Overview

Acorns is trying to attract Millennial investors with some unique methods of investing. But are the offerings

better than what the same investors can find at Firstrade and E*Trade? Let’s have a look.

Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Firstrade

|

$0

|

$0

|

$0

|

$0

|

$0

|

|

Etrade

|

$0

|

$0

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Acorns

|

na

|

na

|

na

|

$3, $5, or $9 per month

|

$3, $5, or $9 per month

|

When it comes to pricing, Firstrade is the King! It's the only broker to offer $0 commissions an all stocks,

ETFs, options, and mutual funds.

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Acorns:

Get Acorns absolutely free and a $20 bonus.

Etrade:

At E*TRADE, get $0 trades + 65₵ per options contract.

Category One: Method of Investing

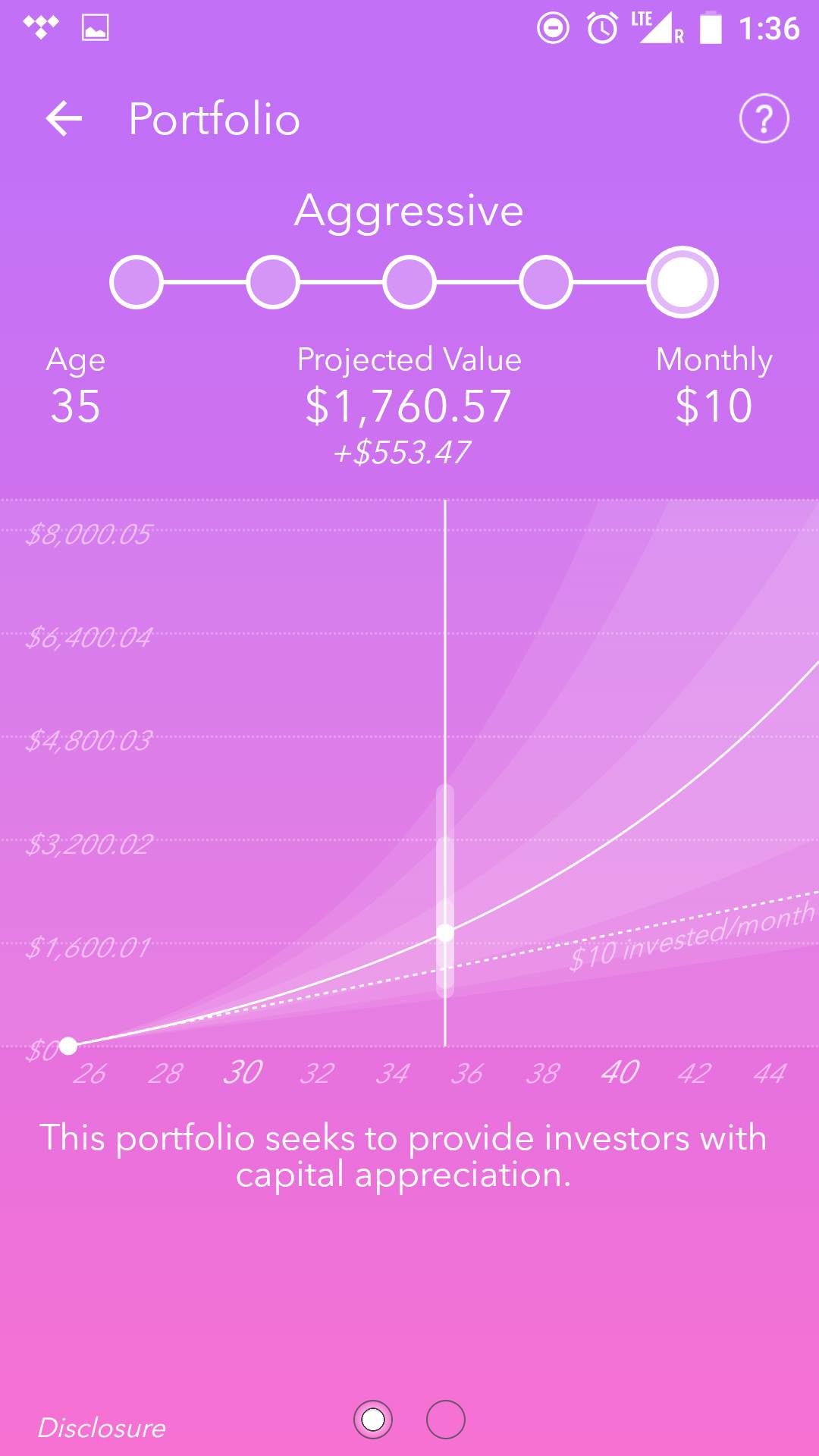

Acorns offers just one type of investing: robo management. Moreover, there are only twelve exchange-traded funds available at the broker. A computer algorithm sets target percentages among these ETFs based on a risk-based questionnaire.

In exchange for this rather limited selection of financial vehicles, Acorns offers round-up investment deposits from card-based transactions. Let’s say you buy lunch for $8.64. Acorns will round that up to $9 and transfer $0.36 to your brokerage account.

