Thinkorswim vs TastyTrade 2024

Overview of thinkorswim and TastyTrade

TastyTrade and Thinkorswim are very popular brokers in the retail investment space, and they owe their popularity to their unique products.

Commissions

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Margin

Rate |

Maintenance

Fee |

Annual IRA

Fee |

|

TastyTrade

|

$0

|

na

|

11%

|

$0

|

$0

|

|

Thinkorswim

|

$0

|

$49.99 ($0 to sell)

|

13.575%

|

$0

|

$0

|

TastyTrade and Thinkorswim Ownership

Although the two platforms are very different, there are some interesting similarities. Thinkorswim and TastyTrade were created by the same people, and you can see their influence in both products.

The current owners of TastyTrade, Tom Sosnoff and Scott Sheridan created Thinkorswim to give traders more access to professional-level investment tools. After selling Thinkorswim, they created TastyTrade, and their approach has not changed.

Like Thinkorswim, TastyTrade provides tools and features that are not available anywhere else.

Trading Platforms

TastyTrade and Thinkorswim have industry-leading trading platforms that provide multiple tools and services designed to give traders an edge in the markets. Your choice of ‘best platform’ will depend on your style of investing and preferences.

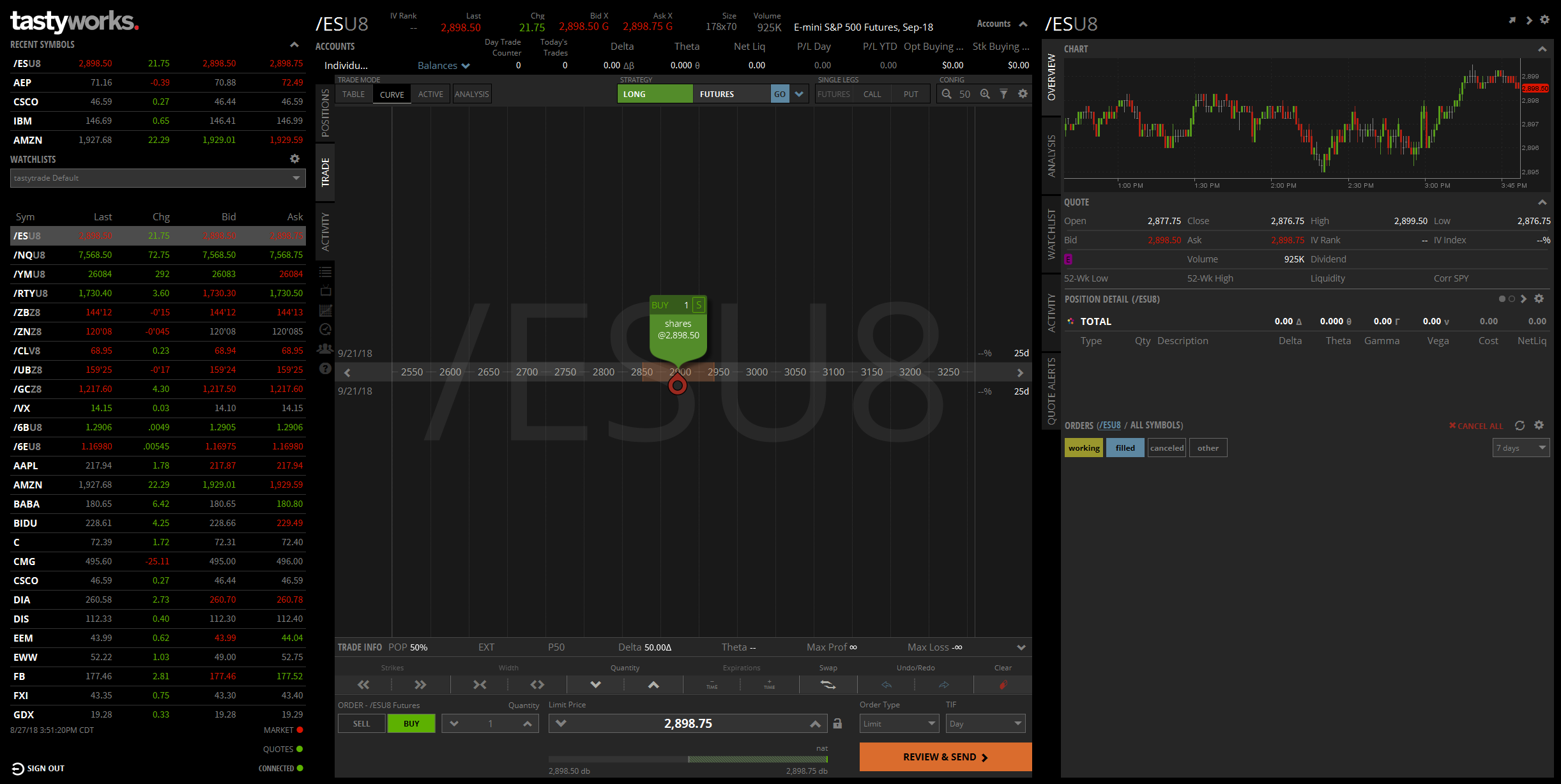

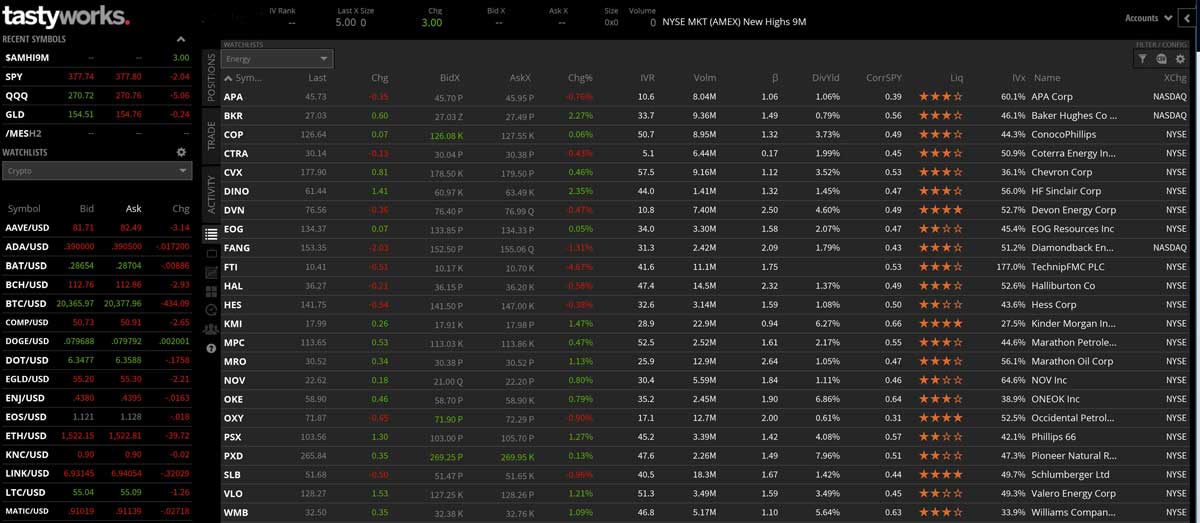

TastyTrade Trading Software

The trading software from TastyTrade is one of the biggest reasons people gravitate to the broker. The development team succeeded in creating a trading platform unlike anything else in the industry. At first glance, the bold colors and layout give a game-like look and feel. However, the longer you spend on the platform, the more of its many intricacies you discover.

