TIAA and E*Trade Comparison

TIAA is about twice as large as E*Trade, measured by total client assets. But does that mean it is twice as good? Here are the results of our

investigation:

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

TIAA

|

$0

|

$50

|

$0 per contract

|

$0

|

$0

|

|

Etrade

|

$0

|

$0

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Charles Schwab

|

$0

|

$49.95 ($0 to sell)

|

$0 + $0.65 per contract

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

TIAA

|

|

|

|

|

|

|

|

Etrade

|

|

|

|

|

|

|

|

Charles Schwab

|

|

|

|

|

|

|

Promotions

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

TIAA:

Open a TIAA investment account.

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Mutual Funds and ETF’s

With E*Trade’s mutual fund screener, we were able to identify 8,449 securities open to new purchases. A smaller list (4,203) offers no load and no transaction fee on every fund. The brokerage gives its customers a selection of All-Star Funds that have been pre-screened for their projected above-average returns. E*Trade charges nothing for access to this list.

For ETF investors, E*Trade offers all exchange traded funds with zero trading fees.

Last, but certainly not least, is E*Trade’s new overnight trading of select ETF’s. There are only twelve right now, but many of them are household names (QQQ, SPY, and GLD, for example).

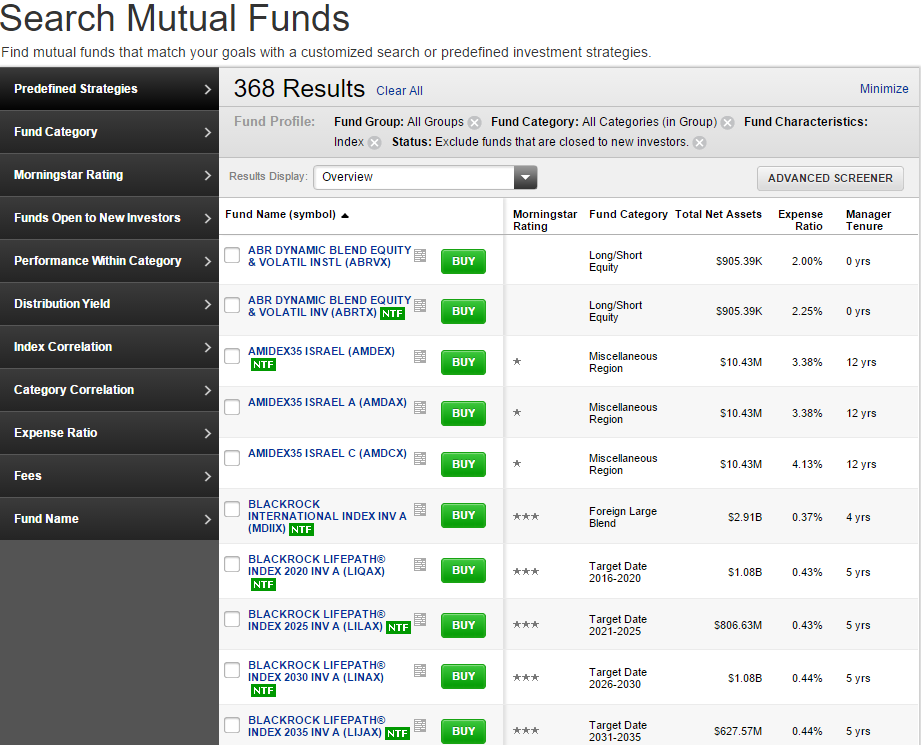

TIAA clients have access to more than 6,500 mutual funds. Because the broker’s fund screener doesn’t offer the ability to scan by load status or NTF status, we don’t know how many of these carry extra charges. We do know that some of the funds on the list of 6,500 have no load and no transaction fee.

Overall, E*Trade seems to outperform in this category.

Other Investments

In addition to stocks, options, bonds, ETF’s, and mutual funds, E*Trade also offers trading in futures. TIAA offers the same investment choices except futures contracts. For retirement savers, TIAA offers fixed and variable annuities, but E*Trade does not.

Looks like a tie here.

Investment Education

The E*Trade website hosts many learning materials. During our investigation, we were able to locate articles and videos on retirement planning, bond investing, how to use the broker’s software, and tax issues. A schedule of upcoming webinars is also posted. For derivative trading, we found many option tools, including a screener and probability calculator.

TIAA customers have a lot of educational resources, too. The articles, however, are rather short; and there are no videos. Some of the topics we found include dollar-cost averaging, compound interest, bond commentary, and more.