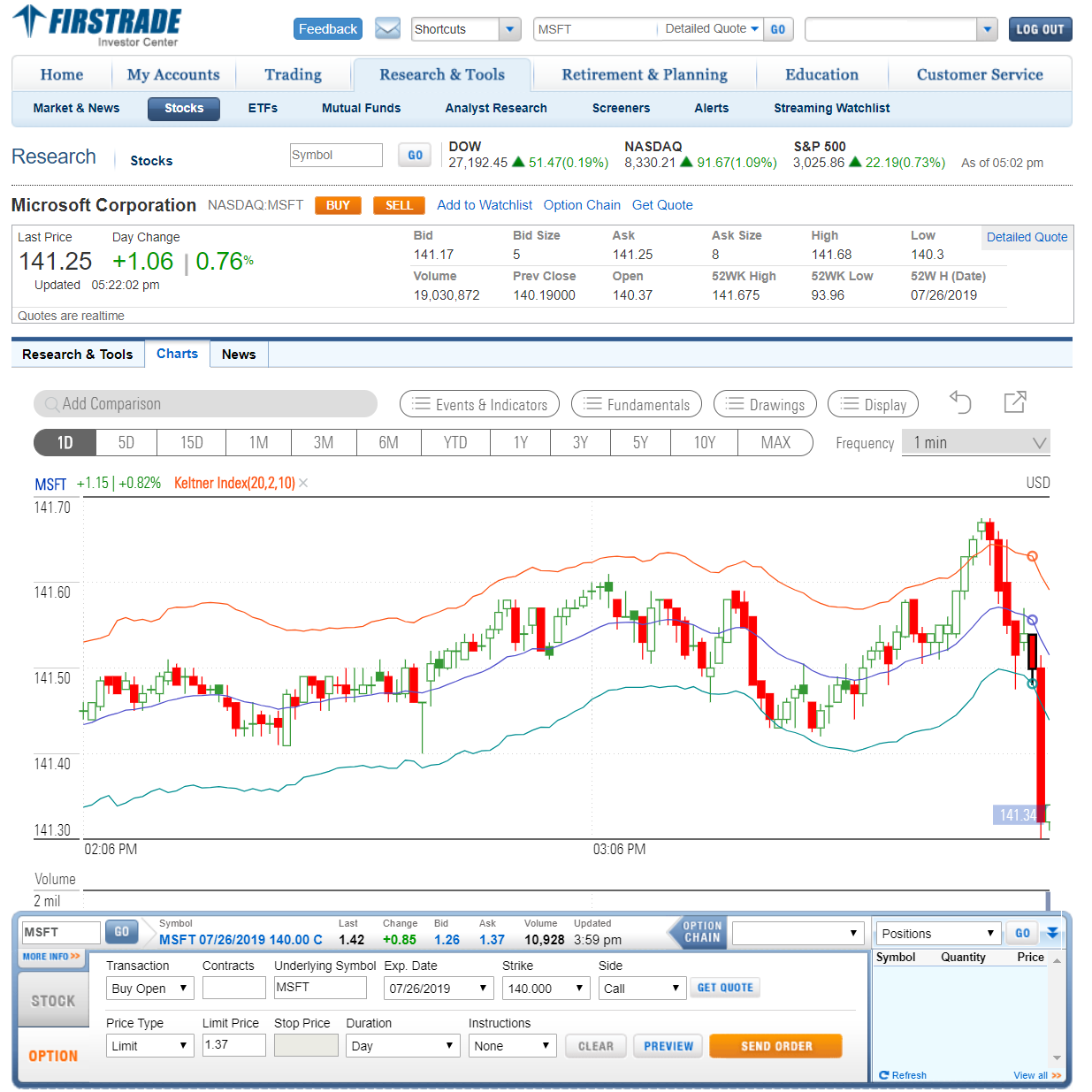

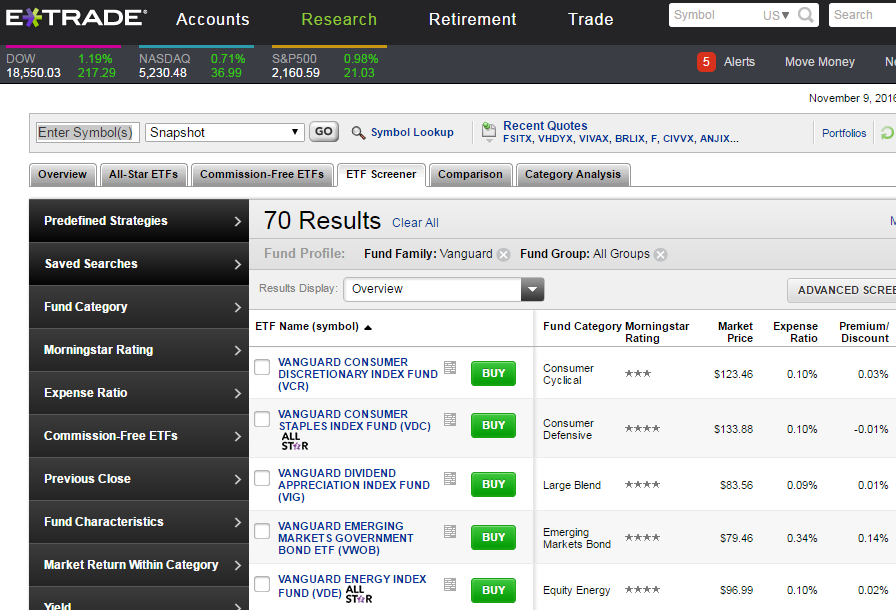

Firstrade and E*Trade don’t offer round-up services, but they do let their customers set up recurring deposits from an external bank account (Acorns does the same). On top of that, they provide self-directed accounts with trading in stocks, bonds, mutual funds, closed-end funds, hundreds of ETFs, and option contracts.

E*Trade offers futures, including bitcoin futures. The broker-dealer also offers portfolio management, including a robo service.

E*Trade wins the first category.

Category Two: Cash Management

Firstrade customers with at least $100 in assets can get a free debit card and the ability to write checks. E*Trade goes a step further by managing an FDIC-insured bank with checking and savings accounts (there are several to choose from) that can be linked to an investment account. One account offers ATM fee reimbursements with a minimum balance, direct deposit, or trading minimums.

Acorns has an FDIC-insured bank account that comes with a Visa debit card but no checks. Included is ATM fee rebates, but as of now the account doesn’t come with mobile check deposit, something E*Trade does offer.

We would go with E*Trade here.

Category Three: Software

All three brokers in our survey have mobile apps. E*Trade is the only one to have two of them. One is designed as a trading app, although the basic one also has some good trading resources, such as streaming financial news and Level II quotes. Combined, the apps offer good charting, derivative tools, and an advanced order form.

Firstrade’s app also provides good charting with many tools; but it fails to offer mobile check deposit, something we did find at E*Trade. Option contracts can be traded, but mutual funds cannot, another function that is possible on E*Trade’s software.

The Acorns app has no trading capability because the company doesn’t offer self-directed accounts. It does have a lot of management functions, such as a tool to link external bank accounts and credit/debit cards. The Acorns website has the same functions and design.

Firstrade’s website is very different from its mobile app. Mutual funds and bonds can be traded, and there are many more resources than the mobile platform offers.

E*Trade’s website provides many useful features, including advanced charting and an order ticket with several trading choices. A browser platform called Power E*Trade offers a much more advanced order ticket; and a desktop platform called E*Trade Pro delivers a professional-level trading experience with just a $1,000 account requirement.

E*Trade easily wins here.

