Is Webull Insured?

Since coming onto the scene in 2017, Webull has quickly established itself as a major player in the consumer investment space. Its mobile-friendly platform and intuitive dashboard configuration quickly grabbed the attention of tech-savvy investors everywhere.

For some investors, this may raise some concerns. How do I know my money is safe?

Is Webull FDIC insured? What happens if the company folds? Thankfully, to operate as a financial institution in the United States, they are required to adhere to financial standards and safeguards like everybody else.

In this article, we will detail the types of insurance that are offered by financial institutions and how Webull utilizes them to protect their users’ capital.

Is Webull FDIC Insured?

The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the United States

government. Their purpose is to protect depositors against the loss of their deposits due to an

FDIC-insured bank or savings association’s failure.

Account holders at FDIC-insured institutions are covered up to

at least $250,000 per depositor.

If your losses are more than $250,000, the FDIC has protocols in place to help you recoup a

portion of those funds as well. No need to apply for coverage, it’s automatically applied when

you open an account at a participating bank.

While other insurers can take months to pay out claims, the FDIC has historically issued payments

to depositors within a few days after a bank’s closing.

Open Webull Account

Open Webull Account

Is Webull SIPC Insured?

Just like the aforementioned, the SIPC is an independent, member-run, non-profit organization overseen

by the Securities and Exchange Commission (SEC).

SIPC insurance protects against the loss or tampering of cash and securities such as stocks and bonds

held at a brokerage firm. If a SIPC-member brokerage firm goes under, the cash and securities held in

your account are covered up to $500,000.

There are some important stipulations. The coverage only extends to $250,000 in cash. If your cash holdings exceed that amount, coverage would only extend to that $250,000 cap.

Keep in mind, this coverage does not guarantee the value of your assets due to things such as market volatility or bad investment advice. In the event of liquidation, the SIPC will only replace the missing stocks and securities with the same.

Think of it like renter’s insurance that restores to you the same exact items that were lost if your apartment burned down. Specifics can be found on their website.

Is Webull Covered by FDIC & SIPC Insurance?

As a brokerage firm, Webull is a member of the SIPC. The cash and securities held in your account

are covered by them for up to $500,000. In the event of liquidation, the SIPC would take action.

Unlike other financial services platforms, Webull is purely a brokerage firm. It does not offer banking products. Thus, FDIC insurance would not apply.

Does Webull Offer Additional Insurance?

Webull’s clearing house, Apex Clearing has made the move to purchase an additional insurance policy. Since Webull’s transactions are managed by Apex, the coverage extends to all Webull users.

The policy offers up to $37.5 million for any one customer’s securities and $900,00 for any one customer’s cash. It’s important to note that this does not cover losses incurred due to investment decisions you have made.

Webull and its partners have taken responsible steps in ensuring that users’ assets are protected should their firm enter into distress or liquidation. Hopefully, this provides clarity and aids in your decision-making should you choose to utilize Webull for your investments.

