|

Acorns in Europe (2024)

Is a brokerage account at Acorns available in Europe (Germany, UK, Hungary, France, Poland, Spain, Austria, Italy, Sweden and other countries)?

|

Is Acorns Offered in Europe

Acorns is not available in European countries (Germany, UK, France, Poland, Spain, Austria, Italy, Sweden, and others).

Open Acorns Account

Open Acorns Account

Alternative to Acorns in Europe

For European investors, we recommend opening an account with these American brokers:

ZacksTrade Website

Open ZacksTrade Account

Minor Accounts with Acorns

Like most other investment firms out there, Acorns will only open accounts for legal adults. This is 18 years of age. The company will also open accounts only for U.S. citizens or lawful residents of the U.S. Acorns will open accounts for soldiers in the armed forces who are temporarily overseas, although they do have to have a U.S. address.

While the age requirement is a hurdle, it is not something that’s insurmountable. On the contrary, Acorns offers custodial accounts, and these are an effective way around the age requirement.

A custodial account at Acorns can be opened in either UGMA or UTMA format. The specific account type will depend on the state of residence of either the minor or the custodian (either can be used). Most states nowadays use the UTMA account, which is the newer format.

And just to clarify, both a minor and a custodian must be used when opening a custodial account. The custodian is a guardian, such as a parent or a grandparent. Their name is on the account along with the child’s name. The child can be any age under 18 as long as there’s a custodian on the account of legal age.

By law, the assets in a custodial account belong to the minor, who receives them when hitting the legal age of majority. This can be anywhere from 18 to 25, depending on the state.

Both custodial account types (UGMA and UTMA) receive the same special tax treatment, which is one of their big advantages. Taxes are not deferred, but they are reduced. The first $1,250 in earnings for the tax year is tax free, which is pretty nice. The next $1,250 is taxed at the minor’s rate, which is usually lower than the parents’ or custodian’s rate. After that, the IRS is no longer generous.

Another big advantage of either custodial account type is that funds in the account can be used for any purpose, not just education, as is usually the case with most financial accounts for adolescents.

Opening an Acorns Custodial Account

It’s really easy

to open a custodial account on behalf of a minor on the Acorns website. Acorns calls

its custodial account the Early program. Just look for the Early link underneath the Investing tab at the top of the site.

On the Early page, look for the green “Get started” button. Click on this and you’ll get the broker’s online application. For a custodial account, you’ll need particulars on both the custodian and the minor, including both Social Security Numbers.

Cost of a Custodial Account at Acorns

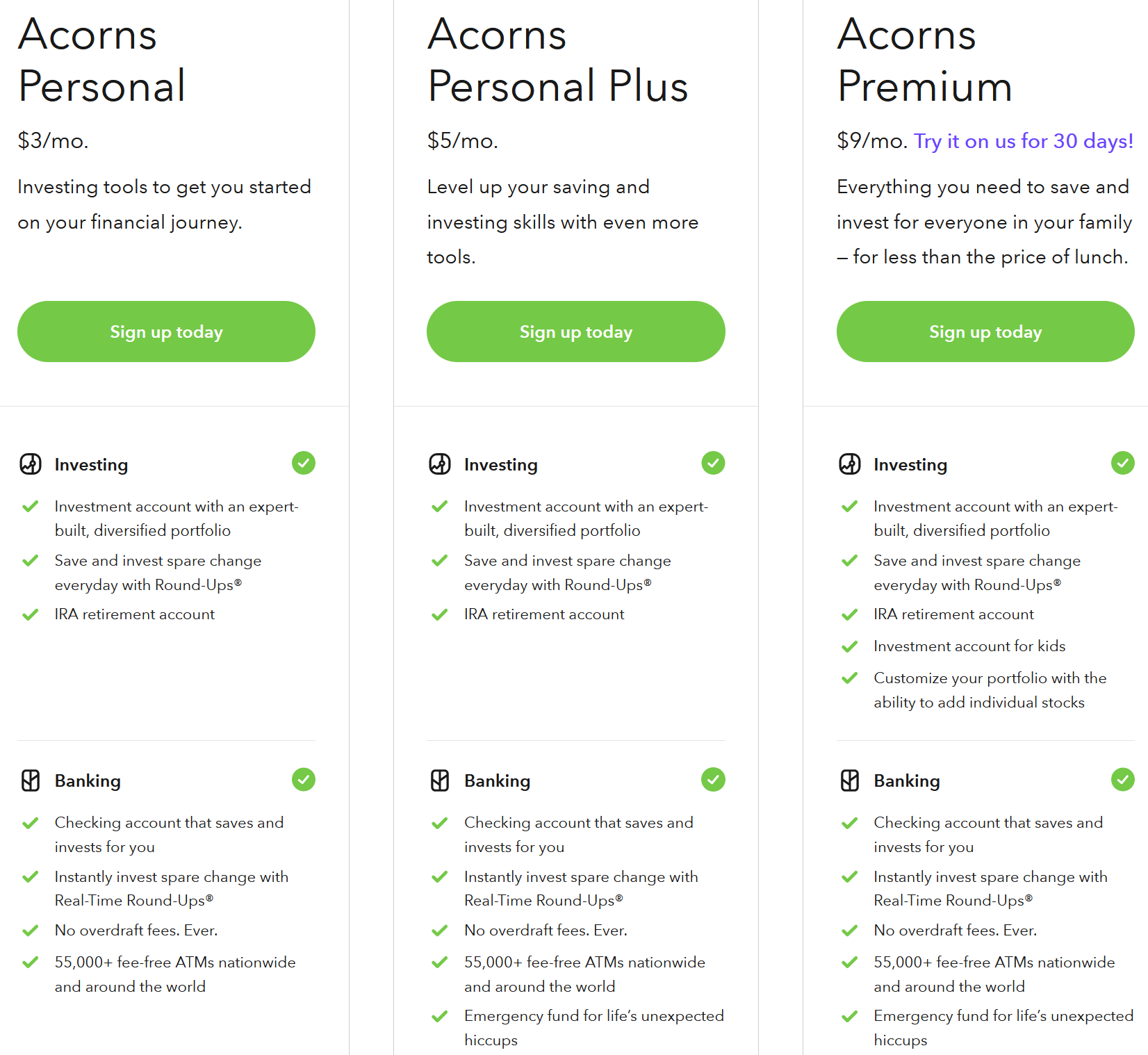

Acorns does charge a monthly fee for its investment service. It is $5. This fee is good for multiple custodial accounts.

Visit Acorns Website

Open Acorns Account

Acorns app in Europe Disclaimer

Availability of Acorns investing app in Europe (Germany, Great Britain, France, Holland, Poland,

Spain, Austria, Italy, Sweden, and other EU nations) might change without notice at any time.

Updated on 1/17/2024.

|