How to Move an Account from Fidelity to M1 Finance and Vice Versa

Transferring investment accounts between Fidelity and M1 Finance is quite easy, thanks to the ACATS network. This fully-electronic system is super easy to use. Just follow our step-by-step guide.

Transfer from Fidelity to M1 Finance

First step: Because accounts aren’t actually moved through the ACATS system, the first task

is to open a brokerage account with M1 Finance. Securities from the Fidelity account will be moved into the M1 account. If you decide to perform a full transfer, the account at Fidelity will be closed. In the case of a partial transfer, the Fidelity account will remain open.

The M1 Finance account will need to have the same name on it that appears on the Fidelity account. The account types must be the same type as well (a custodial account can’t be transferred into an IRA, for example).

Second step: Once the M1 Finance account is open, the Fidelity account may need some prep work before requesting the ACATS transfer. The Fidelity account could be an advisory or self-managed account. Because Fidelity’s robo program uses mutual funds, everything will have to be liquidated (M1 Finance doesn’t offer trading in mutual funds). Keep in mind that selling assets inside a taxable account could have tax consequences. Be sure to consult with a CPA before taking this step.

Other assets available at Fidelity either can’t be moved through the ACATS network, or M1 Finance doesn’t offer trading in them. These products include bonds, foreign stocks, cryptocurrencies, annuities, short positions, and options. Some OTC stocks at Fidelity may not be transferable into M1 Finance, so be sure to check with the latter broker before trying to move specific positions in.

Investment vehicles that can’t be moved will need to be liquidated, transferred to a second Fidelity account, or simply not requested in a partial transfer.

Also keep in mind that fractional shares of stocks and ETFs can’t be moved under any circumstances. If you don’t liquidate these yourself, Fidelity will do so when it receives the transfer request from M1.

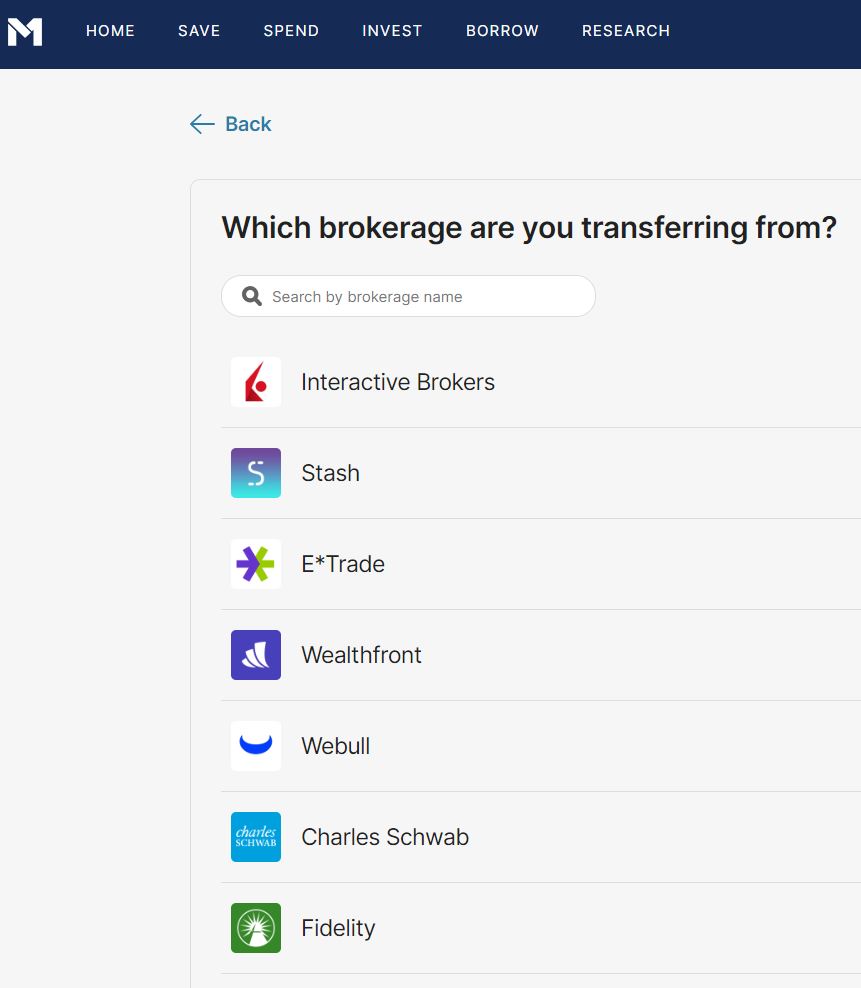

Third step: Speaking of the ACATS transfer, it’s time to request it. This can be accomplished on either the M1 website or mobile app. On the former platform, click on the Invest tab in the top menu. On the next page, find the link at the top of the page to transfer an account to M1. This is the gateway to the ACATS form. The digital form has a selection to move an entire account or just certain assets in the account. The full-transfer form will generate a list of potential outgoing securities firms. Fidelity’s logo is here, so select the Fidelity logo.