As for screeners, E*Trade’s offer more search criteria. The same is true for security profile pages. E*Trade provides more free stock reports, for example.

This category is awarded to E*Trade.

Trading Tools

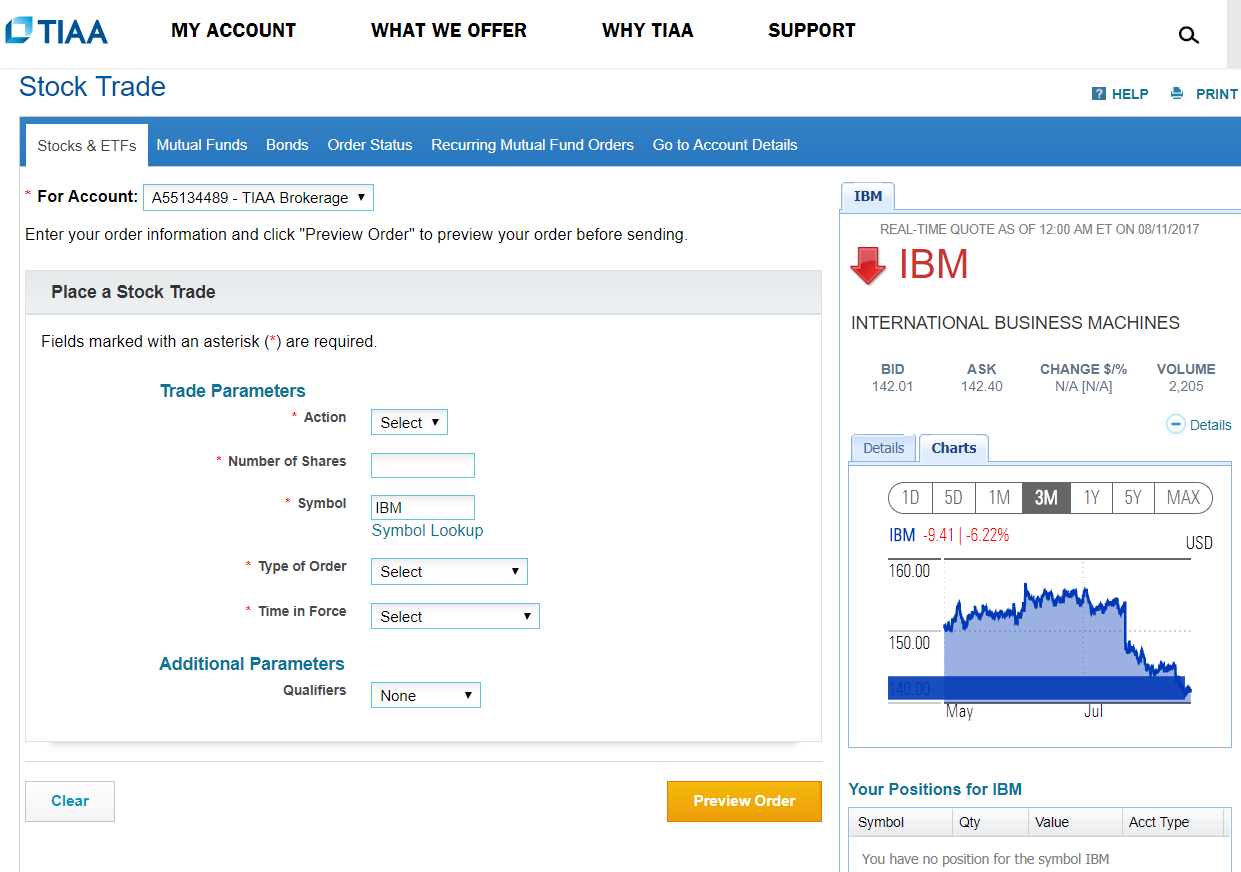

TIAA customers get to trade on the broker’s website and nothing else. The site is pretty simple with only basic charting and minimal tools. The broker’s order ticket is likewise very elementary. There are no advanced order types.

On the positive side, the broker’s site does have option chains, although there are no multi-leg strategies. Alerts can be set for a stock, and a watchlist can be created. The TIAA website does have a trade bar, although it can’t place orders directly.

Moving to E*Trade, we get a browser platform called Power E*Trade. It provides many advanced features not available at TIAA. For example, there is full-screen charting, complex order types, and live streaming of Bloomberg Business News in high definition.

