Edge: Get $0 trades + 65₵ per options contract at Merrill Edge.

Sofi vs Merrill Edge: Results

Merrill Edge definitely outpaced its rival here. We do like SoFi’s crypto trading service, though.

|