Best IRA Firms Pricing

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Margin

Rate |

Maintenance

Fee |

Annual IRA

Fee |

|

Charles Schwab

|

$0

|

$49.99 ($0 to sell)

|

13.575%

|

$0

|

$0

|

|

WeBull

|

$0

|

na

|

9.74%

|

$0

|

$0

|

|

Robinhood

|

$0

|

na

|

8%

|

$0

|

$0

|

|

Firstrade

|

$0

|

$0

|

13.75%

|

$0

|

$0

|

Best IRA Firms Services

Overview of the Best IRA Companies

Before opening an Individual Retirement Account (IRA) at any brokerage firm, be sure to take a look at the IRA lineups of the following four brokers:

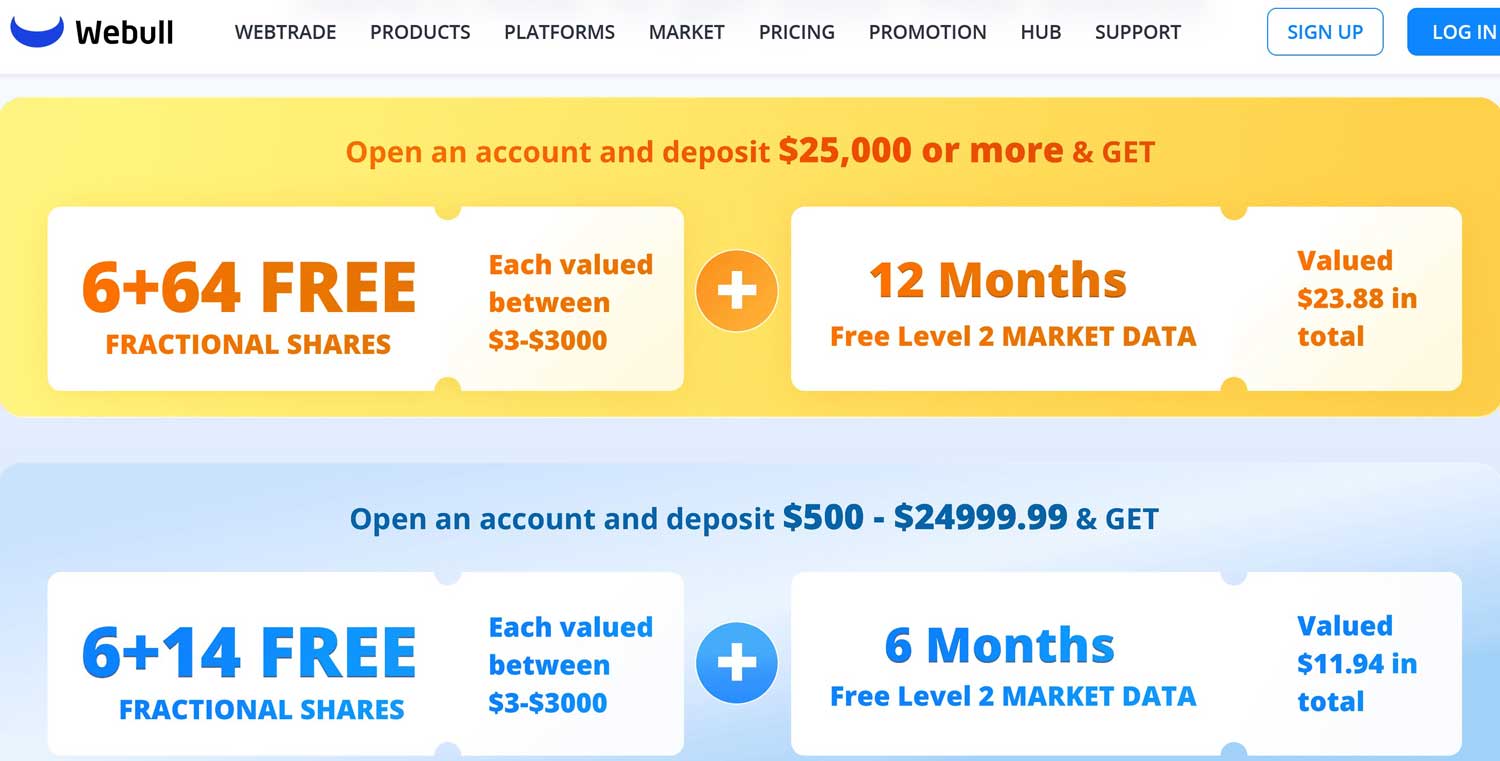

Webull

Webull will accept the transfer of an existing IRA from a rival brokerage firm. A transfer valued at

