Pricing Schedule

If IBKR Lite and IBKR Pro accounts can trade the same investment vehicles, what is the difference between the two? Commissions.

IBKR Lite customers pay no trade fees on U.S.-listed stocks and ETF’s. They also get free real-time data on those securities, which Pro customers don’t get.

In return, Interactive Brokers does not offer SmartRouting to Lite customers. SmartRouting is the company’s computerized order routing system that looks for the highest probability of fill at lowest all-in cost across all available exchanges.

Pricing on other securities is the same or similar for Lite accounts. Option trades range from 65¢ to 15¢ per contract, depending on the account’s monthly trade volume. There is a $1 minimum per order. If an option order is directly routed, the commission is $1 per contract (with a $1.00 minimum).

Lite accounts also pay more in margin interest. Currently, the rate is 7.83% on all balance tiers (Pro accounts get 1.00% lower rate). Lite customers receive less interest on free cash balances as well. The APY right now is 0.0%.

Website Portal

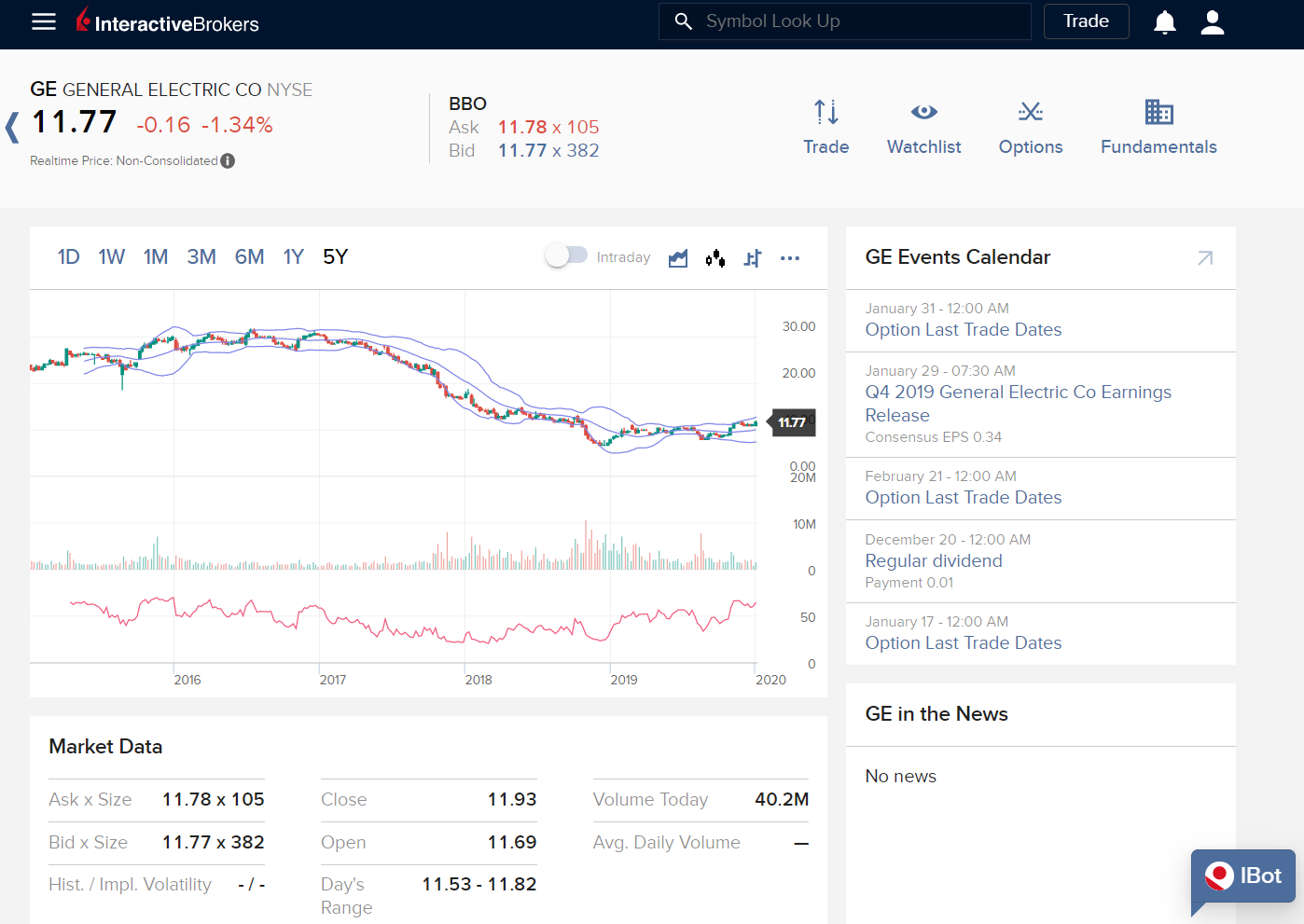

The first trading platform Lite customers get is the client portal. Accessed through a browser window, Interactive Brokers does require a one-time access code sent to a mobile phone (in addition to a user ID and password).

Inside our test account, we found a small watchlist in a compact window on the dashboard. This can be expanded into its own page with many more listings and more watchlists. There are account management tools, such as transaction history and a funds transfer tool.

Charting on the client portal is on a very elementary level. A graph cannot be displayed the width of the monitor, and there are less than 20 technical studies. There is no comparison tool, and 5 years is the maximum timeframe.

Mobile App

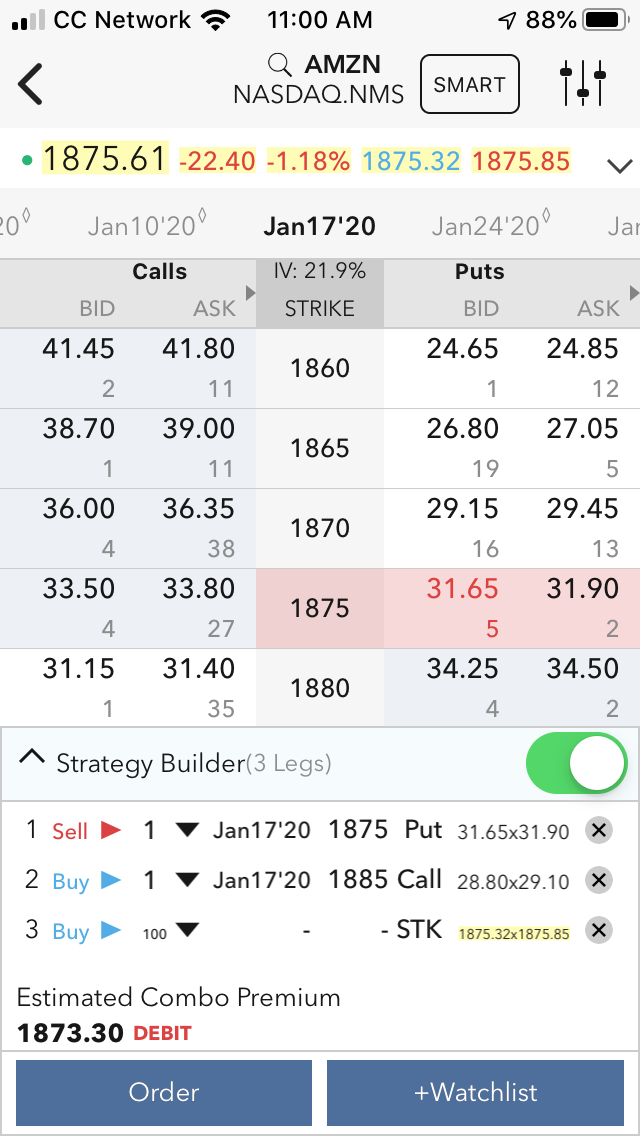

IBKR Lite traders also get to use the broker’s mobile app. The order ticket offers some really

nice features, including a chart on the side that can be swiped over the ticket. The chart shows

up to 6 months of price history with 3 graph styles. Technical studies can be shown here as well.

