Overview of Interactive Brokers and LightSpeed Trading

If you buy and sell a large number of financial instruments every month, you definitely need to check out Lightspeed and Interactive Brokers. These

firms cater to active and day traders, and they have the technology and commission schedules to support this type of trading. There are important

differences between them, however. Let’s check them out.

Fees

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

IB

|

$0+

|

$14.95

|

$0.25+ per contract

|

$0-$240**

|

$30

|

|

LightSpeed

|

$4.50

|

na

|

$0.60 per contract

|

$25 monthly fee (if less than $15,000 in assets)

|

$25 monthly fee (if less than $15,000 in assets)

|

|

WeBull

|

$0

|

na

|

$0

|

$0

|

$0

|

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

IB

|

|

|

|

|

|

|

|

LightSpeed

|

|

|

|

|

|

|

|

WeBull

|

|

|

|

|

|

|

Promotion Links

LightSpeed Trading: none right now.

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Trading Platforms

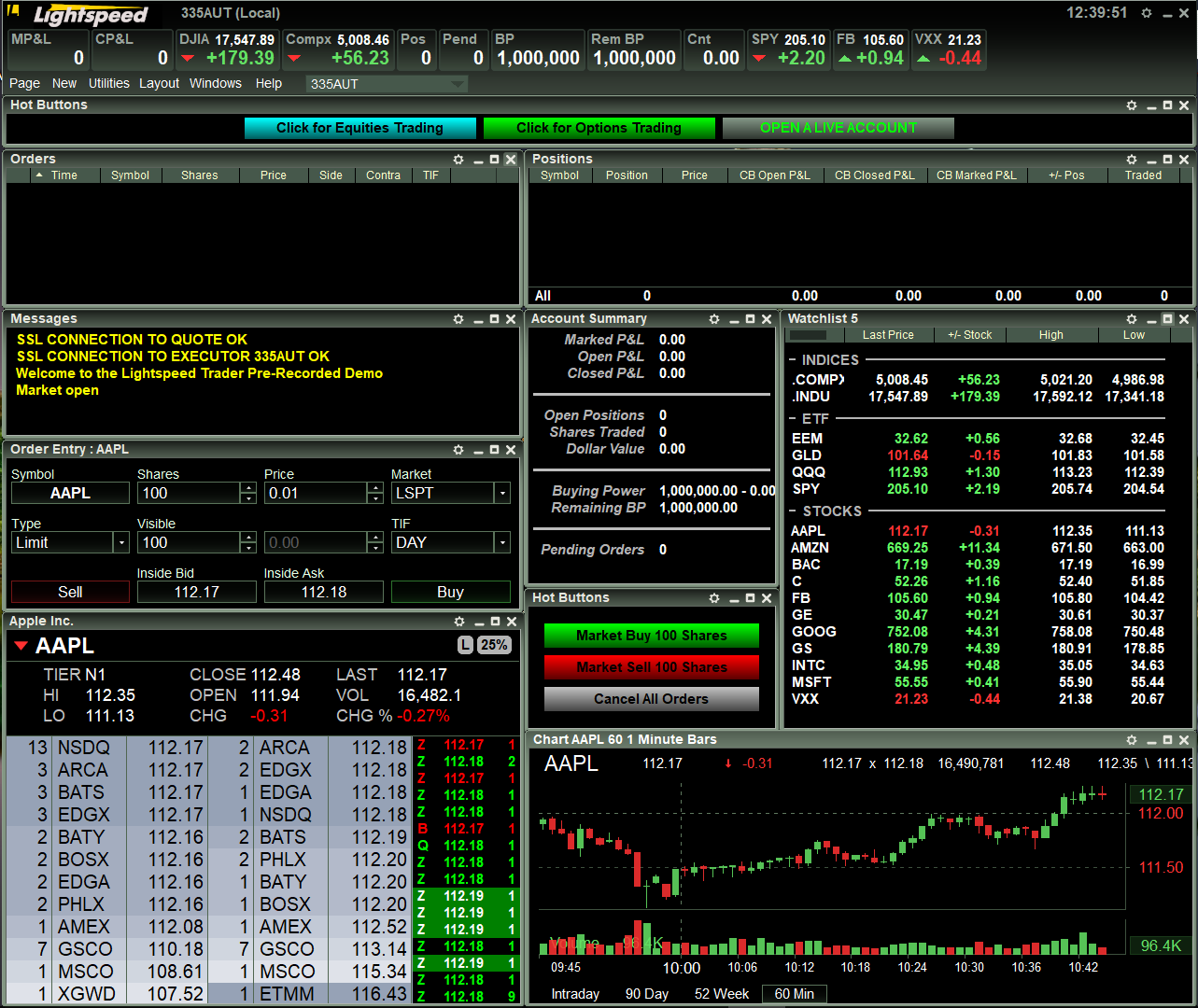

Lightspeed offers several trading platforms that provide a variety of investment tools. The

simplest platform is the browser system. It offers watchlists, order entry, and charting with

technical studies.

