|

TIAA vs Robinhood (2024)

Robinhood or TIAA CREF—which is better in 2024? Compare IRA/Roth accounts, online investing fees, stock broker mutual fund rates, and differences.

|

The Faceoff

TIAA and Robinhood are two brokerage houses that cater to different types of investors. While any

investor can open an account with either firm, each has specific features and services that

distinguish it from the other. In this article, we will compare TIAA and Robinhood on various aspects

to determine which one is the better value.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Robinhood

|

$0

|

na

|

$0

|

$0

|

$0

|

|

TIAA

|

$0

|

$50

|

$0 per contract

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Robinhood

|

|

|

|

|

|

|

|

TIAA

|

|

|

|

|

|

|

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

TIAA: none right now.

Trading Technology

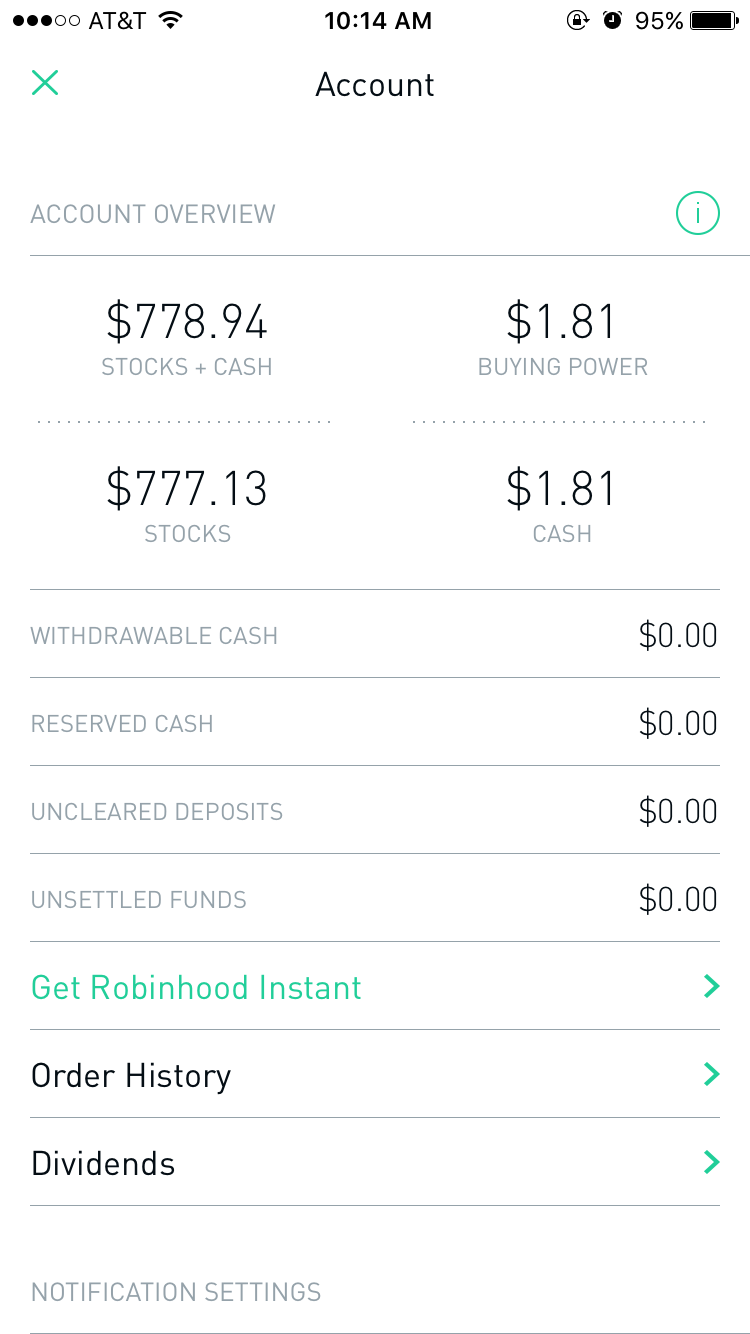

Robinhood offers a mobile app as its primary trading platform. Its website can also be used for

trading and research, but its primary function is to provide FAQs and advertise the broker's

services. The mobile app is rudimentary, with simple graphs and minimal security research and market

news.

