Transfer Interactive Brokers to Fidelity Or Vice Versa (2024)

How to Transfer from Fidelity to Interactive Brokers or Vice Versa

Moving a brokerage account from Fidelity to Interactive Brokers or from Interactive Brokers to Fidelity is easier than you think. Here are the details:

Transfer From Fidelity to Interactive Brokers

Because both investment firms participate in the ACATS transfer system, it’s really easy to send assets from one brokerage house to the other electronically. Just follow these steps:

Step #1: Okay, so you want to move your Fidelity account to Interactive Brokers. The first thing

you’ll need to do is open an account at Interactive Brokers. It will need to be the same account type as the one you have at Fidelity, and it will need to have the same name on it. An existing account will work as long as these two conditions are met.

Interactive Brokers Promotion

Get up to $1,000 of IBKR Stock for FREE!

Open IB Account

Step #2: Once you have the correct account open at Interactive Brokers, it may need some prep work done in it. If you have options or a margin debit coming over, you’ll want to be sure to add both (with the correct options level) to the IB account. You’ll also want to check with Interactive Brokers to verify that mutual funds positions can be moved in. Although IB offers mutual funds, it may not offer every fund that Fidelity offers.

Step #3: The Fidelity account needs to be prepared, too. This may require several tasks. Options that expire in less than 5 business days need to be closed out, transferred to another Fidelity account not involved in the transfer, or simply not transferred in a partial transfer.

Although both brokerage firms offer trading in cryptocurrencies, these assets cannot be moved through the ACATS network. You could sell them and move the cash and repurchase them at Interactive Brokers. Remember that selling assets inside a taxable account could result in consequences with Uncle Sam in April; so consult with a CPA before doing so. The same rule applies to selling other investments.

These other investments could include some micro-cap stocks. Interactive Brokers does not accept incoming transfers of some of these, so they may need to be handled in one of the three ways already mentioned for non-transferrable options.

Foreign stocks are available at both firms and can be transferred through the ACATS system. For any esoteric position, it is advisable to check with Interactive Brokers to verify it will accept the stock.

If your Fidelity account is short against the box on any security (a short sale of a security held long), the position will be netted by Interactive Brokers upon receipt of the assets.

It’s possible to transfer a robo account from Fidelity into a self-directed account at Interactive Brokers. However, Fidelity will only move cash out of an automated account, which means everything will have to be liquidated in this situation.

