TIAA vs Fidelity in 2024

Fidelity or TIAA CREF—which is better? Compare IRA/Roth accounts, online investing fees, stock broker mutual fund rates, and differences.

TIAA vs. Fidelity and Schwab: Points to Know

• Brokerage and advisory accounts can be opened at TIAA, Schwab, and Fidelity.

• Cash-management resources are available at Fidelity and Schwab.

• The best software will be found at Schwab.

TIAA vs. Fidelity and Schwab Introduction

If you’re looking for a brokerage firm to help you with investing, TIAA, Fidelity, and Charles Schwab are well worth checking out. For the full story on these three investment firms, see below.

Investing

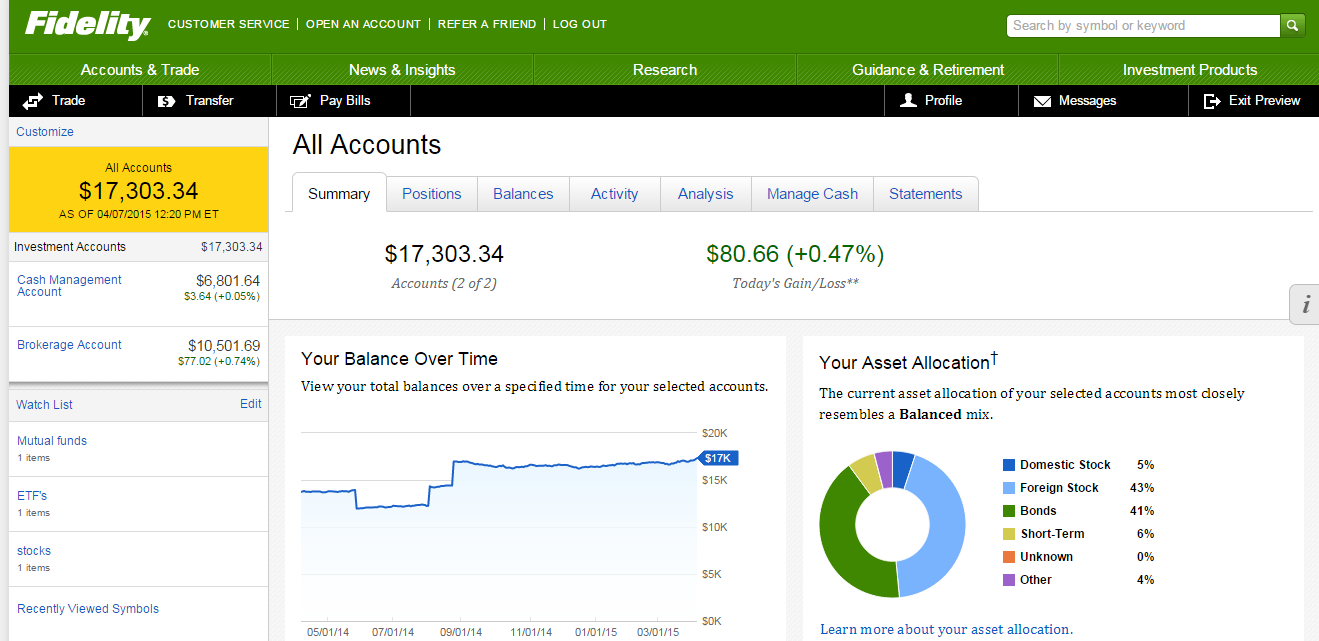

Brokerage and managed accounts can be opened at all three investment firms in this faceoff. Only Fidelity and Schwab offer robo accounts in their advisory programs. Fidelity has no starting minimum, while Schwab’s is free. In all three cases, human financial advisors can be accessed through branch locations.

