Transfer Webull to M1 Finance or Vice Versa (2024)

Step-by-step instructions on how to move account, stocks, and other assets between M1 Finance

and Webull. How much does a transfer cost and how long does it take.

How to Transfer Account Between Webull and M1 Finance

Have you been thinking about trading cryptocurrencies but can’t because your account is at M1 Finance? Or are you at Webull but want to trade fractional shares? Using the ACAT network, it’s quick and easy to move a brokerage account from M1 Finance to Webull and vice versa. Here’s how to make the switch:

ACAT Transfer Steps

Whenever performing an ACAT transfer, you should follow these steps, in the appropriate order:

Step 1: Prepare your old account for moving. This means closing open orders if you’re performing a full transfer. If you’re doing a partial transfer, trades of assets going out should be settled.

Step 2: Open an account with the brokerage firm that has won your business:

Open a Webull Account or

Open a M1 Finance Account. You may already have an account open. In either case, the names and account types must match exactly.

Step 3: Request a transfer with the receiving broker.

Step 4: Sit back and wait for your assets to arrive in your new account. If you requested a full transfer, your old account will be closed automatically.

M1 Promotion

$250 cash bonus for making a $10K deposit at M1 Finance.

Open M1 Finance Account

Webull Promotion

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Transfer Webull to M1 Finance

Using the general guide above, we can see how to transfer a Webull account to M1 Finance:

First, exit any option positions you have open if you’re doing a full account transfer. M1 Finance

doesn’t offer derivative trading, so these securities need to be liquidated. M1 also doesn’t offer cryptocurrency trading, so you need to make sure these digital assets are in a separate account. Alternatively, you could do a partial transfer and only move stocks and ETFs.

In any case, your Webull account must be valued at $1,001 or more; otherwise, your transfer request will be rejected. M1 also doesn’t accept partial shares, although this shouldn’t be a problem as Webull doesn’t offer dividend reinvesting or fractional-share trading.

Second, open an account with M1 Finance if you haven’t done so already. It will need to be either an IRA or an individual account since that is all that Webull offers. Whichever one you choose needs to match the one you have at Webull. If it’s an IRA, it must be of the same type (traditional or Roth).

Third, request a transfer inside your M1 account. To do this, login and click on the Transfers tab in the top menu. You’ll see a yellow Move Money button next. Click on this and you’ll get a new window of 4 transfer options. Choose the one at the very bottom that says Account Transfer.

On the next page, you’ll need to choose between rolling over a 401k or transferring an account. If you’re coming from Webull, you’ll want the latter option.

Clicking on the account transfer link will generate M1’s online ACAT form. Select Webull as the outgoing firm and supply your Webull account number. You will also need to attach a copy of your most recent Webull statement.

Fourth, wait about a week or two and your Webull assets will be in your M1 Finance account.

M1 Promotion

$250 cash bonus for making a $10K deposit at M1 Finance.

Open M1 Finance Account

Transfer M1 Finance to Webull

The process in the other direction is quite similar.

Step 1: There’s not much to do here. M1 Finance will convert any partial shares you have into cash after step 3.

Step 2: Open a Webull account.

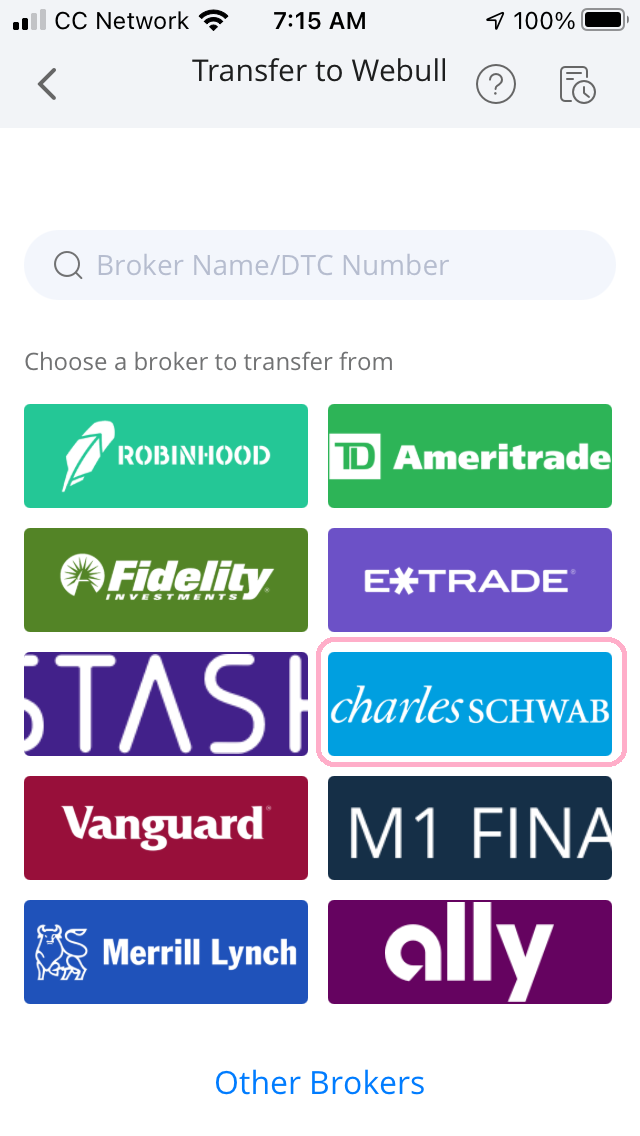

Step 3: Submit a transfer request at Webull. On the mobile app, the digital form can be found by clicking on the bull’s horns and then selecting Transfer. M1 Finance’s logo is prominently displayed on the transfer form. Be sure to select it.

Step 4: Your transfer will be completed in a couple of weeks or less.

Webull Promotion

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Transfer Fees

M1 Finance is a rare bird in the industry for still charging a fee to close an IRA. It’s $100. The brokerage house also charges $100 to transfer any account (retirement or taxable) to another firm. M1 Finance does not charge anything to transfer an account in.

The good news is that Webull regularly offers promotions to refund ACAT fees incurred by new customers. The maximum refund is $100.

Going in the other direction, Webull charges a $75 fee. M1 Finance does not have any ACAT fee specials going right now, but it does offer a $250 cash bonus for transferring an account valued at $100,000 or more.

|