Overview

If you’re looking for a modern tech-savvy brokerage firm, look no further than Webull and Acorns.

Although they are similar in this regard, there are important differences between them. For example,

consider these issues:

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

WeBull

|

$0

|

na

|

$0

|

$0

|

$0

|

|

Acorns

|

na

|

na

|

na

|

$3, $5, or $9 per month

|

$3, $5, or $9 per month

|

When it comes to pricing, Webull is the King! It's the only broker to offer $0 commissions an all stocks,

ETFs, and options.

Promotions

Acorns:

Get Acorns absolutely free and a $20 bonus.

Webull:

Get up to 75 free stocks when you deposit money at Webull!

First Category: Investment Methods

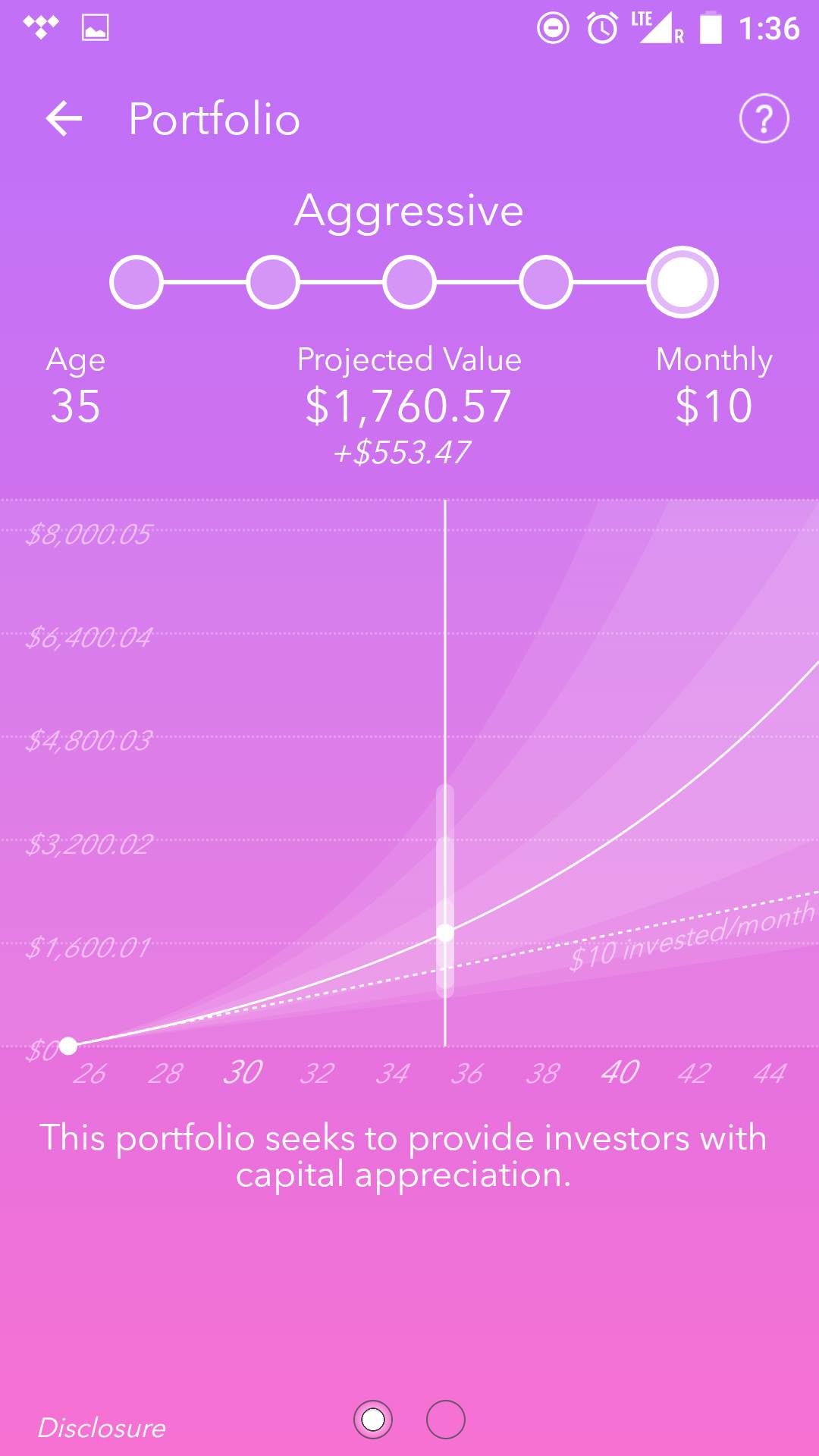

Acorns doesn’t offer self-directed trading accounts. Instead, it provides robo management of 12 (yes, just 12) exchange-traded funds. The kicker is that the broker has a round-up service (there’s a charge for this) that lets clients round up debit and credit card purchases and transfer the difference to Acorns accounts. These transactions can occur anywhere plastic is accepted.

Webull is pretty much the opposite of Acorns. Webull doesn’t offer any investment-advisory services.

