Outline of E*Trade and Public

E*Trade advertises a lot; but does that mean it’s better than Public? Keep reading. We have the

answer.

Public and E*Trade Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Public

|

$0

|

na

|

$0

|

$0

|

$0

|

|

Etrade

|

$0

|

$0

|

$0 + $0.65 per contract

|

$0

|

$0

|

Public and E*Trade Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Public

|

|

|

|

|

|

|

|

Etrade

|

|

|

|

|

|

|

Open Account

Public:

$20 of an asset of your choice with $1,000 deposit at Public.

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

Who Has the Larger Selection of Tradable Assets?

At E*Trade, investors can buy and sell fixed-income securities, mutual funds, stocks, options, ETFs, closed-end funds, and futures contracts (including bitcoin contracts). The brokerage firm also has an IPO section on its website; and offers trading in OTC stocks and penny stocks.

Public offers trading in stocks, ETF’s, cryptocurrencies, options, and closed-end funds on the major

exchanges. That’s it for right now.

E*Trade gets the first victory.

Who Has Better Stock Research Tools?

E*Trade has a stock screener that can look for investments based on many variables. Some examples include 13-day EMA, TipRanks Blogger Sentiment, and annual EPS growth. Equity profiles include a great many details, including option chains, insider trading activity, and price analysis. Reports in pdf format are also available for download at no cost.

At Public, the situation is very different. There is no screener, and just forget about stock reports. Profiles do have trade recommendations, though; and we also found EPS histories.

E*Trade gets our stamp of approval here.

Which Broker Has the Better Learning Hub?

Moving from stocks to general investing topics, we find a very extensive selection of resources at E*Trade. The broker-dealer provides articles on tax planning, options and futures trading, how to use margin, daily insights, and much more. The broker also has a YouTube channel with many videos.

Over at Public, we found another selection of articles. Here are a few examples:

What is a stock portfolio?

What are the advantages of ETFs?

How do bear markets recover?

Unfortunately, we didn’t find any videos.

Another defeat for Public.

Who Has Better Fund Resources?

Now it’s time to take a look at funds. E*Trade clients can use either the broker’s ETF or mutual fund screener to find investments. The company offers lists of All-Star Funds, which are collections of securities pre-screened by the firm’s investment advisors for their expected outperformance.

To drill down on a specific fund, E*Trade offers profiles with loads of data, including Morningstar ratings and portfolio composition.

Public has no fund screener, no pre-screened funds, and no analyst ratings.

E*Trade is the obvious winner here.

Which Firm Has Better Software?