Clicking the configure wheel lets users view up to 5 years of price data.

Order types include limit, market, stop, stop limit, trailing, on-the-close, relative, and adaptive. Advanced order types are bracket, stop loss, and profit taker. Missing on the ticket is direct-access routing.

Charting on the mobile platform comes in wide-screen mode and actually provides more technical studies than the client portal.

Both Bloomberg US and Asia video streams are available on Mobile. Traders’ Insight video commentary

and RealVision video are also active.

One feature we really like about IB’s mobile app is that there is a simulated trading mode where

beginners can get lots of extra practice. What we don’t like about it is the lack of mobile check

deposit.

Interactive Brokers Promotion

Open IB Account

Web Trader

Although direct-access routing is missing on both the mobile app and client portal, it is available on WebTrader, another browser-based platform at Interactive Brokers. Unfortunately, IBKR Lite clients can’t use it.

Desktop Software

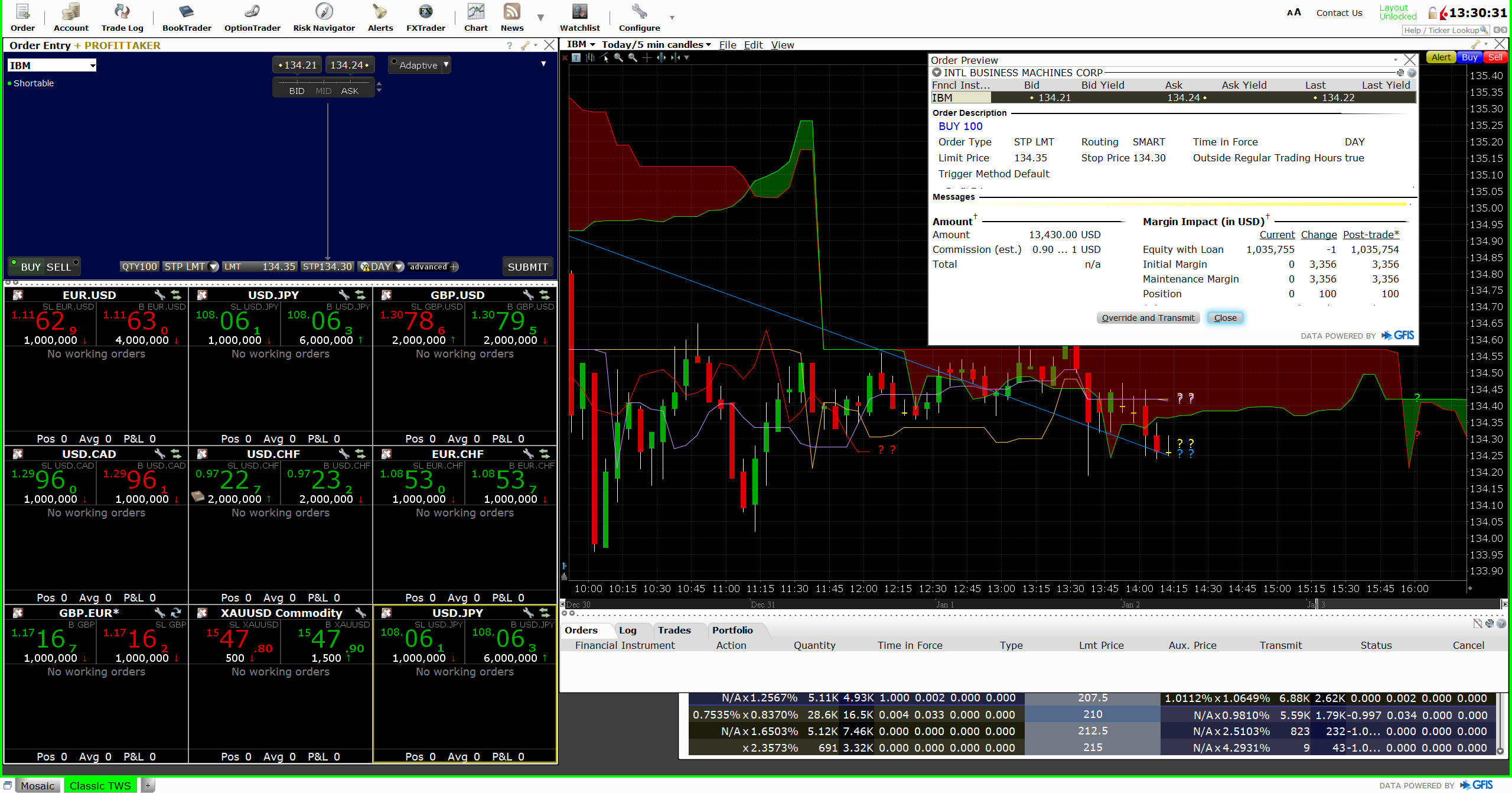

Although IBKR Lite accounts don’t get Web Trader, they do get Trader Workstation, IB’s best software program. It offers a lot of powerful trading features, not least of which is direct-access routing (finally). Other features available on the platform include Level II data, forex trading, time & sales info, iBot, and many other features too many to mention.

Very advanced charting is finally available to Lite clients. Up to 40 years of price history can be shown. We counted no less than 100 studies. Drawing tools include arrows, Fibonacci lines, and text boxes.

The order ticket appears in the top-left corner of the platform. There are many advanced features here, including OCO (one cancels other) orders and hedge preferences.

A “check margin” button is on the order ticket under the “advanced” menu. This is how you can find initial and maintenance margin requirements for any ticker symbol.

Other Tools

Interactive Brokers offers API functionality for Pro customers only. Lite customers do get a smartwatch platform for Apple phones. However, iMessaging is not possible.

iBot is available on Amazon Echo devices as a skill. It can read business summaries of stocks, give quotes, tell you how to open an IB account, and provide dates of upcoming company events.

There is no IB app for Apple TV.

Option Tools

Option tools on the client portal are pretty crummy. There are no pre-installed multi-leg strategies.

On the mobile app it’s possible to build your own multi-leg strategies. There is an option Spread

template on the app.

On Trader Workstation, it’s a different story altogether. OptionTrader is a window (launched from the blue “New Window” button in the upper-left corner) that delivers a lot of useful tools. One is option chains; another is multi-leg strategies, such as iron condors and boxes. Greek values and profit & loss diagrams are other highlights.