Some of Tastywork’s platform highlights include:

- Pre-built watchlists and a watchlist manager

- A follow feed allowing users to follow the trades of TastyTrade staff

- Live video during market hours

- Innovative options trade execution tools

- Simple point-and-click order entry for advanced options strategies

- Limit orders (for closing positions) based on the profit percentage earned

- Active trade tools for futures and stocks

- Pairs trading support

- A growing list of charting tools, including support for third-party indicators

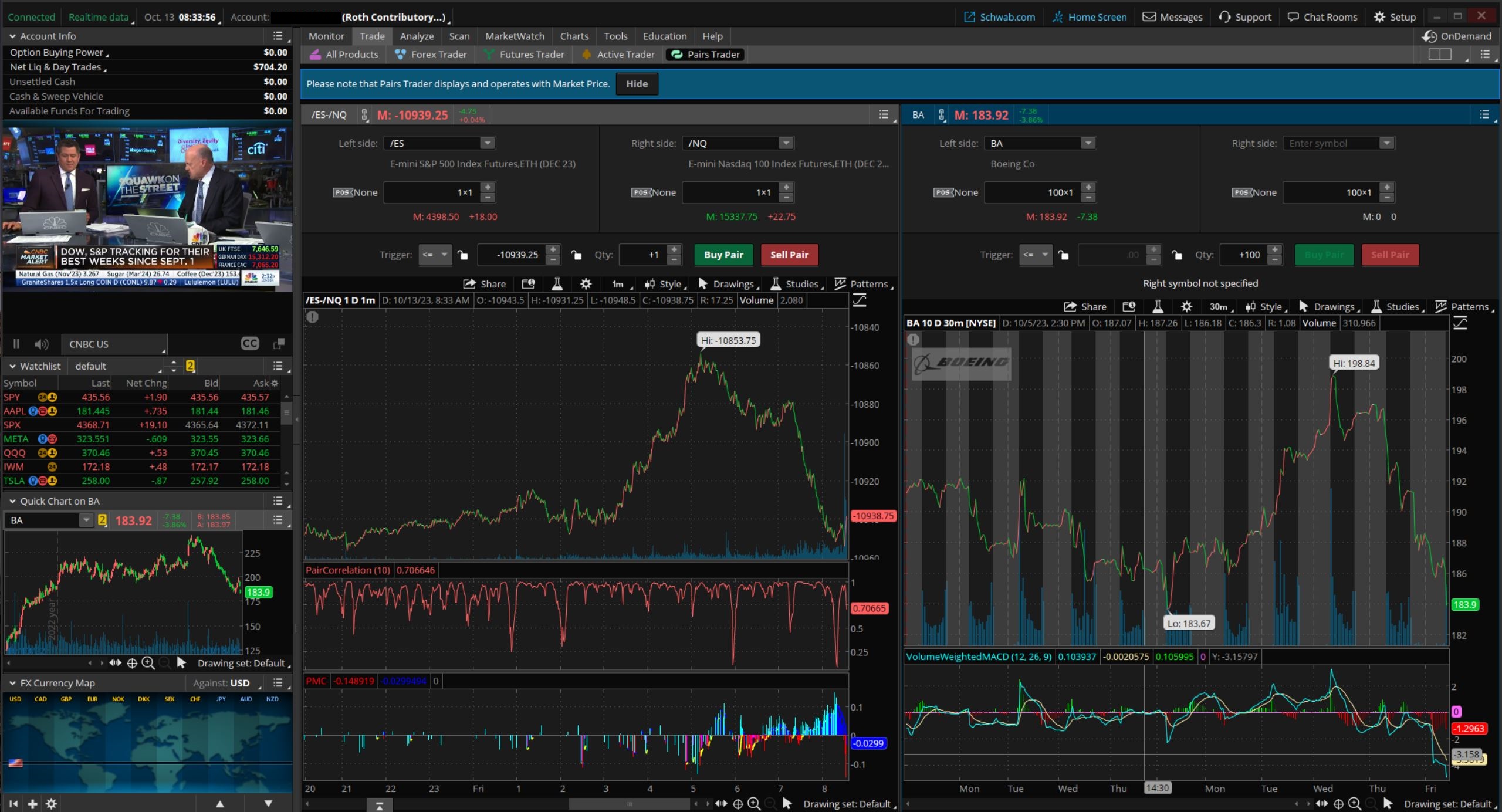

Thinkorswim Trading Software

Thinkorswim is a go-to trading platform for traders of all kinds. The platform does come with a slight learning curve due to its complexity, but everything a trader would need to access the financial markets is baked right in.