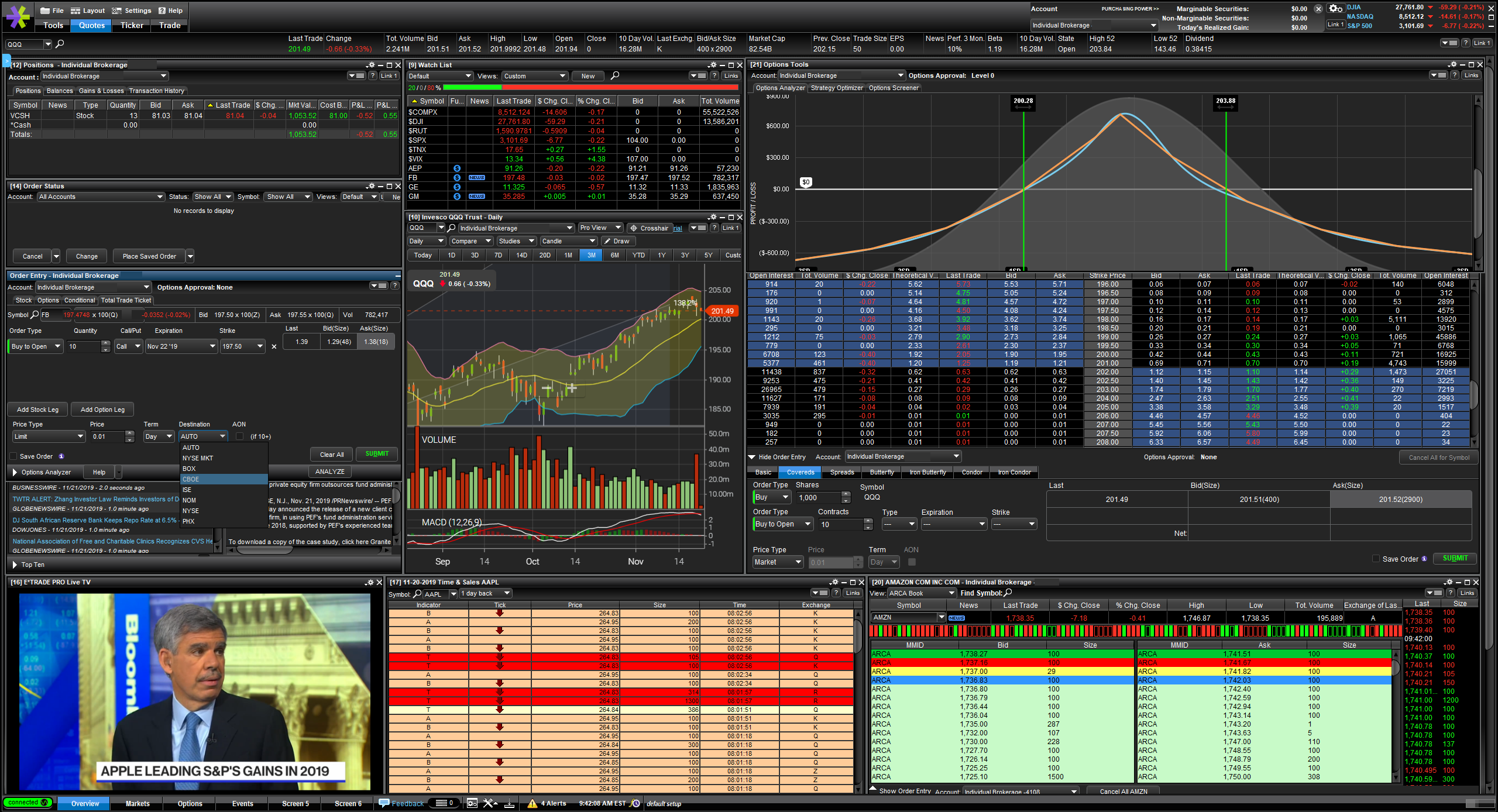

Do you actually want to buy something? Okay, E*Trade has trading tools for that. First is the broker’s website, which itself has decent charting and a good order form. Next is the E*Trade’s browser platform, which offers a much more sophisticated order ticket with many advanced order types. Finally, there is E*Trade Pro, the company’s desktop platform.

Public offers nothing in this category, not even a website login.

E*Trade by a mile in this category.

And What About Mobile Apps?

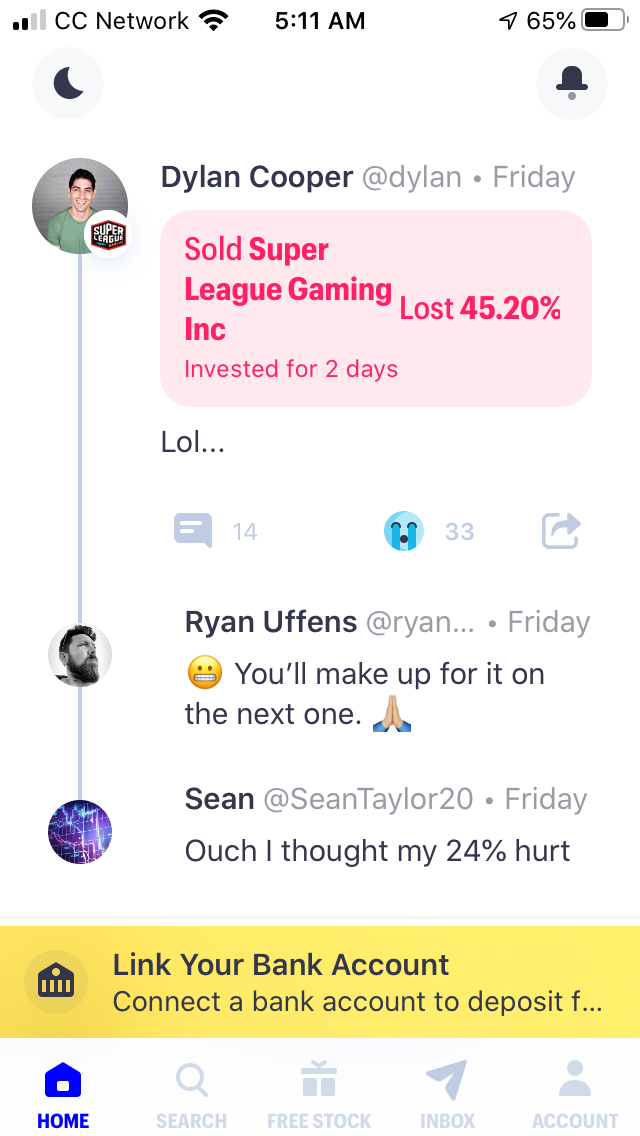

So how do Public clients submit orders? Through the broker’s mobile app. It offers three order types (market, limit, and stop). Charting has just one graph format (line). More advanced features, like mobile check deposit and streaming video news, are missing in action.

E*Trade actually provides two mobile apps. One is the default app, and the other is a trading app. Together, they offer many great tools. These include:

- Streaming business news

- Mobile check deposit

- Level II quotes

- Options, futures, and mutual fund trading

- Advanced charting

- Multiple order types, including trailing orders

Another victory for E*Trade.

Other Services

Fractional-share trading: This is one area where Public outperforms its rival. It’s possible to buy and sell stocks and ETF’s with whole-dollar amounts at Public, a great service that is not available at E*Trade.

Individual Retirement Accounts: Public doesn’t (yet) offer IRA’s, but E*Trade has several of them.

DRIP service: For the conversion of cash into equity shares, both firms offer dividend reinvestment plans.

We get our first draw.

Open Account

Public:

$20 of an asset of your choice with $1,000 deposit at Public.

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

Recommendations

ETF and Stock Trading: With E*Trade’s fantastic software and research materials, it’s an easy choice.

Beginners: E*Trade has better learning materials and customer service; so we have to suggest it over Public.

Long-Term Investors and Retirement Savers: In addition to IRA’s, E*Trade also offers individual 401(k)’s, target-date mutual funds, and portfolio management.

Small Accounts: Either broker will suffice.

Public vs E*Trade Summary

E*Trade outdid its competitor in almost every area. Nevertheless, Public’s fractional-share service

does seem enticing.

Open E*Trade Brokers Account

Open Etrade Account

Open Public Account

Open Public Account

|