Can You Buy Crypto on Merrill Edge?

Although Merrill Edge doesn’t offer direct cryptocurrency trading, there are nevertheless multiple

ways to gain exposure to Bitcoin and other digital currencies with a Merrill Edge account. When you

finish reading this article, you’ll know how and will get an idea how to buy crypto directly.

Blockchain Stocks

Many technology companies are investing quite heavily in the blockchain right now. The blockchain is the electronic ledger that keeps track of all the transactions involving Bitcoin and other digital currencies. Tech firms are interested in this digital record book because they see a bright future in it. It has the ability to reduce cyber crime since it is a public record.

One company that has developed its own blockchain is Baidu. In 2018, the Chinese company rolled out a blockchain-as-a-service (BaaS) platform for businesses. In 2020, it created Xuperchain, which is a beta version designed for the general public. Before these software launches, the company was already accepting Bitcoin as payment for some transactions on its site.

Baidu trades in the United States on the Nasdaq under ticker symbol BIDU. It currently has an overall buy rating from among 30+ analysts. Although it doesn’t pay a dividend, it does have very high average volume (over 11 million shares a day); this means it will have a tight bid-ask spread, which reduces the cost of trading it.

And because Merrill Edge is a zero commission broker (one of the first), trading BIDU will carry no transaction fees.

Blockchain ETFs

If the volatility mentioned above for Baidu concerns you, there are blockchain funds that will smooth out the ups and downs of individual assets. Funds have less volatility because they are composed of multiple assets.

Several new funds have been launched that invest in blockchain stocks. One we found on Merrill Edge’s website is BLCN. This is the Siren Nasdaq NexGen Economy Fund. It holds stocks of companies that are researching, developing, utilizing, or innovating blockchain technology for themselves or for customers. The ETF is passively managed as it tracks an index created for the fund.

Here are some examples of stocks that are in BLCN:

- Microsoft

- Square

- International Business Machines

- Baidu

- Tencent

- Digital Garage

- Galaxy Digital Holdings

Notice that Baidu is one of the holdings. Obviously, the blockchain fund has a greater amount of diversification than the blockchain stock.

Another advantage of BLCN is that it pays a dividend. Sent to shareholders every quarter, it currently is at 10.2¢ per share.

Other blockchain funds at Merrill Edge are KOIN, BLOK, and LEGR.