The broker’s website itself is pretty good for charting and trading, although there is no trade bar on the site. For demanding investors, E*Trade provides a desktop platform. Ten trades per month are required to gain access to it.

E*Trade easily wins here.

Mobile Apps

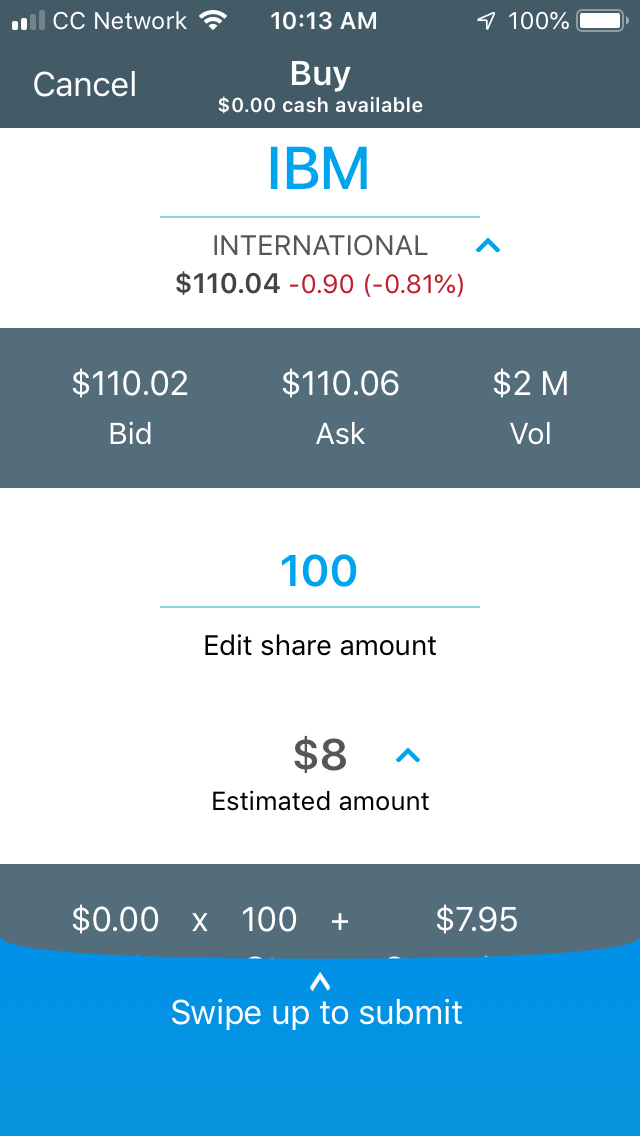

TIAA’s mobile app follows the simplicity of its website cousin. We found account value and not much else. Surprisingly, the app does not have charting or security profile pages. Moreover, there is no mobile check deposit, live video news, or funds transfer.

The app’s trade ticket is confusing and difficult to use, but not because of its sophistication or complexity. There are no option chains on the platform, and we consider this app to be almost useless.

E*Trade actually has two apps. One is a Power version of the company’s browser platform. It has the same interface and offers some really nice features, such as watch lists, option chains, stock profiles, charting, and news articles (courtesy of Reuters, CNBC, and others). The trade ticket offers several advanced features, such as trailing orders. The second E*Trade app provides a mobile check deposit and some repeated features.

TIAA loses again.

Recommendations

Now we come to the crux of this article: who is better? Or maybe we should ask, “Who is better at what?”

For active stock and option trading, we definitely recommend E*Trade over TIAA. The latter broker simply does not have the tools for this type of financial activity.

Mutual fund investors have more products and better resources at E*Trade.

For portfolio management, both companies offer competitive services. But E*Trade customers get a full year free of the broker’s robo service; so we have to go with E*Trade on this one.

For banking services, both companies are competitive, offering unlimited ATM fee rebates with minimum balance requirements. TIAA offers $15 of ATM rebates for any account balance, something E*Trade doesn’t offer; so we’ll suggest TIAA here.

For retirement accounts, both brokers have unnecessary IRA fees; so

it’s a tossup.

Investors who want the best customer service should go with E*Trade, who offers 24/7 service and online chat, neither of which can be found at TIAA.

Promotions

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

TIAA:

Open a TIAA investment account.

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

TIAA vs E*Trade: Which is Better?

TIAA was successful in a few areas, while E*Trade received thumbs up in most. E*Trade is the winner. A larger trove of

client assets apparently does not necessarily mean a better broker.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|