|

Tastytrade vs TradeZero vs Moomoo (2024)

Tastytrade vs Moomoo vs TradeZero—which is better? Compare investing accounts,

online trading fees, stock broker extended hours, and differences.

|

Moomoo vs. TradeZero vs. Tastytrade Introduction

Three powerhouses in active trading are moomoo, TradeZero, and tastytrade. But which one should you

choose? Keep reading.

Cost Comparison

Services

Promotions

Tastytrade:

Get $250 for each trader you refer with this referral link.

Moomoo:

Get zero commissions at Moomoo.

Tradezero:

Trade stocks, options & ETFs for free.

Available Asset Classes

TradeZero, moomoo, and tastytrade all offer trading in:

Stocks

Options

ETFs

Closed-end funds

tastytrade has cryptocurrencies, futures, and options on futures. A Caribbean branch of TradeZero has cryptos, and moomoo delivers access to multiple Chinese securities exchanges.

Not one of the three broker-dealers offers managed accounts.

Winner: Draw between tastytrade and moomoo

Margin Trading

All three brokerage firms offer margin trading. moomoo customers pay a flat

6.8% for U.S. and Hong Kong borrowings on long positions.

TradeZero also has a flat rate across all debit levels. Currently, it’s

9%.

tastytrade is the lone broker here with a tiered margin schedule. It varies from

11% to 8%.

moomoo’s software display margin details on entered ticker symbols. These data points include short interest rate and initial margin requirement.