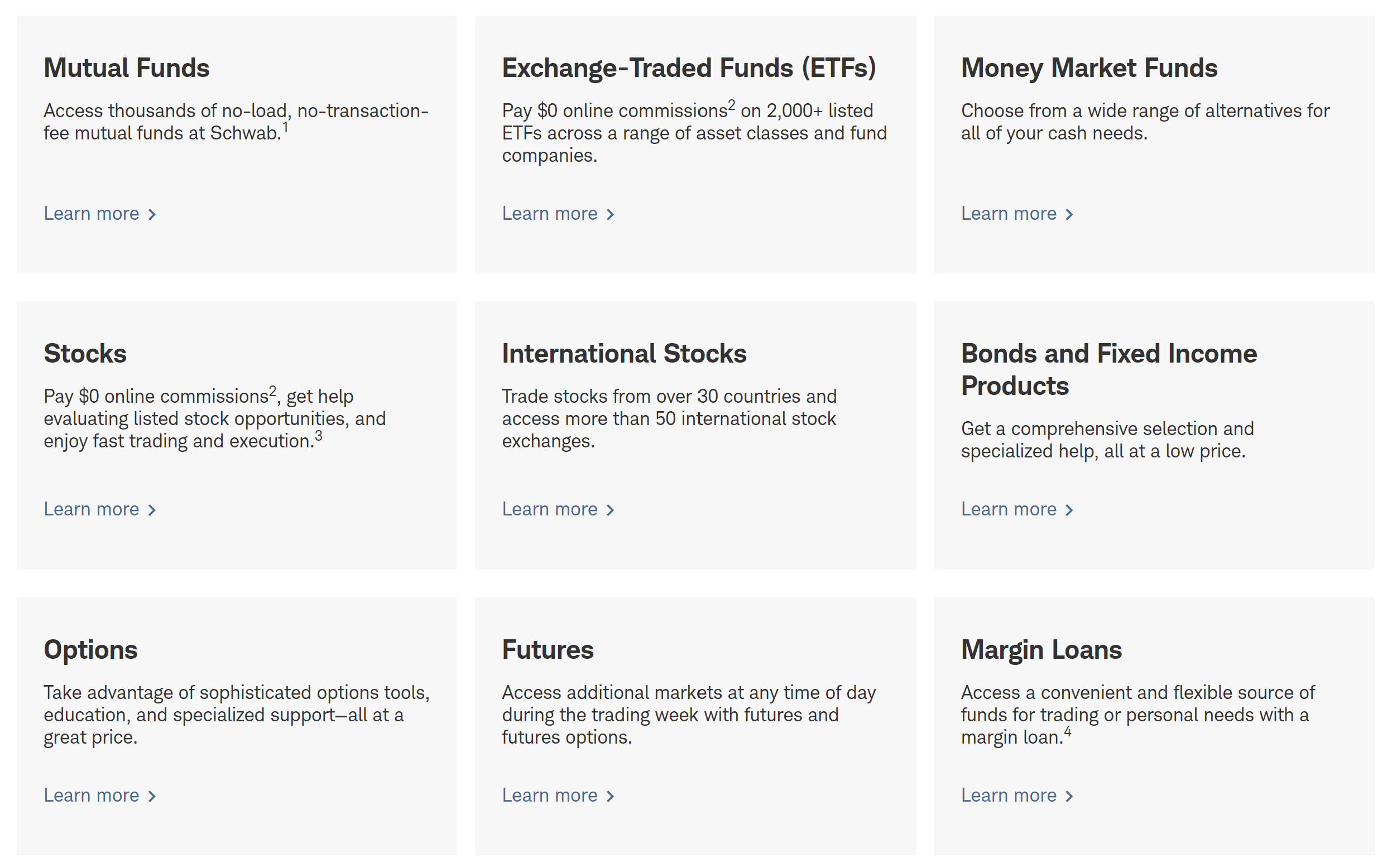

For self-directed customers, all three firms offer trading in the following asset classes:

- Stocks

- Bonds and other fixed-income securities

- Option contracts

- ETFs

- Closed-end funds

- Mutual funds

All three firms offer trading in over-the-counter (OTC) stocks, while Schwab and Fidelity offer access to some foreign exchanges. Schwab offers trading in futures and forex, while Fidelity has a cryptocurrency service.

Winner:

Winner: Draw between Fidelity and Schwab

Banking

TIAA Bank has closed, and the company no longer offers any cash-management services. Fidelity and Schwab are different stories. Schwab continues to operate Schwab Bank, which provides checking and savings accounts along with other services like mortgage loans.

Fidelity doesn’t have a bank, although it does provide debit cards and checkbooks connected to hybrid brokerage-bank accounts. It’s possible to invest in money market funds at either Fidelity and Schwab, and some of these yield around 5.0% right now.

