Transfer Sofi to Fidelity or Vice Versa (2024)

Want to Transfer a Brokerage Account Between Fidelity and SoFi Invest? Here's How

SoFi is a broker with several valuable features, such as high-yield cash management and automated investment options. However, it does not offer as many investment products and services as traditional brokers like Fidelity. If you prefer a broker with a wider range of account types and investment options, you may consider transferring your SoFi account to Fidelity.

Here are the steps to transfer a SoFi brokerage account to Fidelity and vice versa.

Account Transfer Methods

When moving a brokerage account, there are two main approaches: manual transfer and automated transfer. The steps for each method are similar, but there are a few important differences.

Manual transfers involve selling your assets, settling transactions, transferring funds to your bank, and closing your account if you no longer plan to use it.

Automatic transfers are more straightforward, but you must ensure your account is in good standing. If you have debts, open orders, or unsettled transactions or transfers, automated transfers can be reversed, leading to an unsuccessful transfer and a fee.

Once everything is confirmed, the receiving broker (in this case, Fidelity) should initiate the ACAT transfer, called TOA transfers by Fidelity.

Both methods have advantages and considerations, so carefully review the details and choose the transfer method that suits your needs.

Transfer a SoFi Account to Fidelity

Whether you choose the manual or automated approach to move your SoFi account to Fidelity, knowing the details of each method is helpful.

Manual Transfers

As mentioned, the first step for manually transferring your account to Fidelity is liquidating all your investments. Once you have closed all your positions, you must wait approximately three days for the funds to settle. When your entire cash balance is listed under 'Withdrawable Cash,’ you can transfer your funds.

The next step is to transfer your funds using one of SoFi's available transfer methods. The broker offers ACH and wire transfers to move money to outside banks. If you have a SoFi bank account, transferring funds is also possible.

However, if you choose to do this, please note that transfers from the Automated Invest account may take up to six days to clear. On the other hand, transfers from the Invest account typically clear within three days.

Automated Transfers

As a reminder, automated transfers from SoFi to Fidelity are initiated by Fidelity. The Fidelity account should be the same type as the SoFi account, as you cannot transfer a brokerage account to a retirement account or vice versa.

