|

TIAA Cons and Pros for 2024

|

TIAA Cons and Pros Overview

TIAA (also known as TIAA-CREF) is a Fortune 100 firm that has operated since 1918. It specializes in

financial management for customers who work in non-profit fields,

such as medical, academia, and government agencies. 72% of TIAA’s mutual funds have received an overall Morningstar rating of 4 or 5 stars. So is it a

good broker to open an investment account? Let's take a look at TIAA brokerage pros and cons to find out.

TIAA Pros

- The minimum investment amount for (NTF) mutual funds can be as low as $500.

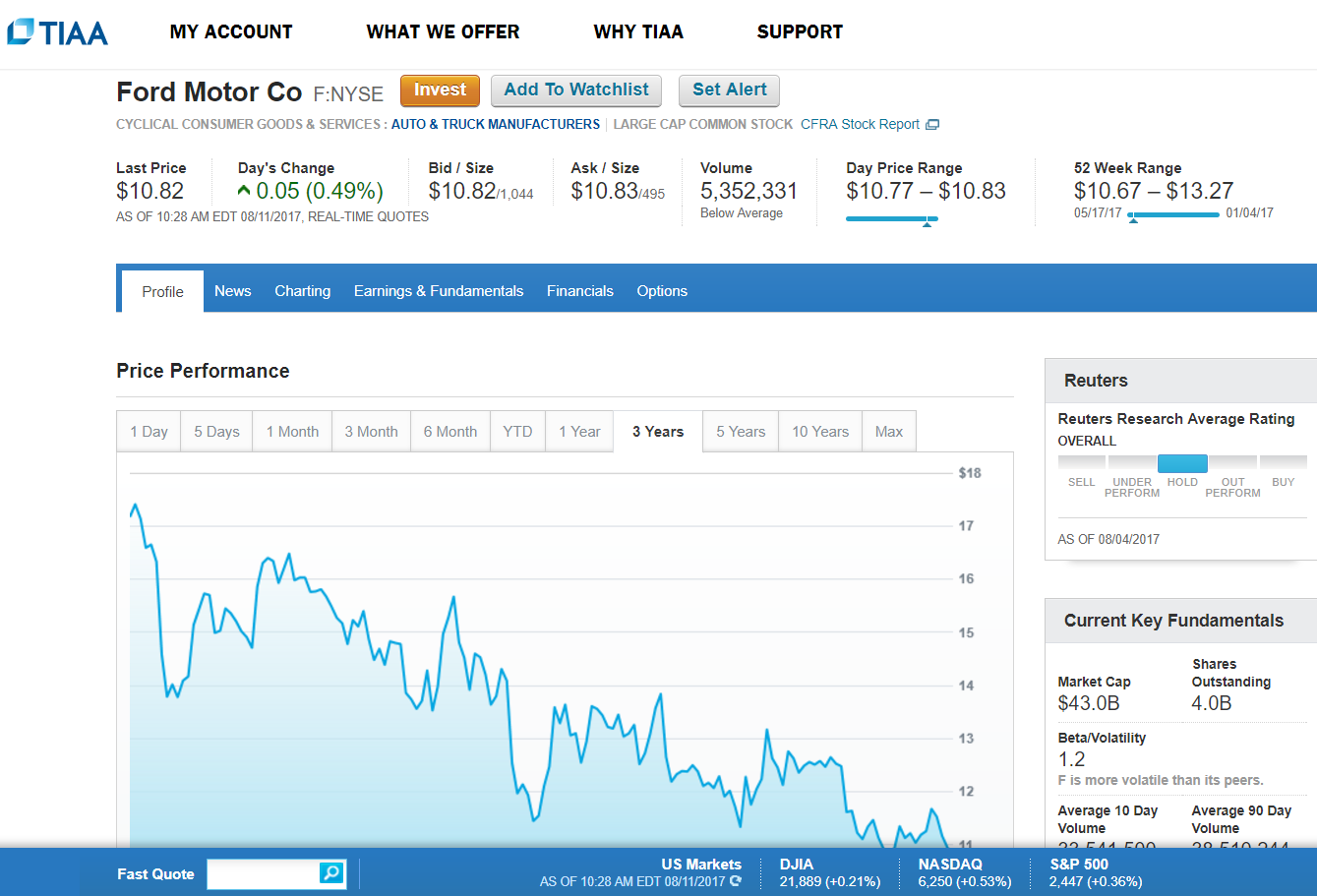

- The website features interactive content throughout the site and helps investors zero in on what is financially prudent at each life stage.

- The website is great for people new to investing, with quizzes, charts, graphs, bullet points, testimonials and more.

- The site’s educational components are excellent, filled with how-tos, fast facts, and investing tips.

- TIAA’s mutual fund selection is larger than some other brokers, including Merrill Edge, which

provides less than 4,000.

- The availability of investment advisors across the United States is a major advantage that TIAA offers, especially for investors who need some extra financial guidance. Most broker-dealers don’t offer this luxury. Firstrade, Vanguard, and Ally Invest are three firms that don’t have branch locations.

- The company’s new robo-advisory service is a hands-free alternative to the traditionally-managed account. Many brokers still don’t offer the high-tech service. These companies include Robinhood and TradeStation.

- Saturday service is a very helpful TIAA advantage. Vanguard, by comparison, is closed the entire weekend.

- Some investors may be interested in the company’s TIAA funds. Most brokers don’t manage their own fund families. These companies include E*Trade and SogoTrade.

TIAA Cons

- More exclusive to the non-profit world of academic, government, medical and other non-profit fields.

- A lot of information on the website is a little too basic for a savvy investor — there are a lot of “Investing 101” and “What is a Mutual Fund?” headers that pop up throughout the website.

- The lack of a desktop trading platform is a real TIAA disadvantage for stock and option traders. Most broker-dealers at least offer one to active traders who meet trading

