|

Interactive Brokers vs Public (2024)

Interactive Brokers vs Public.com—which app is better in 2024? Compare investing accounts, online

trading fees, stock broker extended hours, and differences.

|

Interactive Brokers vs. Public.com Introduction

If you want to find a broker that offers fractional shares, Public and Interactive Brokers have

what you’re looking for. We’ll help you choose the right one. Here’s how the two firms differ:

Public and Interactive Brokers Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Public

|

$0

|

na

|

$0

|

$0

|

$0

|

|

IB

|

$0+

|

$14.95

|

$0.25+ per contract

|

$0-$240**

|

$30

|

Public and Interactive Brokers Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

Public

|

|

|

|

|

|

|

|

IB

|

|

|

|

|

|

|

Open Account

Public:

$20 of an asset of your choice with $1,000 deposit at Public.

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Securities Offered

Interactive Brokers customers have access to the following list of investments:

- Fixed-income securities

- Precious metals

- Forex

- Structured products

- Contracts for difference

- Futures (including Bitcoin contracts)

- Warrants

- Equities (including over-the-counter and penny stocks)

- Option contracts (including options on futures)

- ETFs

- Mutual funds

- Closed-end funds

- Crypto-currencies

On top of all of its U.S. offerings, Interactive Brokers also offers many foreign assets.

Public traders can buy and sell these securities:

- Exchange-traded funds

- Stocks (excluding OTC stocks)

- Opetions

- Closed-end funds

- Crypto-currencies

Winner: Interactive Brokers

Trading Software

IB customers can choose from a desktop platform (with many professional-level tools), a client portal with less robust charting (but with many useful features, including an advanced order ticket), and a browser platform with direct-access routing. This last piece of software is only available to IBKR Pro customers. The broker’s desktop platform has a demo mode, which is a great way to practice the software.

Public has no computer software at all, other than its website, which has no trading capability.

Winner: Interactive Brokers

Mobile Apps

IB’s mobile app is on a professional level with lots of powerful resources. There is an artificial intelligence that’s a work in progress. Horizontal charting with multiple tools is not to be missed; and the platform’s multiple order tickets are excellent.

