Overview of TradeZero and E*Trade

E*Trade is a well-known brokerage house with funny TV commercials. TradeZero, on the other hand, is not well-known at all. Could E*Trade customers be missing out on a better deal? Let’s find out.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Etrade

|

$0

|

$0

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

TradeZero

|

$0

|

na

|

$0.59 per contract

|

$0

|

na

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Etrade

|

|

|

|

|

|

|

|

TradeZero

|

|

|

|

|

|

|

First Category: Available Assets

TradeZero offers just three security types for trading:

- Equities

- Exchange-traded Funds

- Option contracts

E*Trade has the same three but adds:

- Bonds

- Mutual Funds

- Futures (including crypto contracts)

- IPOs

Winner: E*Trade

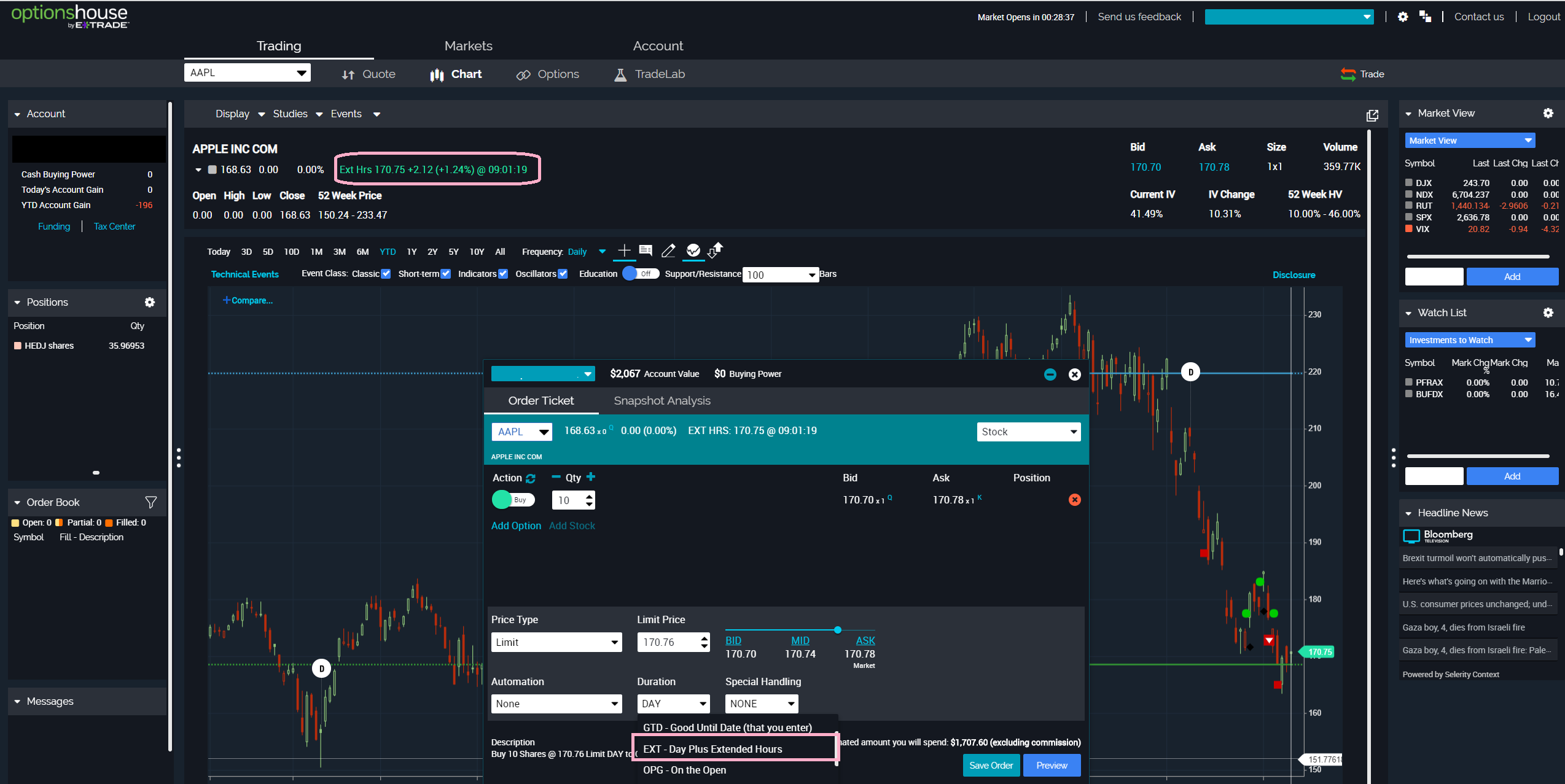

Second Category: Web-Based Trading

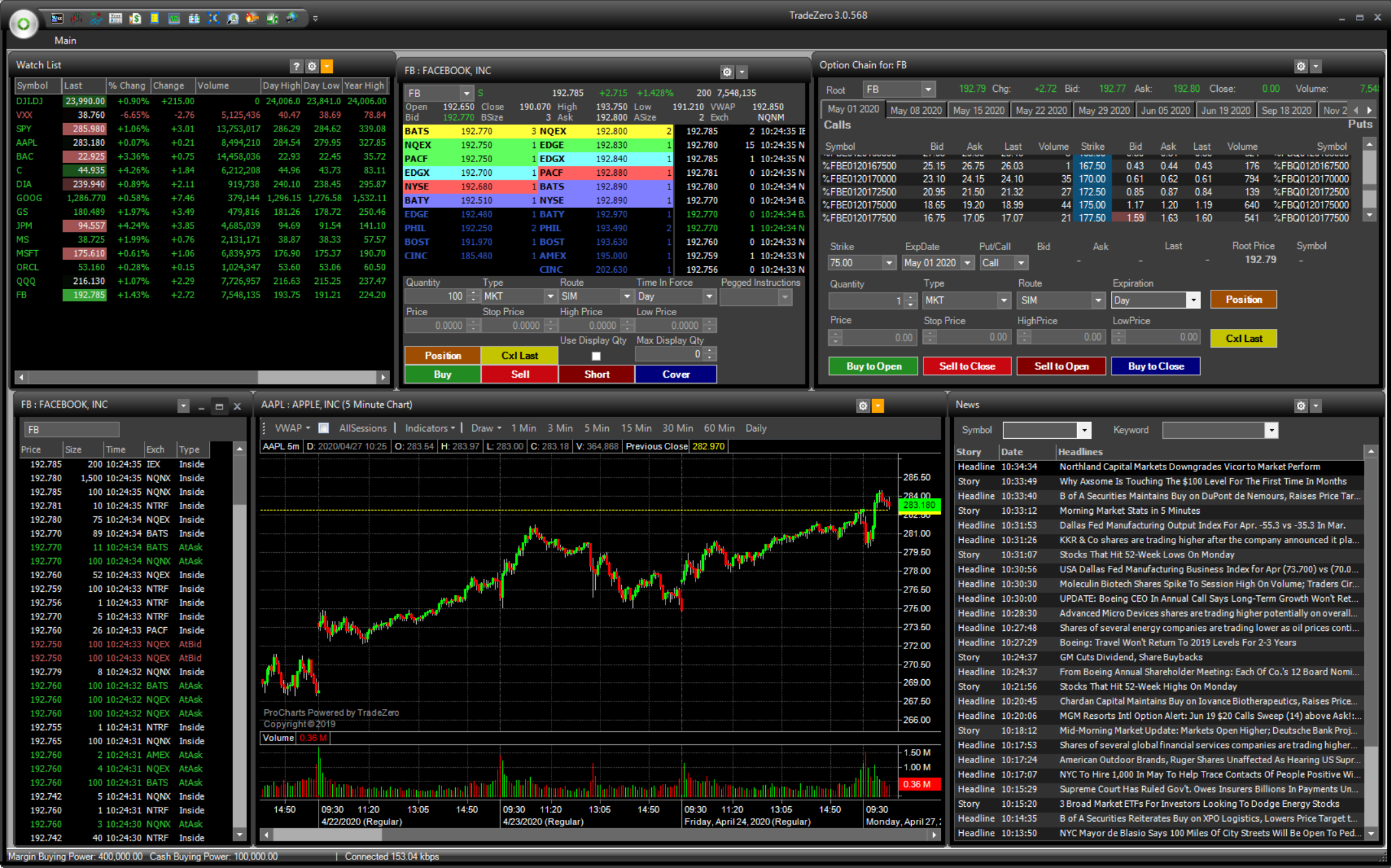

E*Trade and TradeZero both have browser-based platforms. TradeZero actually has two of them, one of which costs $59 per month. The primary advantage it offers is Level II quotes, which E*Trade’s browser system doesn’t have. TradeZero’s free platform doesn’t have options trading, which E*Trade’s software does have.

