Coverdell Education Savings Accounts at E*Trade

If you’re looking for a tax-smart way to save money for a child’s or grandchild’s education, E*Trade has a Coverdell ESA that may be right up your alley. Here’s the full scoop:

E*Trade Coverdell ESA Overview

With a Coverdell Education Savings Account at E*Trade, it’s possible to save for education expenses that occur at any time from kindergarten through graduate school. Anyone (not just a family member) with earned income below certain thresholds can contribute to a Coverdell ESA.

Opening a Coverdell at E*Trade

A Coverdell ESA can be opened on either E*Trade’s website or mobile app. On the former platform, you’ll need to scroll down to the bottom and click on the link to open an account that appears under the ‘Quick Links’ section. On the first page, click on the tab for brokerage accounts. Under this tab, there is a link to the Coverdell application. (If you click on the purple button at the top of the page to open an account, the application for the Coverdell account won’t show up.)

On the mobile app, look for the button to sign up on the front page of the app. Tap on this, and you’ll get the same form the website has.

On the very first page of the application, you’ll first need to agree to a ton of fine print. Click or tap on the continue button to pull up the first page of the actual application, which is from DocuSign. You’ll need to enter an email address, to which DocuSign will send a validation code. Enter this code to begin the application.

If the DocuSign system isn’t to your liking, there is a second method to open a Coverdell ESA at E*Trade. Simply download this pdf form, fill it out, and send it to E*Trade. It will need to be dated and signed, which means it will need to be printed off.

Investments in an E*Trade Coverdell ESA

Once the Coverdell account is open, it will have a variety of financial products to invest in. E*Trade’s lineup includes stocks, mutual funds, ETFs, closed-end funds, options, and fixed-income vehicles. These asset classes can be traded in self-directed mode. It is not possible at E*Trade to open a Coverdell ESA as a robo account.

Cost for E*Trade’s ESA

E*Trade’s Coverdell account is subject to the same pricing schedule as other self-managed accounts. This means trades of stocks and funds will receive $0 commissions in most cases. OTC securities are $6.95 per trade.

Perhaps best of all, the Coverdell ESA at E*Trade requires no minimum balance. An account can be opened with no deposit if desired. Once opened, there are no recurring account fees, such as annual or maintenance fees.

Transferring an Existing Coverdell ESA to E*Trade

If you already have a Coverdell account with another investment firm, it’s possible to transfer the account to E*Trade. The first step is to open a Coverdell at E*Trade. Once this is open, simply log into the account and perform an ACAT transfer (the starting point on the website is the Transfer link that appears at the top of the site). Be sure to specify Coverdell as the account type at the outgoing firm.

Tax Benefits of a Coverdell ESA

The primary advantage of opening a Coverdell account is that the account grows on a tax-deferred basis. Earnings in the account aren’t taxed every year, as they are in a regular taxable brokerage account. When money is finally withdrawn from the account, the amount of the withdrawal is also tax-free as long as the funds are used to cover educational expenses.

Per IRS guidelines, the income limits for contributors to a Coverdell account are $220,000 for married filing jointly in 2024. The annual contribution limit is $2,000.

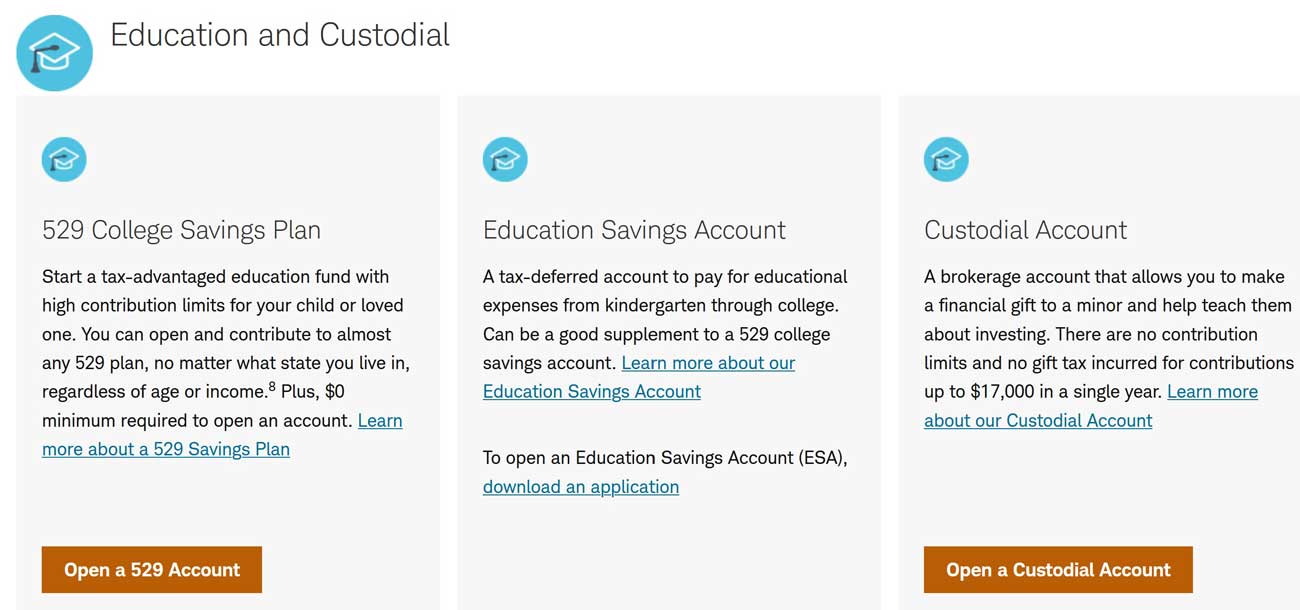

Schwab Custodial Account as an Alternative

The primary drawbacks of the Coverdell ESA are the income and contribution limits noted above. The

custodial account doesn’t have either limit, so it’s definitely an alternative worth considering for some families.

Charles Schwab offers a long list of account types. Among these is the custodial account. Because Schwab charges no account fees and has no account minimums on the custodial account, opening one literally requires $0.

A custodial account at Schwab

can be opened in robo or self-directed mode. Schwab also has a full-service investment-advisory program where a human investment advisor can provide advice and management for a custodial account. Plus, Schwab has lots of learning materials on its software platforms.

It’s really easy to open a custodial account at Schwab. On the company’s website, look for the orange-brown button to open an account. On the mobile app, tap on the account icon in the upper-left corner and select the link to open an account.

Unlike both 529 plans and Coverdell accounts, a UTMA/UGMA account has no cap on annual contributions. But there’s no tax deferral for a UTMA/UGMA account, either.

Free Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Updated on 4/24/2024.

|