Winner: moomoo

Computer Software

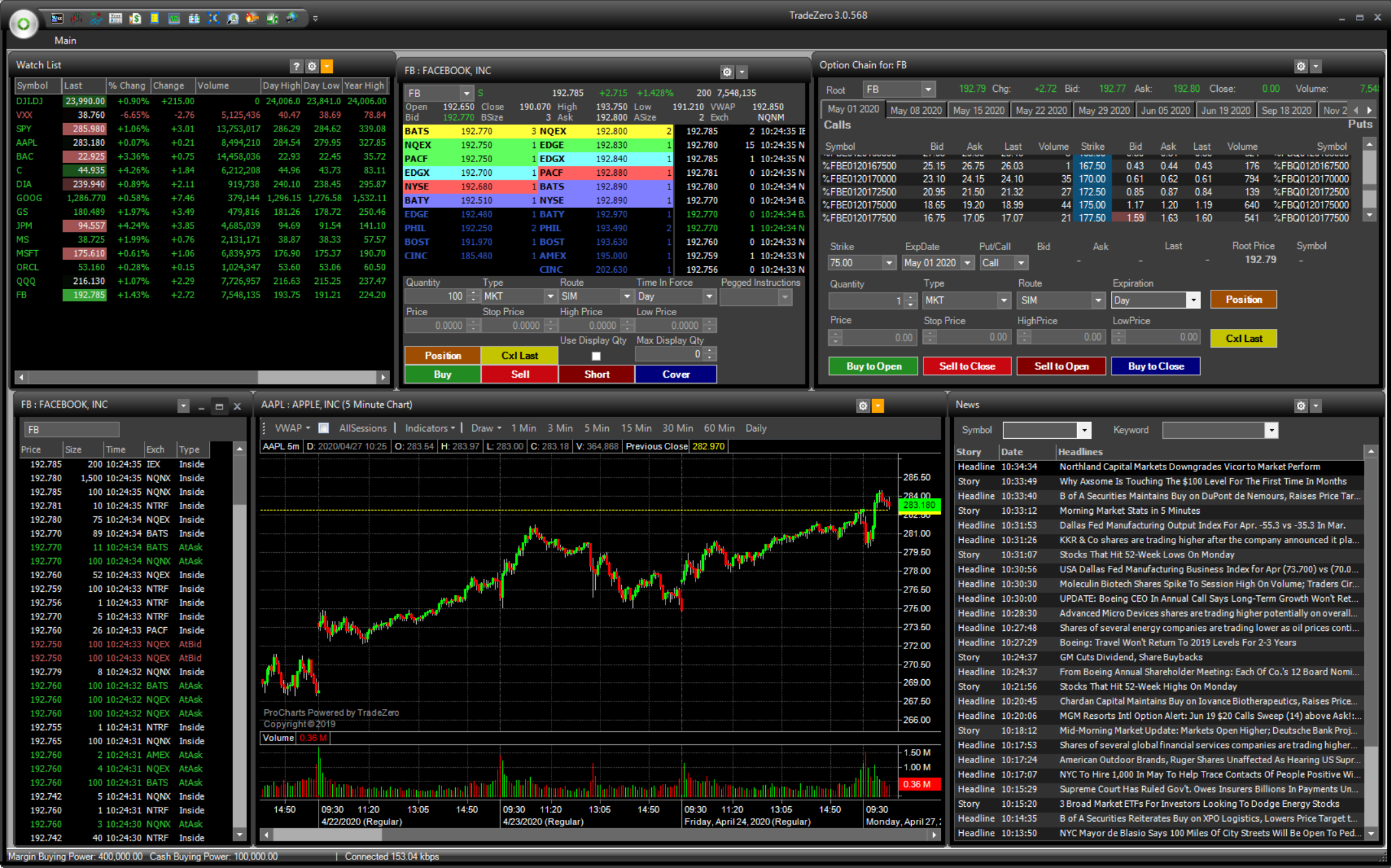

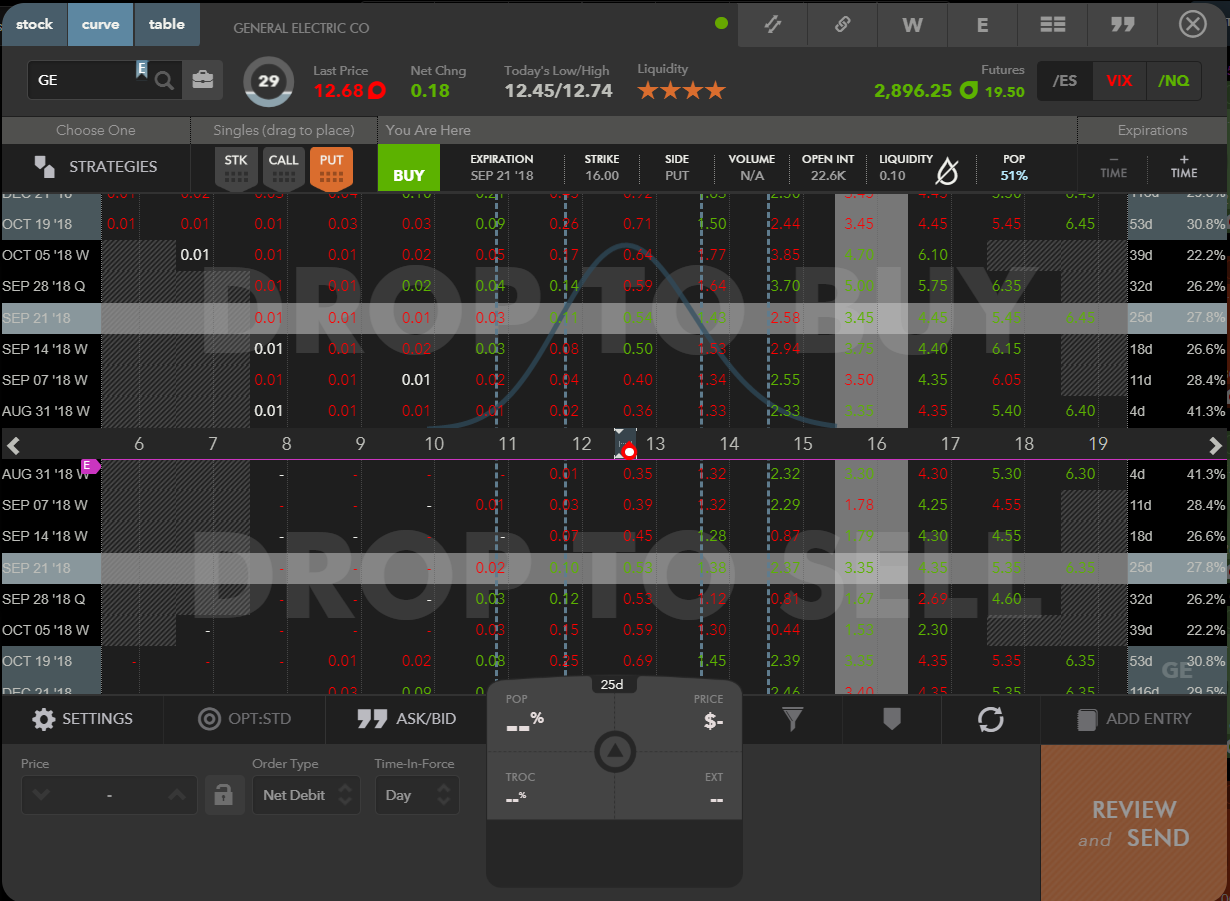

All three brokerage firms have websites and desktop platforms. TradeZero has multiple platforms, and two of them (ZeroPro and ZeroWeb) do have a monthly fee. It is $59 per month, which covers both platforms.