It provides self-directed trading in stocks, options, closed-end funds, cryptocurrencies, and ETFs.

Every ETF in the United States is available for trading. That’s more than 2,000 funds. Penny stocks can be traded as well.

We like Webull’s setup better.

Second Category: Technology

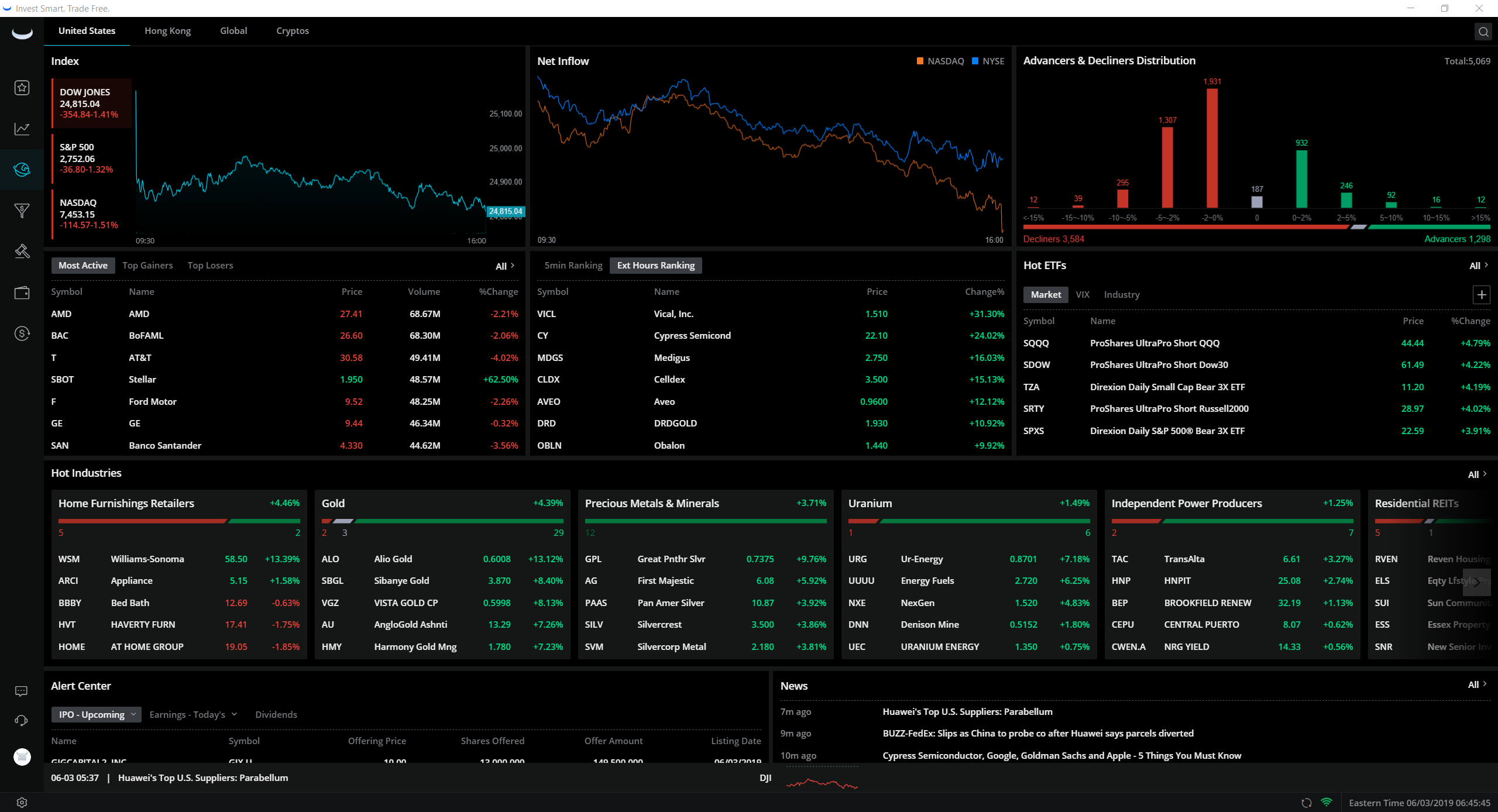

To service its self-directed clients, Webull offers three trading tools: a mobile app, a browser platform, and a desktop program. The latter two are exactly the same.

The computer program delivers option chains for derivative traders. For stock and fund traders, there are charts with technical studies and drawing tools. There is a default watchlist on the platform that can be modified. The trade ticket offers a variety of order types and duration choices.

The Webull mobile app has a community forum where traders can discuss investing and the day’s market news. There is also a simulated trading mode, which the desktop software also has. Charting on the mobile system is quite good.

Because Acorns doesn’t emphasize self-directed trading, the broker doesn’t have a desktop platform. It does have a mobile app and website, though. Both of them are user-friendly but don’t offer any trading tools because self-directed trading isn’t possible. There are account management features and not much else.

Webull takes another victory.

