Victory Capital Review for 2024

|

Review of Victory Capital Management Mutual Funds

Victory Capital Management (VCM) is a financial services company that has $147.2 billion in assets under

management. Their primary strategy for gaining new customers is to purchase the funds of other

companies or the entire brokerage company. The companies they acquire maintain their independence

and operate as “franchises” underneath the Victory Capital Management umbrella. People can also

use Victory Capital Management without being a customer of a company they acquired. In this post,

I will describe my experience with the company and the pros and cons of their service.

Victory Capital Management Investment Products

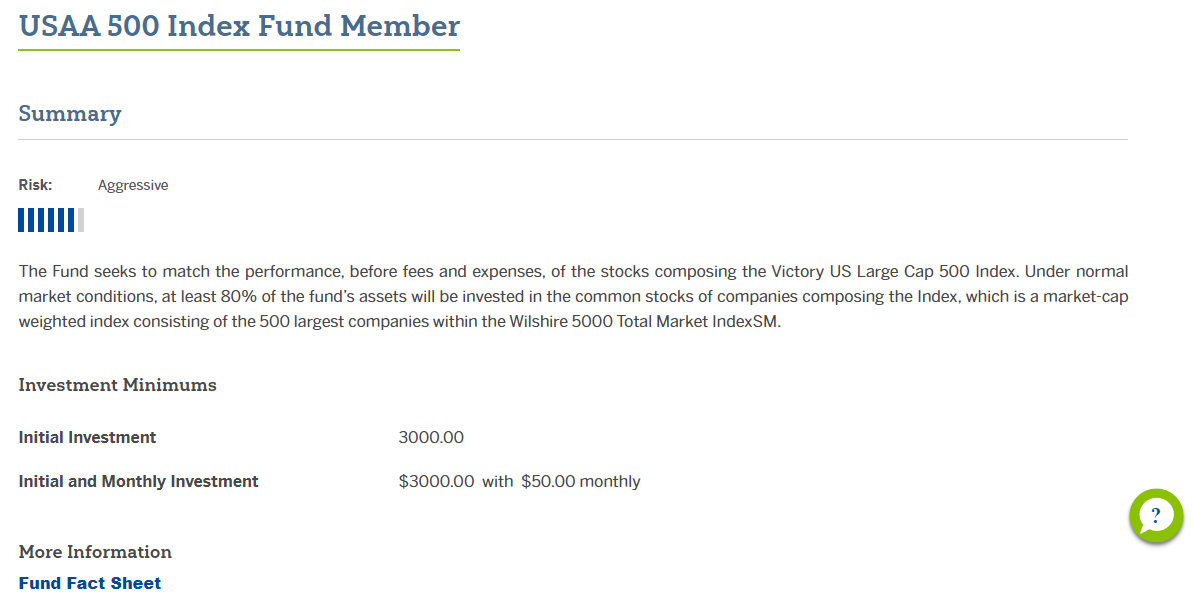

There are a limited number of mutual funds, ETFs, and other investment products available with

Victory Capital Management. The company offers 56 mutual funds for investors. 45 of these funds are a result of the USAA acquisition.

Many current users at Victory Capital Management were introduced after their mutual funds were acquired by the company. In the past, Victory Capital Management also has purchased other companies like Munder Capital and RS Investments. The ratings for these funds are on-par with other funds. The mutual funds maintain the same characteristics and investment goals as before their acquisition. Some funds are more conservative and some more aggressive.

In addition to being a holding space for formerly acquired funds, Victory Capital Management also

offers ETFs. The brand for these products is called VictoryShares. They tout the ETFs as low cost,

diversified, and tax-efficient. There are currently 23 of these ETFs available for investing. I do

not have personal experience using VictoryFunds, but they appear to feature a balance of aggressive

and conservative options. The expense ratio is 0.38%, which is below average for ETFs. Customers can

buy and sell ETSs with no transaction fee.

The company also offers 529 College Savings Funds and Retirement Funds. It appears that the

retirement options they have are variations of the USAA Target Retirement Funds. It is not clear if

the funds could be set up inside an IRA or are simply mutual funds positioned as being appropriate

for retirement planning. Like with the retirement options, the college savings options reference

formerly-USAA owned products that retain their USAA brand name. Overall, the product offering is

limited but sufficient for the casual investor.

Customer Service

Since becoming a customer of Victory Capital Management, I have experienced their customer service. Reaching someone at the company that you have money invested in is important. On three occasions, I have attempted to reach someone by phone at Victory Capital Management. The first time was before the USAA acquisition. I succeeded in getting a nice lady on the phone. The person on the line was knowledgeable and answered my questions.