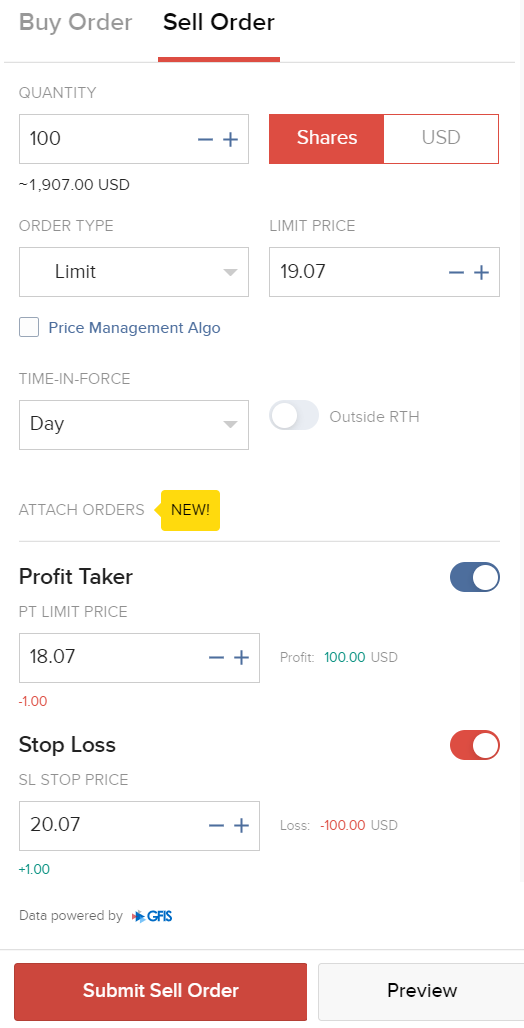

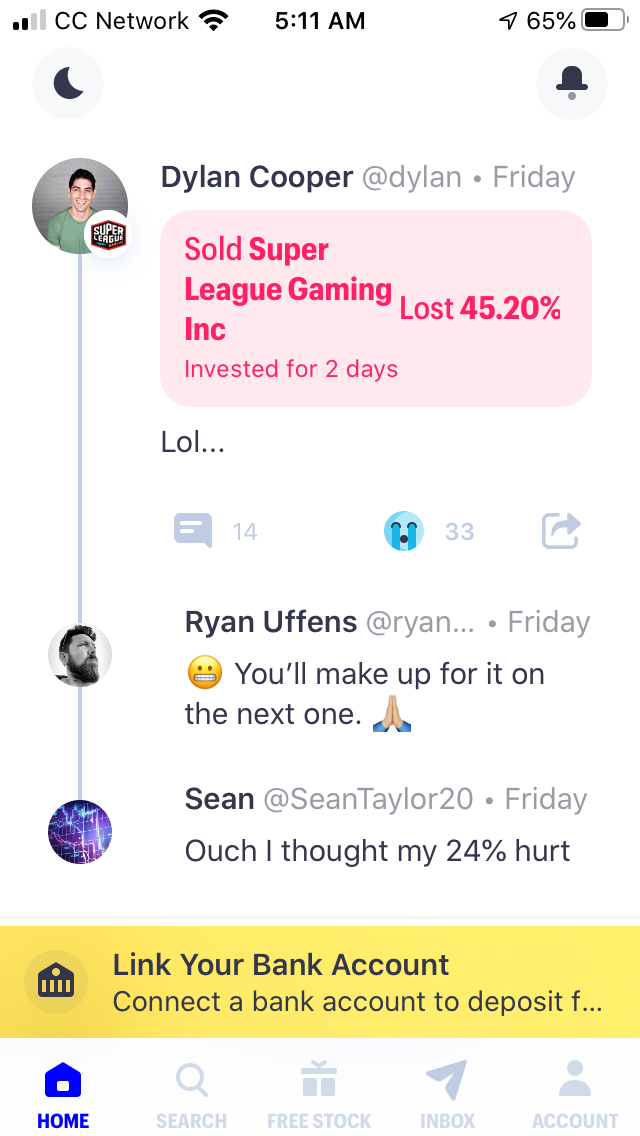

Public’s app doesn’t have an advanced order ticket, horizontal charting (or any tools), option chains, or an AI. There is a social networking forum that allows customers to connect with each other, the one highlight.

Winner: Interactive Brokers

Investment Education

Public customers who need to brush up on their investment knowledge won’t find a great deal of help. The company’s website hosts a few articles on topics such as:

- What is a stock?

- Bonds – Types and Benefits (although Public doesn’t offer them)

- How do bear markets recover?

The Public website also displays the day’s biggest market movers, a back-testing stock value machine, and a series of online events.