Some of Thinkorswim’s highlights include:

- Fully customizable trading platform with its own coding language, Thinkscript

- Advanced charting tools

- Detailed economic calendar allowing you to keep track of market-moving events

- Dedicated futures and Forex trading dashboard

- Earnings analysis for securities

- More than 400 technical indicators for charting, with the ability to add third-party tools

- Users can create their own indicators or modify the ones they use with the platform’s coding tool

- In-depth scanners for stocks and other investment tools

Visit Websites

TastyTrade:

Get $250 for each trader you refer with this referral link.

Thinkorswim: Get $0 trading commissions free Charles Schwab account.

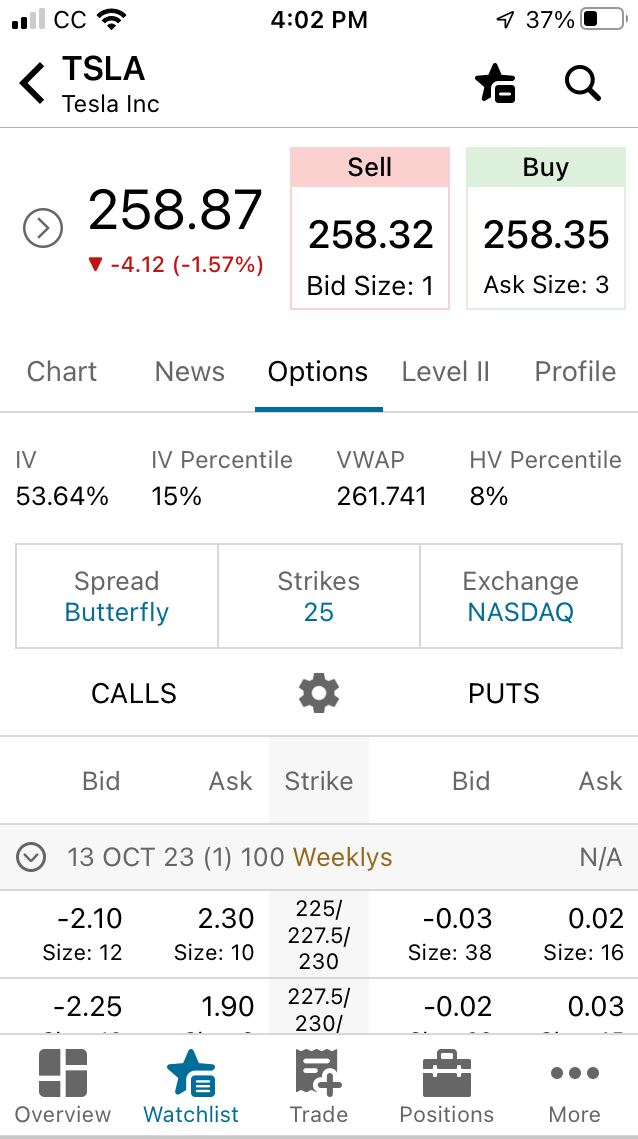

Mobile Access

As with the trading platforms, both TastyTrade and Thinkorswim provide full-featured trading apps. Both brokers have built a full suite of tools and services into their mobile applications, and it is possible to place trades and manage investments in many contexts.

Thinkorswim Mobile has better charting than the TastyTrade app, but TastyTrade has a much more intuitive order entry interface. TastyTrade also has some unique tools and services that many investors find helpful. One example is the TastyTrade follow feature, which offers actionable investment ideas.

In terms of speed and reliability, both applications are excellent.

Customer Service

Customer service is always an essential feature of an online broker. TastyTrade and Thinkorswim provide good customer care, but Thinkorswim is a bit better regarding technical help.

When you need to ask a general question, using the virtual assistant at both brokers is the quickest way to get answers. However, both brokers also have a live chat feature during regular trading hours.

Where Thinkorswim edges out in front is the company’s ability to provide in-depth technical assistance when things aren’t working right. The Thinkorswim customer care team can access your machine and help you solve problems efficiently.