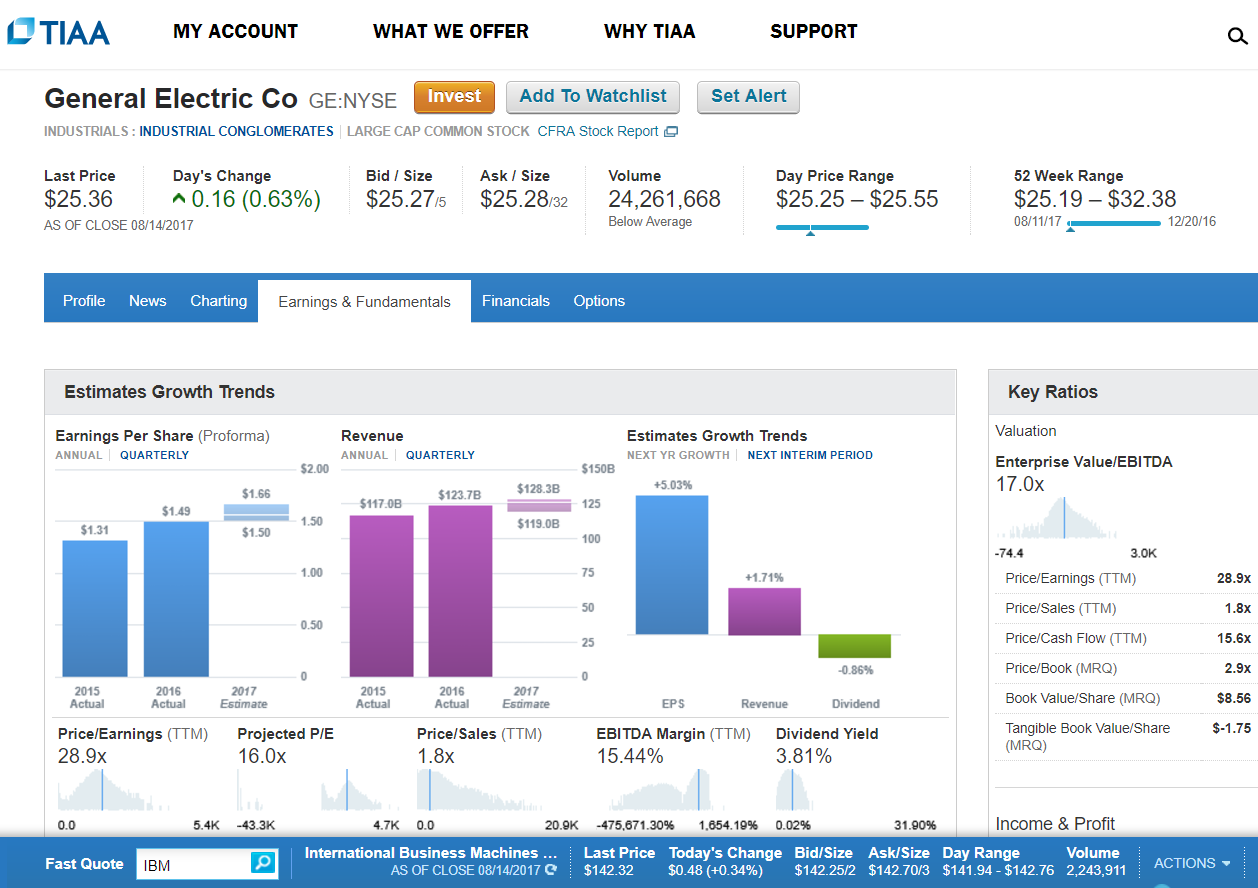

On the other hand, TIAA offers a more advanced trading platform on its website and mobile app. The

charting tools are basic, but more advanced than Robinhood's mobile platform.

TIAA wins the first category.

Customer Support

TIAA provides phone support during extended hours, including Saturday hours and a 24/7 automated

phone service. The broker also offers an international phone number for travelers and Spanish

language service. TIAA has many branch locations in the U.S., with financial advisors located even outside

major cities. However, the broker does not provide financial advice to self-directed account holders.

Robinhood offers phone support 24/7, but has no branch locations.

TIAA wins here, too.

Fees and Commissions

Robinhood offers commission-free equity trading. There are no deposit requirements or ongoing fees, and a live

agent-assisted trade over the phone costs only $10.

TIAA charges no fees for stock and ETF transactions, has no annual fee, and no minimum deposit

requirement for a regular brokerage account. Its margin rates, however, are higher than at

Robinhood: 12.625% vs 8%.

Robinhood wins its first category.

Mutual Funds and ETF’s

TIAA investors can buy and sell ETFs and mutual funds. The broker manages 290 TIAA-branded funds,

some of which carry no loads. These do, however, come with transaction fees. The TIAA mutual fund screener displays

over 7,200 funds, but there is no way to search exclusively for no-load, no-transaction-fee

funds.

Robinhood offers commission-free trading for all US-listed ETFs, but does not provide

any mutual funds.

TIAA wins this category.

Investment Advice and Managed Accounts

TIAA offers managed accounts with access to a financial advisor, however its robo-advisory service is

the cheaper option. The minimum deposit for the robo-service is $5,000 vs $50,000 for a traditionally-managed

account, while costs are 0.30% vs 1.15%.

Robinhood does not offer financial advice or managed accounts.

TIAA wins this category.

Other Investment Products

TIAA clients have access to fixed-income, education savings plans, annuities, life insurance,

and estate planning. Derivative contracts cost $0 each, while bond transactions

have a $50 commission.

Robinhood offers options and crypto trading with no commissions.

This category is a tie.

Banking Features

TIAA offers a debit card and checks for a trading account with a balance of $10,000 that has been

opened for at least a month.

Robinhood has a rewards-rich debit card called Cash Card, 5% yield

on cash balances, checking features, and more.

Robinhood comes on top.

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

TIAA: none right now.

TIAA vs Robinhood: Which is Better?

TIAA won more categories. Nevertheless, Robinhood is the better broker for more active traders and

for anyone who wants the best pricing and the best margin rates/interest on their cash.

|

Open Account

|

Open Account

|