Inherited IRAs at Fidelity

Among its many IRA types, Fidelity Investments offers the Inherited IRA. In addition to the account itself, Fidelity has great pricing and a wide range of retirement resources. Here’s the full scoop:

Overview of Fidelity’s Inherited IRA

Fidelity offers an Inherited IRA in both Roth and Traditional tax structures. It can be used to inherit the assets of a regular IRA or a workplace retirement account, such as a 403b, 457, or 401k.

An Inherited IRA can be set up as either a self-directed (brokerage) or investment-advisory (managed) account. The latter option would be really good for Inherited IRA clients who need a little extra guidance. Inherited IRAs can be a more complex than standard IRAs as tax and inheritance laws come into the picture.

Inherited IRAs for Spouses

Both spouses and non-spousal beneficiaries can open an Inherited IRA. Spouses have the option of simply rolling over inherited assets into an existing IRA instead of opening an Inherited IRA. Fidelity offers many other types of IRAs, including Roth, Traditional, SEP, SIMPLE, and Rollover accounts.

Required Minimum Distributions from an Inherited IRA

An IRA of any type at Fidelity can be set up to take RMDs (Required Minimum Distributions) if they are necessary. They are not required in all situations, but they are in many. Be sure to consult with a qualified tax pro on this issue before making any type of withdrawal from an IRA of any kind.

Inherited IRA Resources

Fidelity offers a great deal of retirement resources that Inherited IRA owners may want to check into. For example, Fidelity has a discrete department called Transition Services that helps customers with all sorts of matters related to account conversions and transfer issues. Its number is 800-544-0003.

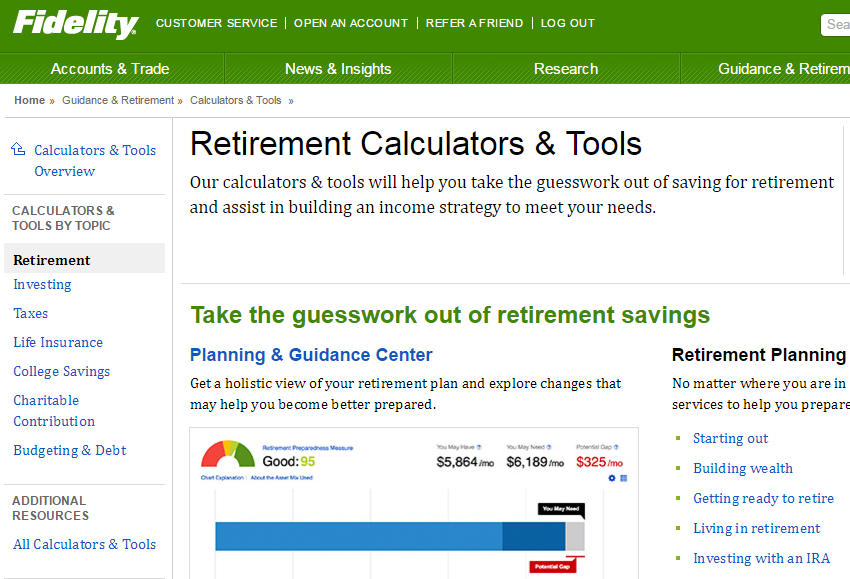

Then there is Fidelity’s treasure trove of educational materials on its website. These cover all sorts of issues on IRAs, retirement, inheritance, and related topics. Resources we found include:

- Managing estate planning

- Dementia and Alzheimer’s: signs and symptoms

- Claiming life insurance benefits

- Retirement Income Calculator

- Executor & Trustee Guidelines

Fidelity’s has an online notification tool that can be used to report the death of a Fidelity client. It also has a really helpful checklist of steps to take when a loved one passes away.

Available Investments

An Inherited IRA at Fidelity has access to the same lineup of tradable assets that other retirement accounts have. The list includes:

- Stocks

- Options

- Bonds and other fixed-income securities

- Funds (mutual, exchange-traded, and closed-end)

Although Fidelity does offer trading in bitcoin and Ethereum, neither one can be traded in an IRA.

Fees and Minimums

Fidelity’s Inherited IRA is subject to the same pricing schedule that other IRAs come with. This means there are no closeout, maintenance, annual, or inactivity charges. An Inherited IRA can be opened with no deposit.

Once opened, an Inherited IRA receives Fidelity’s excellent commission schedule, which comes with free trades on many assets, including U.S.-listed stocks and ETFs. Many mutual funds are also commission-free.

There is no fee to transfer an Inherited IRA into or out of Fidelity.

Opening an Inherited IRA at Fidelity

Thanks to Fidelity’s user-friendly website, opening an Inherited IRA is a simple procedure. Just look for the link at the top of the site to open an account. Clicking on this link will produce a page with the most popular account types. Click on the link to show all Fidelity accounts; scroll down until you see the tile for the Inherited IRA.

There is a button in the tile to open an Inherited IRA. If you click on this link, you will get the application for the Traditional version. Click on the link ‘Inherited IRA’ to go to an informational page that has an orange button to open an account. If you click on this button, you’ll get a pop-up window to choose between Roth and Traditional versions of the Inherited IRA.

A copy of the decedent’s death certificate may be needed during the account application.

Schwab as a Substitute

If you would rather use Schwab as the investment firm for an Inherited IRA, you’re in luck. Schwab

offers the Inherited IRA along with its own cornucopia of retirement resources.

To open an Inherited IRA with Schwab, simply click on the orange-brown button at the top of the website to open an account. Click on the link to show all accounts (the Inherited IRA won’t initially show up). Next, find the tile for the Inherited account. Click on this and choose the application for a regular or minor beneficiary (Schwab has two applications). The application for a minor beneficiary is for persons under the age of 18. A digital copy of the death certificate will be needed.

It’s also possible to open an Inherited IRA on Schwab’s mobile app.

Free Charles Schwab Account

Open Schwab Account

Updated on 1/31/2024.

|