On the two recent attempts to reach a support person, I was left on hold for over 30 minutes and forced to try different options. These situations occurred after the USAA acquisition. After failing to get through on the phone, I tried the website chat. On one occasion, I reached the website chat without issue and my problem was solved. The last time I tried to reach support, the website chat was not even loading due to being overwhelmed I assume. The message directed me to a support form, which also did not work. After refreshing the chat pages many times, I got connected to chat. Eventually the chat operator did help resolve my issue.

In the sample of my outreach, I must conclude that the support was sub-par. In the end, I got the answers I needed. But being left on hold and receiving website errors at a time when money is literally on-the-line is frustrating. It appears that they do not have the customer support resources to address the volume of inquiries coming in. People looking for quality support from a skilled expert should not use Victory Capital Management.

Users Experience

The experience of using a website or application from a financial company is important. There is a huge con for Victory Capital Management. They do not have a mobile application. In today’s mobile-first world, that is a big downside. Investment companies like Schwab, Ameritrade, and nearly every other all have expansive mobile applications. Being forced to use a browser to get the data needed is time-consuming and not effective.

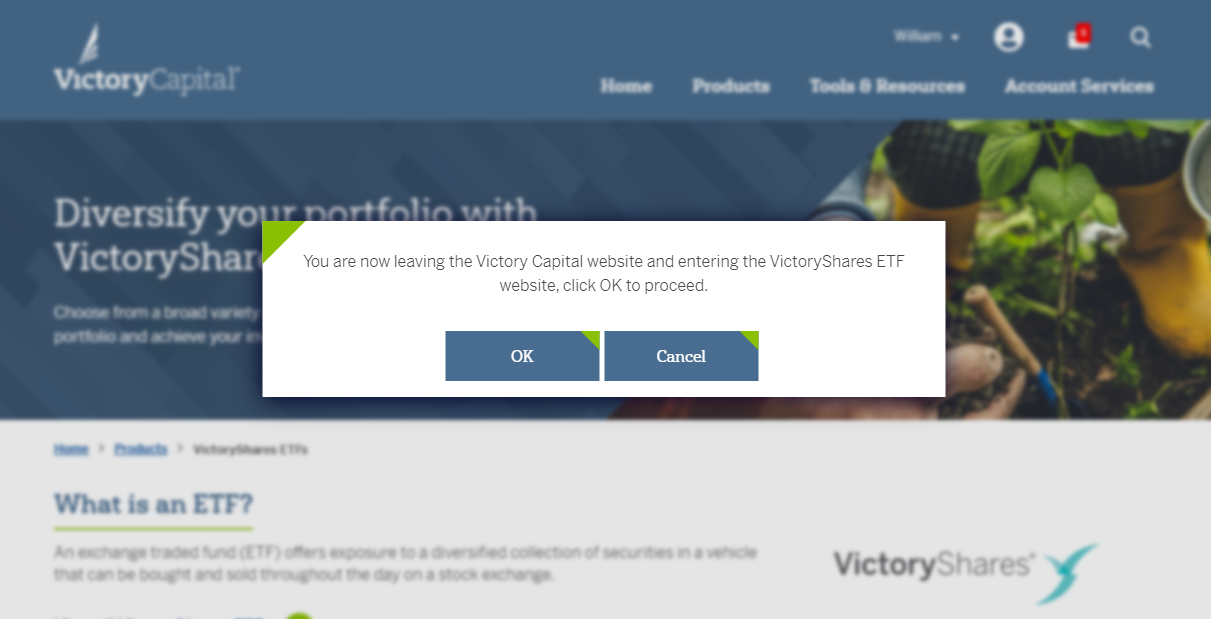

The desktop experience of Victory Capital Management is also lacking. The interface of their website is disjointed at times. Clicking into the ETF or retirement category prompts a pop-up notifying the person they are going to a new site. After getting to the new website, the interface and navigation is slightly different. This lack of unity for the site makes it feel cobbled together.

Security is important when it comes to banking. Victory Capital Management requires two-factor authentication when logging in every time. This is a good decision for safety reasons, but I would prefer to have an option to “remember computer” to make logins less time-consuming.

Getting metrics and data on investments is important to assess your positions and make wise choices. The interface for viewing data is basic. There are no interactive charts within the interface. The data displayed is very static. Advanced research with Victory Capital Management is not possible. In addition, customers are limited to only the offerings that Victory Capital Management provides. Statements on account activity are generated on a quarterly basis. Having monthly statements and a better view for analytics would be an improvement.

Best Brokers For Victory Capital Funds

Victory Capital Review Conclusion

Many people find themselves using Victory Capital Management as a result of their former brokerage acquisition. There are better brokerage firms available if a person is looking to buy a new mutual fund or ETF. The company does the basics for investment management. Their lack of mobile apps or advanced metrics leaves the user wanting more. On the website and in the member area, Victory Capital Management clearly knows what products and buzzwords are important for investors. There is little depth to their offering, however. Overall, I do not recommend using Victory Capital Management for active investors.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|