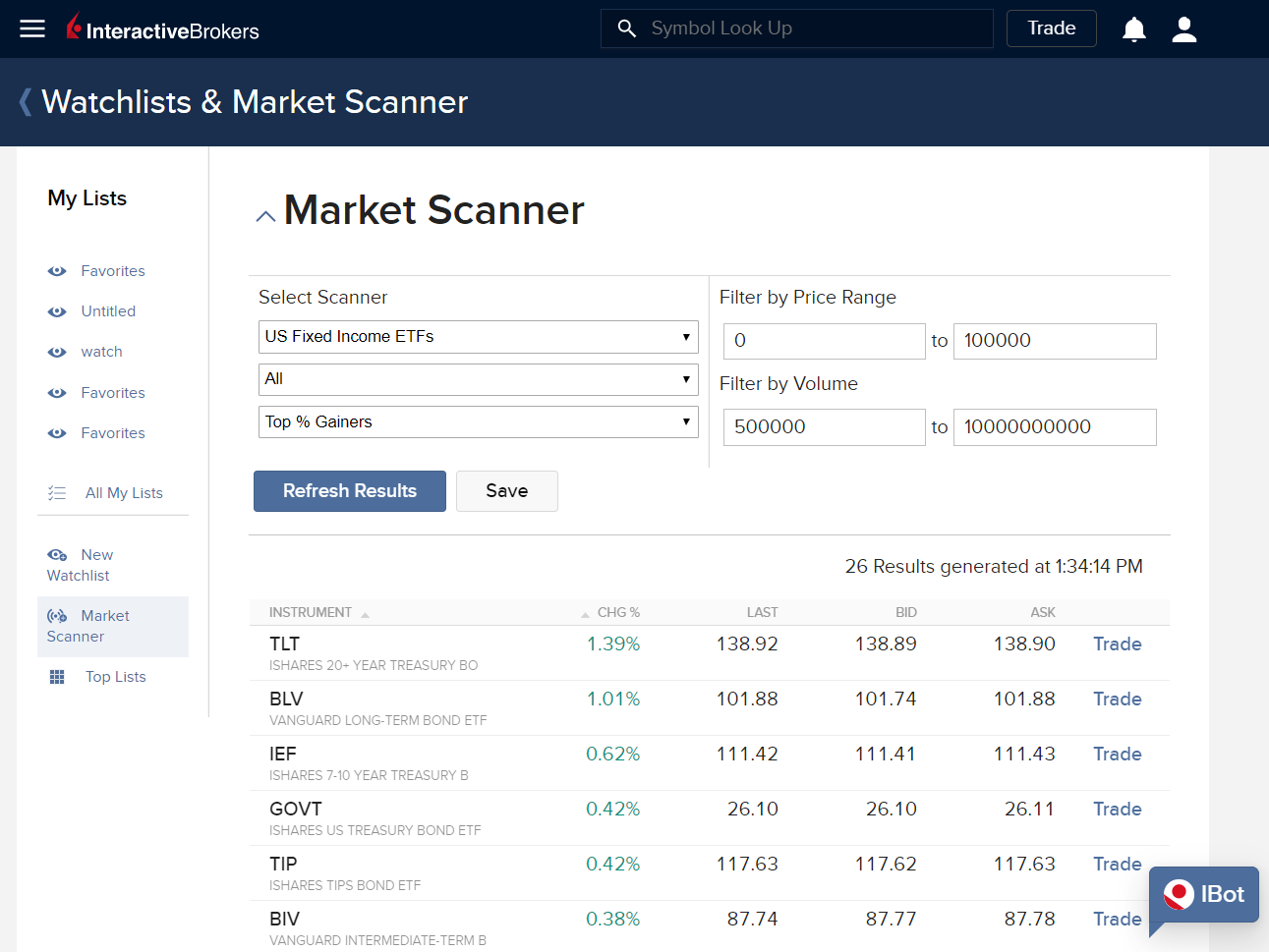

Investment Research

There are some good security research features at Interactive Brokers. An ETF screener is on the client portal. Separate searches must be performed for bond ETF’s and stock ETF’s. Volume and price are searchable criteria. A drop-down menu provides many more variables. The same tool can be used to scan for U.S. stocks and foreign investments.

The Interactive Brokers website has an educational hub (found in the top menu). During our snooping, we found a lot of articles, webinars, videos, and courses. Topics covered include options pricing, how to place a short sale, and generating income in a retirement account.