requirements. Merrill Edge and E*Trade are two examples.

Charles Schwab offers its desktop software to all of its customers with zero requirements.

- One of the major TIAA cons is that the firm has failed to produce a simple browser-based platform, which is quite common in the on-line brokerage industry. For example, TradeStation and TD Ameritrade both offer the technology.

- TIAA’s mutual fund transaction cost is higher than what some other firms charge. For instance,

Firstrade charges nothing.

- The mutual fund selection at TIAA is actually smaller than what is available at many other broker-dealers. TD Ameritrade and WellsTrade clients have larger pools of funds.

- Although TIAA offers traditionally-managed accounts, its fee is higher than comparable services.

Charles Schwab,

for instance, is FREE.

- Many other brokerage houses offer 24/7 customer support over the phone. WellsTrade and Merrill

Edge are two examples.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

TIAA Overview

TIAA CREF lowered some of its commissions and it is now not as expensive comparing to peers as it

used to be. Equity (stock or ETF) trades now cost $0.

Mutual funds trades at TIAA are expensive at $50 per transaction:

Firstrade is charging

$0, and Etrade is at $19.99 for the same transactions.

At TIAA-CREF bonds and CDs are available only via Client Service Assistance (no online access). In most other brokerage firms you could buy all

investments online at a much more reasonable pricing.

The company offers Portfolio Advisor Program for clients with taxable and IRA assets of more than $50,000. Portfolio Advisor manages taxable and IRA investments using

a strategy customized to investor’s needs, goals and personal beliefs. This program is designed for clients who want hands-free approach to investing: the firm

handles all ongoing investment decisions - investment selection, asset allocation, and rebalancing — on investor’s behalf.

TIAA-CREF is not focusing on providing services for trading - powerful trading platform or charting is not offered.

The firm encourages long-term investing with infrequent account rebalancing. While this strategy might work for a lot of customers, it does not provide flexibility

to those clients who want a more active approach to their investing.

|