TIAA vs Vanguard in 2024

Vanguard or TIAA CREF—which is better? Compare IRA/Roth accounts, online investing fees, stock broker mutual fund rates, and differences.

TIAA vs. Vanguard and Schwab: Key Takeaways

• Managed and self-directed investment accounts are available at Vanguard, TIAA, and Schwab.

• Only Schwab has bank accounts.

• The largest list of tradable products will be found at Schwab.

TIAA vs. Vanguard and Schwab Introduction

Before you open your next brokerage account, you really should have a look at TIAA, Schwab, and Vanguard. Here’s our take on these three:

Trading Services

All three securities firms in this contest offer both investment-advisory and self-managed accounts. In the former setup, TIAA doesn’t have a robo service, although the other two firms do (in addition to old-school, human-managed accounts).

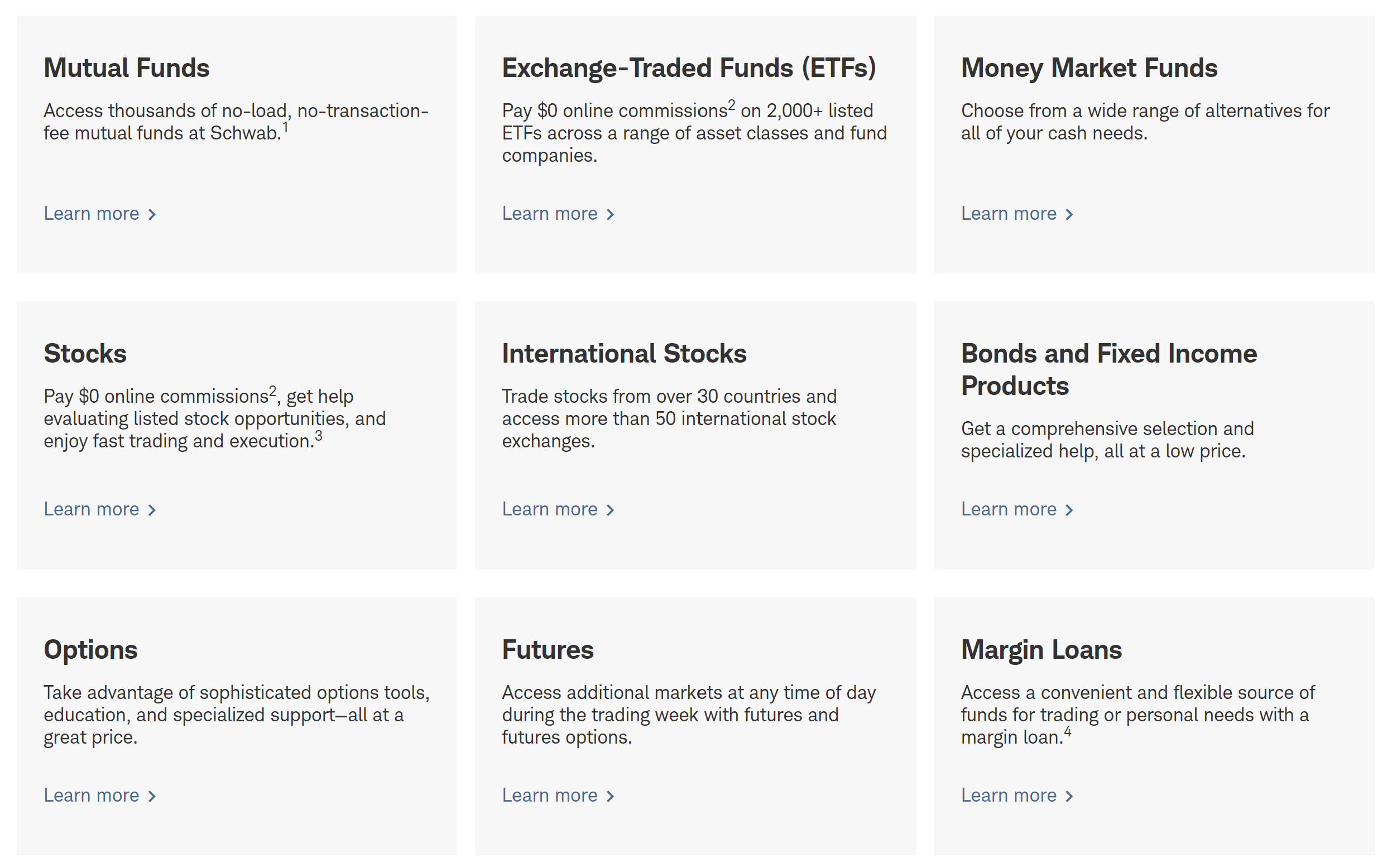

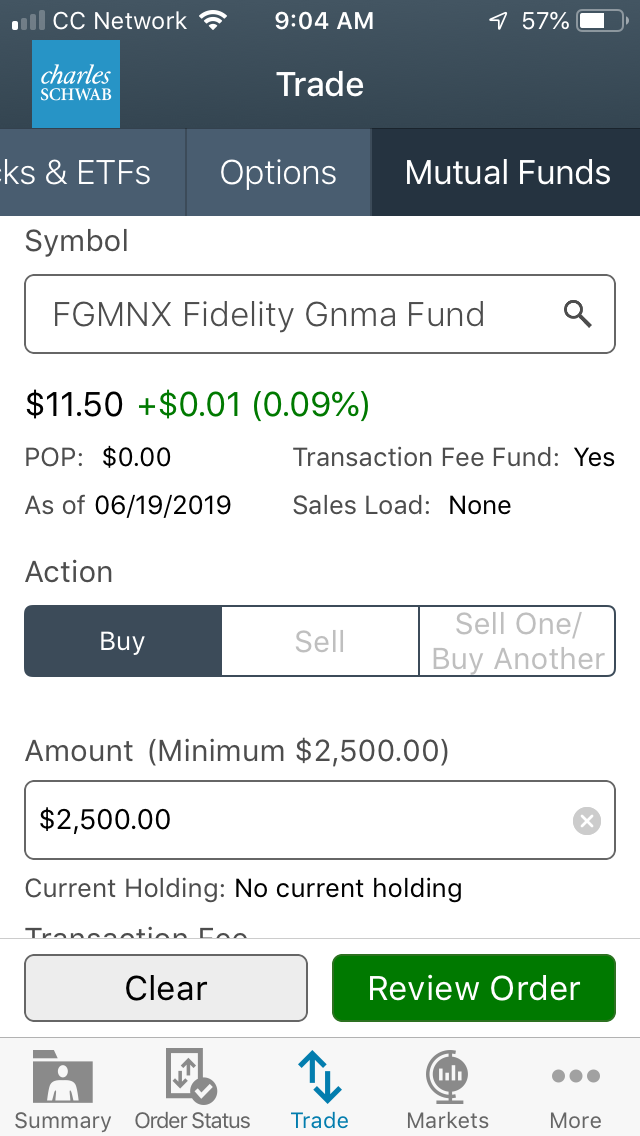

Brokerage accounts will have the largest selection of tradable assets. Expect to find equities, options, funds (mutual, closed-end, and exchange-traded), and fixed income at any firm. Schwab goes a little further with OTC stocks, foreign stocks, futures contracts, and forex. Nobody here has cryptocurrencies.

Winner:

Winner: Schwab

Cash Management

Investing is only the beginning of the financial picture at Charles Schwab. The corporate powerhouse also operates Schwab Bank, which has FDIC insurance and a lot of cash-management products. On the list are pledged-asset lines, mortgages, and deposit accounts. The latter come with zero ATM fees and a 0% conversion rate.

Vanguard and TIAA both previously offered bank products but both have shut down these services.

Winner: Schwab

Margin Accounts

The most elementary form of trading is the cash setup. With this system, all trades must be fully paid for. A margin account, by contrast, provides the ability to place trades using borrowed funds. Not surprisingly, this service comes at a cost at all three brokerage firms.

Currently, Vanguard clients pay between 13.75% and 11.75% for margin debits. Schwab’s stepped schedule

begins at 13.575% and drops to 11.825%.

TIAA customers get the lowest schedule; it begins at 12.625% and stops at 11.625%. Schwab and Vanguard traders get negotiated rates above balances of $500k.