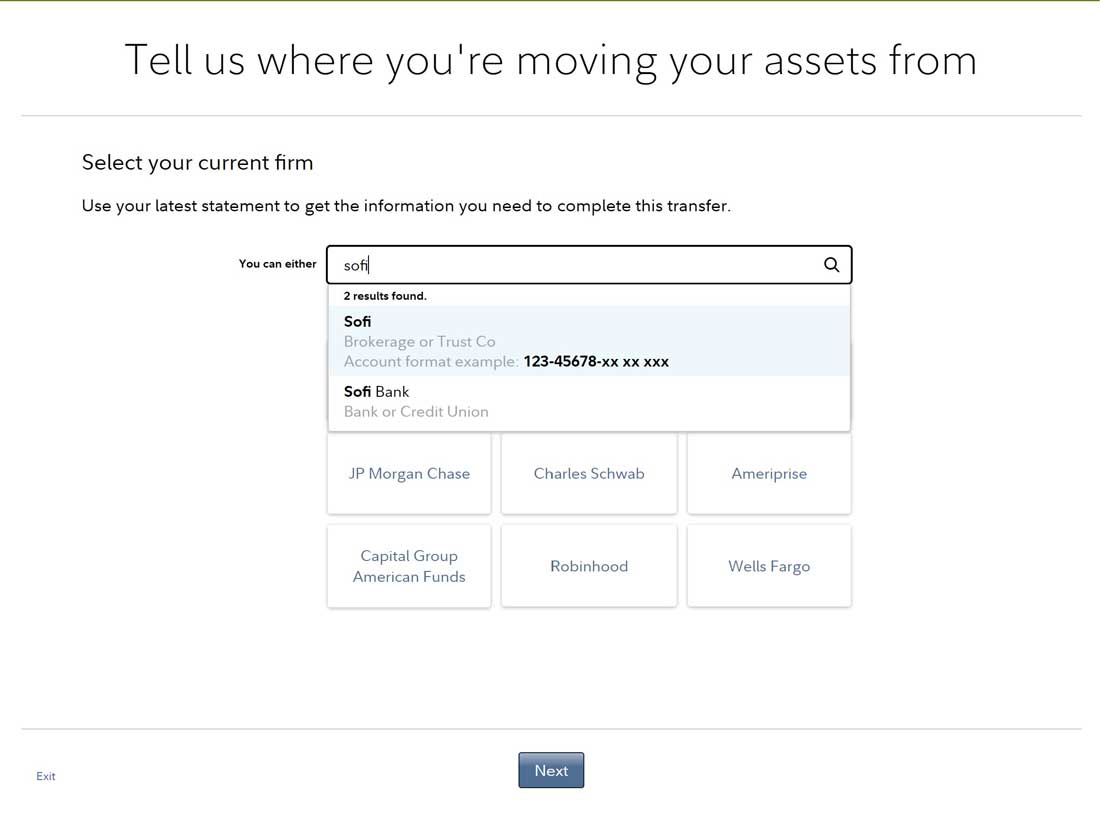

From your Fidelity dashboard, navigate to the 'Transfer' tab and select the 'Transfer an Account to Fidelity' option from the dropdown list.