ZeroPro and ZeroWeb offer advanced hotkeys, multi-window charting, a stock screener, custom layouts, and more. Only ZeroPro offers a stock screener and options trading. ZeroFree is a free platform that provides trading and charting without most of these features.

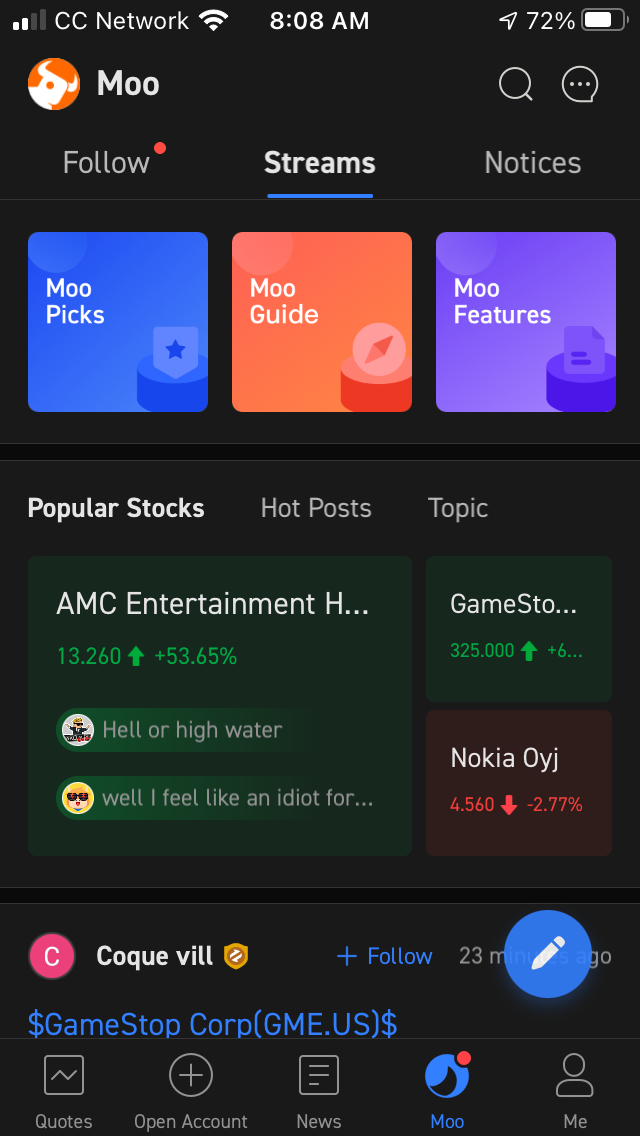

Over at moomoo, we found a free desktop platform with lots of tools. These include moo, a social-networking platform, and a Quant tool that is able to create automatic-trading strategies. Charting can be accomplished in full screen with lots of tools. The trade ticket has bracket orders.

tasty’s order form on its desktop platform also has bracket orders. The broker has a web-based order ticket that omits bracket orders. Charting is not very good on the browser system but is quite advanced on the desktop program. tastytrade is unique by publishing recent trades of its top executives. These trades can be found on its computer platforms.