Winner: Debatable

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

TIAA:

Open a TIAA investment account.

Vanguard:

Open a Vanguard investment account.

Mobile Platforms

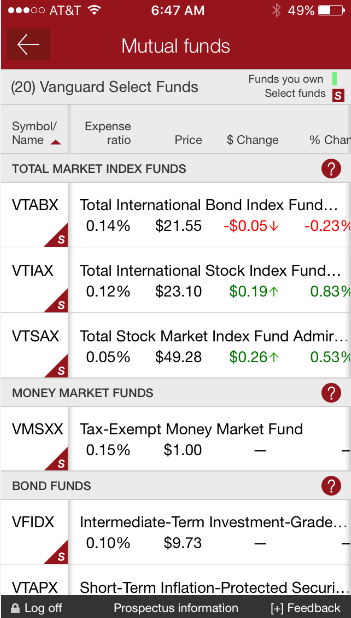

To manage accounts and actually trade something, all three broker-dealers have mobile apps. Vanguard’s is very simple with no advanced tools to mention. A chart cannot be rotated horizontally, and there are no graphing tools. There are 4 order types and 2 duration choices.

The situation at TIAA is quite similar. During our probing, we found no sophisticated tools. Charting is on the same elementary level, and the order ticket has the same 4 order types. There is no mobile check deposit tool, which is something we did find on the Vanguard app.

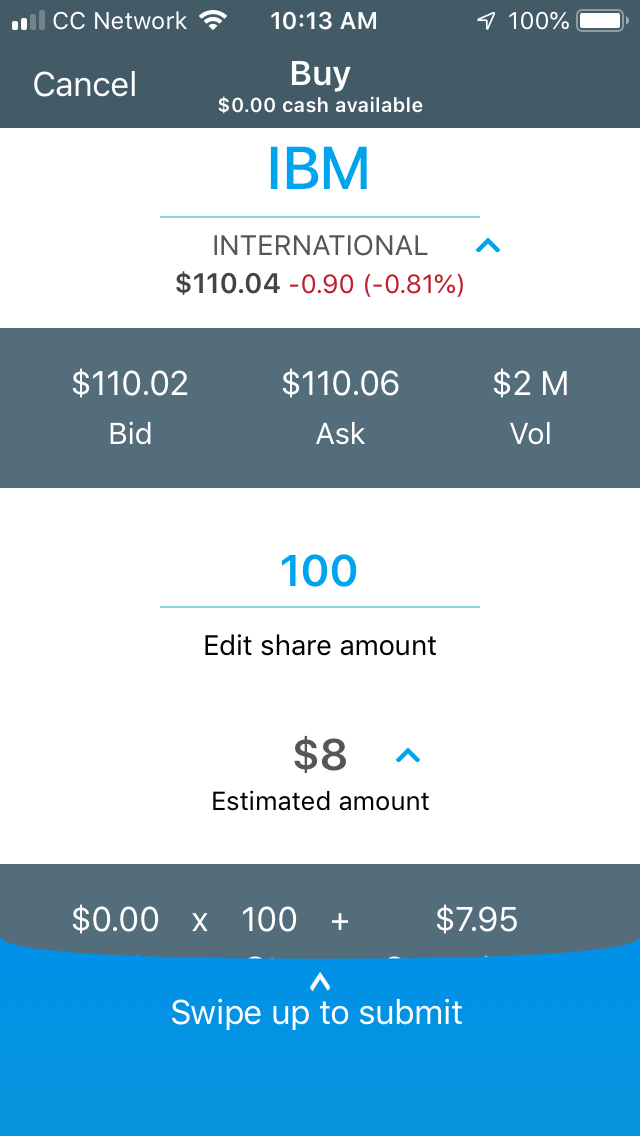

Schwab has two apps, and mobile check deposit appears on one of them. The one without is a high-powered

trading app called

thinkorswim that makes up for the

lack of mobile check deposit with all sorts of high-level trading resources, including hundreds of technical studies and an order ticket with 7 trade types.

