|

How Old To Open a TD Ameritrade Account? TDA for Under 18.

TD Ameritrade age limit. How old do you have to be to open a brokerage account at TD Ameritrade?

TD Ameritrade account for under 18 years old.

|

TD Ameritrade Closed Its Doors

Charles Schwab Website

Open Schwab Account

TD Ameritrade Age Requirement

In most cases, the minimum age to open a brokerage account at TD Ameritrade is 18. There are

some exceptions, though. Here are the specifics:

TD Ameritrade Minor Accounts

There are several minor account types that allow an adult to open an investment account with a minor who is under the age of 18. Typically, the adult is both the custodian and the donor, while the minor is the beneficiary. It doesn’t always have to be set up this way, however.

For example, with either a UGMA or a UTMA (the two custodial account types), it’s possible to have two adults in the picture, one acting as the custodian (the manager of the account) and the other as donor (the one contributing funds to the account). A custodial account can only have one custodian and one minor, though.

In fact, it has to have one custodian and one minor. Social Security Numbers of both parties are required when opening the account. This is quite easy to do on TD Ameritrade’s website. Just click on the Open an Account link that appears at the top of the site.

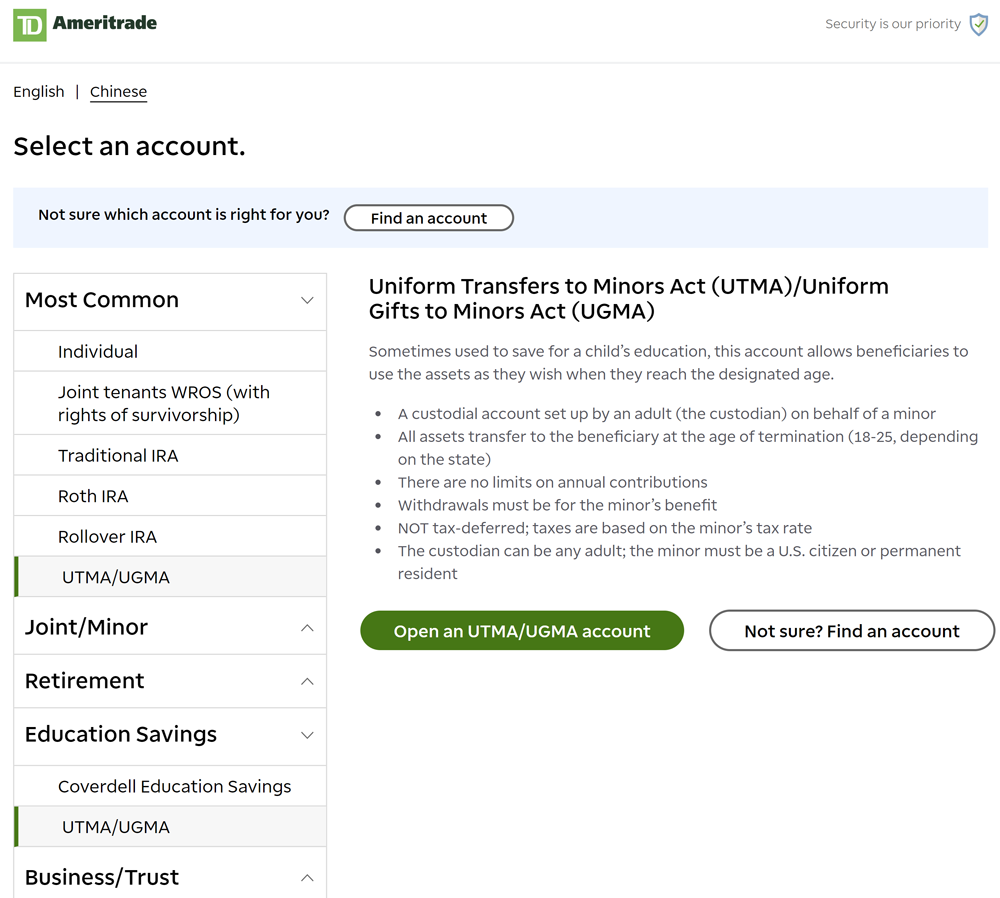

On the next page, you’ll see a selection of available account types in the left-hand vertical menu. Scroll down to the Joint/Minor section. Click on this link to expand the menu. You will see all of the joint and minor accounts available at TD Ameritrade.

Joint accounts can be opened by two or more parties. These parties can be individuals or entities. Individuals must be at least 18 years old.

Minor accounts include a UTMA/UGMA option. Either account type can be opened on behalf of a minor under the age of 18. The exact type (UTMA or UGMA) used will depend on the state of residency at the time of account opening. Most states now use the UTMA account. With either type, the minor must be a U.S. citizen or permanent resident, although the custodian doesn’t have to be one.

