Trading Options at Merrill Edge

No doubt, Merrill Edge is one of the best places in cyberspace to trade options. Our research reveals why.

Options on the Website

A good place to start with options trading is on the Merrill Edge website. Under the Research tab, there is a link for options. Select this to get the page on options research. There is a lot of material on this hub. The following tabs help to navigate through the information:

- Overview

- Options Screener

- Strategy Assistant

- Education

Beginners should start with the Education tab. Here, we found articles and videos on a wide range of topics. Examples include:

- Equity Option Basics

- The Greeks

- Options Pricing

- Generating Income

The Screener tab is a good place to visit to actually find contracts that are over- or undervalued. The search engine can look for contracts based on lots of criteria, including:

- Greek values

- Historical volatility

- Underlying security rating

- Expiration date

- Option type (call or put)

- Intrinsic value

During our test drive of the search wizard, we found over 800,000 contracts. Not bad.

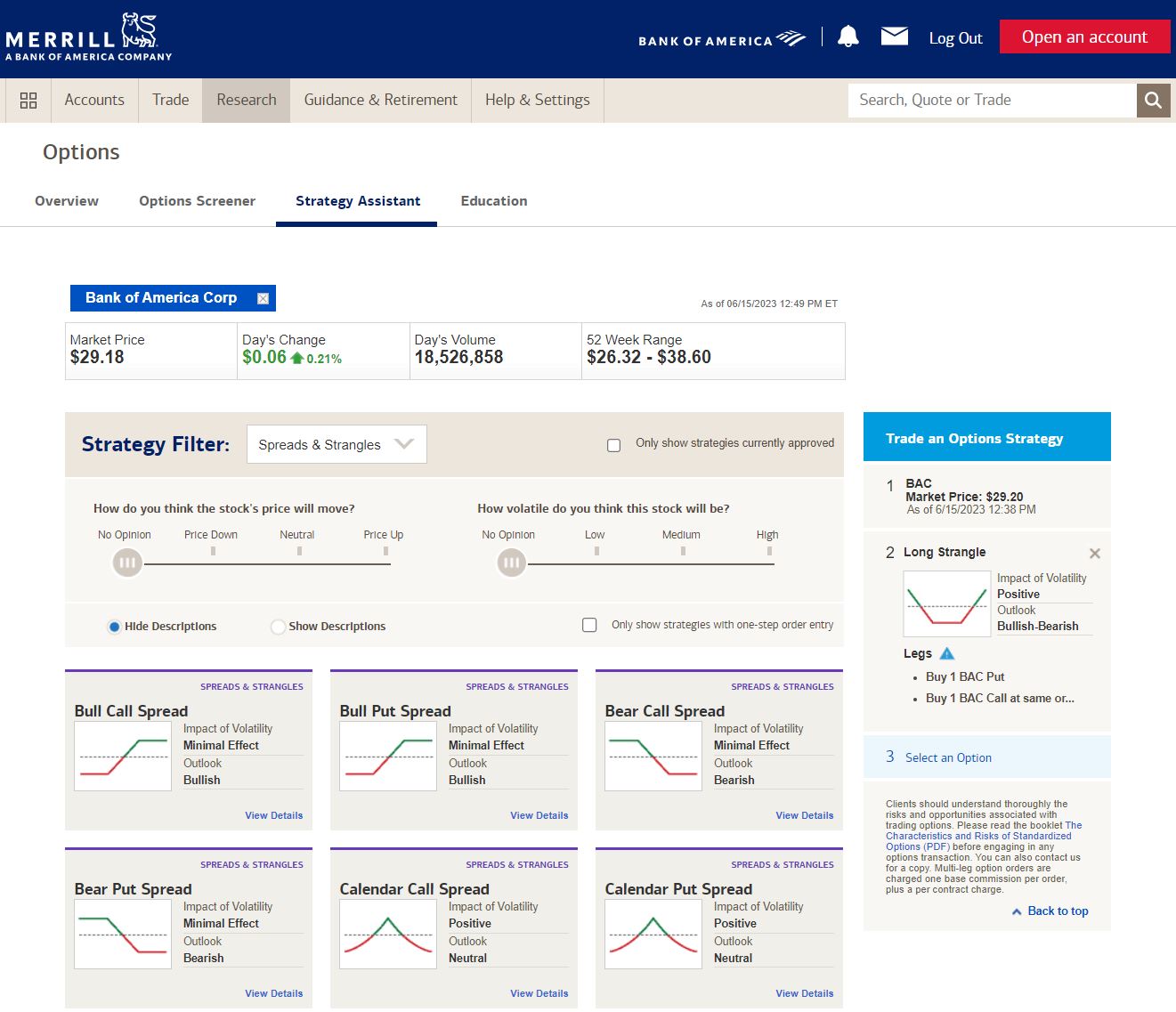

The strategy builder on the Assistant tab is really good for finding a spread to trade. The only required input is ticker symbol or company name. The results can be filtered by the following issues:

- Stock sentiment (bullish, bearish, or neutral)

- Expected volatility (low, medium, or high)

- Strategy type (calls/puts, spreads and strangles, stocks & options, advanced strategies)

- Strategies only the selected account can trade

The results are shown in tile format. Clicking on a tile populates the step-by-step order ticket with the chosen strategy. The next step is to select an expiration date. Finally, click on the hyperlink of a proposed trade to see the profit-loss diagram. At this point, it’s possible to adjust contract quantity, expiration date, option type, strike price, and action (buy or sell). If everything looks good, the trade can be submitted.

Options on the Mobile App

The website is only the beginning at Merrill Edge. The company’s mobile app can also be used to trade derivatives. To do this, simply go to an asset’s profile and look for the link to view the option chain on the stock or ETF. The profile can be found by doing a search on the Research page or scrolling to the bottom of the Accounts tab to find the app’s watchlist.

The option chain will have prices for calls and puts. Unfortunately, there are no spreads of any kind on the app. Nevertheless, it is possible to trade the individual contracts that show up. To do this, simply tap on a bid or ask price. The option order ticket will automatically populate with the contract requested. Details, such as expiration date and strike price, cannot be changed here. There is a graph at the top of the contract’s price history.

Near the bottom of the option’s profile on the app is a list of important details, including open interest and days to expiration. It’s a good idea to review these particulars before submitting a trade for the contract. There are buy and sell buttons at the bottom of the screen.

Options on MarketPro

There’s another place where Merrill Edge clients can trade options: the web-browser platform. Called MarketPro, it actually offers two routes. The first is under the Options tab, which appears in the top menu. Here, there are chains for calls and puts plus other strategies, like butterflies and condors. Simply right click on a bid or ask price in the chains and select buy to open or sell to open to fill the appropriate trade ticket.

The second way to trade options on MarketPro is with OptionsPlay. This is a discrete platform—a platform within a platform—that delivers a lot of tools that the first choice doesn’t. For example, OptionsPlay has a graph of standard deviation, trade suggestions based on bullish or bearish sentiment, and a profit-loss simulator that helps to see potential gains and losses on a trade.

It’s possible to modify a suggested trade on OptionsPlay, and this feature creates an easy way to take a suggestion from the software and tweak it a little. To do this, simply click on the modify button that appears on a proposed trade and change any of the features mentioned above that can be changed on the website.

Pricing

Although we do really like its software for options trading, quality comes at a price. Merrill Edge charges $0.65 per contract on every derivative trade. Using a live agent over the phone adds $29.95. There is no charge for exercises or assignments, though. The value of options trading with Merrill Edge is debatable, especially with brokers nowadays with no contract fees.

|