Open Webull Account

Open Webull Account

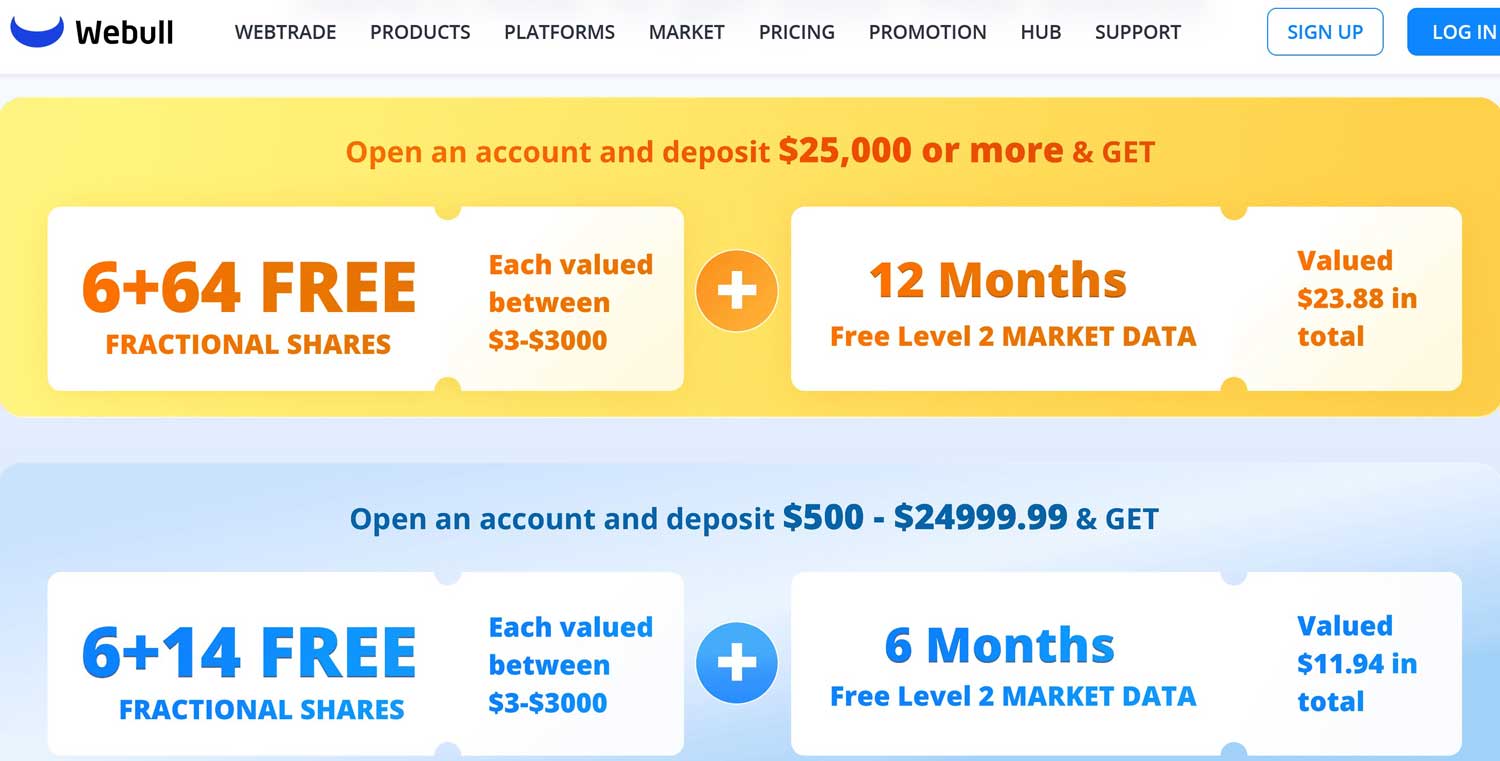

Commission Schedule

Now we come to the $64 million question, or perhaps we should say the $0 question: what does Webull charge for its services?

Stock and fund trades are $0. Option trades have the same base charge, and believe it or not, there are no per-contract fees.

The broker doesn’t charge anything to open or close an account; and there’s no minimum balance requirement, another great feature.

On the flip side, the brokerage house does have lots of charges for wire transfers (anywhere from $8 to $45). The Automated Clearing House system is free, but a returned ACH is $30.

Margin rates are very low: they range from 6.74% for very large debits to 9.74% for balances under

$25k.

Options Trading

With the addition of options trading, Webull’s software hasn’t changed much. On the mobile app, there is an “Options” icon on a stock’s profile. Tapping on this produces option chains.

On the computer platform, it’s a little hard to find. At the bottom of a chart, there is a double up-arrow. Clicking on this expands an options chain window. Next to the up-arrow is an expand icon if you want to replace the chart with chains. To the far-left side, a yellow icon is displayed next to the word “Options” to indicate real-time data is turned on for derivative prices.

