Is SoFi Invest Safe?

Have you thought about opening a brokerage account with SoFi? Are you perhaps wondering about SoFi’s credibility and security? If so, keep reading, as we’ve done the research and have the answers to your questions.

Who Owns SoFi?

Since March of 2024, SoFi—full name Social Finance Inc.—is a publicly traded company (NASDAQ stock ticker SoFi).

Since 2018, the company has been led by Chief Executive Anthony Noto, who formerly served as an executive for the NFL as well as Twitter and Goldman Sachs.

The current largest shareholder is SoftBank Group Corp., with 8.1% of outstanding shares. There are not many hedge funds currently invested in SoFi. The collective shares of the top twenty-five shareholders also works out to less than 50%, meaning that no one individual has a controlling (i.e. majority) interest.

Also of note is that SoFi insiders hold roughly 8% of the company’s stock, which suggests that they believe in the future success of the company.

The largest shareholder by the far is the public, holding nearly three-quarters of the existing shares. This means that the company, at least in theory, will have to work to please its public shareholders, which should be a good thing for the company in general.

Background

SoFi was started in 2011 by four students who met at the Stanford Graduate School of Business and envisioned more affordable loans for students.

In 2016, the company became the first startup online lender to receive Moody’s AAA rating. The following year, CEO Mike Cagney resigned, and Anthony Noto left Twitter to take his place.

In 2018, the company settled with the FTC, agreeing to stop making claims about the amount of savings from student loan refinancing without backing them up with reliable evidence.

In 2024, SoFi went the SPAC route to go public, and now trades on the NASDAQ as SoFi.

Is SoFi Legitimate?

SoFi Technologies Inc. is registered with the U.S. Security and Exchange Commission (SEC) and incorporated in the state of Delaware. Their Reporting File Number is 001-39606.

SoFi Securities is also registered with the SEC and incorporated in the state of New York. The Reporting File Number is 008-68389.

They are also registered as a brokerage firm with FINRA (San Francisco office), and neither SoFi Securities (CRD 151717) nor SoFi Wealth (CRD 167958) have any disciplinary history.

SoFi is a legitimate personal finance company, helping millions of people with student loans (more than $6 billion), including refinancing and consolidating debt, as well as insurance and investment offerings.

They are also taking steps to become a chartered bank through their purchase of Pacific Bancorp, a small community bank. This will help SoFi expedite its goal of holding a national bank charter, which will allow the company to expand its offerings and run its loan business more efficiently.

SoFi Competitors

Is SoFi Insured?

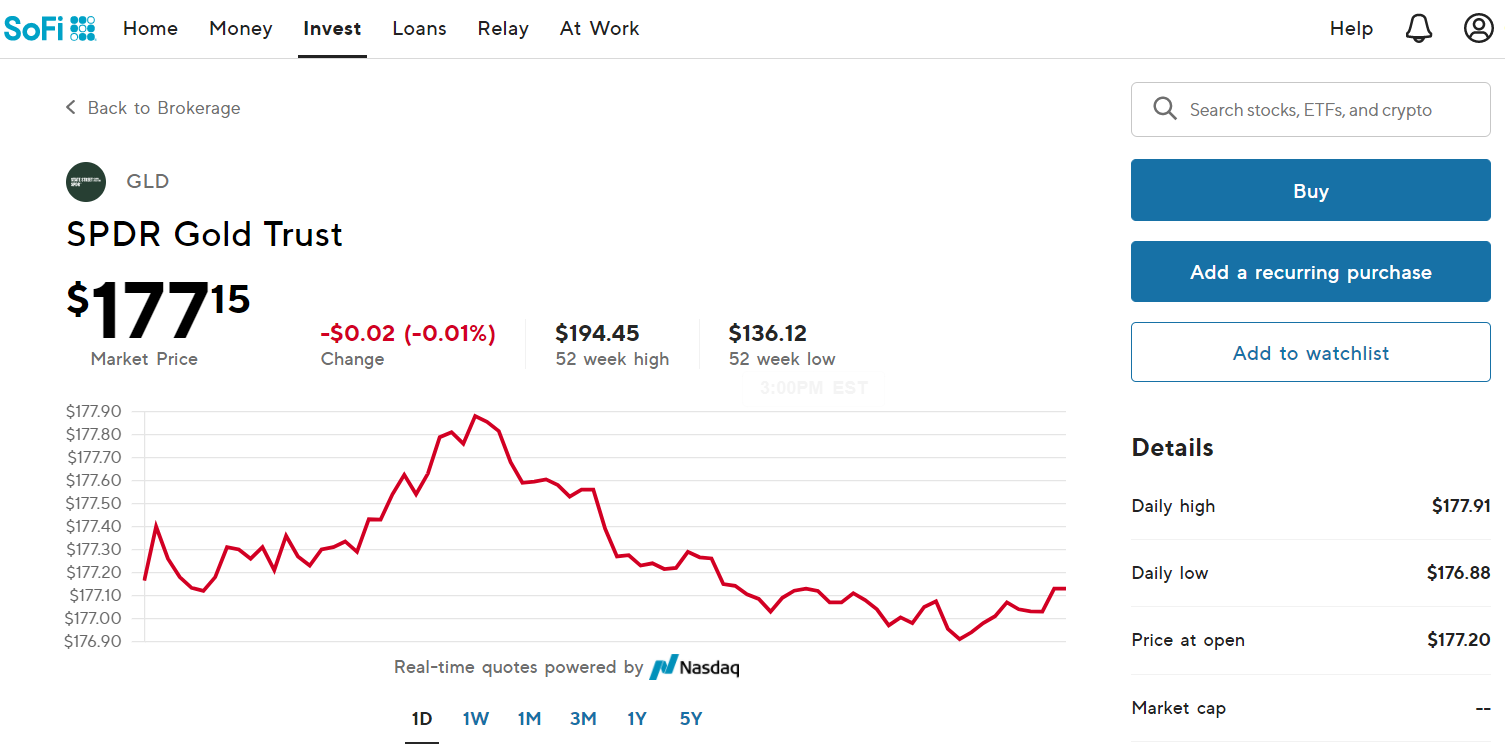

In terms of security, SoFi Invest uses encryption (256-bit SSL), and another company, Apex Clearing, maintains client funds, allowing for access to SIPC (Securities Investor Protection Corporation) insurance up to $500,000, as well as FDIC insurance for bank sweeps.

SoFi Money, its checking and savings options, offers up to $1.5 million in FDIC coverage, which is roughly six times as much insurance as is offered by the standard bank account.

Another positive for SoFi is that their “Financial Specialists” are all registered Certified Financial Planners and held to a fiduciary standard, meaning that they must act in the best interests of their clients.

SoFi Complaints

No, SoFi is not accredited by the Better Business Bureau (BBB). To gain this accreditation, businesses must apply, and it is likely that SoFi has not applied.

Nonetheless, SoFi has an A+ rating with BBB, which is the highest rating offered. To make their ratings, the BBB considers company size, company history, transparency, and governmental actions taken against the company.

It should be noted that the BBB does not factor in customer reviews into its rating. On the site, SoFi has a very poor rating, which is perhaps to be expected as people go to the BBB site to make complaints, not offer positive feedback.

Wrapping up: Is SoFi a Scam?

SoFi is most definitely not a scam. Although it is relatively new as a broker compared to many (think Charles Schwab, TD Ameritrade, Fidelity, etc.), it ensures that your money is insured and also operates under a fiduciary standard, so that any advising you seek out must be conducted in your best interest.

Ultimately, if you take your money to SoFi Invest, you can be sure that your money is as safe with them as with any other broker-dealer out there.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|