How to Transfer from Fidelity to Tradestation or Vice Versa

If you have a brokerage account at Fidelity Investments and want to give TradeStation a try, or if

you’re in the opposite situation, keep reading. We’re going to show you everything you need to know to get an account at one firm to the other.

Moving from Fidelity to TradeStation

To move from Fidelity Investments to TradeStation, simply follow these easy steps:

Step One: Open a new TradeStation account if you don’t already have one. An existing one will suffice if it has the same name on it and is of the same type (such as trust account to trust account).

Step Two: With the TradeStation account open, it needs to be prepared. If option contracts or a margin balance will be transferred in, these trading privileges must first be added to the TradeStation account. Be sure to add the right margin level. If any foreign stocks will be moved in the transfer, this privilege must also be added to the TradeStation account.

Step Three: With the TradeStation account fully prepared, it’s time to do the same with the Fidelity account. If you plan to perform a full account transfer, open orders need to be closed out, and all completed orders need to settle. Options that expire in less than a week should not be moved. Cryptocurrencies cannot be transferred in an ACAT transfer, which is what we’re doing here. Digital currencies reside in their own account at Fidelity; just be sure not to try to move this account. Foreign stocks can be moved in an ACAT (or DTC) transfer if both firms permit trading in such securities, and both do here.

Although TradeStation does offer trading in mutual funds, it’s possible that the broker wouldn’t accept some funds. It is recommended to check with TradeStation that specific mutual funds can be moved in.

If the Fidelity account is a robo account, all positions will need to be converted into cash because Fidelity’s automated program uses mutual funds that TradeStation won’t accept.

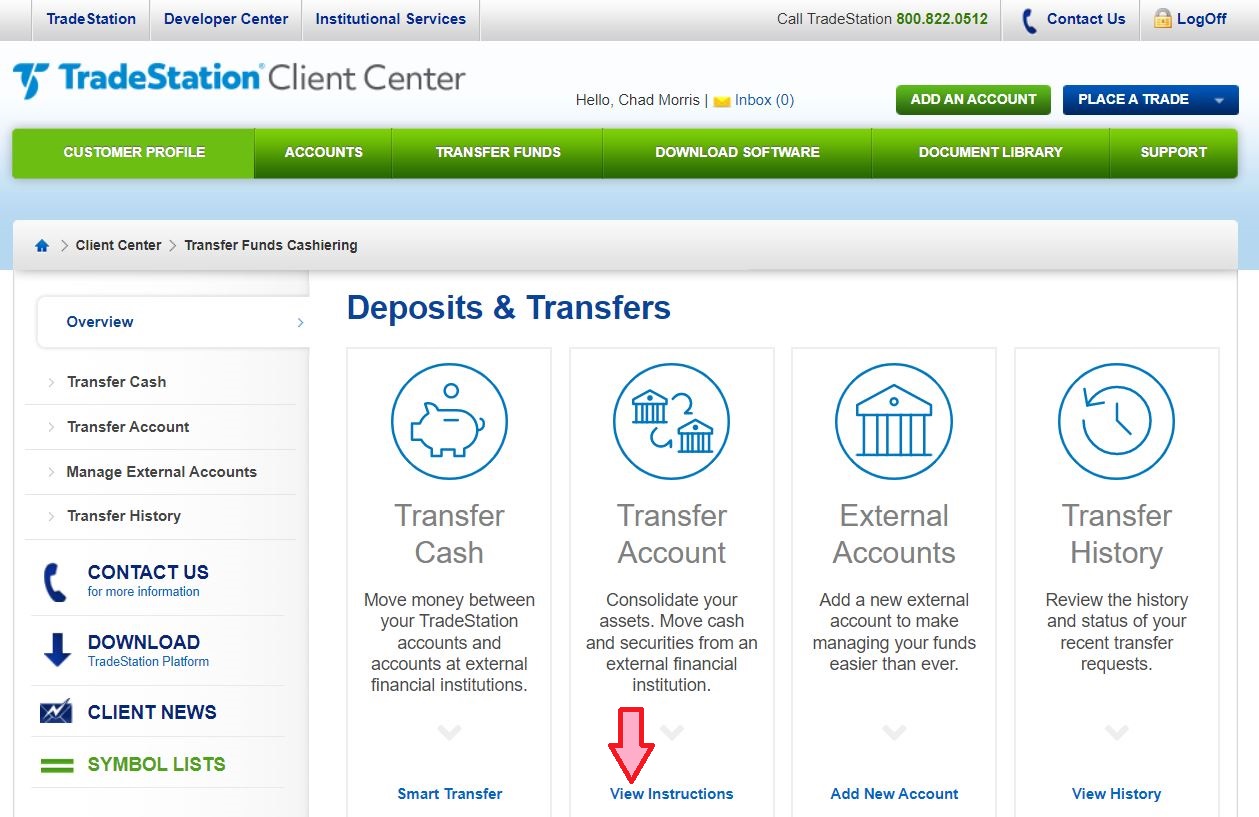

Step Four: With both accounts fully prepared, it’s time to make the ACAT transfer request, which must be done with the incoming brokerage firm. In this case, that firm is TradeStation. Unfortunately, TradeStation doesn’t provide an online ACAT form, so a hard-copy form must be filled out and sent to TradeStation. The form can be accessed through the hyperlink or by logging into the TradeStation account and clicking on the Transfer Funds link in the top menu and then selecting the link to transfer an account. Once filled, the form can be sent to TradeStation via email, snail mail, or fax.