Third Category: Learning Materials

For investment education, the Acorns site has videos and articles that address basic financial issues such as managing credit, weathering bear markets, and using its round-up service. The number of materials is rather small, and they’re mostly about personal finance rather than trading.

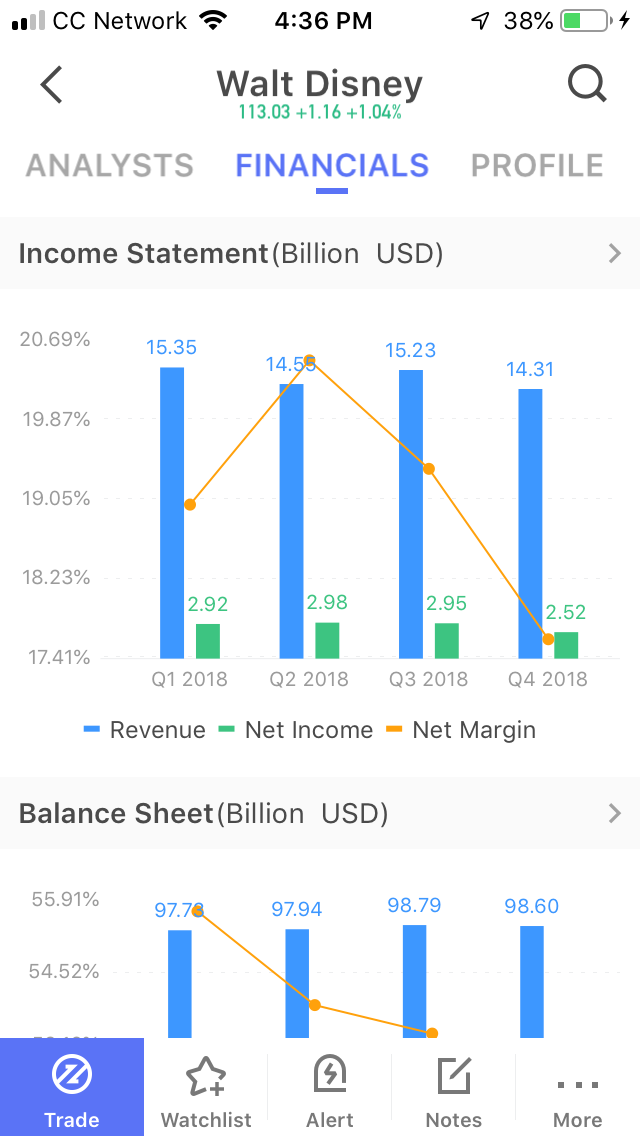

At Webull, the picture is largely the opposite. There are brief articles on trading topics, but the lion’s share of information is found on security profiles. Here, there is data on short interest, institutional holdings, time and sales, order flow, and margin requirements. Although there are no pdf stock reports, there are analyst recommendations.

Webull also has a stock screener that looks for investments based on a few criteria. These include EPS, market cap, and sector. Results can easily be sorted by any condition.

Another loss for Acorns.

Fourth Category: ETFs

As we already mentioned, both investment firms in this study offer ETFs. The problem we have with Acorns is that it only offers trading in a grand total of 6 funds. Moreover, there isn’t much information on these funds. Clients answer questions on an online questionnaire, and then the company’s robot makes trading decisions.

At Webull, there aren’t a lot of great fund resources, either. The broker’s platform shows the day’s big ETF movers. Fund profiles display news articles, dividend history, and asset allocation over multiple quarters.

Webull has a slight advantage.

Fifth Category: Cash Management Tools

Despite Acorns’ limited investment service, the company does provide some decent banking tools. Its app offers mobile check deposit. For spending, Acorns customers get a Visa debit card and FDIC insurance up to $250,000. Moreover, ATM fees are reimbursed by the broker. There is a $3 monthly fee for all this, the one downside.

Webull offers nothing in this category and finally suffers a loss.

Sixth Category: Other Services

Dividend Reinvestment Program: Acorns automatically reinvests dividends from its 12 funds. Webull does not have a DRIP service.

IRAs: Webull has more investment options for Individual Retirement Accounts.

Automatic mutual fund investing: For obvious reasons, neither Webull nor Acorns offers

this service.

Fractional-share Trading: Available at Webull but not in Acorns.

Webull wins another category.

Recommendations

Beginners: It’s tempting to choose Acorns for its auto-investing service. But there’s really

nothing to learn at Acorns. We think new traders will learn more at Webull, especially with its

decent, although not great, customer support.

Mutual Fund Traders: We propose

Charles Schwab.

ETF and Stock Trading: Webull’s software and research materials make it the easy pick.

Long-Term Investors and Retirement Savers: Both brokers will work.

Small Accounts: Because of Acorns’ flat monthly fee, small accounts will be better

off at Webull.

Promotion Offers

Acorns:

Get Acorns absolutely free and a $20 bonus.

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Webull vs Acorns - Outcome

Acorns has a unique style of investment management, but it also underperforms Webull in most

categories. The latter broker is obviously the better firm for self-directed trading.

Open Webull Account

Open Webull Account

Open Acorns Account

Open Acorns Account

|