|

JP Morgan Chase vs Moomoo (2024)

JP Morgan Chase vs Moomoo—which is better? Compare investing accounts,

online trading fees, stock broker extended hours, and differences.

|

J.P. Morgan Investing vs. Moomoo Introduction

J.P. Morgan Investing is owned by an old-school financial conglomerate. Moomoo, on the other hand,

is an upstart brokerage firm trying to change the way people invest. Could the newcomer be the better investment firm? Here’s an answer:

Cost Comparison

Services

| Broker Review |

Cost |

Investment Products |

Trading Tools |

Customer Service |

Research |

Overall Rating |

|

TastyTrade

|

|

|

|

|

|

|

|

Moomoo

|

|

|

|

|

|

|

Promotions

J.P. Morgan Chase:

Get $0 stock commissions at J.P. Morgan.

Moomoo:

Get zero commissions at Moomoo.

For Investment Methods, J.P. Morgan Investing Is the Winner

Moomoo clients get to trade the following list of asset classes:

- US and Chinese stocks

- ADRs

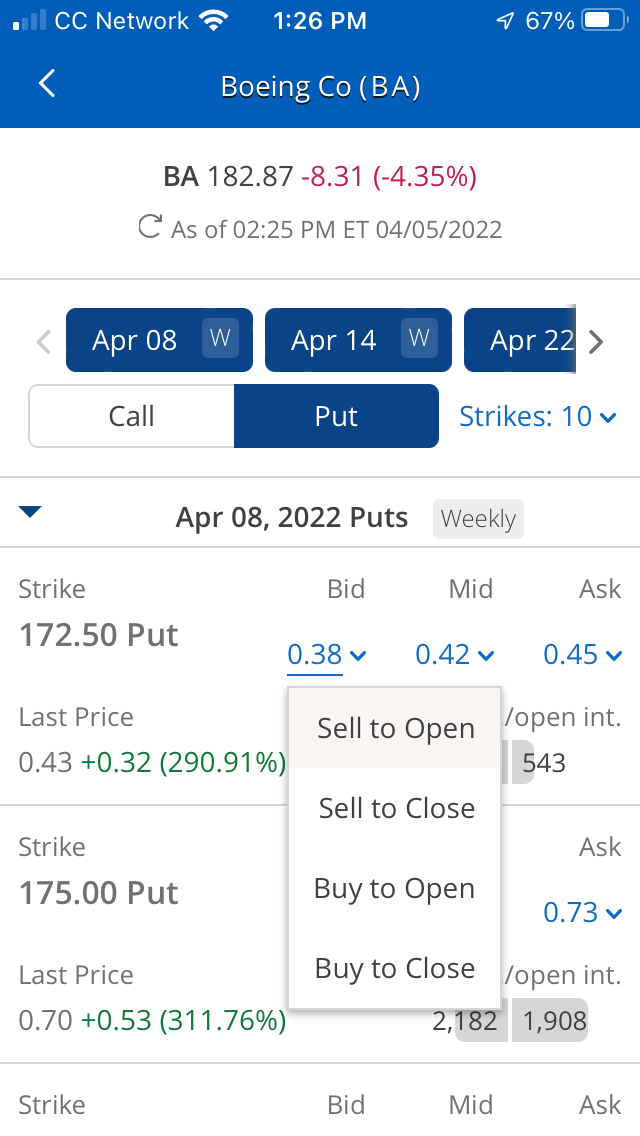

- Options

- ETFs

- Closed-end Funds

Currently, these investment vehicles can only be traded inside individual taxable accounts.

J.P. Morgan Self-Directed Investing offers both joint and individual accounts. Tradable instruments include:

- US stocks

- ADRs

- Options

- Mutual funds

- ETFs

- Closed-end funds

- Fixed-income securities

In the PC Software Category, Moomoo Is Our Pick

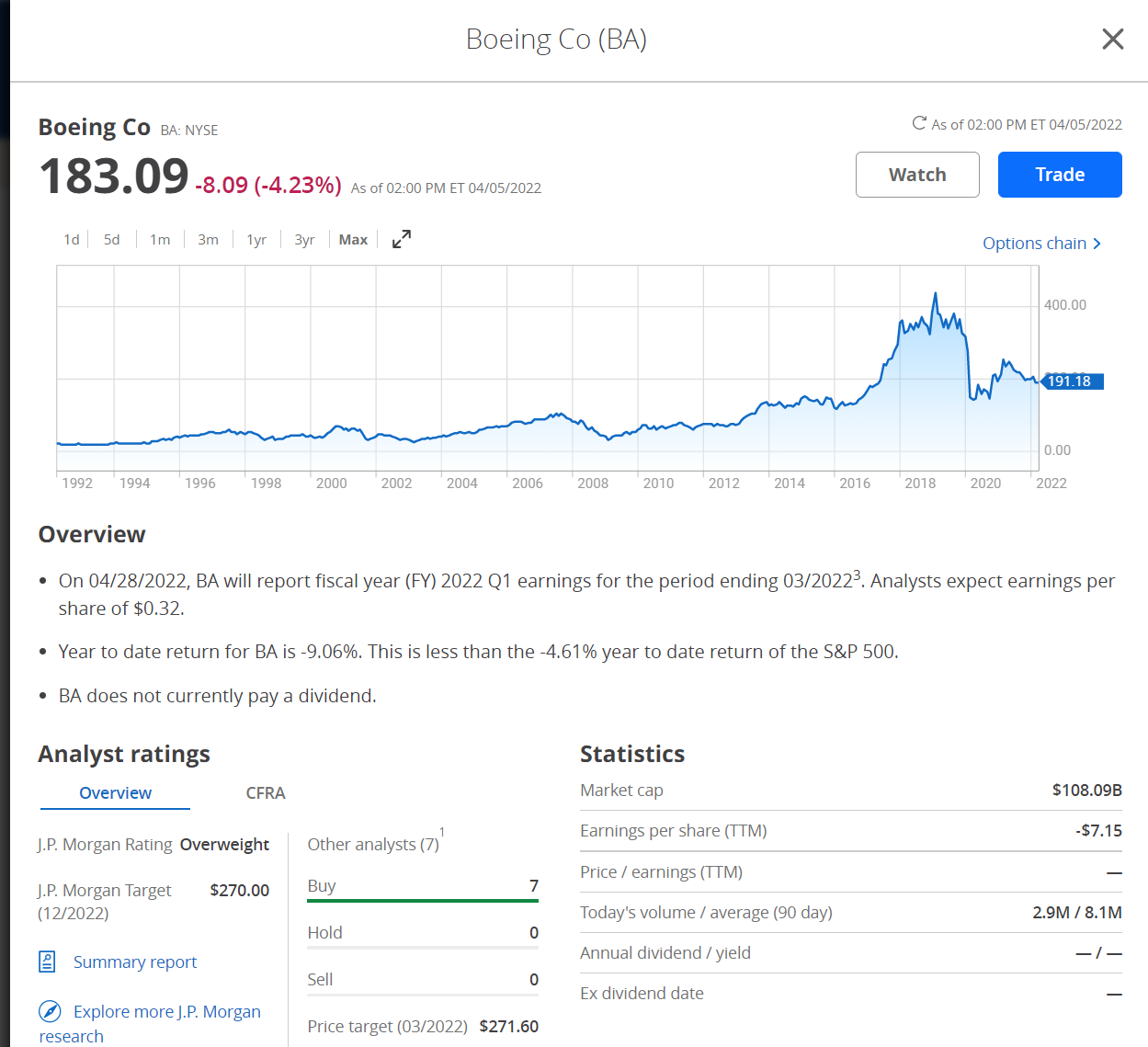

To actually trade the available products, both broker-dealers have computer software. For J.P. Morgan Investing, this consists solely of a website. It’s actually the Chase Bank website. Brokerage accounts have trading tools. Some highlights include:

- Trade ticket with 4 order types

- Basic charting without full-screen mode

- Watchlist, but no alerts

Moomoo’s website is used mainly to advertise the company’s services. It recently has added educational articles, a stock screener, and asset profiles. However, there is no trading capability.

So where do moomoo customers place trades? On the broker’s desktop platform. It can be downloaded from the website (click on the Download link at the top of the site).

Moomoo’s desktop software has a lot of great features. Charting is available in full-screen mode, and there is a right-click menu. A screenshot button can take a picture of a graph. There are watchlists and alerts. The trade ticket has 12 (yes, 12) order types but only 2 duration choices.