As for pricing, neither Fidelity nor Schwab charges anything for its bank products. Checkbooks and debit cards are free, and both debit cards come with some really nice perks, like ATM fee refunds. Schwab, but not Fidelity, provides these worldwide. In one of Fidelity’s cash-management programs (called Bloom), it’s possible to earn cash bonuses for various activities.

Winner: Another tie

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Vanguard:

Open a Vanguard investment account.

Margin

It’s possible to trade on margin inside brokerage accounts at all three firms in this comparison.

Fidelity and Schwab provide user-friendly online tools to switch an account from cash to margin

status. At TIAA, a form must be downloaded, printed, signed, and returned to the broker.

Once an account has enabled margin trading at any broker, it will be subject to interest charges if it

borrows money. Right now, Schwab’s tiered margin schedule starts at 13.575%

and bottoms out at 11.825%. Fidelity has the

same rates. TIAA’s schedule ranges from 12.625% to 11.625%.

Winner: Pretty close overall

Websites

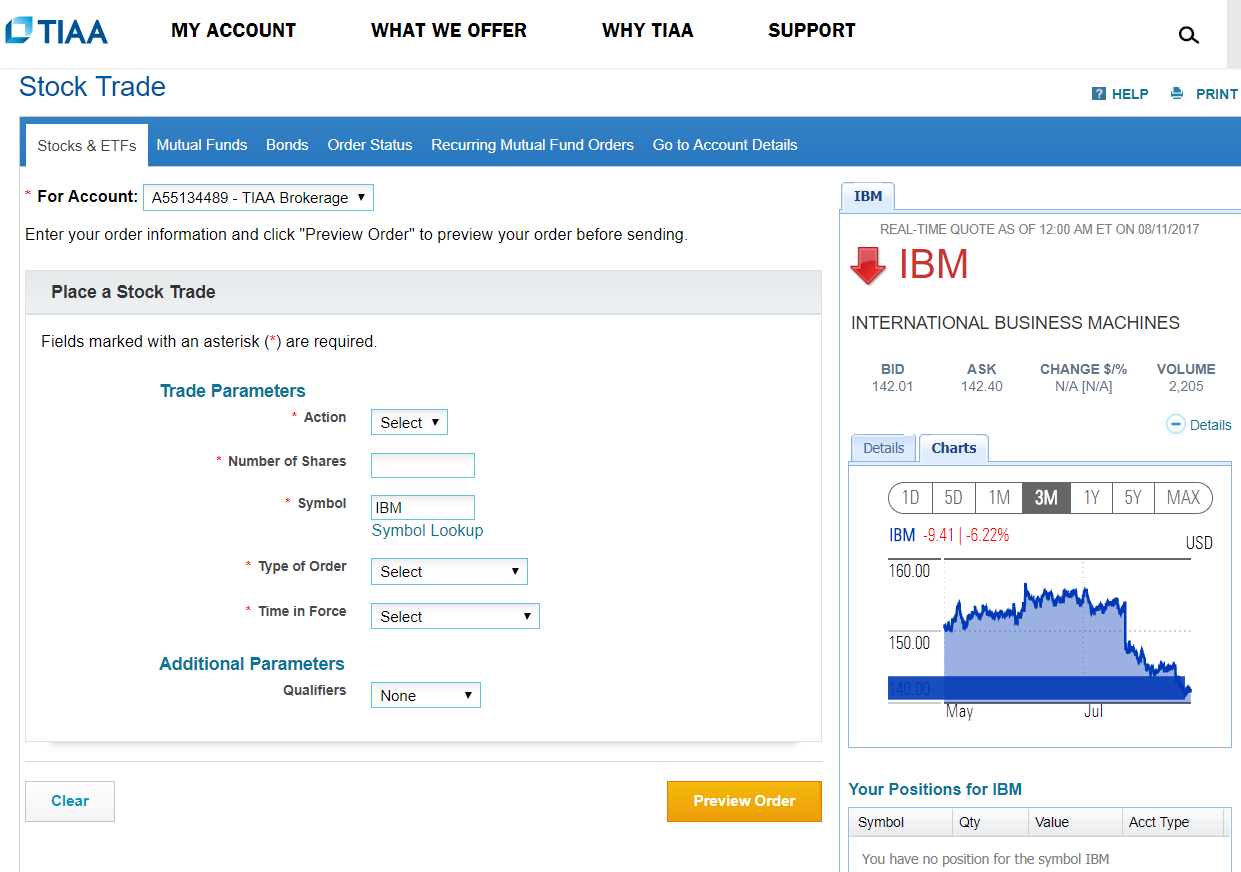

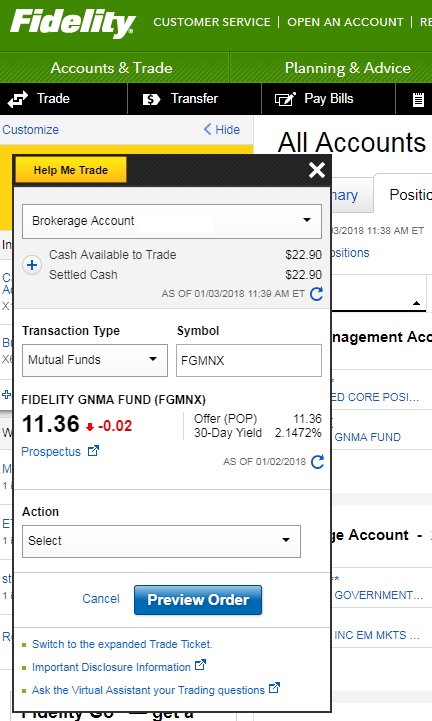

Although TIAA offers margin accounts, advanced trading really is not possible due to a rather simple website. There is no browser platform, so the website proper is the only option. A chart cannot be displayed the full width of the screen on TIAA’s website, although there are a few technical indicators and company events.