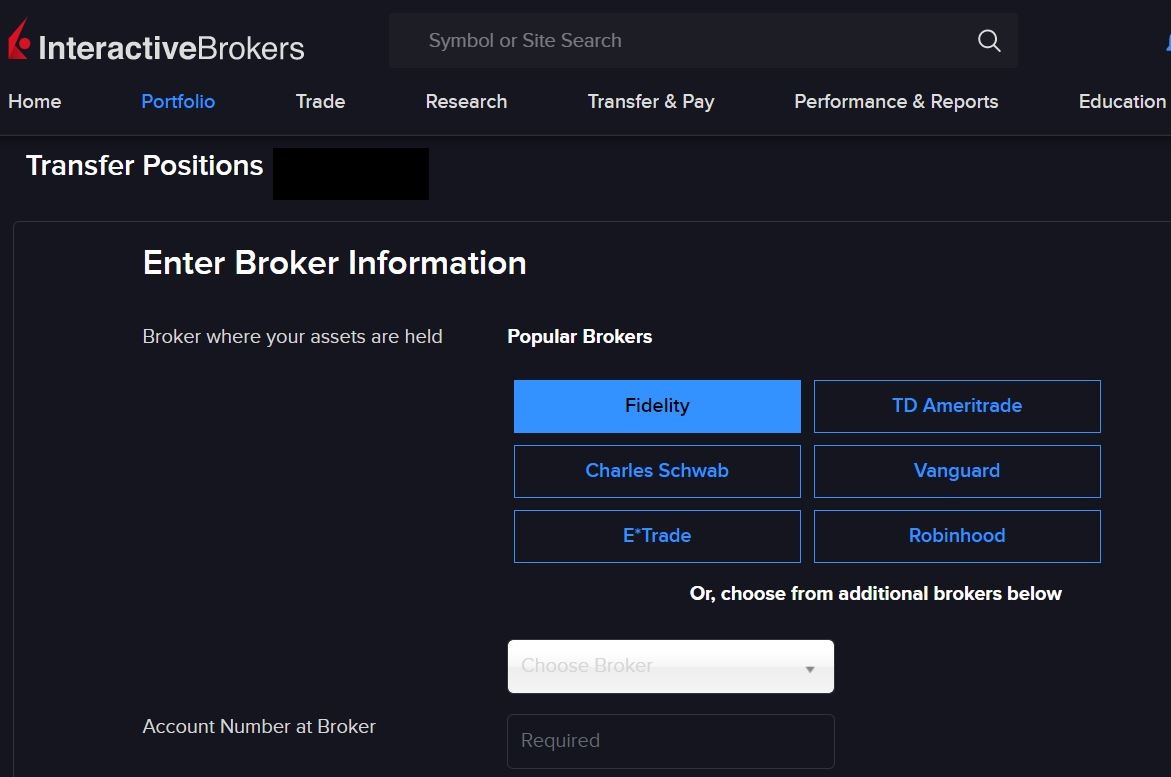

Step #4: With both accounts ready to go, it’s time to request an ACATS transfer. To do this, log into the IB website and click on the Transfer & Pay tab in the top of the site. In the drop-down menu, select the link to transfer positions. On the next page, you’ll need to specify the United States as the region, and then ACATS as the transfer type.

On the following page, there will be a collection of possible outgoing brokerage firms. Fidelity’s name is in the list, so click on the button for Fidelity. Fill in the other requested details such as account type and number.

At this time, you’ll be given the ability to specify full or partial transfer. There is also a pop-up tool on IB’s transfer form that can be used to verify if a micro-cap stock is transferable or not. Once all the fields have been filled in correctly, submit the transfer, and Interactive Brokers will notify Fidelity.

Interactive Brokers places a hold of up to 30 days on cash and securities received from an ACATS transfer. During this time, trading is possible, but withdrawal and transfer are not.

Interactive Brokers Promotion

Get up to $1,000 of IBKR Stock for FREE!

Open IB Account

Transfer From Interactive Brokers to Fidelity

Moving an account in the opposite direction follows the same general rules and steps outlined above (with the exception that Fidelity will accept micro-cap stocks). If you’re transferring into a robo account at Fidelity, the transfer must be 100% cash.

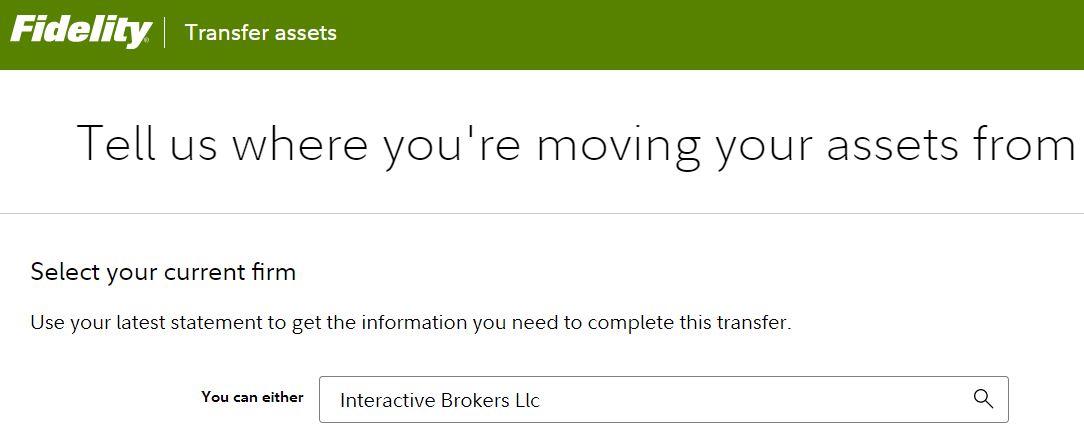

To request an electronic transfer, head to the Fidelity site and select the transfer link under the Accounts & Trade tab. Go through the on-screen instructions and specify “Interactive Brokers LLC” as the outgoing firm. Fill in the requested information, and the two brokerage firms will take over.

Price of Transferring

Neither brokerage house charges an ACATS fee for an incoming or outgoing transfer. Pretty simple.

Fidelity Alternatives

ACATS Timeframe

It can take up to 2 weeks for an ACATS transfer to fully process and assets to show up in the receiving account. Expect at least a week at minimum.

|