During our testing of both platforms, we found it fairly easy to place option orders. Clicking on a bid or ask price (or tapping on one on the mobile platform) automatically populates a trade ticket. Here, the break-even point of the trade is shown along with maximum gain and loss numbers.

Webull now also offers multi-leg strategies.

Security Analysis

Before you jump into the deep end with real money and start placing trades, you may want to thoroughly educate yourself with the broker’s learning materials. For general education, there’s not a whole lot. We did find a glossary on its site along with a helpful list of FAQs.

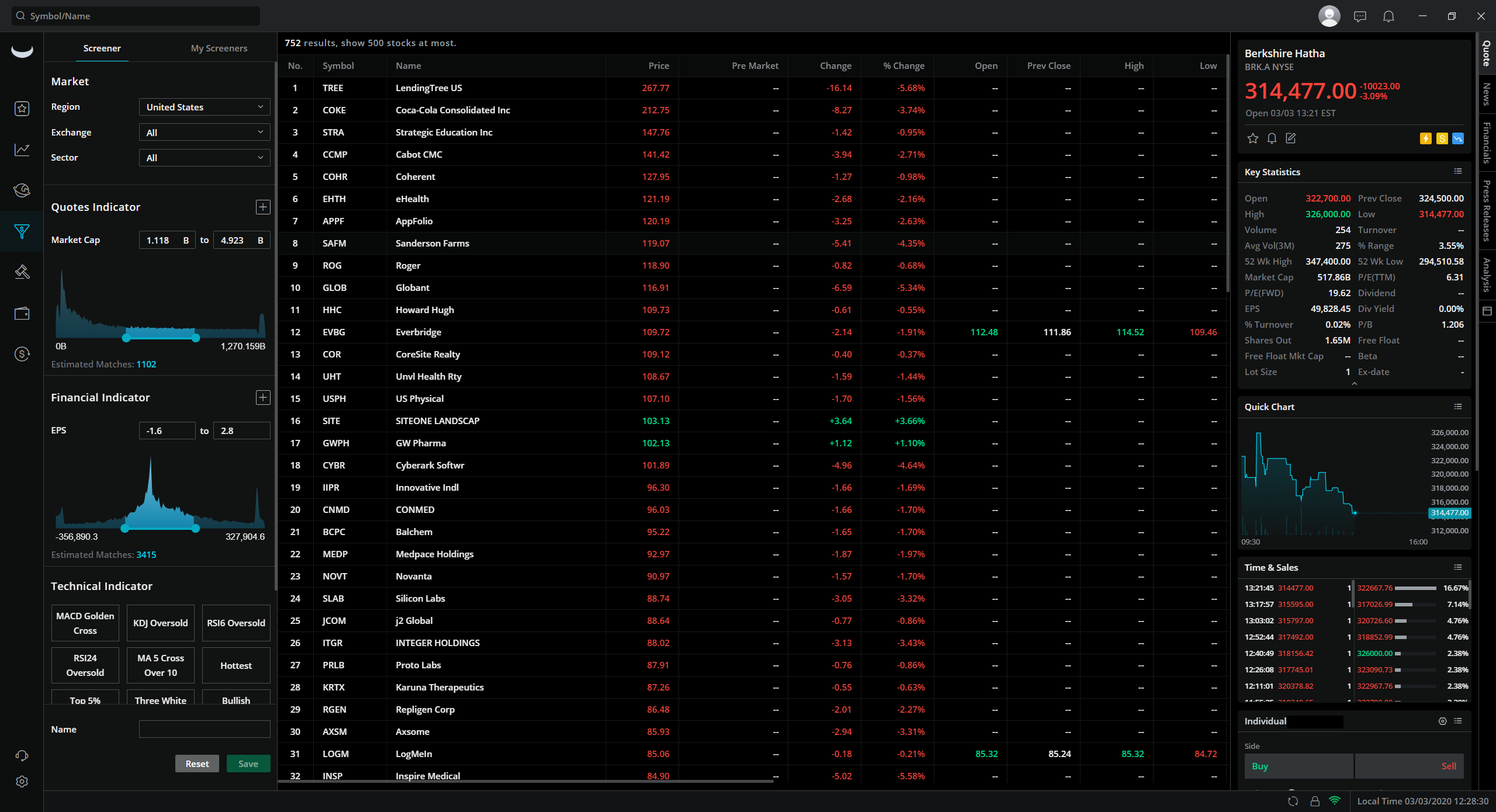

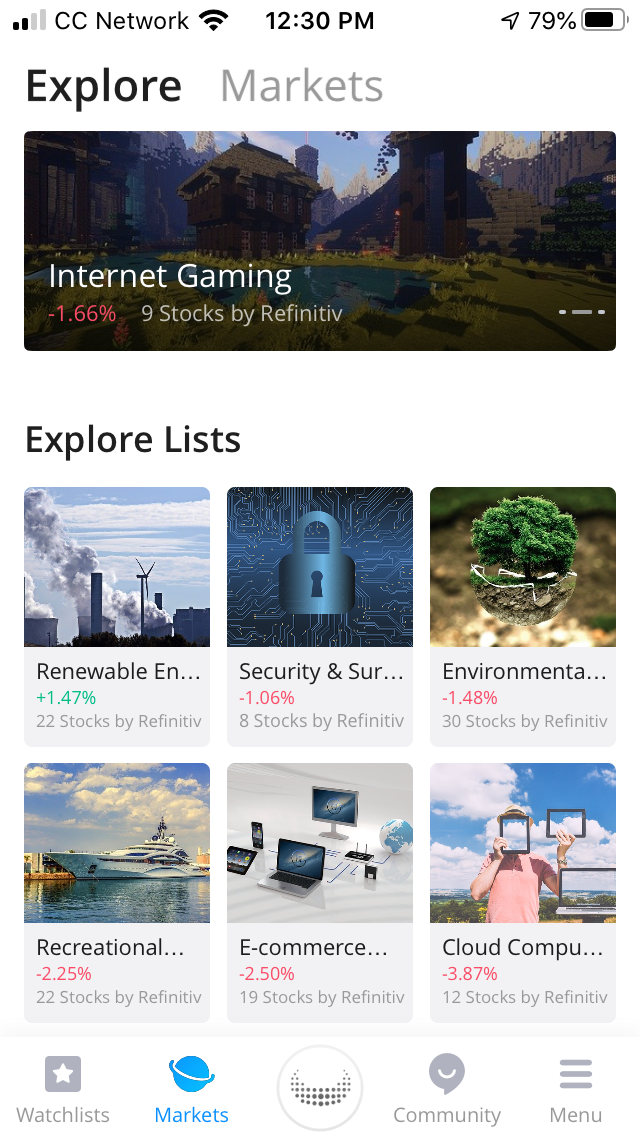

For security research, the computer platform and mobile app both offer screeners. There are a few

search criteria on the desktop platform’s screener. Strangely, geographic region is one of them,

although Webull doesn’t offer trading in any of the results. Other choices include EPS, market cap,

and technical indicators. Somewhat oddly, the mobile app has more search criteria. Both platforms

offer pre-defined screens.

A markets section on both the platform and mobile app present data on important economic sectors, most active stocks, market indexes, net flows on major exchanges, upcoming IPOs, precious metals prices, and more.

On the mobile app, there is an economic calendar. Sections include stocks with ex-dividend dates, earnings releases, and economic data to be released by the government.

Other Services

Webull has a pre-market trading service that starts at 4 o’clock in the morning, EST, and runs to

the opening bell. After the market closes, another session begins and runs until 8 o’clock in the

evening. These are the best trading hours offered at online brokers right now. Only Interactive Brokers matches these hours,

and only on its non-free pricing plan.

There is no DRIP service at Webull right now, and obviously, no periodic mutual fund investing.

Fractional shares of stocks and ETFs are now available.

Updated on 1/19/2024.

|