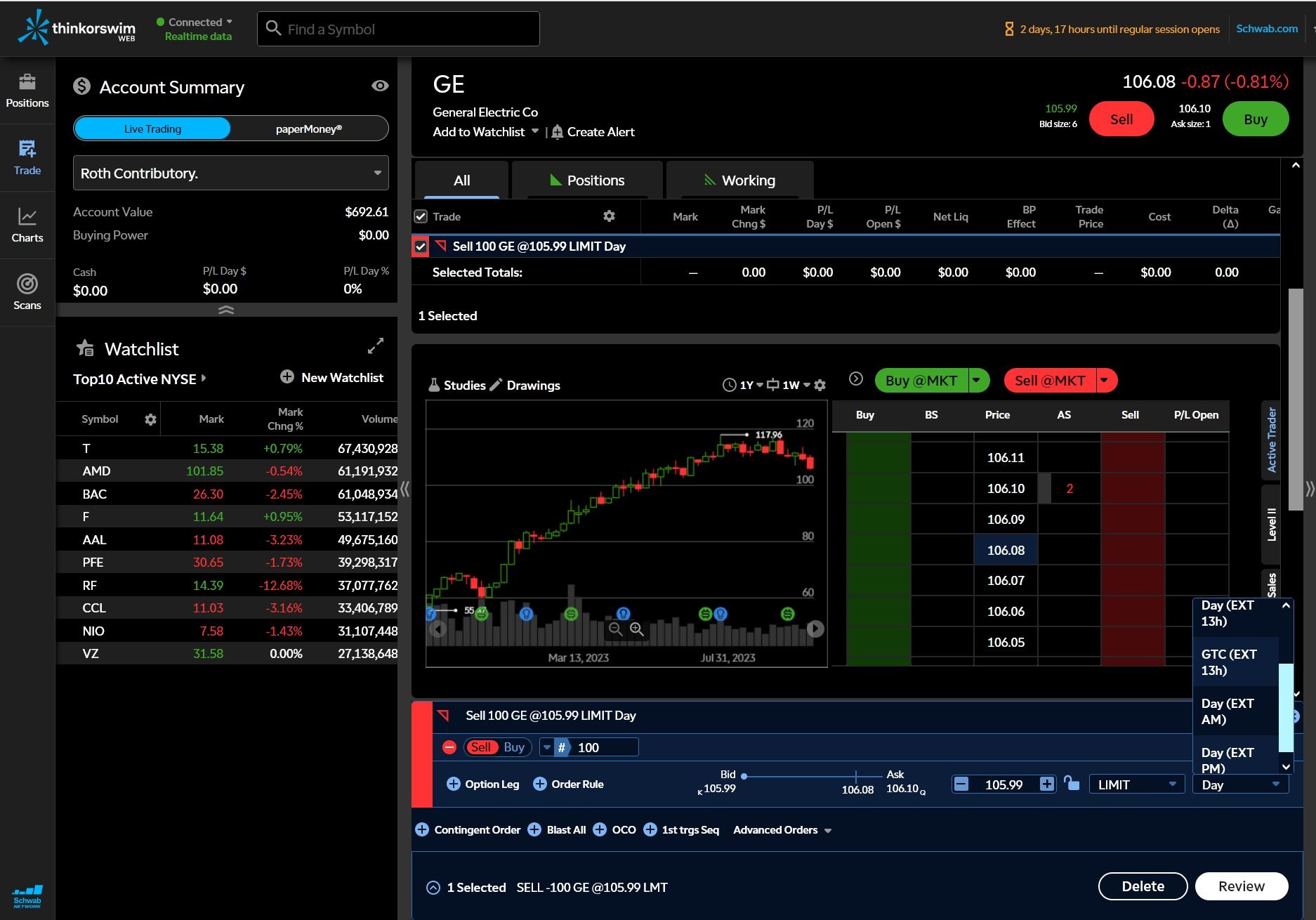

Over at Schwab, there is a browser platform. Called thinkorswim, it delivers a much more advanced experience, although the website itself is quite good. There are many advanced order types (TIAA’s ticket only has 4 basic trade types), and several pro-level features are available, such as Level II quotes.

Fidelity’s website doesn’t have a browser platform, but the website manages to deliver basket, conditional, trailing, and recurring orders. Charts and option chains are on a high level, and we really like Full