$5,000 or more will receive a $75 bonus for making the switch. However, before deciding to jump ship,

be aware that there are three big differences between an IRA at Webull and other brokers:

(1) It has no affiliated company that provides financial advice or any type of planning service that retirement savers may need.

(2) It has no lifecycle mutual funds (or any other mutual funds) that IRAs can invest in. Webull also doesn’t offer fixed-income securities.

Although these are significant downsides, self-directed traders can nevertheless find some good deals with the company’s IRA service. First of all, there are no annual or closeout fees, which is an advantage over many brokers.

Second, Webull has some really good trading software, which simply doesn’t exist at many brokers in any form. Up first is its browser platform. Launched from its website, this trading software delivers some really good resources that beginners and seasoned pros alike will find useful. Charting can be accomplished in full-screen mode, and there are many tools. A practice mode is available that can really help to learn the platform.

A desktop version of this computer program is available, too. It has a lot of the same features, although there are some differences. For example, the desktop system can save layouts (multi-chart trading and custom are examples).

The third strength Webull offers here is fractional-share trading, which can be really beneficial to small IRAs.

The biggest weakness Webull has for IRA investors is perhaps in the area of retirement education. There is very little information of value on Webull’s website for retirement planning. The broker is clearly designed for active trading rather than long-term financial planning.

Although Webull does offer trading in cryptocurrencies, these assets cannot be traded inside a retirement account. Moreover, an IRA at Webull cannot be margin enabled, which means day trading is not possible inside an IRA.

Learn more...

