Account Transfers Between Fidelity and Acorns

Although it is possible to move assets between Fidelity and Acorns, the process is a little cumbersome due to the latter broker’s policies. Here are the details:

Transfer from Fidelity to Acorns

Acorns does not accept or send electronic transfers of securities via any available type of transfer (such as ACATS or DTC). Therefore, to get securities from Fidelity to Acorns, the assets at Fidelity will need to be converted into cash. This cash balance will need to be moved into a bank account of some kind, and from there it can be moved into the Acorns account.

Notice that we said “a bank account of some kind.” Because Fidelity offers hybrid investment-bank accounts, it is possible to use the Fidelity account in an ACH transfer. You’ll need to get the account and routing numbers from Fidelity using the broker’s informational page on direct deposits. The numbers will also appear on any checks you have for the account. Some account types at Fidelity, such as IRAs, cannot be used in this manner. Of course, it’s also possible to push the money into an external bank account.

Whichever account you want to use, you’ll need to link it to the Acorns brokerage account by adding the account and routing numbers at Acorns. To do this, log into the Acorns site and look for the link to add a bank account. The link will be on the dashboard.

Once the bank account has been connected, it’s time to get down to business. First, assets at Fidelity need to be sold off. These investments could include cryptocurrencies, option contracts, stocks, foreign stocks, and mutual funds. Some of these holdings may be in discrete accounts. If so, the cash balances will need to be moved to the one account connected to the Acorns account.

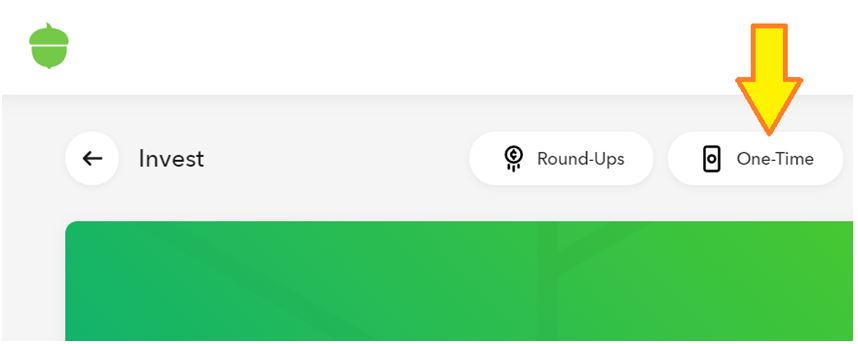

Once the cash is available for withdrawal, it should be moved to the outgoing account. From there, simply pull the cash from the Acorns account. To do this, click on the securities account on the Acorns dashboard and then choose a one-time transfer at the top of the page. With this widget, you’ll be able to pull cash into the account, and Acorns’ robot will turn it into shares of ETFs.

Open Acorns Account

Open Acorns Account

Transfer from Acorns to Fidelity

As already mentioned, Acorns will not electronically transfer securities. However, this time we do have another transfer method. Called a non-ACATS transfer, this option will be more cumbersome than the one just described. However, the advantage is that securities can be moved—at least whole shares of securities. Fractional shares will be converted into cash by Acorns.

To get started with this transfer option, you’ll need to contact Fidelity and request this type of transfer from the Acorns account. Fidelity will compile the paperwork for you and send it to you. Once you receive the paperwork, the next step is to get a medallion signature guarantee on it. Check with your local bank or other financial institution for this necessary impression.

Once you have the medallion signature guarantee on the paperwork, you’ll need to submit it to Acorns via snail mail or e-mail. Once Acorns has everything in proper order, it will send an e-mail to the account owner asking for verification of the transfer. If Acorns receives no answer, it will cancel the transfer.

It’s also possible to sell everything in the Acorns account and move the cash balance into the Fidelity account using the method discussed in the previous section. In this direction, an external bank account will be required. Acorns offers checking accounts.

Fidelity Alternatives

Note About Robo Accounts

A robo account at Fidelity will only accept a transfer of cash. A self-directed account at Fidelity can accept transfers of securities and/or cash.

Possible Cost of Transferring

Fidelity charges nothing for an incoming or outgoing ACH transfer. Easy enough. The non-ACATS transfer method from Acorns will set you back $50 for each ETF moved. Fidelity refunds other firms’ outgoing transfer fees if the value of the transfer is $25,000 or more.

Potential Tax Consequences

Remember that selling assets in a taxable account could trigger a Form 1099-B during tax season. Moreover, withdrawing cash from a tax-deferred account, such as an IRA, could generate a Form 1099-R.

How Long Does a Transfer Take?

A transfer of either type (cash or non-ACATS) could take up to two weeks, due to the amount of red tape (for the non-ACATS) and the number of transfers involved (for the cash transfer).

|