While E*Trade’s platform does seem to be more advanced than TradeZero’s free software, it doesn’t have a short locate tool, which TradeZero’s free platform does have.

Winner: Tie

Third Category: Desktop Software

Traders who demand more can use a desktop platform at either firm. E*Trade only requires a $1,000 account

balance (and a subscription to real-time quotes, which is free) to use Pro, its desktop program. As the name suggests, it comes with a lot of sophisticated tools.

Not to be outdone by E*Trade, TradeZero offers ZeroPro, a desktop platform. The names are similar, and in fact, you’ll find many of the same advanced features. But TradeZero charges $79 per month to use it (or you can place trades totaling 100,000 shares in a month). And that’s a big difference.

Winner: E*Trade

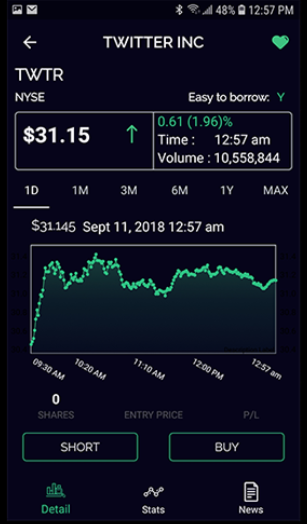

Fourth Category: Mobile Apps

In today’s busy world, of course both brokerage firms have mobile apps. E*Trade actually has two of them. One is built from the browser platform, and so it’s designed for heavy trading, including futures contracts. The other one does an impressive job in its own right, offering mobile check deposit and streaming video news.

The TradeZero app doesn’t quite have the same features that E*Trade provides. For example, there is no options trading capability on the TradeZero platform. Options can be traded on both E*Trade apps, by comparison. But once again, TradeZero manages to include a short locate tool, something E*Trade’s app doesn’t have. But for charting and news, E*Trade is better.

Winner: E*Trade

Fifth Category: Day Trading and Swing Trading

Shorting. Although selling securities short is possible at either firm, only TradeZero has a short locate widget. Furthermore, E*Trade customers have to sign up to be eligible to trade hard-to-borrow stocks.

Extended Hours. TradeZero’s pre-market session opens at 4:00 am, EST. By comparison, E*Trade’s early-bird session doesn’t start until 7:00. The two firms have the same after-hours period. E*Trade offers overnight trading in some ETFs, a great service that TradeZero doesn’t offer.

Level II Quotes. Both broker-dealers offer Level II data. While TradeZero customers have to pay for it, E*Trade clients who have at least $1,000 in assets get the data for free.

Direct-access Routing. TradeZero offers 9 venues, while E*Trade has only 2.

Margin. E*Trade charges between 12.2% and 14.2% for margin debits. The US branch of TradeZero charges a flat 9%.

Routing Fees and Rebates. E*Trade doesn’t offer maker-taker fees, but TradeZero does.

Pattern Day-Trading Rule. With TradeZero’s Bahamian company, it’s possible to circumvent the $25,000 PDT rule. This is not possible with E*Trade.

Winner: TradeZero

Sixth Category: Other Services

Dividend Reinvestment Program: E*Trade, but not TradeZero, offers DRIP service.

IRAs: You can open an Individual Retirement Account at E*Trade, but not at TradeZero.

Winner: E*Trade

Top Competitors

Recommendations

- Mutual Fund Traders: E*Trade for obvious reasons.

- Beginners: We suggest E*Trade for its 24/7 customer service and very good educational resources.

- Long-Term Investors and Retirement Savers: With E*Trade’s financial planning services, target-date mutual funds, several retirement account options, and branch locations, it is the only real choice here.

- Small Accounts: E*Trade.

- Stock/ETF Trading: E*Trade’s stock and ETF research materials are much better than anything TradeZero has. Combined with free software, E*Trade is our pick.

Promotions

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

TradeZero:

Trade stocks, options & ETFs for free.

TradeZero vs E*Trade Summary

Despite TradeZero’s undistinguished state, it has done a good job of rivaling E*Trade and even

outpacing it in some areas related to day-trading.

|