Up next in order of sophistication is Livevol X. This one comes with basket order entry and advanced window linking. After Livevol X is LS Trader. It offers hot key order entry and customizable order routes (neither of which the other programs have). LS Trader also is customizable and has up to 40 screens of custom layouts.

Sterling Trader Pro is also available at Lightspeed. It comes with API access and many other advanced features, such as direct-access routing. Finally, we arrive at RealTick Pro, which is the only platform at Lightspeed capable of trading futures.

Besides these mainstay platforms, specialty programs can also be used at Lightspeed Trading. These include Wex, SILEXX OEMS, Derivix, and CQG.

Transitioning to Interactive Brokers, we get just one software program. Although this may sound like a huge underperformance on the part of IB, the

platform is actually quite sophisticated. Named Trader Workstation, the

software provides access to global securities (which Lightspeed fails to do). There is also a simulated trading login.

Trader Workstation provides a great deal of customization. The thickness of candlesticks can be changed, for instance. We also liked the sophistication of the software’s charting application. The trading ticket incorporates many different types of orders and time-in-force options.

Trader Workstation, Livevol X, and the Lightspeed browser platform all carry zero fees. The other three programs at Lightspeed do carry monthly charges, but two of them (RealTick Pro and LS Trader) are eligible for software fee rebates.

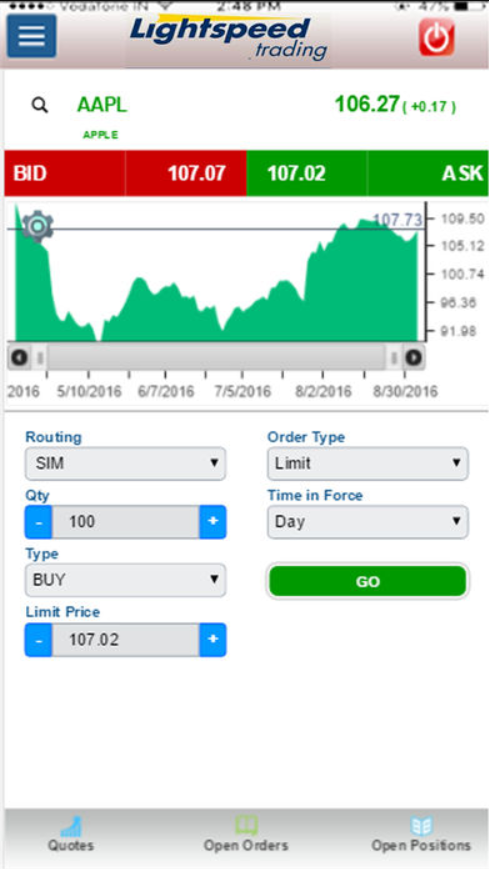

Mobile Platforms

Each broker offers a mobile platform, and there is no charge for either one. The mobile app at Lightspeed comes with advanced order types (such as trailing stop) and watch lists. Market data is available at no cost. We also found charting and Level I quotes.