Step Five: Monitor the transfer request. Once the request begins processing, it will appear on the TradeStation website. Go back to the Transfer Funds tab at the top of the site. This time, select Transfer History on the next page.

TradeStation charges $0 to receive an ACAT transfer, and Fidelity charges the same to send one.

TradeStation Promotion

Get up to $3,500 bonus with a qualifying deposit.

Open Tradestation Account

Moving from TradeStation to Fidelity

Going in the other direction will follow a similar path:

Step One: Open a new Fidelity account if the current one doesn’t have the right name on it or is not of the correct type. It could be either an advisory or self-directed account.

Step Two: The Fidelity account needs to be correctly set up. This means adding options and margin privileges, if necessary. Same goes for foreign-stock trading if any foreign equities will be coming over.

Step Three: The TradeStation account must be arranged properly. Futures cannot be sent through the ACAT network, and Fidelity doesn’t offer trading in them anyway. Option contracts should have at least a week of life in them. Cryptocurrencies should remain behind at TradeStation. Fidelity won’t accept some transfers of small OTC stocks.

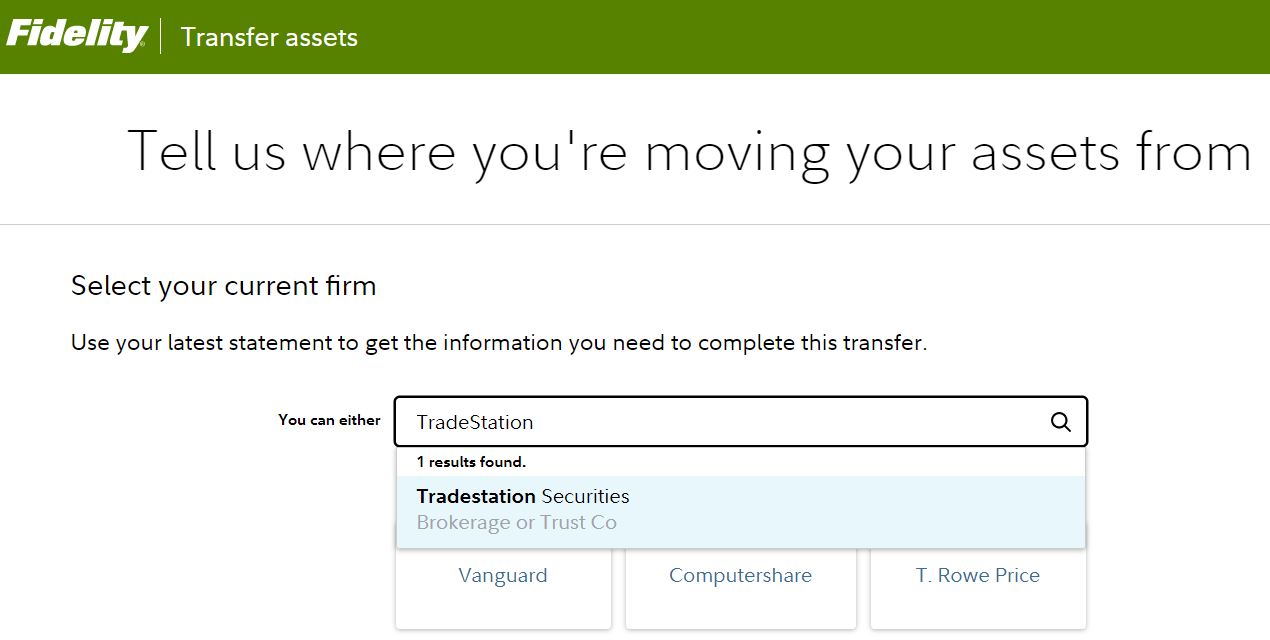

Step Four: Now that both accounts have been correctly prepared, it’s time to start an ACAT transfer. The request should be made with the incoming firm, which is Fidelity in this case. Thankfully, Fidelity has a digital transfer form, so submitting the request will be a little simpler this time. The ACAT form can be accessed on either the website or mobile app. On the latter platform, look for the Transact icon in the lower menu. On the transfer form, specify a transfer of investments from an external firm. On the next page, you should enter “TradeStation Securities” as the outgoing firm. You’ll need to input several details, such as the TradeStation account number. Once finished, submit the request, and Fidelity will do the rest.

The same form can be pulled up on the Fidelity website by hovering over the Accounts & Trade tab in the top menu and selecting the Transfers link in the drop-down menu.

Keep in mind that a robo account at Fidelity will only accept a transfer of cash. Obviously, in this situation everything in the TradeStation account will have to be liquidated. This could have tax consequences if the TradeStation account is a taxable account.

This time, there could be a transfer fee. TradeStation charges $125 for an outgoing transfer. Fidelity will refund the fee if the value of the transfer is at least $25,000.

Step Five: It’s possible to keep an eye on a requested transfer. This can only be accomplished on the Fidelity website (and not the mobile app). Go back to the Transfers page. This time, look for the link to track an account transfer.

Comparison and Alternatives

How Long Does a Transfer Take?

The entire process from Fidelity to TradeStation, start to finish, should take 7 to 10 business days. In the other direction, Fidelity predicts 3 to 5 business days, although it cautions that this estimate could vary.

|