Winner:

Winner: Schwab

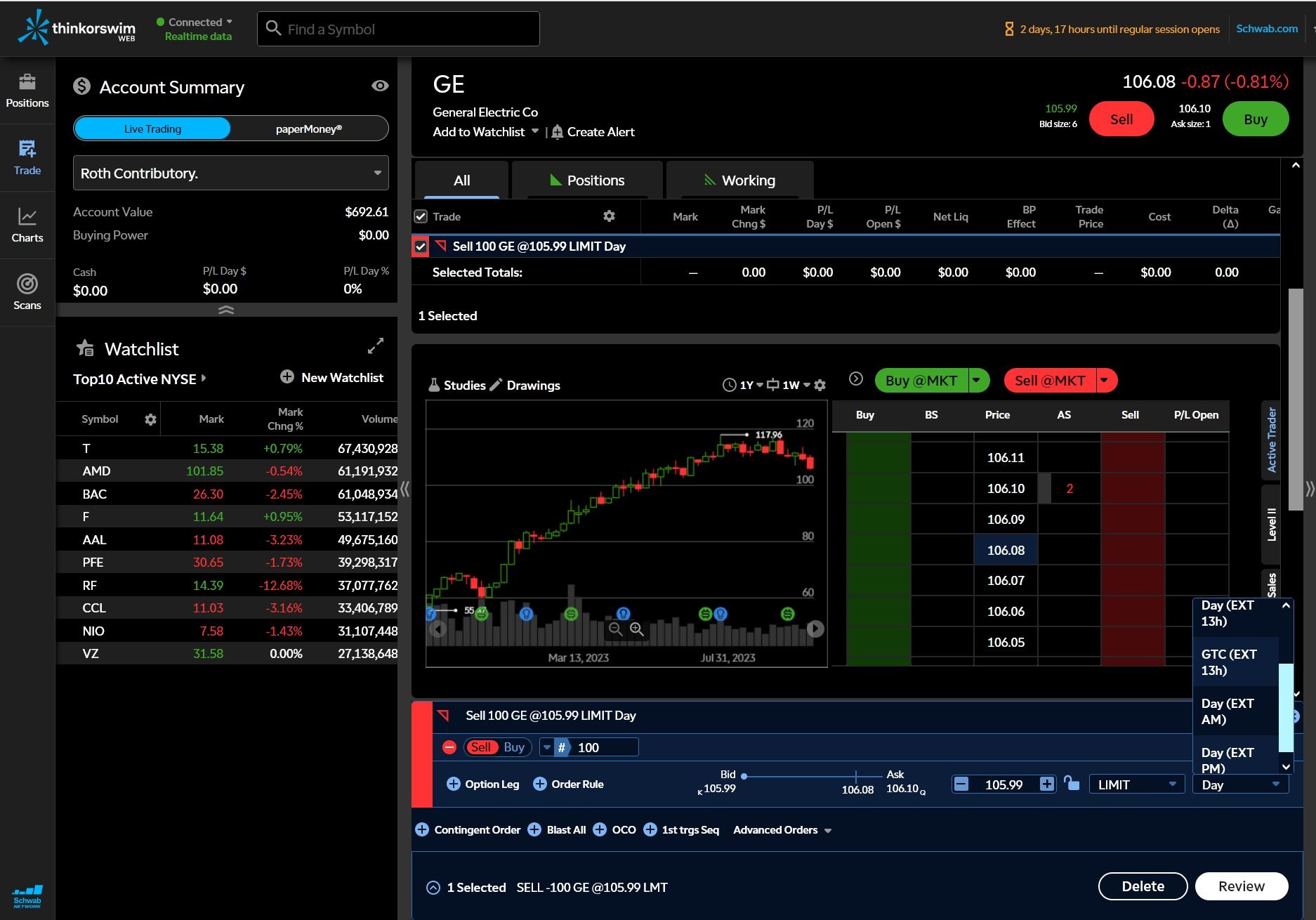

Website Tech

thinkorswim makes another appearance on Schwab’s website. This time, it is a web-browser platform with two trade tickets—the one we saw on the mobile app plus an Active Trader ticket that functions as a price ladder. Charting is actually on a lower level, although this time there is simulated trading.