Margin Trading

Margin is available at both brokers. You can unlock margin buying power by depositing at least $2,000

into your account. With margin, you can purchase twice the number of shares your account balance would

otherwise support.

Despite the similarities, you do pay higher margin interest rates at Thinkorswim.

TastyTrade Margin Rates

|

Debit Balance

|

Margin Interest Rates

|

|

under $24,999.99

|

11%

|

|

$25,000 - $49,999.99

|

10.5%

|

|

$50,000 – $99,999.99

|

10%

|

|

$100,000 - $249,999.99

|

9.5%

|

|

$250,000 - $499,999.99

|

9%

|

|

$500,000 - $999,999.99

|

8.5%

|

|

$1,000,000 +

|

8%

|

Thinkorswim Margin Rates

|

Debit Balance

|

Margin Rate

|

|

$0 - $24,999.99

|

13.575%

|

|

$25,000 - $49,999.99

|

13.075%

|

|

$50,000 - $99,999.99

|

12.125%

|

|

$100,000 - $249,999.99

|

12.075%

|

|

$250,000 - $499,999.99

|

11.825%

|

|

$1,000,000+

|

call 877-752-9749

|

In addition to the lower margin interest rates, Tastyworks also has lower margin requirements for investment vehicles like futures and forex.

Available Securities

TastyTrade and Thinkorswim are both full-featured brokers offering a wide range of securities.

Whether you want to invest in stocks, futures, derivatives, forex, or fixed-income investment vehicles, you’ll be well served no matter which of these brokers you choose.

Although TastyTrade and Charles Schwab offer many types of securities, there are some that can be found at one broker rather than the other. For instance, TastyTrade offers cryptocurrency trading and does not support OTC securities. The opposite is true for Charles Schwab.

Ease of Use

For newer traders, TastyTrade is the most accessible platform to use. However, Thinkorswim has a more traditional format making it easier for investors who have been around for a while.

The TastyTrade trading platforms provide easy navigation and trade execution but do not skimp on the details. Beginners and experts can feel right at home using TastyTrade’s tools.

Thinkorswim is similar in that it appeals to investors of all experience levels. The platform customizability that thinkorswim is known for allows advanced users to adjust the platform to specific use-case scenarios. At the same time, thinkorswim has many pre-built features that do not need to be changed.

Education and Advisory Services

You'll find good options at both brokers if you are looking for education and advisory services. However, the services you find at each are quite different. The ‘better choice’ comes down to what you are looking for.

The educational content provided by both TastyTrade and Thinkorswim can be accessed from within the respective trading platforms.

TastyTrade

At TastyTrade, investors can access educational content in a few different ways. The broker offers a learning platform called tastytrade that provides courses and interactive live broadcasts. There is also a follow feature available in the trading software and the mobile app. The following feature allows investors to see (and learn from) what types of positions other traders are putting on.

Thinkorswim

Thinkorswim offers a built-in education suite called the Learning Center. Investors can read articles and descriptions on a variety of topics. There are also video courses and regular webinars discussing important topics.

Visit Websites

TastyTrade:

Get $250 for each trader you refer with this referral link.

Thinkorswim: Get $0 trading commissions free Charles Schwab account.

Recommendations

TastyTrade and Thinkorswim are great at what they do. While there is much shared between them, both focus on different things. The better choice comes down to what you want and expect from your broker.

If you are looking for a trading platform that provides an intuitive trading interface, capped commissions, a trade-follower tool, access to the cryptocurrency markets, and ongoing bonus offers, TastyTrade may be the better choice for you.

If you are looking for advanced charting tools, cash management features, a wider range of account types, and access to the OTC markets, Charles Schwab is the better choice.

Thinkorswim vs TastyTrade Summary

thinkorswim, backed by Charles Schwab, outperformed TastyTrade in most categories. Nevertheless, the latter company offers a great value, especially for options and futures trading.

Open TastyTrade Account

Open TastyTrade Account

Open Thinkorswim Account

Open Thinkorswim Account