Winner: moomoo

Mobile Apps

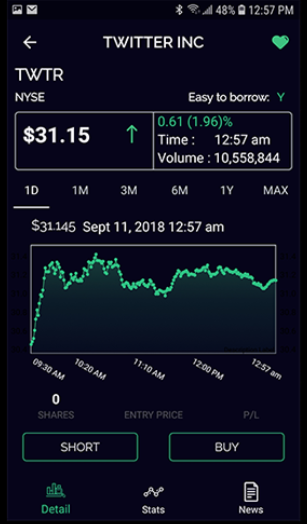

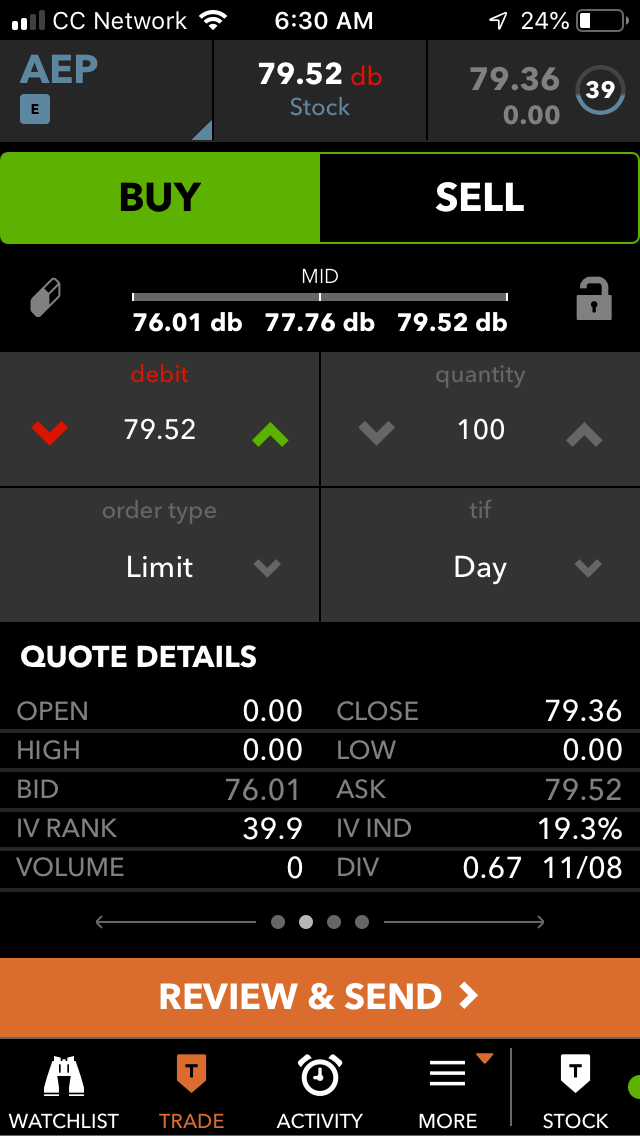

Traders who have to work during the market day can still trade with any one of the three mobile apps

these three brokers have created. TradeZero’s has no monthly fee and comes with some nice features, including:

- Discrete button for sell short

- News articles

- Watchlists

- Time & sales data

The tasty app has integrated option spreads. The order ticket has a graphical interface where contracts can easily be slid along a horizontal axis to change their strike prices. The ticket for equities has just four order types:

- Market

- Limit

- Stop

- Stop limit

moomoo’s app has an order form with 8 trade types, including some advanced ones like market-if-touched and trailing stop. Although charting on the tasty app is horrendous, moomoo succeeds in delivering horizontal charting with many tools. Social networking makes another appearance, and we really like the in-depth asset profiles.

Winner: moomoo

Day Trading

Short Positions: All three brokerage houses permit short positions. TradeZero has a short locate tool. tasty’s software shows if a security is hard to borrow. moomoo displays the number of shares available for shorting.

Level II Quotes: TradeZero and moomoo have them.

Direct Access to Market Venues: Available only at TradeZero.

Extended Hours: Pre-market and after-hours securities trading are possible at all three firms. TradeZero and moomoo have the longest sessions. Cryptocurrencies at tastytrade are available for trading almost 24 hours a day, 7 days a week.

Routing Fees and Rebates: Only available with a TradeZero account.

Day Trade Tracking: moomoo and tastytrade have day-trade trackers on their desktop platforms. TradeZero has one on its account portal on its website.

Winner: TradeZero

Supplementary Services

Cash Management: Only ACH and wire transfer tools will be found at these firms.

IPO Access: Possible at moomoo.

Fractional Shares: Not available at any of the broker-dealers in this comparison.

Individual Retirement Accounts: tastytrade has IRAs (and a $60 IRA termination fee).

DRIP Service: tastytrade offers it.

Winner: tastytrade

Recommendations

Active Stock Trading: It seems TradeZero has the edge for day trading, although its software fees cause us to balk. A better value will be found at moomoo, especially for traders of Chinese securities.

Small Accounts: TradeZero doesn’t cut it for small accounts. moomoo and tasty have no fees of any kind, at least on taxable accounts. There are no minimums, either.

Retirement Savers & Long-Term Investors: Not a single brokerage firm in this survey does well here. We would head to Schwab to find annuities, lifecycle mutual funds, branch locations, and financial-planning services.

Beginners: moomoo offers paper trading, which is a great way to practice.

Mutual Funds: No one here has them, but

Charles Schwab does.

Promotions

Tastytrade:

Get $250 for each trader you refer with this referral link.

Moomoo:

Get zero commissions at Moomoo.

Tradezero:

Trade stocks, options & ETFs for free.

Final Judgment

moomoo is the overall winner here. We do like TradeZero for day trading, and tasty is it for futures

and crypto trading.

|

Open Account

|

Open Account

|