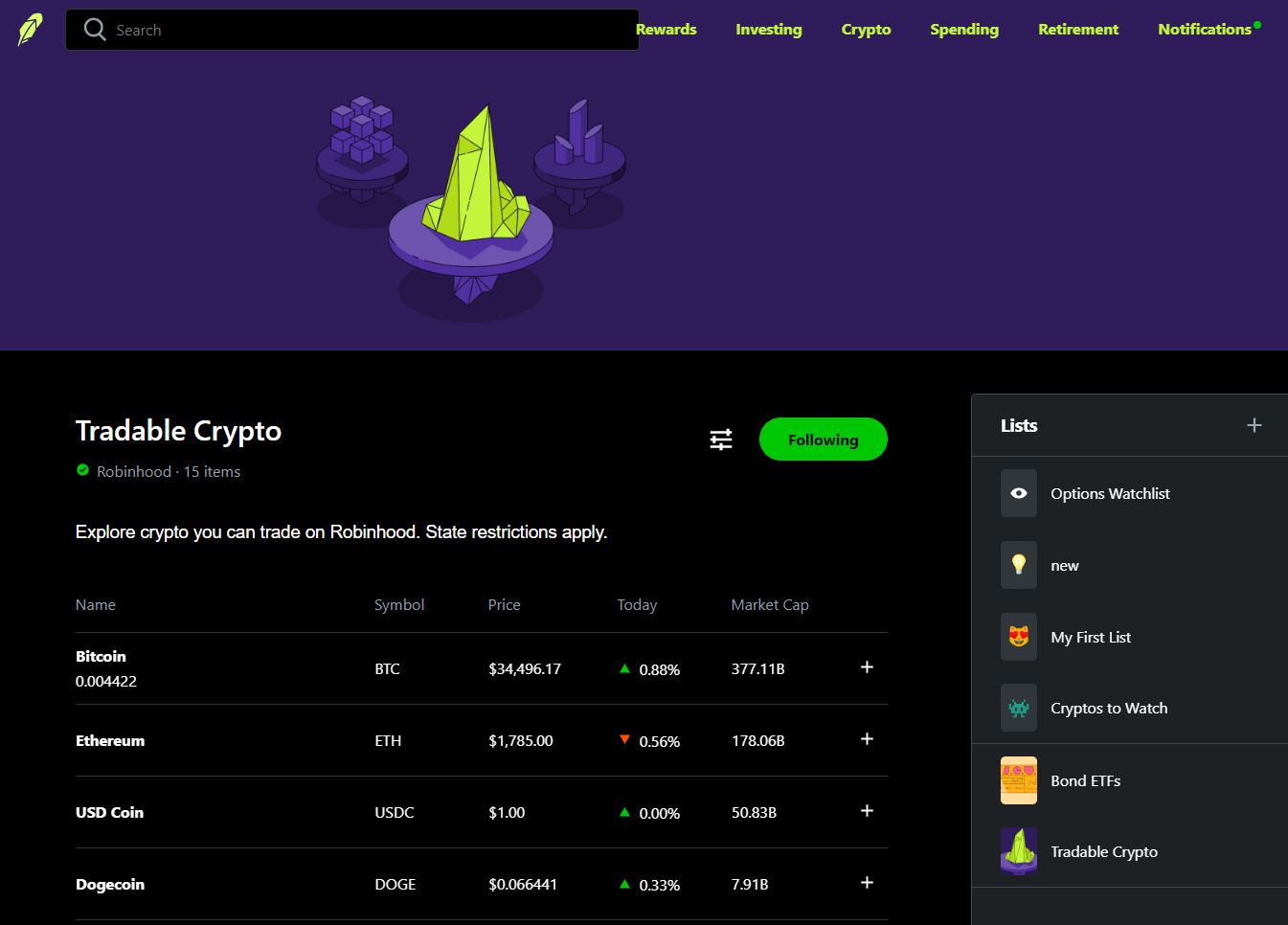

Trading Cryptocurrencies Directly at Robinhood

If the over-the-counter market causes you to balk, you could instead trade cryptocurrencies

directly. Although you can’t buy crypto at Merrill Edge,

you can with a Robinhood account.

The broker-dealer offers direct trading in these coins:

- Aave (AAVE)

- Avalanche (AVAX)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Compound (COMP)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Shiba Inu (SHIB)

- Steller Lumens (XLM)

- Tezos (XTZ)

- Uniswap (UNI)

- USDC (USDC)

Robinhood charges no commissions on crypto trades, and the minimum trade amount is just $1.

Robinhood Promotion

Open Robinhood Account

Trading at Merrill Edge vs. Trading at Robinhood

Trading cryptocurrencies at Robinhood carries both advantages and disadvantages compared to indirect crypto trading at Merrill Edge.

Trading hours: Cryptocurrencies trade seven days a week, nearly 24 hours a day. Regular breaks are taken for software maintenance, but otherwise it’s nearly around the clock.

Settlement: Crypto trades at Robinhood have instant settlement. By contrast, stocks and funds at Merrill Edge settle in two business days after the trade date.

Grayscale Funds

If blockchain investing isn’t enough for you, there is always direct cryptocurrency trading. Grayscale is an investment company with several funds that hold digital currencies. These products do trade over the counter, so there is increased risk with them.

Here’s a list of some of the more popular Grayscale funds:

- Grayscale® Bitcoin Trust

- Grayscale® Bitcoin Cash Trust

- Grayscale® Ethereum Trust

- Grayscale® Ethereum Classic Trust

- Grayscale® Litecoin Trust

- Grayscale® XRP Trust

Because these funds hold only cryptocurrency, their prices closely track the relevant coins.

During our research, we found all of the above Grayscale funds at Merrill Edge.

|