Webull Incentive

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

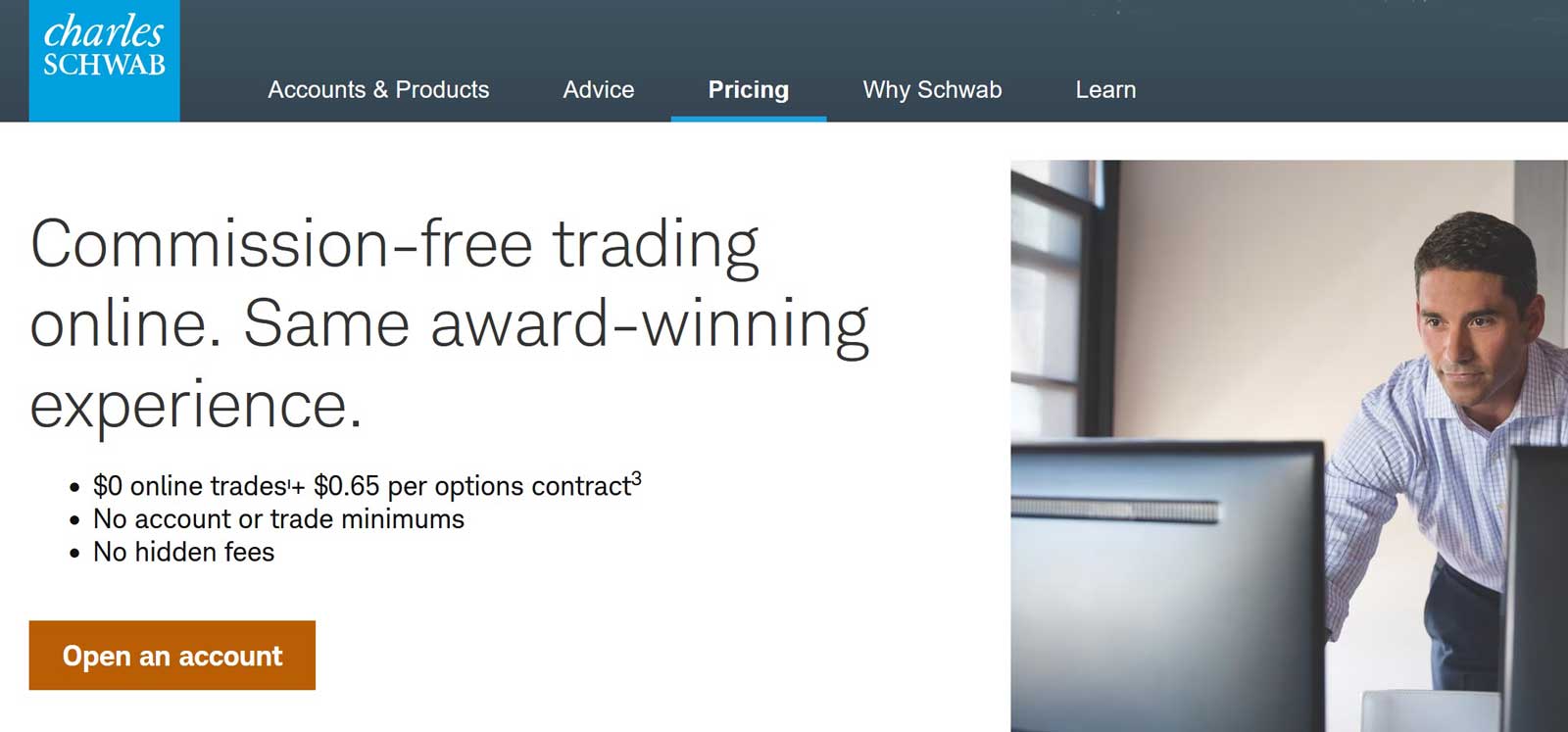

Charles Schwab

Charles Schwab offers a variety of retirement accounts to suit your needs, whether you are looking for an account with tax advantages, advanced trading capabilities, or automation.