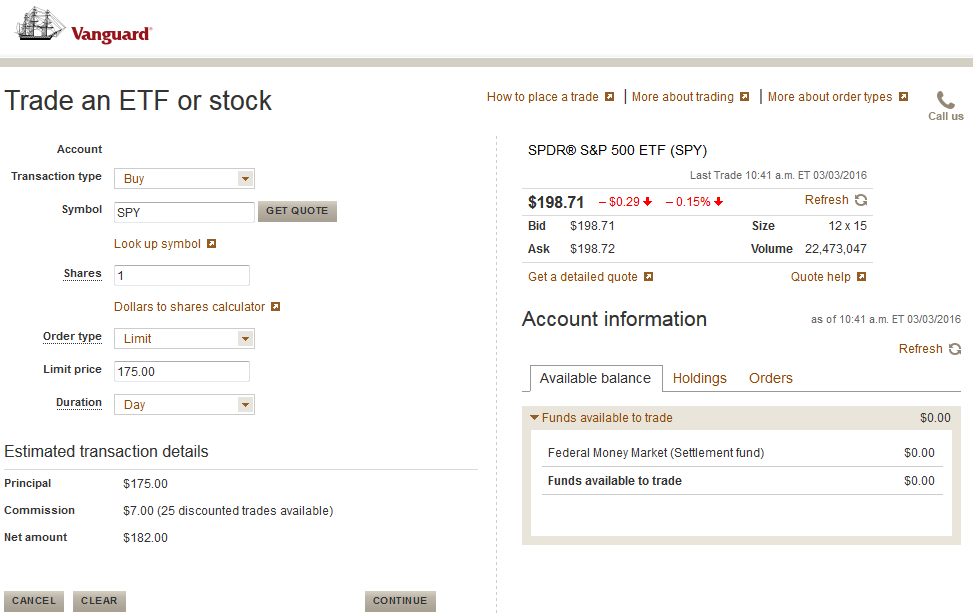

There is no simulated trading on the Vanguard site, and in fact, there is no browser platform. Simple trading tools are what we found on the website. A graph cannot be displayed the full width of the computer screen, and there are only 7 technical studies.