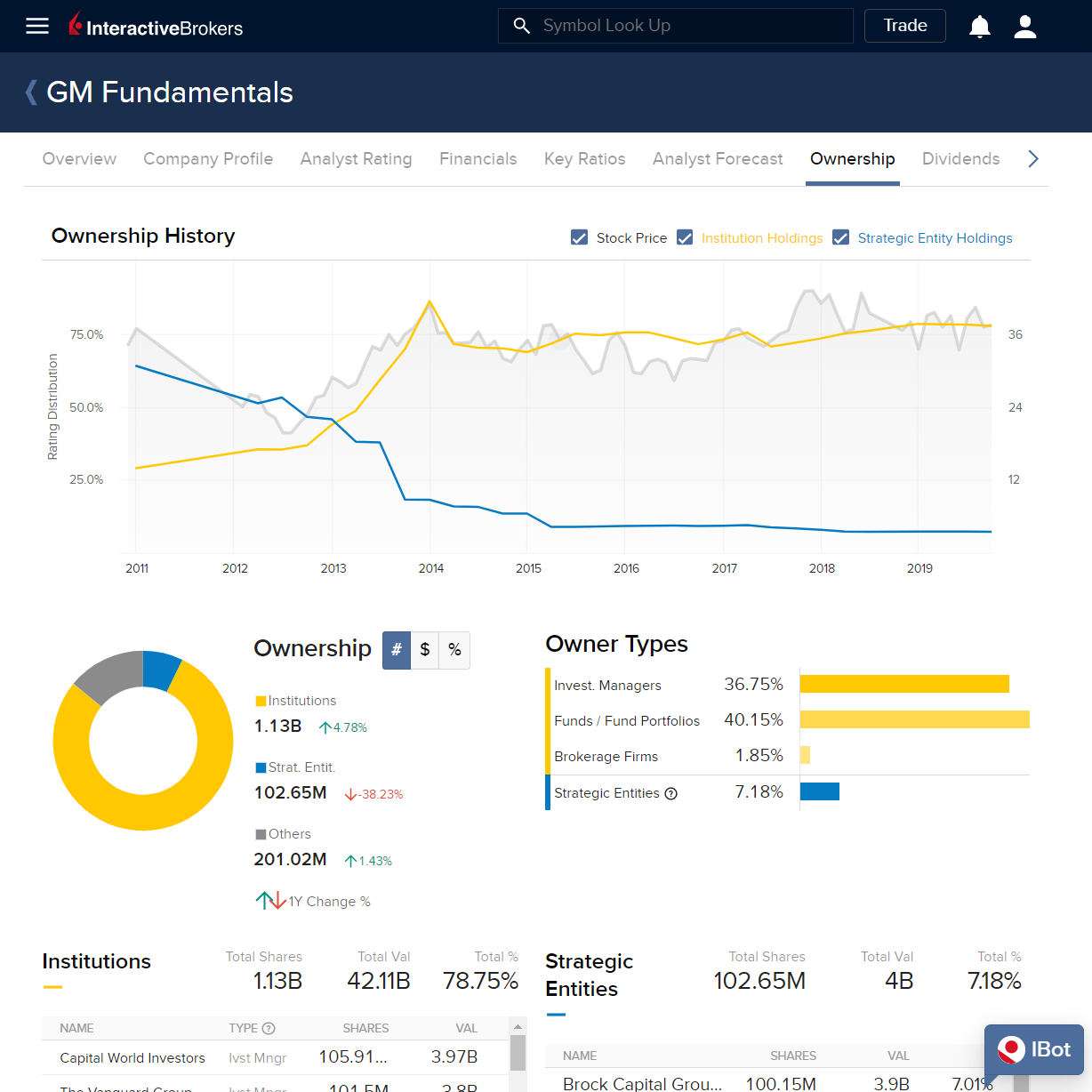

On the client portal, stocks have a good amount of information. To find the details, we first had to enter a ticker symbol and then click on “Fundamentals” on the stock’s front profile. Once we got to the particulars, we found information on dividend payments, analyst ratings with price targets, ownership by funds, EPS history with estimates and actual numbers, SEC statements, key ratios such as price/book in both numerical and colored chart format, and a company profile.

The one feature we wanted to see here but couldn’t find is stock reports in pdf format from third-party analysts.

Mutual Funds and ETF’s

IBKR Lite customers can buy and sell roughly 26,450 mutual funds from around 285 fund families. About 7,000 of these have no load, and about 8,300 have no transaction fee. Non-U.S. residents can trade a smaller list of mutual funds.