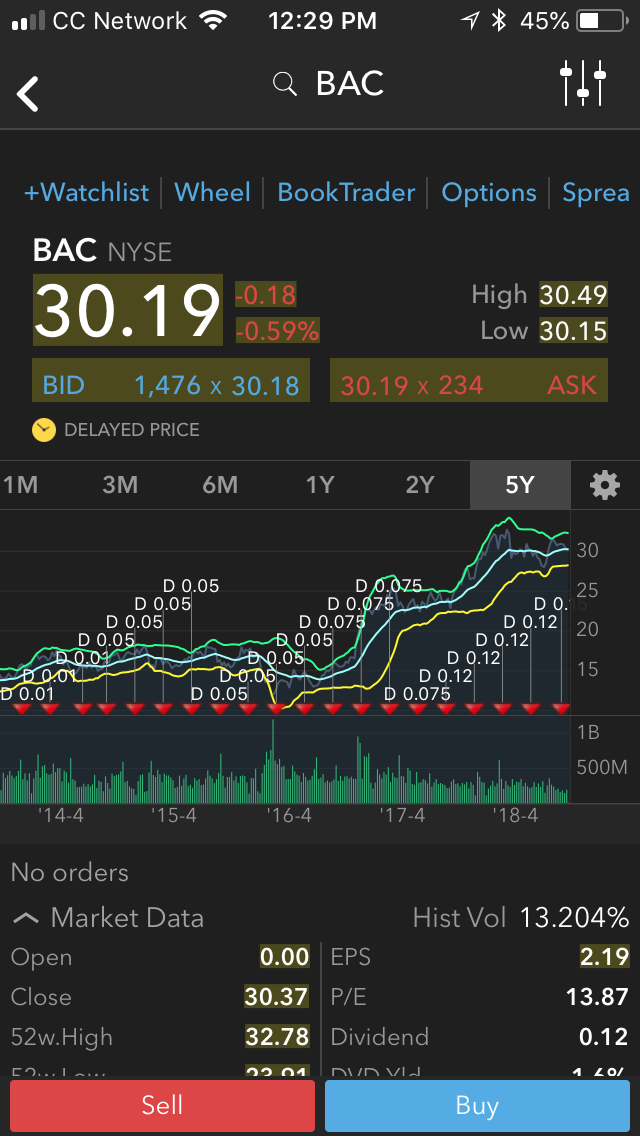

The IB mobile platform delivers pretty good charting with roughly fifty technical studies. Another nice feature is the ability to change the graph style. There is a watchlist and iBot, which is an AI helper. Several order types are available. We liked the inclusion of profit & loss information.

Level II Quotes

Because both companies in our survey specialize in active trading for experienced investors, they of course offer Level II data (they do charge for this). Almost every platform at Lightspeed offers Light II information. The exceptions are the mobile and browser systems.

Trader Workstation delivers Level II data in one of two windows: Market Depth and Market Depth Trader. The latter has more tools, and the prices from the various market centers are color-coded. On the simpler Market Depth, they are in shades of gray.

Options and Other Financial Instruments

Interactive Brokers offers a lot more than just stocks. Also on tap are options, bonds, ETF’s, futures, forex, contracts for difference, and even mutual funds. Lightspeed offers options, ETF’s, and futures, but fails to deliver mutual funds, bonds, or contracts for difference. Moreover, Interactive Brokers provides access to a very large range of global securities, which Lightspeed does not do.