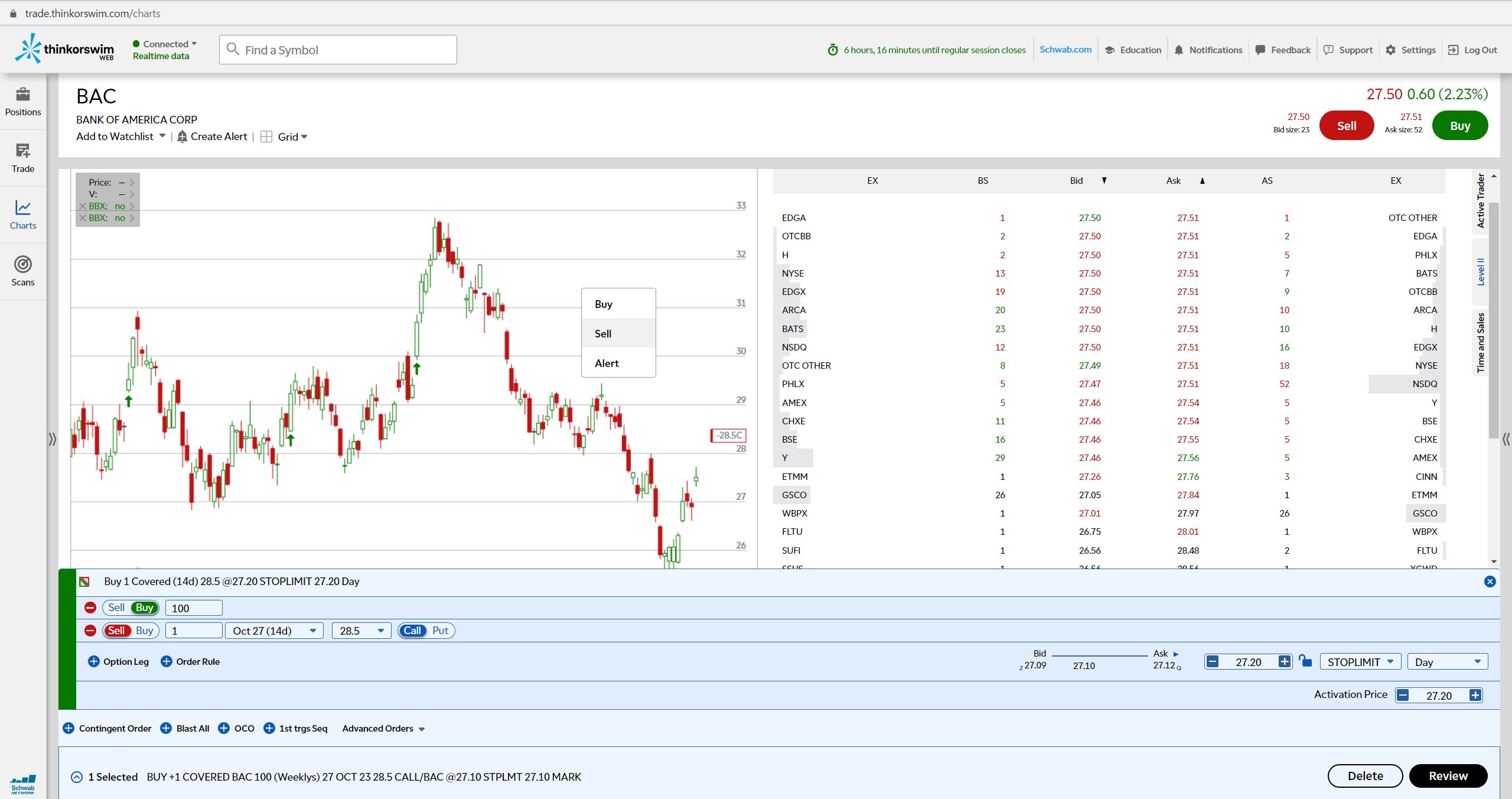

One notable feature of Schwab's retirement accounts is the ability to enable margin, which can unlock more trading opportunities. It is important to note, however, that margin in Schwab's IRAs works differently from the margin services offered in standard brokerage accounts.

Let’s take a closer look at how IRA margin trading works at Charles Schwab.

When you first open a Schwab IRA, margin is not enabled by default. However, you can activate margin by following a few simple steps.

The first step is to fill out and submit a margin activation request form. You can download the form by navigating to ‘Support’ and selecting ‘Forms & Applications.’ Once the form is complete, you can upload it directly to your secure message center. Alternatively, you can send the form by mail or fax.

If you cannot locate the form for any reason, you can obtain it by contacting a member of the Client Service Team through the Live Chat tool or by calling (800-435-4000).

As previously mentioned, Schwab's IRA margin trading differs from standard brokerage accounts.

Once margin is activated, you can trade with unsettled funds and establish positions using options spreads. However, margin cannot be used for selling securities short or borrowing against your portfolio.

Due to these differences in how Schwab's IRA margin is utilized, some of the base requirements for activating it are also different. Normally, a minimum of $2,000 is required to enable margin. However, when using a Schwab IRA with your own capital, the only account minimum to note is the $5,000 threshold for selling options.

If you are looking for additional IRA types to suit your needs, Charles Schwab is an excellent option. In addition to the standard options, the broker also offers some specialized retirement accounts.

The IRA types available at Charles Schwab include Traditional, Roth, Rollover, Inherited IRA (Beneficiary), Custodial IRA, Individual 401(k), SEP-IRA, and Simple IRA.

Charles Schwab offers a variety of investment options for its retirement accounts. IRAs focused on self-directed trading include access to

stocks, ETFs, options, fixed-income securities, OTC, futures, and Forex. For a more passive approach, Schwab has an automated investing service that provides access to curated ETF portfolios, financial planners, and automated tax-loss harvesting. Additionally, Schwab offers wealth management through its Schwab Wealth Advisory service, where financial professionals not only create and manage a retirement portfolio but also help with retirement planning.

Learn more...