Category Four: Education & Research

Acorns customers get a small selection of learning resources. These cover topics on general investing and how the Acorns service works. The videos and articles tend to be rather short. A brief FAQ answers a few common questions.

On Firstrade’s website, we found screeners for all investment products the broker offers. There is also an educational module that presents articles and videos on topics such as how to place an options order. Security profiles have enormous amounts of information, courtesy of Morningstar.

Investors at E*Trade have the broker’s website, mobile apps, browser platform, and desktop program to conduct lots of research. Stock profiles offer free third-party equity reports from analysts like Market Edge and Thomson Reuters. The desktop system has an economic calendar and some powerful tools for options research.

E*Trade wins this category.

Category Five: Portfolio Management

Firstrade offers no portfolio management at all; so it’s automatically out of the contest here. At Acorns, there is a robo service but no human management. The cost is $3, $5, or $9 per month, depending on the package with no minimum. E*Trade offers both types of management, and the company begins at 0.30% for its automated management. There’s a $500 minimum. Human advisors are more expensive with higher minimums, but they manage more than just ETFs. Some packages also include a financial plan and a one-on-one working relationship with a breathing advisor.

Again, it’s E*Trade.

Category Six: Other Services

DRIP plans, automatic investing in mutual funds, and IRAs are available at both Firstrade and E*Trade. Obviously, auto deposits into mutual funds and DRIP service aren’t available at Acorns, although the company does offer 3 IRA types (fewer than the other 2 competitors).

A tie between Firstrade and E*Trade.

Our Recommendations

Beginners: For new traders, we propose E*Trade over the other two: we like its educational resources. I

Mutual Fund Traders: Firstrade has eliminated all transaction fees for funds and has a large list. It’s

our pick.

Retirement Savers and Long-Term Investors: Firstrade and E*Trade are pretty even here.

ETF and Stock Trading: E*Trade has better trading tools.

Promotions

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Acorns:

Get Acorns absolutely free and a $20 bonus.

E*Trade:

At E*TRADE, get $0 trades + 65₵ per options contract.

Firstrade vs. Acorns vs. E*Trade: Results

Millennials may gravitate towards Acorns, but they will find better resources at E*Trade and Firstrade.

Open Account

Open Account

Open Account

|