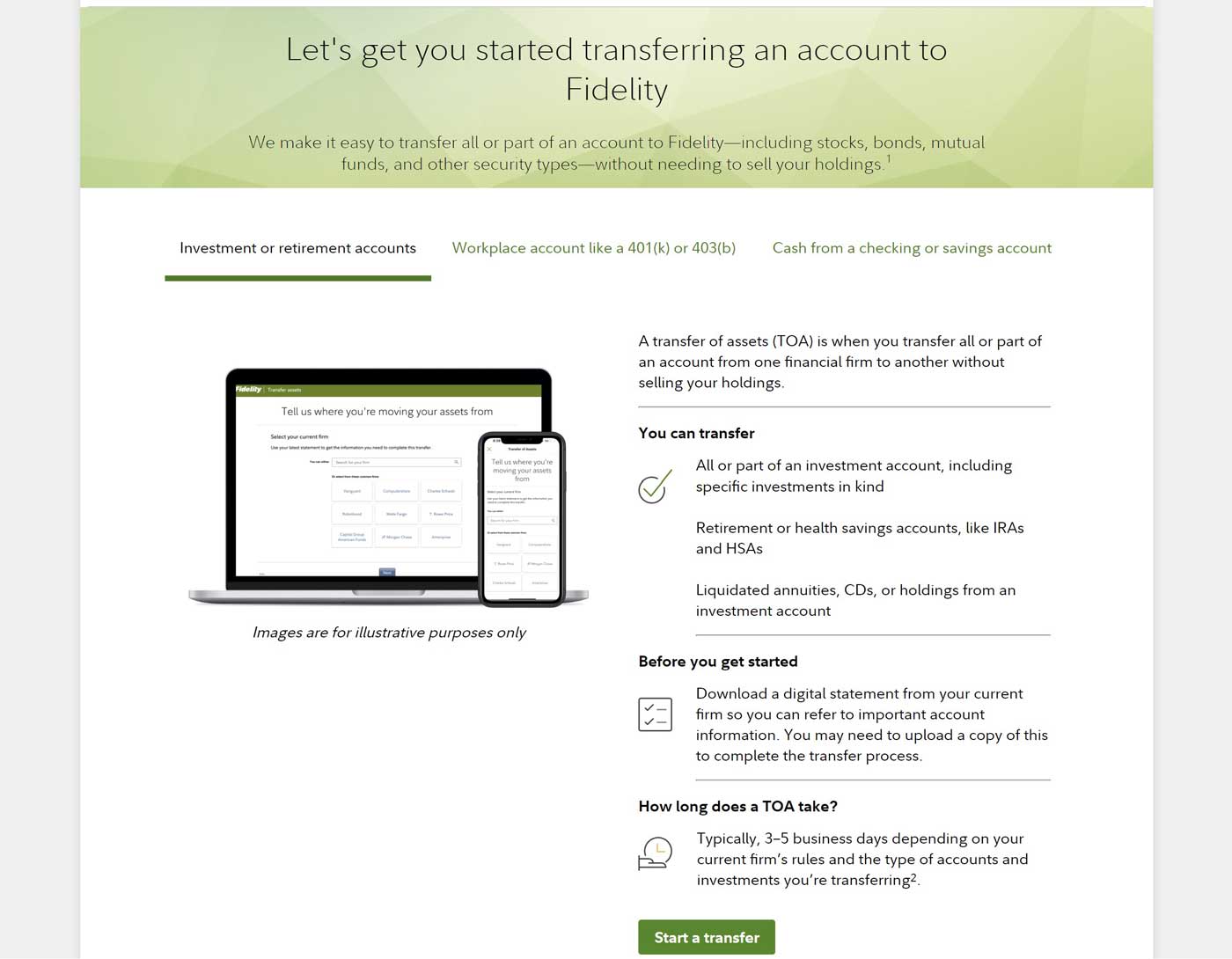

On the next page, Fidelity will guide you through the account transfer process, starting with some general information and tips to make the transfer process go as smoothly as possible.

To initiate a transfer, select 'Start a Transfer' and provide Fidelity with the following information: the name of the broker you are transferring assets from, the value of your portfolio, the types of assets included, the receiving account type, and more.

Typically, Fidelity's transfer of assets (TOA) process takes less than a week.

Why Transfer to Fidelity?

There are several compelling reasons to transfer a SoFi account to Fidelity. As a full-service broker, Fidelity offers a comprehensive range of financial products and services.

Here are some key benefits:

- Fidelity has over 75 years of history and is one of the largest financial institutions globally.

- The broker offers diverse investment options, including mutual funds, stocks, bonds, options, cryptocurrencies, OTC-listed securities, and ETFs.

- Fidelity provides professional portfolio management services for hands-off investors.

- Fidelity offers retirement accounts and planning services.

- Additionally, Fidelity provides customer support and educational resources.