Charles Schwab Website

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Robinhood

Robinhood offers two types of IRA accounts. You can open a Traditional and Roth IRA. While the retirement account options at Robinhood have fewer features compared to other full-service brokers like Charles Schwab, they offer an attractive match program designed to give customers a compoundable boost to annual contributions.

Robinhood's IRA Match program gives you

an additional 1% to your IRA for contributions. The bonus does not count towards your yearly contribution limit, and there is no limit on earning. You can receive the bonus on all deposits and account transfers, despite their size and type.

The IRA Match becomes available for investment after deposits are completed. To avoid the early IRA match removal fee, contributions must remain in the IRA for at least 5 years from the contribution date. Gold members can earn an additional 2% match by remaining a member for at least 1 year

after the first 3% match.

For 2024, investors under 50 can contribute up to $6,500 and those 50 and over can contribute up to $7,500. This allows for potential extra earnings of $65 or $75, on top of any contributions that you make.

The selection of securities available for trading within an IRA on Robinhood is more limited compared to other top brokers. However, most investors will find Robinhood's listing of U.S.-listed stocks, ETFs, and options to be large enough to meet their needs.

Another great feature of Robinhood's retirement account is the Recommended Portfolio. This collection of investments includes several ETFs that are chosen by an automated system and is based on the investor's strategies and goals. The portfolio combines a mix of different assets with varying levels of risk and reward. If desired, you can also modify the assets by selecting your own.

Learn more...