View, a digital personal-finance platform that links to other financial accounts in cyberspace.

Winner:

Winner: Schwab

Mobile Apps

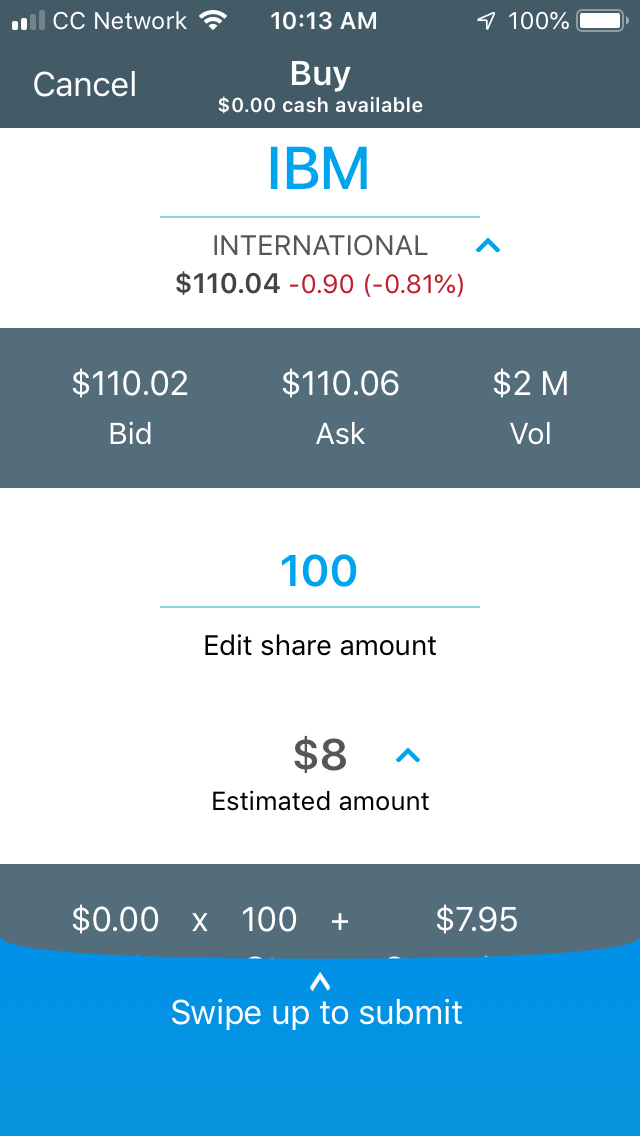

Like its website, the TIAA mobile app is very basic. And in fact, it’s even simpler as charts have no tools at all this time. The order ticket is the same, however, with limit, market, stop, and stop-limit orders.

Fidelity’s mobile app is much more advanced with a virtual chat bot, tons of market news, mobile check deposit, and horizontal charting with several important tools.