The mutual fund scanner in desktop TWS and client portal offers a lot of functionality and allows to

sort on things like Lipper ratings, yield, returns, expense ratios, etc.

Money market funds have a minimum investment of $10,000, while other funds are at $3,000. Transaction-fee funds are $14.95 per trade or 3% of trade value, whichever is smaller.

Account Types

A few account types can be opened with the IBKR Lite commission schedule. These include individual, joint, UGMA/UTMA, trusts, and IRA’s. IRA types include traditional, Roth, rollover, SEP, and inherited. There is no SIMPLE account.

Other account types that Interactive Brokers offers for institutional investors cannot use IBKR Lite.

Banking Features

IBKR Lite customers can sign up for the broker’s FDIC-sweep program. It offers up to $2,500,000 worth of government insurance, which is 5 times the normal level. As already mentioned, IB pays interest on free cash balances. Bill pay is available; however there are per-transaction charges.

A debit card from Mastercard can be attached to an IBKR Lite account free of charge. It functions with Android, Apple, and Samsung Pay. There are no ATM refunds, however; and IB doesn’t offer checkwriting.

Foreign Stocks

IBKR Lite accounts have the same access to foreign markets that other IB clients have. This great service includes not just international stocks, but other financial products like bonds and options. The assets can be traded on foreign exchanges with Trader Workstation. Even better, commissions are very reasonable.

Day Trading

IBKR Lite offers several trading services day traders will appreciate. Some of them we have already seen, namely the desktop software. The following should also be noted:

Short Locate

Interactive Brokers offers a convenient short locate feature on its website. You simply need to enter a ticker symbol, and the tool will show how many shares are available for shorting and—perhaps more importantly—the cost to short the stock.

Level II Quotes

Available on Trader Workstation, Level II quotes show the bid and ask prices that are available through specific market venues.

Direct-Access Routing

Also available on Trader Workstation, it’s possible to send orders to specific exchanges.

Margin

Both initial and maintenance margin requirements for IBKR Lite clients are 25% for long stock positions. The end-of-day margin requirement is 50%.

IBKR Lite Margin Rates

|

Debit Balance

|

Margin Rate

|

|

$0 - $100,000

|

7.83%

|

|

$100,001 - $1,000,000

|

7.83%

|

|

$1,000,001 - $50,000,000

|

7.83%

|

|

$50,000,001+

|

7.83%

|

IBKR Pro Margin Rates

|

Debit Balance

|

Margin Rate

|

|

$0 - $100,000

|

6.83%

|

|

$100,001 - $1,000,000

|

6.33%

|

|

$1,000,001 - $50,000,000

|

6.03%

|

|

$50,500,001+

|

5.83%

|

Other Services

IBKR Lite customers can enroll an entire account (but not individual securities) for automatic dividend reinvesting. IB does not offer periodic investments into mutual funds.

Recommendations

Mutual Fund Investors:

With the best selection of mutual funds in the industry, IB is now a great broker for mutual funds

investing.

Individual Retirement Accounts: TD Ameritrade offers a larger selection of IRA’s than Interactive Brokers; so it gets our stamp of approval.

Beginners: Interactive Brokers is designed

for experienced traders, and nothing about IBKR Lite changes that school of thought.

Webull would be good for new

traders.

Active ETF and Stock Trading:

IB is one of the best brokers for active traders.

Long-Term Investors and Retirement Savers: Fidelity and

Charles Schwab are our picks.

Small Accounts: Because IBKR Lite comes with neither fees nor minimums, we can endorse it for

small traders.

Interactive Brokers Review Summary

It seems that a paradox has been discovered: Interactive Brokers is designed for professional-level traders,

but IBKR Lite is designed for basic trading. Despite this contradiction, IBKR Lite does offer a good value with

low prices and advanced features.

Interactive Brokers Promotion

Open IB Account

|