Transfer a Fidelity Account to SoFi

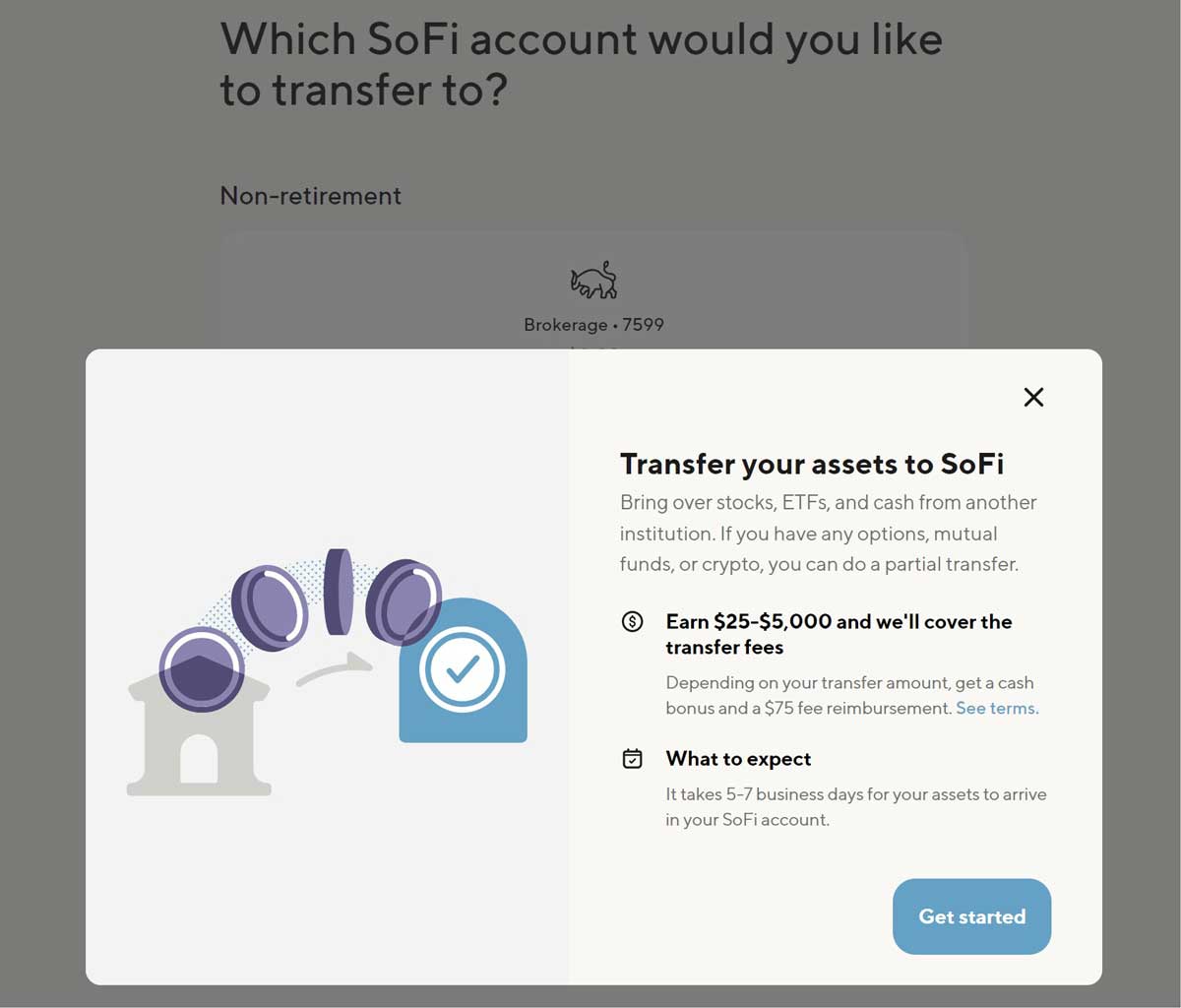

To transfer a Fidelity account to SoFi for a modern approach to personal finance management, you can choose between manual or automated transfer. Both options have the same settlement requirements, transfer times, and costs.

However, it's important to note that Fidelity supports more account types and securities than SoFi. This may not be a problem for manual transfers, but it can affect automated transfer requests.

Investors should be cautious not to transfer unsupported assets since the receiving broker can only accept accounts and securities it supports.

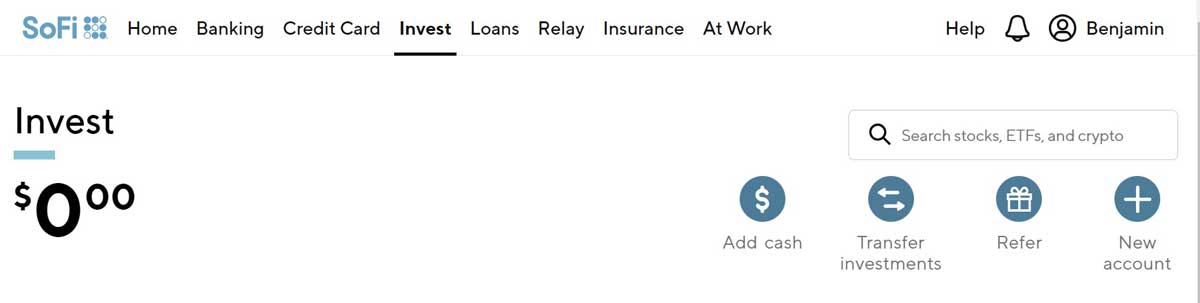

To start an ACATS transfer from your SoFi account, navigate to 'Transfer Investments' on the main SoFi Invest page. From there, all you need to do is follow the steps and enter your Fidelity account information when requested. The transfer should only take about seven business days to complete.

Best Alternatives

|