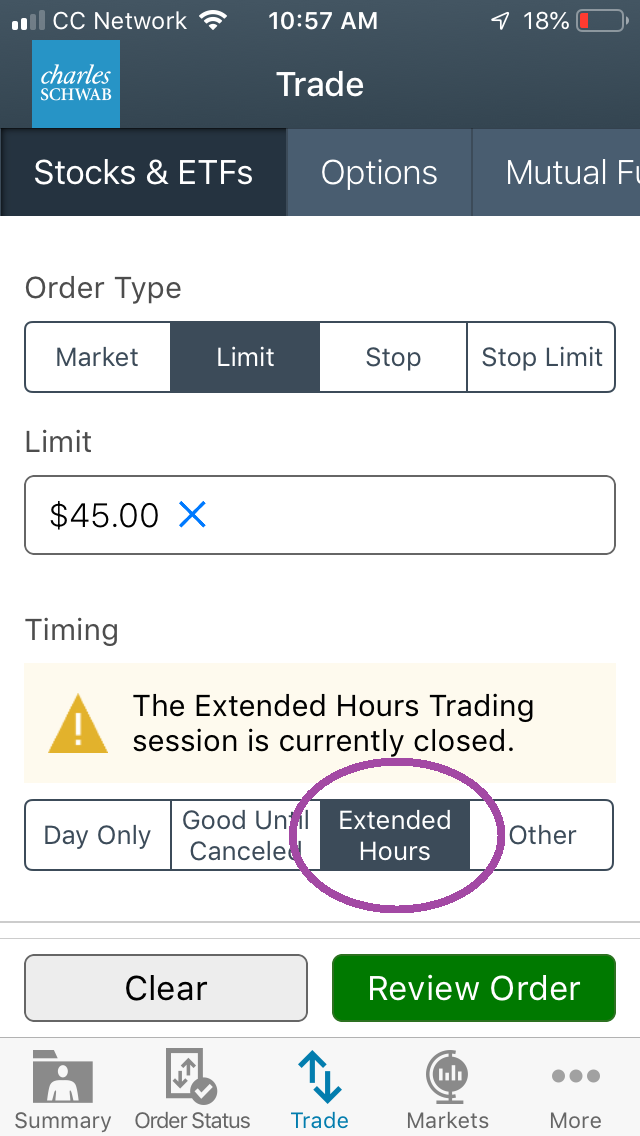

Schwab actually has two apps—a basic app and a thinkorswim app for heavy-duty trading. Combined, they deliver a high level of trading and account management. We really like thinkorswim’s order ticket, which has many professional-level trade types.

Winner:

Winner: Schwab

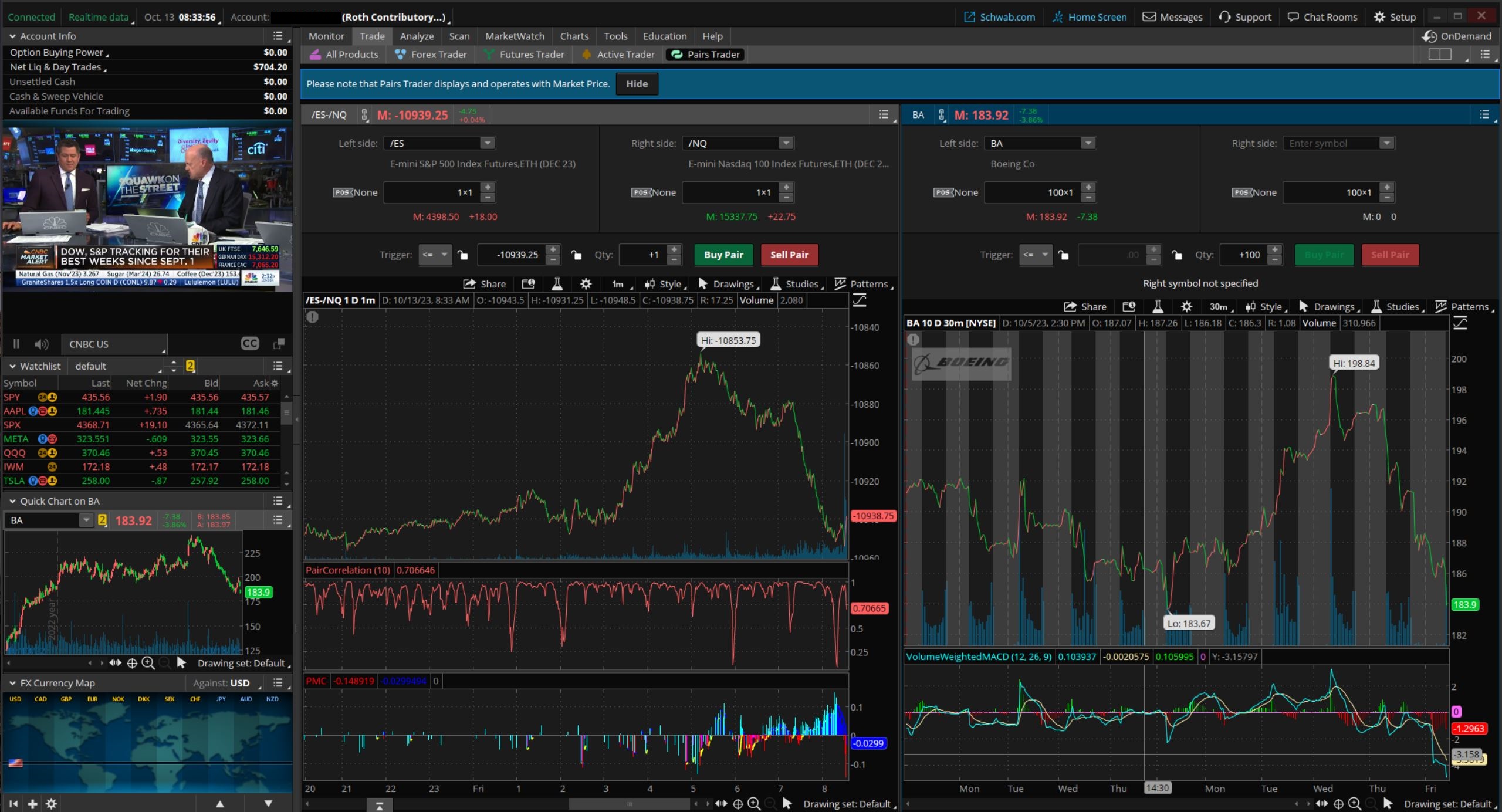

Desktop Programs

Traders at Fidelity and Schwab can use advanced desktop software to achieve the highest level of performance. Their platforms come with a lot of advanced tools, with thinkorswim from Schwab delivering the larger number of technical indicators.

TIAA has no desktop program at all.

Winner: Schwab

Extra Services

IRA Services: Business and personal IRAs can be opened at all three firms.

Fully-Paid Stock Lending: At Fidelity and Schwab, but not at TIAA, it’s possible to earn some extra cash by loaning out stock shares.

Fractional-share Trading: It’s possible to buy securities in whole-dollar amounts at all three firms. Schwab limits its service to the 500 stocks of the Standard & Poor's Index.

Extended Hours: Available only at Schwab and Fidelity.

Recurring Mutual Fund Purchases: Investors at all three firms can set up systematic purchases of mutual funds.

Dividend Reinvestment Plans: Once again, available at all three broker-dealers.

IPO Access: Fidelity and Schwab provide it.

Winner: Fidelity

Recommendations

Small Accounts: Fidelity gets the recommendation for small advisory accounts, as its robo service has no minimum-deposit requirement. For self-managed accounts, none of the brokerage firms have any minimum requirements.

Stock and ETF Trading: Schwab.

Retirement Planning & Long-Term Investing: For self-directed investors, Fidelity or Schwab would be better. For advisory service, any of the three (with a local branch office). All three firms sell annuities.

Mutual Funds: At TIAA, we found 11,366 mutual funds. Schwab has 5,948, while Fidelity boasts 9,344. Schwab has the best fund screener. Toss up.

Beginning Investors: For the total rookie out there, we suggest a managed account with any of the three.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Vanguard:

Open a Vanguard investment account.

Verdict

Although TIAA has a great focus on retirement planning, it is no match for Fidelity and Schwab in the realm of hard-core trading.

Open Charles Schwab Account

Open Schwab Account

Open Fidelity Account

Open Fidelity Account

Open Vanguard Account

Open Vanguard Account

Updated on 2/13/2024.