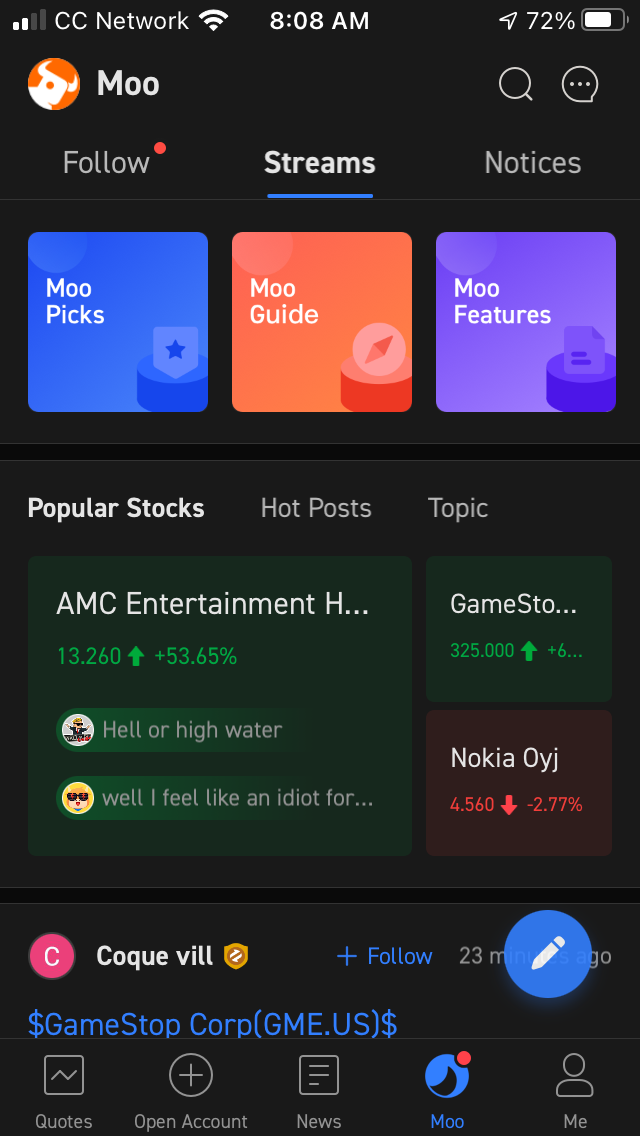

Moomoo Wins for Mobile Apps

Moving on to mobile trading, moomoo once again shines brightly. Its app has widgets for all sorts of stuff. Examples include free stock promotions for referring friends, an elite member program, news articles, and a learning center. Trading tools include:

- A simulated trading system

- Watchlists that sync with desktop system

- Order ticket with 8 trade types

- Horizontal charting with several tools

J.P. Morgan Investing once again borrows software from Chase Bank. Although there’s not nearly as much trading power on this app compared to moomoo’s app, there are some resources that can get the job done. Examples include:

- Vertical charting (no horizontal charting, but there are some graphing tools)

- Order ticket from the website (4 order types)

- Discrete tickets for options and mutual funds

- Chains for calls and puts

- Multiple watchlists that sync with the website

Moomoo Is the Only Choice for Margin Trading

Although J.P. Morgan Investing doesn’t offer margin trading, moomoo does. In fact, the latter broker offers only margin accounts. The current rate is a flat

6.8% for all margin loans (for long positions). For short positions, the rate varies by security and even by day.

J.P. Morgan Investing Has the Edge in Miscellaneous Services

Extended Hours Trading: Pre-market and after-hours trading are both available at moomoo. J.P. Morgan Investing has neither session.

Periodic Mutual Fund Investing: This one is the opposite. J.P. Morgan Self-Directed Investing has it, but moomoo does not.

Individual Retirement Accounts: Moomoo does not offer retirement accounts (yet). J.P. Morgan Investing does.

Banking Tools: Only J.P. Morgan Investing has checks and debit cards.

DRIP Service: Dividends from securities can be converted into additional shares only inside a J.P. Morgan Self-Directed Investing account.

Fractional Shares: Not available at either firm at this time.

Initial Public Offerings: moomoo has an IPO Center that appears on both its mobile app and desktop program. J.P. Morgan Investing customers have no such service.

These Are Our Recommendations

ETF/Stock Trading: With moomoo’s fantastic desktop software and very good mobile app, it is the only real option here.

Small Accounts: J.P. Morgan Automated Investing has a $500 minimum deposit requirement. Neither broker has any minimums or recurring fees for self-directed accounts.

Long-Term Investors & Retirement Savers: As already mentioned, moomoo has no retirement accounts at all. By comparison, J.P. Morgan Automated Investing has a glide slope service for retirement accounts, and target-date mutual funds are available with J.P. Morgan Self-Directed Investing.

Mutual Fund Trading: J.P. Morgan Self-Directed Investing has over 3,000 funds with neither transaction fee nor load.

Beginners: Moomoo’s software is good, but it’s not really designed for beginners. The broker also doesn’t have stellar customer service or a lot of learning materials.

Alternatives

Moomoo vs JP Morgan Summary

Moomoo has definitely delivered a better package for advanced equity traders. But for long-term

investing and financial planning, J.P. Morgan Investing is still the better horse in the race.

|

Open Account

|

Open Account

|