Robinhood Incentive

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

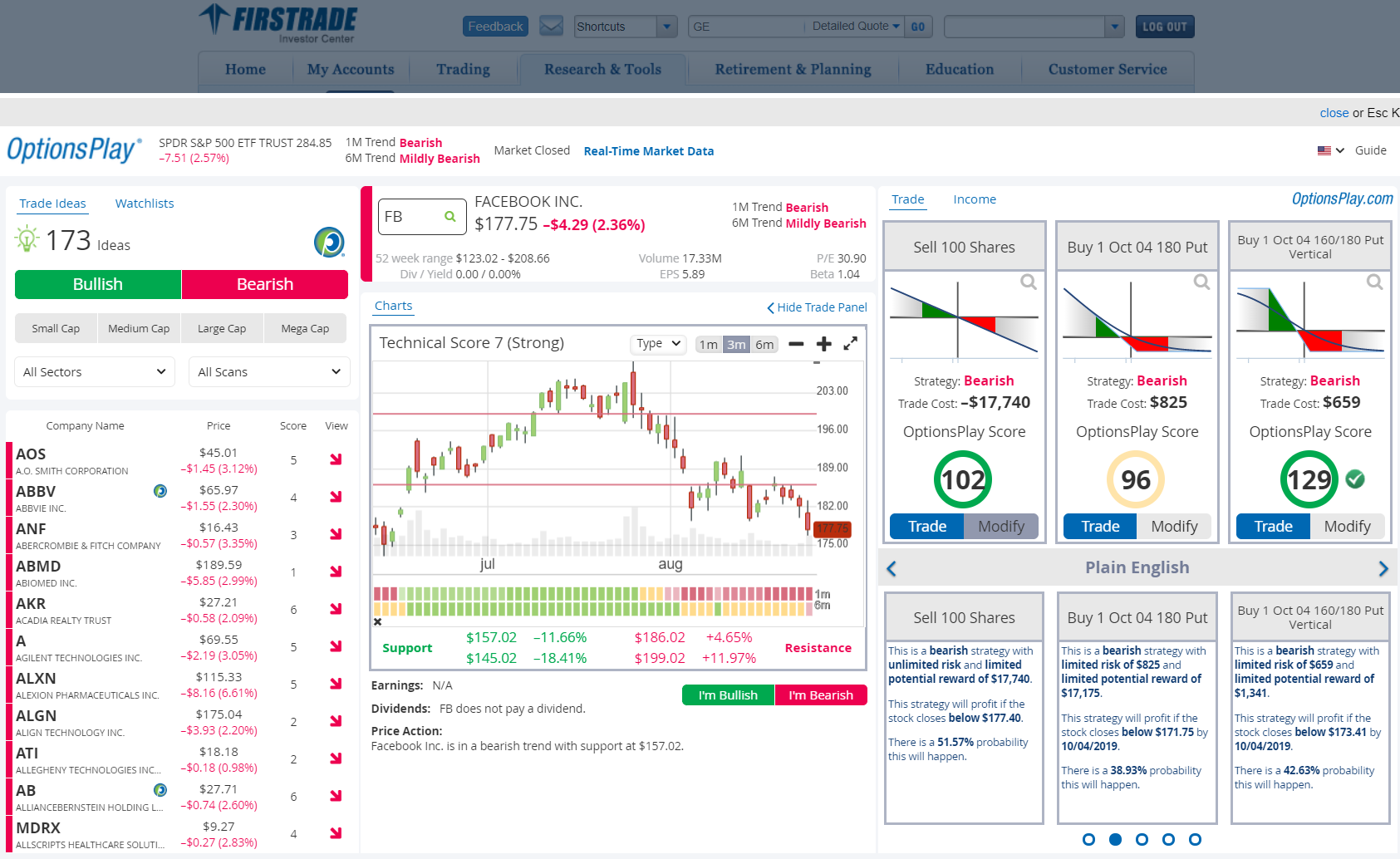

Firstrade

Rounding out our list of teh best IRA brokers is Firstrade. The firm has two personal IRAs (Roth and traditional) and two small-business IRAs (SEP and SIMPLE). These accounts can only be opened in self-directed mode at Firstrade because the company doesn’t offer any type of investment management.

A self-directed IRA can trade equities, mutual funds, ETFs, closed-end funds, and bonds. Like Webull and Robinhood, Firstrade offers cryptocurrency trading, but the service is not available inside of IRAs.

One of Firstrade’s greatest strengths (for both tax-deferred and taxable accounts) is its list of available mutual funds. This is over 16,000 products that are open to new investors.

During our probing with Firstrade’s mutual fund screener, we found hundreds of lifecycle mutual funds with target dates ranging from 2010 to 2065. Not a single one has a transaction fee at Firstrade, and some are no-load products as well.

IRA account holders will find a moderate amount of information on retirement topics on Firstrade’s website. Relevant resources will be found, conveniently enough, under the Retirement tab in the top menu. We found a very brief retirement calculator with the following inputs:

- Your age today

- Your Contribution per Year

- Age that you want to retire

- Rate of Return

Missing on this calculator is the all-important starting balance, so we don’t recommend using this one. Scroll down on the same page to find other financial-planning calculators, including:

- What will my qualified plan(s) be worth at retirement?

- How much will I need to save for retirement?

- Are my current retirement savings sufficient?

These calculators use lots of criteria, including amount currently saved, so they’re more useful.

Firstrade has no on-going fees of any kind on its tax-deferred accounts, nor is there any fee to close one. Paper statements, confirmations, and even tax documents do have fees, however.

Firstrade will accept a rollover of an old employer’s retirement plan into an IRA. Firstrade charges no fee for this service. If the outgoing firm does, Firstrade has an account transfer fee special that will refund up to $200 in any fee charged for the transfer if it is valued at $2,500 or more.

Learn more...

Firstrade Incentive

Get up to $250 ACAT rebate and $0 commission trades.

Open Firstrade Account

Best IRA Companies Recap

Investors who want a full-service broker with extensive offerings and learning resources may prefer

Charles Schwab. Those who want fractional shares may prefer Webull, while those looking for a

contribution match program may prefer Robinhood. Firstrade could be a good choice for those seeking a

wide variety of mutual funds and no fees for tax-deferred accounts.

| Broker | Robo | Annual fee | Cancel fee | IRA Versions | Rollover Service |

|---|

| Charles Schwab | Yes | $0 | $0 | 8 | Yes |

| Webull | Yes | $0 | $0 | 2 | Yes |

| Robinhood | No | $0 | $0 | 2 | Yes |

| Firstrade | No | $0 | $0 | 4 | Yes |

Promotions

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.