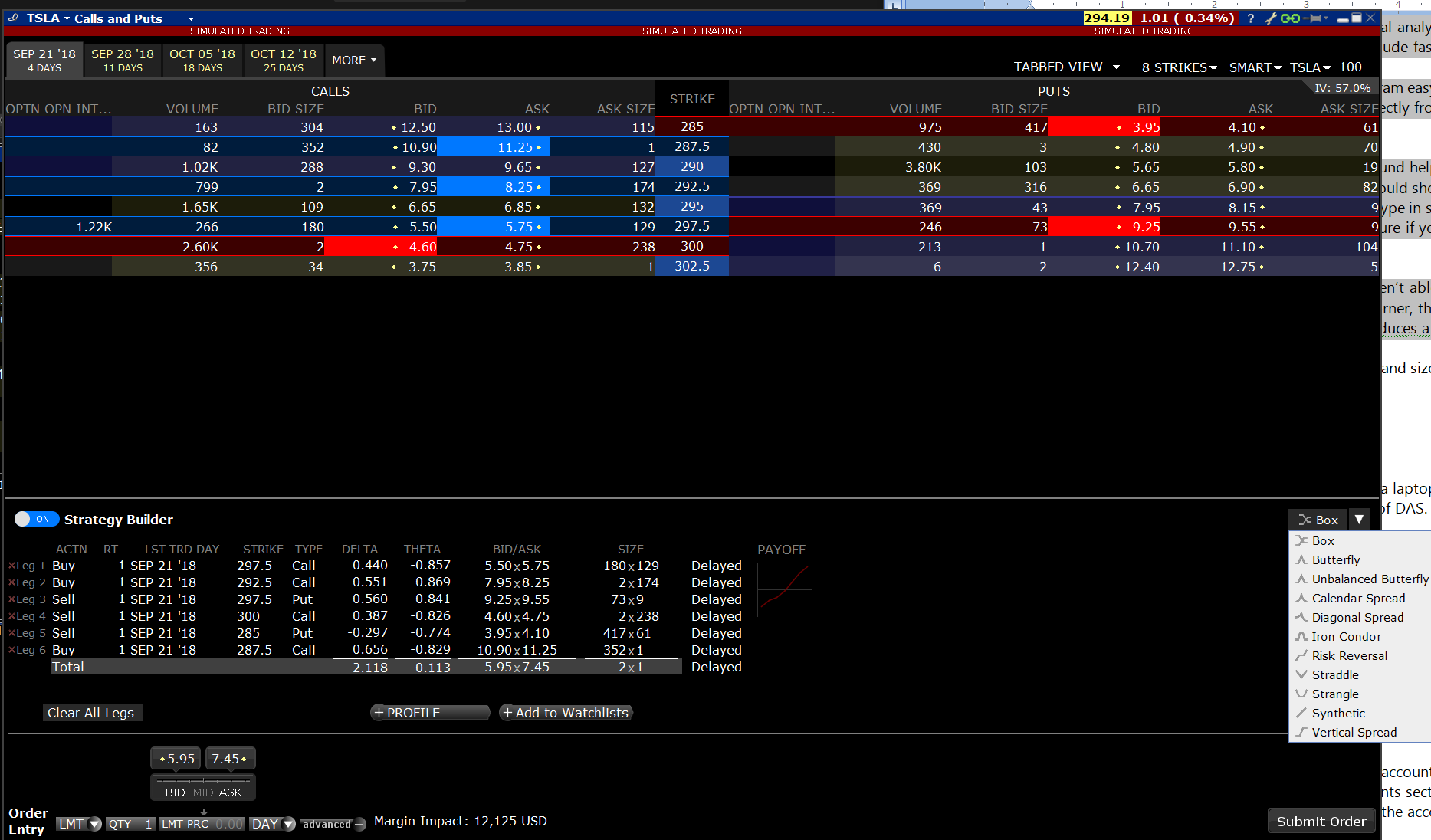

Options can be traded on every single platform Lightspeed offers, although the browser and mobile systems don’t offer Level II quotes on them. Livevol X is designed for derivative trading and comes with option market scanners and analysis tools.

Trader Workstation has option chains with calls and puts. Turning on “Strategy Builder” within the options window produces several multi-leg strategies. Clicking on a bid or ask price adds a leg to an order ticket at the bottom of the window.

Extended Hours

In addition to regular weekday trading, both broker-dealers in our survey offer extended-hours trading. Lightspeed’s pre-market session lasts from 4 am until 8 am, while the after-hours period is from 4 pm until 8 pm. Interactive Brokers customers have access to the same sessions.

Margin

Lightspeed currently charges 12.5% for margin

debits below $50,000. The broker’s initial margin requirement for long stock positions is 50%, while maintenance is a lower 25%.

Interactive Brokers clients pay a very low 6.83% on debit balances under $25,000. The broker’s initial and maintenance margin requirements are the same as Lightspeed’s.

Security Research

It’s possible to research securities at either firm. On Trader Workstation, we found a stock scanner with the ability to search on European and Asian exchanges. We also found ETF’s with this tool. A feature called BookTrader displays time and sales data for a stock. Forex has tools as well.

Lightspeed provides research on all its platforms. Market scanners are available on LS Trader, Sterling, and Livevol X. RealTick Pro offers streaming news and fundamental research. Livevol X provides historical options data and a portfolio risk dynamic skew.

Recommendation

For reasons already mentioned, we recommend Interactive Brokers over Lightspeed for forex, fixed-income, CFD, and mutual fund traders.

If you want to trade within a web browser, then we suggest Lightspeed. Although the broker has many desktop platforms, some traders might actually prefer something less complicated. Interactive Brokers seems like a simpler choice with just one platform.

Due to the company’s great margin rates, we endorse Interactive Brokers for traders who use a lot of margin. We also propose IB for low-volume traders because its platform is free, and infrequent trading would only cost $10 per month.

Promotions

LightSpeed Trading: none right now.

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Interactive Brokers vs LightSpeed Summary

Lightspeed and Interactive Brokers have a lot of great resources for day traders and other

sophisticated investors. While IB offers commission-free plan, Lightspeed does not, which makes the

broker very expensive. For $0 commission trading,

Webull

is also a great choice for a trader.

|