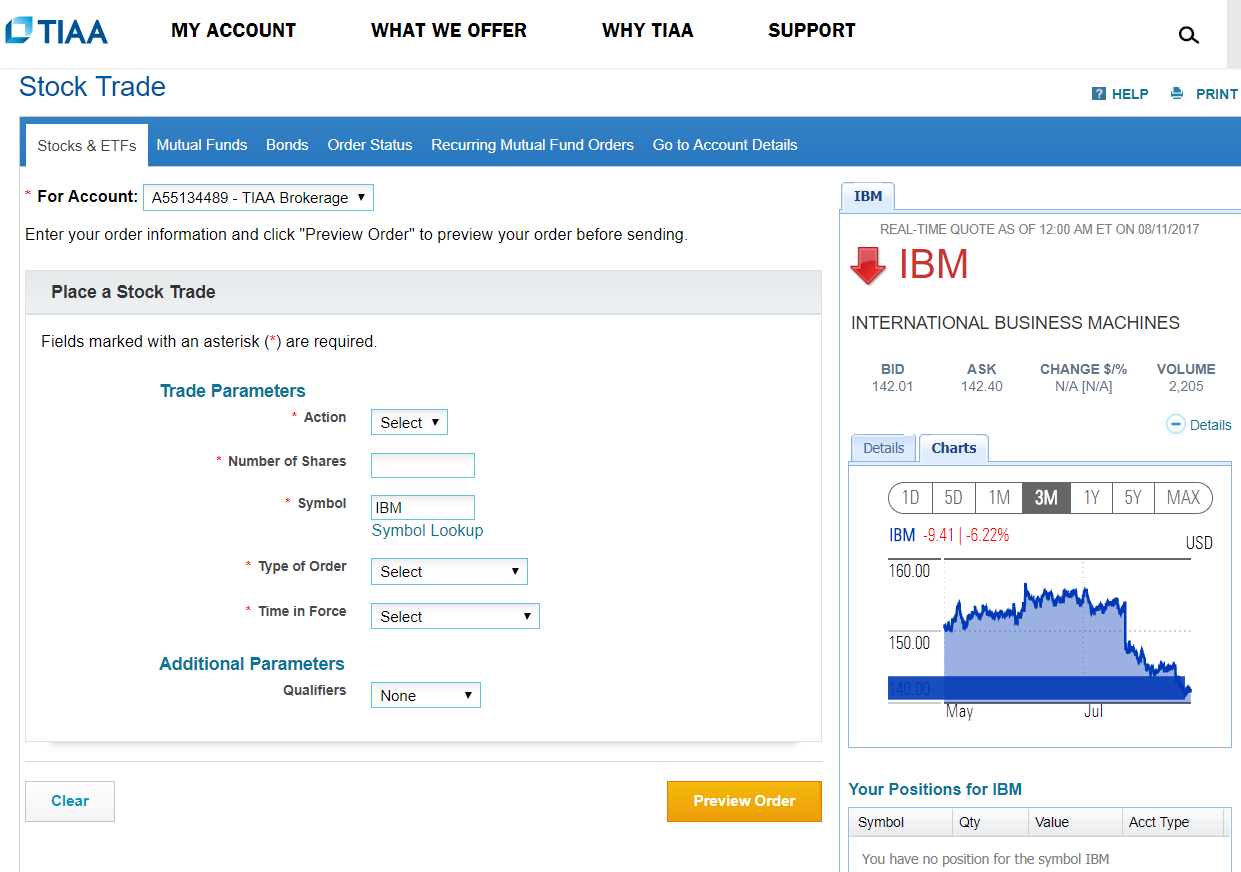

On the TIAA site, we found 13 technical indicators, although full-screen charting is not a possibility. There is no browser platform, although there are alerts, a watchlist, and option chains (for calls and puts only). A trade bar at the bottom of the site delivers a somewhat better experience than the one we received at Vanguard.

Winner:

Winner: Schwab

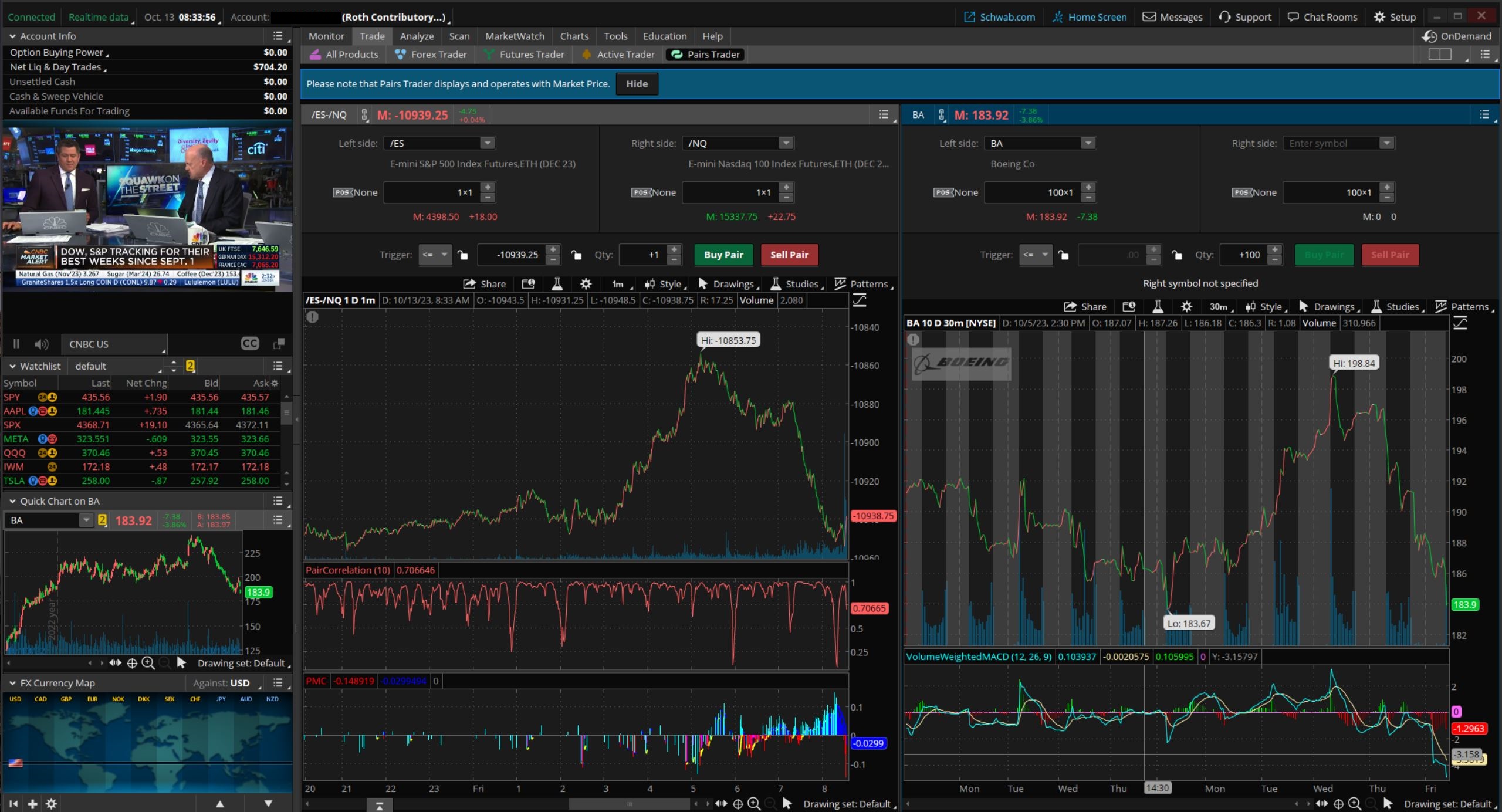

Desktop Software

For the absolute highest level of trading, there is desktop software. Schwab’s platform continues with the thinkorswim label; it has tons of sophisticated tools that the most demanding of traders will really like. During our test drive of the platform, we especially appreciated these features:

- Advanced charts with over 400 technical studies and 11 plot styles

- Time and sales data

- Probability analysis

- Multiple order tickets

- thinkBack, a backtesting tool

- Pairs and multi-leg trading

- Economic calendar

- Dealing boxes for futures and forex

- Powerful search engines

- Live streams of video financial news

Neither Vanguard nor TIAA has a desktop platform.

Winner: Schwab

Further Services

Autopilot Mutual Fund Purchases: Possible at all three brokerage houses, although Vanguard restricts its service to Vanguard funds.

IRA Lineup: Individual Retirement Accounts of many kinds can be opened at all three investment firms. Only TIAA has a termination fee of $130, and Vanguard does impose recurring fees on some of its business IRAs.

Fully-Paid Securities Lending Program: TIAA doesn’t have one, but Schwab and Vanguard do.

Extended Hours: Schwab is the only brokerage firm in this battle with

both pre-market and after-hours trading. Plus, it offers overnight trading in some ETFs.

Fractional Shares: Most securities at TIAA can be purchased in whole dollars. At Vanguard,

fractional-share trading is restricted to Vanguard funds, while Schwab restricts its service to S&P 500 equities.

Dividend Reinvestment Plans: All three offer free DRIP services.

Initial Public Offerings: Only at Schwab.

Winner: Schwab

Our Recommendations

Equity Trading: Definitely Schwab with thinkorswim.

Small Accounts: Schwab requires $5k to begin automated investing, while Vanguard clients need

$3k to get into its robo program. Self-directed customers don’t need to make a deposit of any amount

at any firm.

Long-Term Investors & Retirement Savers: With annuities, branch locations, target-date mutual funds, financial planners, and more, Schwab gets our seal of approval.

Mutual Funds: Schwab has the fewest mutual funds but the best fund screener and the best fund

tools on its website. Take your pick.

Beginning Investors: A managed account with any firm in this tug-of-war would be a good way to

start investing.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

TIAA:

Open a TIAA investment account.

Vanguard:

Open a Vanguard investment account.

Outcome

Vanguard and TIAA must do much more to overcome the colossus Charles Schwab.

Open Charles Schwab Account

Open Schwab Account

Open TIAA Account

Open TIAA Account

Open Vanguard Account

Open Vanguard Account

Updated on 2/13/2024.