The partial-transfer form has a somewhat different layout. You’ll need to select Fidelity’s name from a drop-down list. Further down the page, it’s actually possible to specify full or partial transfer. On either form, you’ll need to specify the account type and number at Fidelity.

When you’re finished, submit the transfer. When the investments from Fidelity arrive at M1, they will appear under the Holdings section. They will not automatically go into a Pie. You’ll need to manually place them into Pies.

M1 Promotion

$250 cash bonus for making a $10K deposit at M1 Finance.

Open M1 Finance Account

Transfer from M1 Finance to Fidelity

Moving in the other direction will follow the same basic outline.

First step: An account at Fidelity will need to be opened. An existing one will work if it meets the two criteria already specified regarding name and account type. The Fidelity account could be an advisory or self-directed account.

Second step: Both accounts will need some prep work. Crypto positions can’t be transferred through the ACATS system, so any of these assets at M1 Finance will have to be handled appropriately. If a margin balance will be coming over, be sure to add margin trading to the Fidelity account.

A robo account at Fidelity can only accept a transfer of cash, which obviously will require liquidation of everything in the M1 Finance account

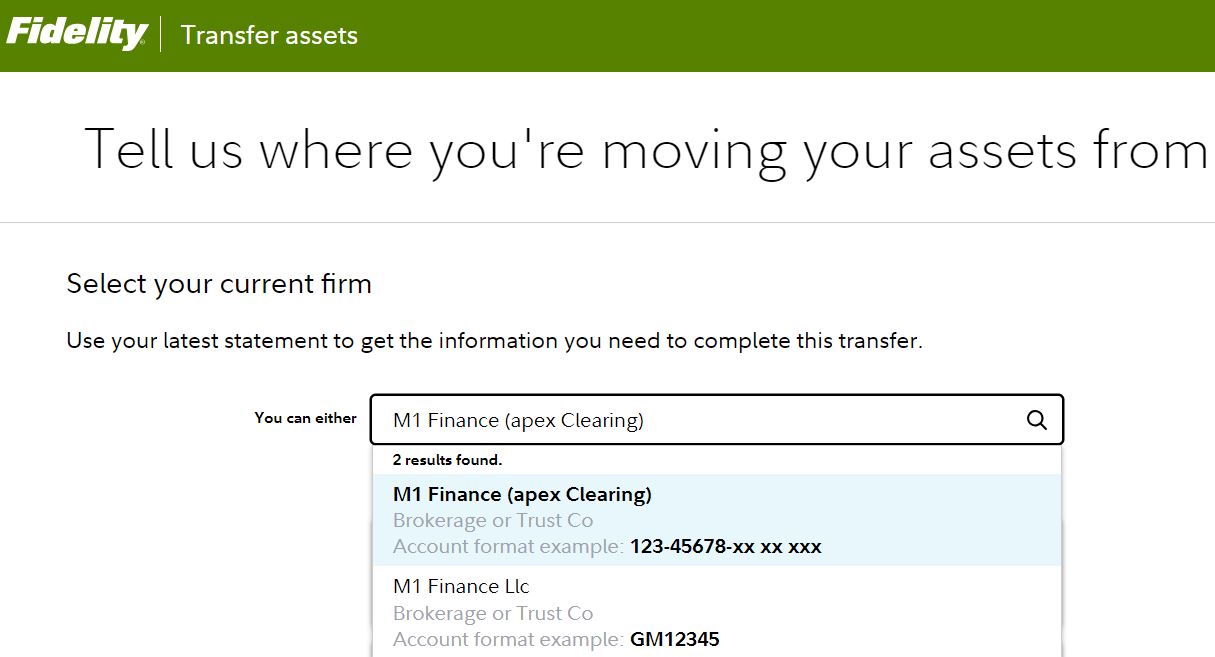

Third step: The ACATS request should be made on the Fidelity mobile app or website. On the latter system, click on the Transfers link under the Accounts & Trade tab. Be sure to select the link to deposit, withdraw, or transfer money on the next page. You’ll get a list of transfer options. Select the link to transfer an account to Fidelity (whether transferring cash or securities). Be sure to specify M1 Finance as the outgoing brokerage firm.

Top Transfer Destinations

How Long Does an ACATS Take?

Fidelity promises a turnaround time of roughly 3 to 5 business days for an incoming transfer. M1 Finance predicts a time to completion of approximately 5 to 7 business days. Cash from the liquidation of fractional shares may take longer.

|