The age of termination of a custodial account is often higher than 18. This is the age when assets must be turned over to the beneficiary, who is the minor. In California, for example, this can be as late as 25.

There is also a guardian account at TD Ameritrade that can be opened by a court-appointed guardian on behalf of a legal minor.

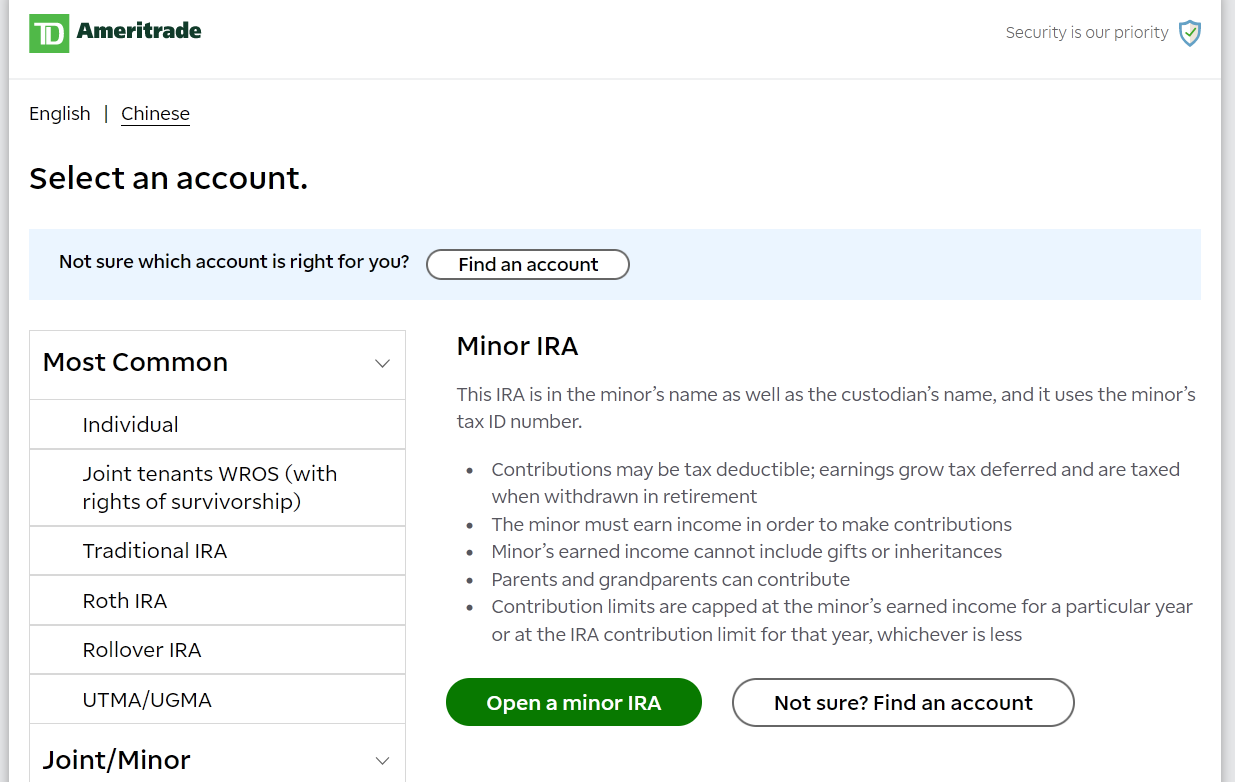

Within the Joint/Minor section is also a Minor IRA. As with any other IRA, the account owner (who is the minor in this case) must have earned income for contributions to be made. This is an important difference from the other minor brokerage accounts. Like other brokerage accounts for adolescents, the Minor IRA is opened with a custodian, although it uses the juvenile’s tax ID number.

Scrolling down a little further, there is a section for Education savings. Expand this and you’ll find the Coverdell account. As with the other minor accounts discussed thus far, this one can be opened on behalf of a person under the age of 18.

Unlike the regular custodial account, however, the Coverdell account has annual contribution limits. Moreover, withdrawals must be used for educational expenses.

The other account types cannot be opened on behalf of a minor. The account owner must be at least 18 years old. These accounts include profit-sharing plans, individual accounts, business accounts, solo 401k plans, IRAs, and others.

Open TD Ameritrade Account

Open TD Ameritrade Account

Resources for Beginners

TD Ameritrade does have a lot of learning materials on its website for new traders, so minors who end up at TD Ameritrade will find lots of resources on investing. These include articles and videos on pretty much all investment products (stocks, bonds, funds, options, and more) plus some good resources on using the broker’s software.

One resource that young investors might benefit from, robo investing, has been discontinued at TD Ameritrade. When the brokerage firm integrates with Schwab in late 2024 and early 2024, Schwab’s robo service will be available. It actually is now because TD Ameritrade accounts can voluntarily be moved to Schwab early free of charge.

|