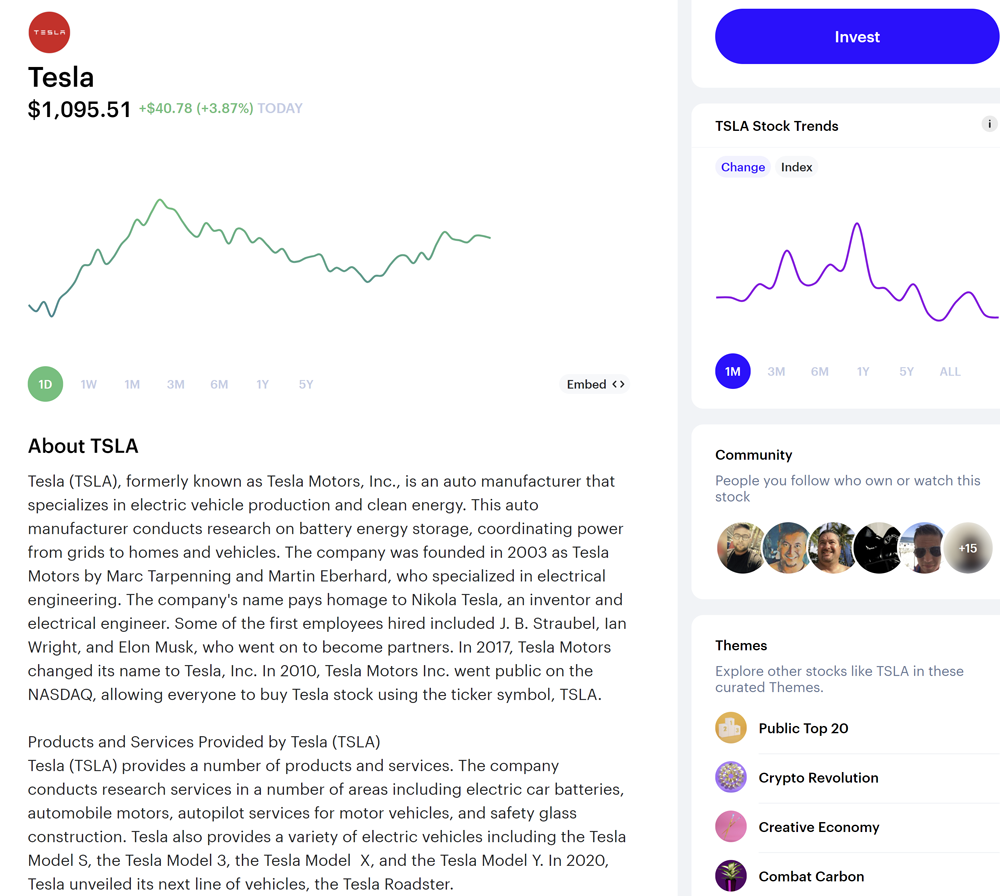

Security profiles at Public display a moderate amount of information. For example, there are news articles, company events, trade suggestions, and trade data points like market cap.

Interactive Brokers has a stock screener, a great tool that Public fails to deliver. Moreover, the IB screener can be used to look for global investments. Equity profiles on IB’s client portal show enormous amounts of information, including:

- Option chains

- ESG Ratings

- Price targets

- Analysts’ trade recommendations

- Ownership details

- List of competitors

- Financial statements, in both quarterly and annual formats

IB’s website hosts an education hub with the following resources:

- Traders' Academy

- Webinars

- Short Videos

- Traders' Glossary

- Student Trading Lab

- Traders' Calendar

- Live Events

Winner: Interactive Brokers

Day Trading

Extended Hours. Interactive Brokers, but not Public, offers pre-market and after-hours trading.

Level 2 Quotes. Interactive Brokers offers Level 2 data (and several other data packages). Public does not.

Margin. IB has some of the lowest margin rates in the industry.

Shorting. IB has a short locate tool on its website.

Routing Fees and Rebates. IB offers rebates and fees for directly-routed trades.

Winner: Interactive Brokers

Other Services

Dividend Reinvestment Program: Both firms offer free DRIP services.

IRAs: If you’re trying to build a nest egg, Interactive Brokers offers IRAs; but Public does not.

Fractional-Share Trading: You can trade whole-dollar amounts at either firm.

Winner: Interactive Brokers

Promotions

Public:

$20 of an asset of your choice with $1,000 deposit at Public.

Interactive Brokers: Get up to $1,000 of IBKR Stock for FREE!

Our Recommendations

Stock and ETF Trading: Interactive Brokers.

Beginners: Public’s software is more user-friendly, but IB has more educational tools. Tie.

Long-Term Investors and Retirement Savers: Interactive Brokers.

Small Accounts: Both Public and IBKR Lite have no on-going fees or balance requirements.

Public vs Interactive Brokers Summary

Interactive Brokers is the obvious winner of this contest. Despite the result, we do recommend

Public over IB if you want to social network with other traders.

Open Interactive Brokers Account

Open IB Account

Open Public Account

Open Public Account

|